Answered step by step

Verified Expert Solution

Question

1 Approved Answer

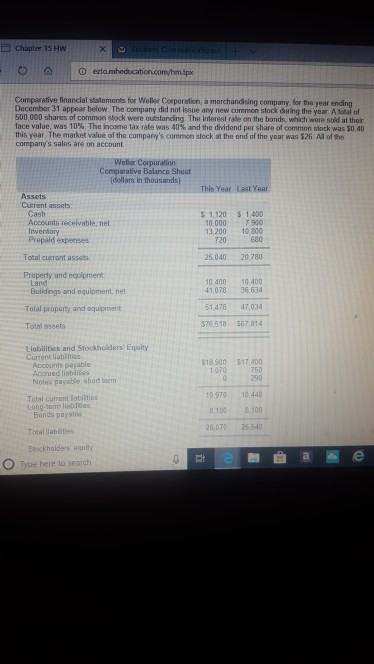

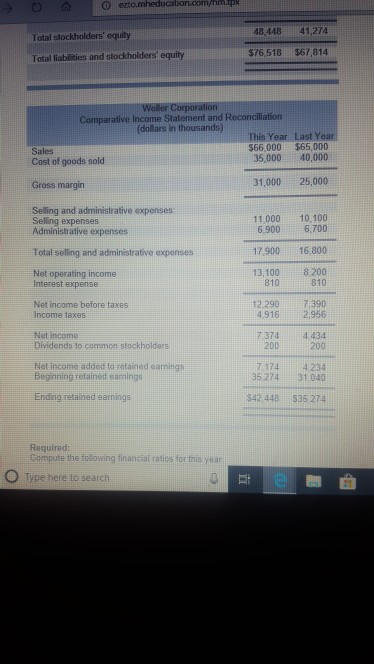

Chapter 15 HW Comparative financial statements for Weller Corporation, a merchandising compary, for the year ending December 31 appear below The company did not issue

Chapter 15 HW Comparative financial statements for Weller Corporation, a merchandising compary, for the year ending December 31 appear below The company did not issue any new common s?ock during the year A sotal of 500,000 shares of common stock were outslanding The interest rate on the bonds, which wore sold at ther face value, was 10% The horn tax fate was 40% and the drid nd per share of ommon sock wa, so 4D this year The market value of the company's common stock at the end of the year was $26 Al of the company's sales are on account Comparative Balance Shest dollars Year Last Year Assets Current assets Cash Accounts receivable, net Inveriory Prepaid expenses s 1,120 3 1.400 10,000 7.900 13,200 10 800 720 60 Total current assets 25,040 20,780 Property and equipment 10,400 10.400 Land Buildings and equipment, net 41,078 36.634 51.478 47.034 76 518 567 814 Total propenmy and equipment Total sssets Liabilities and Stockholders Equity Current liabiitien Accounts payable Accrued lisbaes $18 900 $17,400 750 290 1 070 Notes payable shot sernm 19.970 12 440 10 8100 28,070 25540 Total current Fabisties Long-serrm lisbilios Bonds paystil Total lablities Stockhalders squit O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started