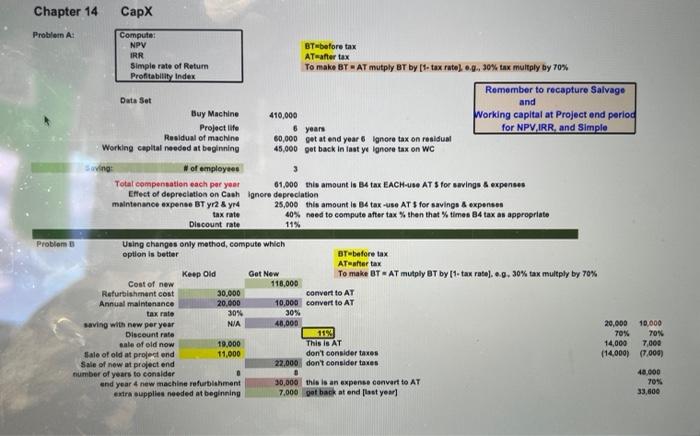

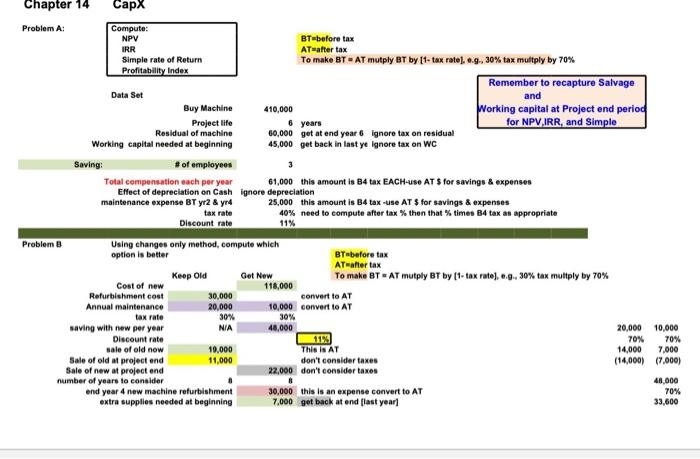

Chapter 14 Probler A: Computer NPV BT before tax IRR AT after tax Simple rate of Return To make BT - AT mutply BT by [-tax rate)... 30% tax multply by 70% Profitability Index Remember to recapture Salvage Data Sot and Buy Machine 410,000 Working capital at Project and period Project life for NPV IRR, and Simple Residual of machine 60,000 get at end year 6 ignore tax on residual Working capital needed at beginning 45,000 get back in last ye ignore tax on WC of employees Total compensation each per year 61,000 this amount is B4 tax EACH-Use AT S for savings & expenses Effect of depreciation on Cash Ignore depreciation maintenance expense BT yr2 & ynd 25,000 this amount is B4 tax-use ATS for savings & expenses tax rate 40% need to compute after tax then that times 84 tax as appropriate Discount rate 11% 6 years Problem To make BT - AT mutply BT by [ 1- tax rate). .. 30% tax multply by 70% Using changes only method, compute which option is better BT-before tax AT after tax Keep Old Get New Cost of new 118,000 Refurbishment cost 30,000 convert to AT Annual maintenance 20.000 10,000 convert to AT tax rate 30% 30% saving with new per year NIA 40,000 Discount rate sale of old now 19.000 This is AT Sale of old at project and 11,000 don't consider taxes Sale of now at project end 22,000 don't consider taxes number of years to consider 0 and year 4 new machine refurbishment 30,000 this is an expense convert to AT extra supplies needed at beginning 7.000 get back at and last year] 20,000 10,000 70% 70 14,000 7,000 (14,000) (7.000) 48.000 70% 33,600 and Chapter 14 Problem A: Compute: NPV BT=before tax IRR AT-after tax Simple rate of Return To make BT-AT mutply BT by 11-tax rate), 0.9.30% tax multply by 70% Profitability Index Remember to recapture Salvage Data Set Buy Machine 410,000 Working capital at Project end period Project life 6 years for NPV IRR, and Simple Residual of machine 60,000 get at end year 6 ignore tax on residual Working capital needed at beginning 45,000 get back in last ye ignore tax on WC Saving # of employees 3 Total compensation each per year 61,000 this amount is B4 tax EACH-use AT $ for savings & expenses Effect of depreciation on Cash ignore depreciation maintenance expense BT yr2 & yra 25,000 this amount is B4 tax-use AT $ for savings & expenses tax rate 40% need to compute after tax then that times B4 tax an appropriate Discount rate 11% Problem Using changes only method, compute which option is better BT-before tax AT after tax Keep Old Get New To make BT = AT mutply BT by t1- tax rate), 6.9., 30% tax multply by 70% Cost of new 118,000 Refurbishment cost 30,000 convert to AT Annual maintenance 20,000 10,000 convert to AT tax rate 30% 30% saving with new per year NIA 48,000 20,000 10,000 Discount rate 70% 70% sale of old now 19,000 This is AT 14,000 7.000 Sale of old at project end 11,000 don't consider taxes (14,000) (7.000) Sale of new at project and 22.000 don't consider taxes number of years to consider 8 48.000 end year 4 new machine refurbishment 30,000 this is an expense convert to AT 70% extra supplies needed at beginning 7,000 get back at end flast year 33,600 Chapter 14 Probler A: Computer NPV BT before tax IRR AT after tax Simple rate of Return To make BT - AT mutply BT by [-tax rate)... 