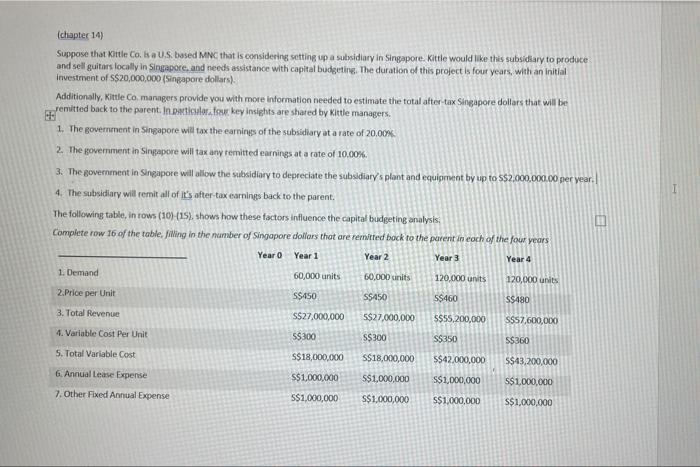

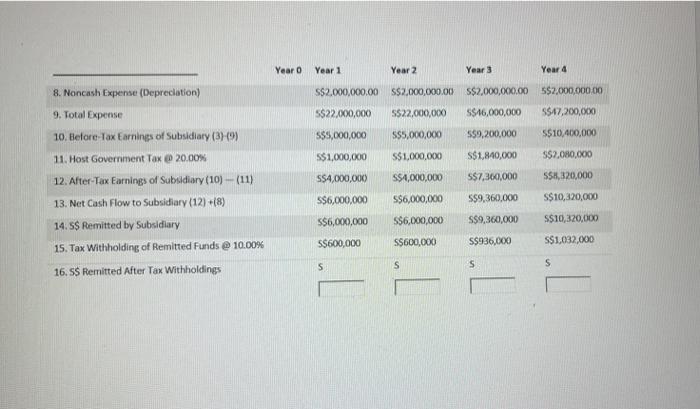

(chapter 14) Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of $$20,000,000 (Singapore dollars). Additionally, Kittle Co. managers provide you with more information needed to estimate the total after-tax Singapore dollars that will be remitted back to the parent. In particular, four key insights are shared by Kittle managers. 1. The government in Singapore will tax the earnings of the subsidiary at a rate of 20.00% 2. The government in Singapore will tax any remitted earnings at a rate of 10.00% 3. The government in Singapore will allow the subsidiary to depreciate the subsidiary's plant and equipment by up to $$2,000,000.00 per year. 4. The subsidiary will remit all of it's after-tax earnings back to the parent. The following table, in rows (10)-(15), shows how these factors influence the capital budgeting analysis. Complete row 16 of the table, filling in the number of Singapore dollars that are remitted back to the parent in each of the four years Year 0 Year 1 1. Demand 60,000 units $$450 S$27,000,000 2.Price per Unit Year 2 60,000 units $$450 5$27,000,000 $$300 Year 3 120,000 units $$460 $$55,200,000 $$350 Year 4 120,000 units $$480 S$57,600,000 3. Total Revenue 4. Variable Cost Per Unit $$300 $$360 5. Total Variable Cost $$18,000,000 S$18,000,000 $$42,000,000 $$43,200,000 6. Annual Lease Expense $$1,000,000 $$1,000,000 $$1,000,000 $$1,000,000 7. Other Fixed Annual Expense $$1,000,000 $$1,000,000 $$1,000,000 $$1,000,000 8. Noncash Expense (Depreciation) 9. Total Expense 10. Before-Tax Earnings of Subsidiary (3)-(9) 11. Host Government Tax @ 20.00% 12. After-Tax Earnings of Subsidiary (10)-(11) 13. Net Cash Flow to Subsidiary (12) +(8) 14. S$ Remitted by Subsidiary 15. Tax Withholding of Remitted Funds @ 10.00% 16. S$ Remitted After Tax Withholdings Year 0 Year 11 Year 2 Year 3 $$2,000,000.00 $$2,000,000.00 $$2,000,000.00 5$22,000,000 $$22,000,000 $$46,000,000 5$5,000,000 $$5,000,000 $$9,200,000 $$1,000,000 $$1,000,000 $$1,840,000 $$4,000,000 $$4,000,000 $$7,360,000 $$6,000,000 $$6,000,000 559,360,000 $$6,000,000 $$6,000,000 $$9,360,000 $$600,000 S$600,000 $$936,000 S S S Year 4 5$2,000,000.00 $$47,200,000 $$10,400,000 $52,080,000 558,320,000 $$10,320,000 $$10,320,000 $$1,032,000 S