Chapter 14 Long-Term Liabilities, Intermediate Accounting 16th Edition Donald Kieso

I need assistance with the red marks. Thank you!

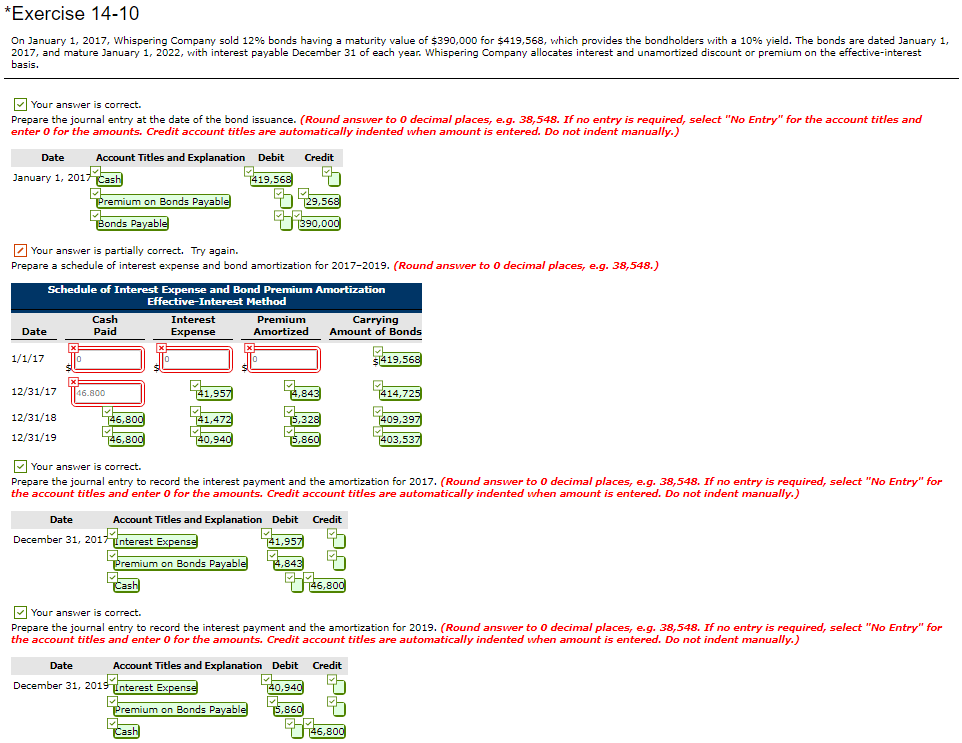

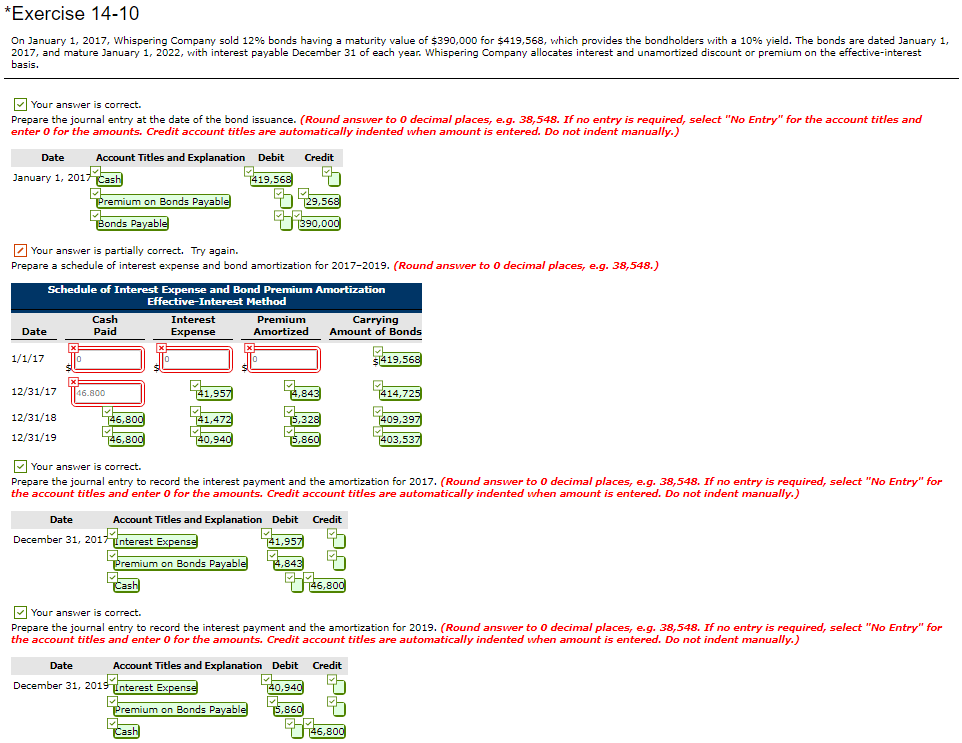

Exercise 14-10

On January 1, 2017, Whispering Company sold 12% bonds having a maturity value of $390,000 for $419,568, which provides the bondholders with a 10% yield. The bonds are dated January 1, 2017, and mature January 1, 2022, with interest payable December 31 of each year. Whispering Company allocates interest and unamortized discount or premium on the effective-interest basis.

Prepare a schedule of interest expense and bond amortization for 20172019.

Exercise 14-10 On January 1, 2017, whispering Company sold 12% bonds having a maturity value of $390,000 for $419,568, which provides the bondholders with a 10% yield. The bonds are dated January 1, 2017, and mature January 1, 2022, with interest payable December 31 of each year. Whispering Company allocates interest and unamortized discount or premium on the effective-interest basis Your answer is correct. Prepare the journal entry at the date of the bond issuance. (Round answer to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit anuary 1, 2017 tas 19,56 remium on Bonds Payabl 9,56 onds Payabl Your answer is partially correct. Try again. Prepare a schedule of interest expense and bond amortization for 2017-2019. (Round answer to 0 decimal places, e.g. 38,548.) Schedule of Interest Expense and Bond Premium Effective-Interest Method Cash Paid Interest Expense Premium Amortized Carrying Amount of Bonds Date $419,56 12/31/17 46.800 12/31/18 12/31/19 80 32 09,39 80 94 86 03,53 ur answer is correct. Prepare the journal entry to record the interest payment and the amortization for 2017. (Round answer to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit December 31, 2017 unterest Expens remium on Bonds Payabl e 80 Your answer is correct. Prepare the journal entry to record the interest payment and the amortization for 2019. (Round answer to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit 94 86 Date Credit December 31, 2019 nterest Expens mium on Bonds Payabl Cash 6,80