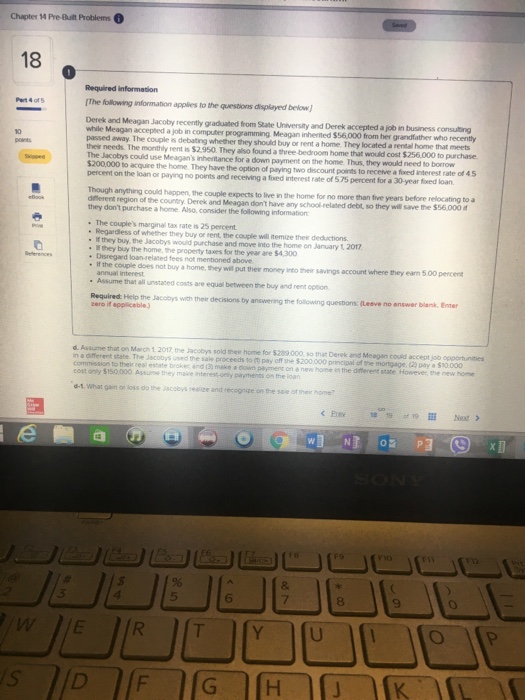

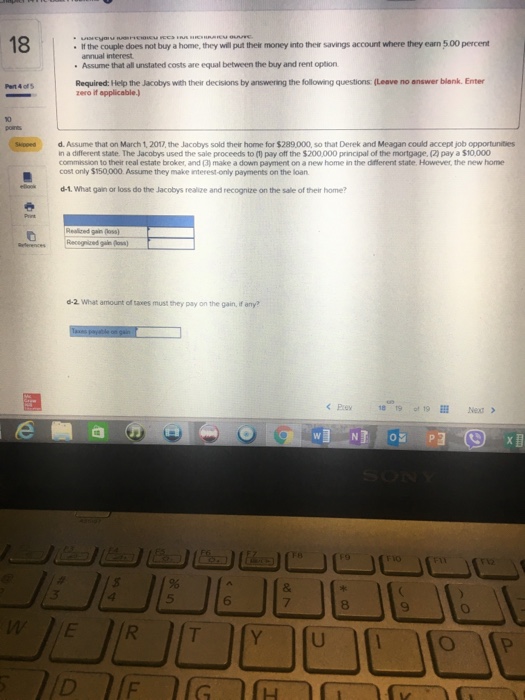

Chapter 14 Pre Built Problems 18 Required information The following information applies to the questions displayed below 4 of5 Derek and Meagan Jacoby recently graduated from State University and Derek accepted a job in business consulting while Meagan accepted a job in computer programming Meagan passed away. The couple is debating whether they should buy or rent a home. T their needs. The monthly rent is $2,950. They also found a three bedroom home that would cost $256,000 to purchase The Jacobys could use Meagan's inherfance for a down payment on the home. Thus, they would need to borrovw $200,000 to acquire the home They have the option of paying two discount points to receve a percent on the loan or paying no poients and receving a fixed interest rate of 5,75 percent for a 30-year fixed loan inherited $56,000 from her grandfather who recently hey located a rental home that meets to receive a fxed interest rate of 4 5 Though anything could happen, the couple expects to live in the home for no more than five years before relocating to a difflerent region of the country Derek and Meagan dont have any school elated debt, so they will save the $56.000 they don't purchase a home Also, consider the following information The couple's marginal tax rate is 25 percent Regardless of whether they buy or rent, the couple will temize their deductions . If they buy, the Jacobys would purchase and move into the home on January 1 2017 they buy the home, the property taxes for the year are $4,300 Disregaed loan-related fees not mentioned above - If the couple does not buy a home, they wil put ther money into their savings account where they ean 5.00 pencent annual interest Assume that all unstanted costs are equal between the buy and rent opsion Required. Help the Jacobys with their decisions by answering the following questons: (Leave no answer biank. Enter zero if appliceble n a different state. The Jscobys used the sale proceeds to () pay of she $200 000 principal of the morigage.(22 pay cost only $150,000 Assume they make $10.000 to their eeal estate brokec and 13) make a down plyment on a new home in the difflerent state However, the new home paymencs O the loan or loss odo the Jacobys eaie and recopnize on the sae of their home F? 3 5 6 7 8