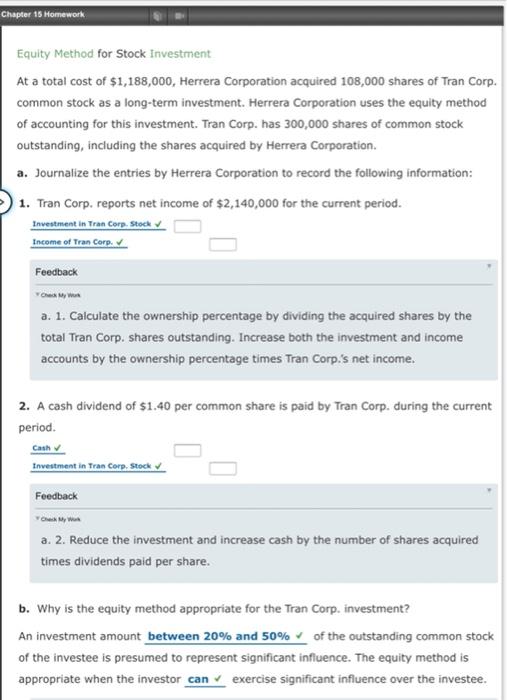

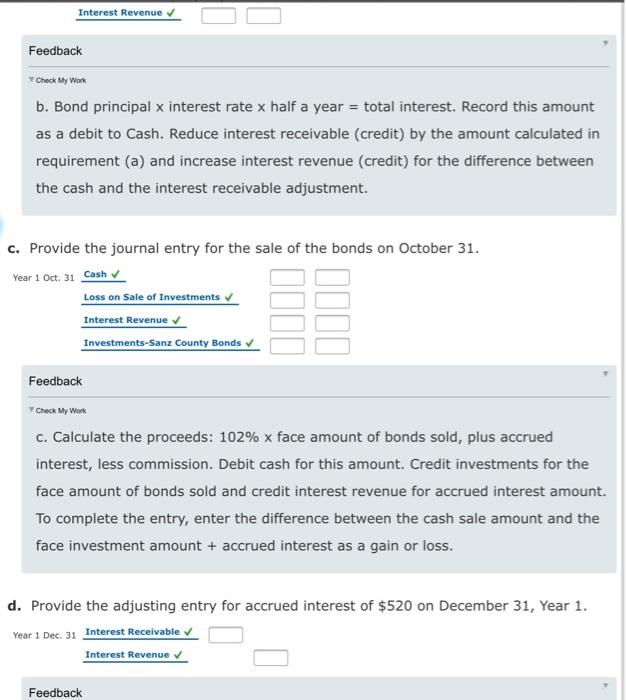

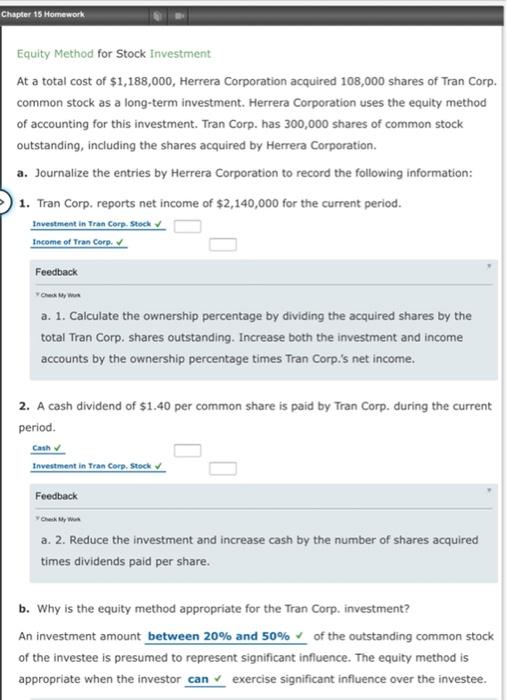

Chapter 15 Homework Equity Method for Stock Investment At a total cost of $1,188,000, Herrera Corporation acquired 108,000 shares of Tran Corp. common stock as a long-term investment. Herrera Corporation uses the equity method of accounting for this investment. Tran Corp. has 300,000 shares of common stock outstanding, including the shares acquired by Herrera Corporation a. Journalize the entries by Herrera Corporation to record the following information: 1. Tran Corp. reports net income of $2,140,000 for the current period. Investment in Tran Corp. Stock Income of Tran Corp. Feedback Chey a. 1. Calculate the ownership percentage by dividing the acquired shares by the total Tran Corp. shares outstanding. Increase both the investment and income accounts by the ownership percentage times Tran Corp.'s net income. 2. A cash dividend of $1.40 per common share is paid by Tran Corp. during the current period. Cash Investment in Tran Corp. Stock Feedback a. 2. Reduce the investment and increase cash by the number of shares acquired times dividends paid per share. b. Why is the equity method appropriate for the Tran Corp. investment? An investment amount between 20% and 50% of the outstanding common stock of the investee is presumed to represent significant influence. The equity method is appropriate when the investor can exercise significant influence over the investee. Interest Revenue Feedback Check My Work b. Bond principal x interest rate x half a year = total interest. Record this amount as a debit to Cash. Reduce interest receivable (credit) by the amount calculated in requirement (a) and increase interest revenue (credit) for the difference between the cash and the interest receivable adjustment. c. Provide the journal entry for the sale of the bonds on October 31. Year 1 Oct. 31 Cash Loss on Sale of Investments Interest Revenue Investments-Sanz County Bonds 1110 Feedback Check My Work C. Calculate the proceeds: 102% x face amount of bonds sold, plus accrued interest, less commission. Debit cash for this amount. Credit investments for the face amount of bonds sold and credit interest revenue for accrued interest amount. To complete the entry, enter the difference between the cash sale amount and the face investment amount + accrued interest as a gain or loss. d. Provide the adjusting entry for accrued interest of $520 on December 31, Year 1. Year 1 Dec. 31 Interest Receivable Interest Revenue Feedback Chapter 15 Homework Equity Method for Stock Investment At a total cost of $1,188,000, Herrera Corporation acquired 108,000 shares of Tran Corp. common stock as a long-term investment. Herrera Corporation uses the equity method of accounting for this investment. Tran Corp. has 300,000 shares of common stock outstanding, including the shares acquired by Herrera Corporation a. Journalize the entries by Herrera Corporation to record the following information: 1. Tran Corp. reports net income of $2,140,000 for the current period. Investment in Tran Corp. Stock Income of Tran Corp. Feedback Chey a. 1. Calculate the ownership percentage by dividing the acquired shares by the total Tran Corp. shares outstanding. Increase both the investment and income accounts by the ownership percentage times Tran Corp.'s net income. 2. A cash dividend of $1.40 per common share is paid by Tran Corp. during the current period. Cash Investment in Tran Corp. Stock Feedback a. 2. Reduce the investment and increase cash by the number of shares acquired times dividends paid per share. b. Why is the equity method appropriate for the Tran Corp. investment? An investment amount between 20% and 50% of the outstanding common stock of the investee is presumed to represent significant influence. The equity method is appropriate when the investor can exercise significant influence over the investee