30% tax multply by 70% Profitability Index Remember to recapture Salvage Data Sot and Buy Machine 410,000 Working capital at Project and period Project life for NPV IRR, and Simple Residual of machine 60,000 get at end year 6 ignore tax on residual Working capital needed at beginning 45,000 get back in last ye ignore tax on WC of employees Total compensation each per year 61,000 this amount is B4 tax EACH-Use AT S for savings & expenses Effect of depreciation on Cash Ignore depreciation maintenance expense BT yr2 & ynd 25,000 this amount is B4 tax-use ATS for savings & expenses tax rate 40% need to compute after tax then that times 84 tax as appropriate Discount rate 11% 6 years Problem To make BT - AT mutply BT by [ 1- tax rate). .. 30% tax multply by 70% Using changes only method, compute which option is better BT-before tax AT after tax Keep Old Get New Cost of new 118,000 Refurbishment cost 30,000 convert to AT Annual maintenance 20.000 10,000 convert to AT tax rate 30% 30% saving with new per year NIA 40,000 Discount rate sale of old now 19.000 This is AT Sale of old at project and 11,000 don't consider taxes Sale of now at project end 22,000 don't consider taxes number of years to consider 0 and year 4 new machine refurbishment 30,000 this is an expense convert to AT extra supplies needed at beginning 7.000 get back at and last year] 20,000 10,000 70% 70 14,000 7,000 (14,000) (7.000) 48.000 70% 33,600 and Chapter 14 Problem A: Compute: NPV BT=before tax IRR AT-after tax Simple rate of Return To make BT-AT mutply BT by 11-tax rate), 0.9.30% tax multply by 70% Profitability Index Remember to recapture Salvage Data Set Buy Machine 410,000 Working capital at Project end period Project life 6 years for NPV IRR, and Simple Residual of machine 60,000 get at end year 6 ignore tax on residual Working capital needed at beginning 45,000 get back in last ye ignore tax on WC Saving # of employees 3 Total compensation each per year 61,000 this amount is B4 tax EACH-use AT $ for savings & expenses Effect of depreciation on Cash ignore depreciation maintenance expense BT yr2 & yra 25,000 this amount is B4 tax-use AT $ for savings & expenses tax rate 40% need to compute after tax then that times B4 tax an appropriate Discount rate 11% Problem Using changes only method, compute which option is better BT-before tax AT after tax Keep Old Get New To make BT = AT mutply BT by t1- tax rate), 6.9., 30% tax multply by 70% Cost of new 118,000 Refurbishment cost 30,000 convert to AT Annual maintenance 20,000 10,000 convert to AT tax rate 30% 30% saving with new per year NIA 48,000 20,000 10,000 Discount rate 70% 70% sale of old now 19,000 This is AT 14,000 7.000 Sale of old at project end 11,000 don't consider taxes (14,000) (7.000) Sale of new at project and 22.000 don't consider taxes number of years to consider 8 48.000 end year 4 new machine refurbishment 30,000 this is an expense convert to AT 70% extra supplies needed at beginning 7,000 get back at end flast year 33,600