Answered step by step

Verified Expert Solution

Question

1 Approved Answer

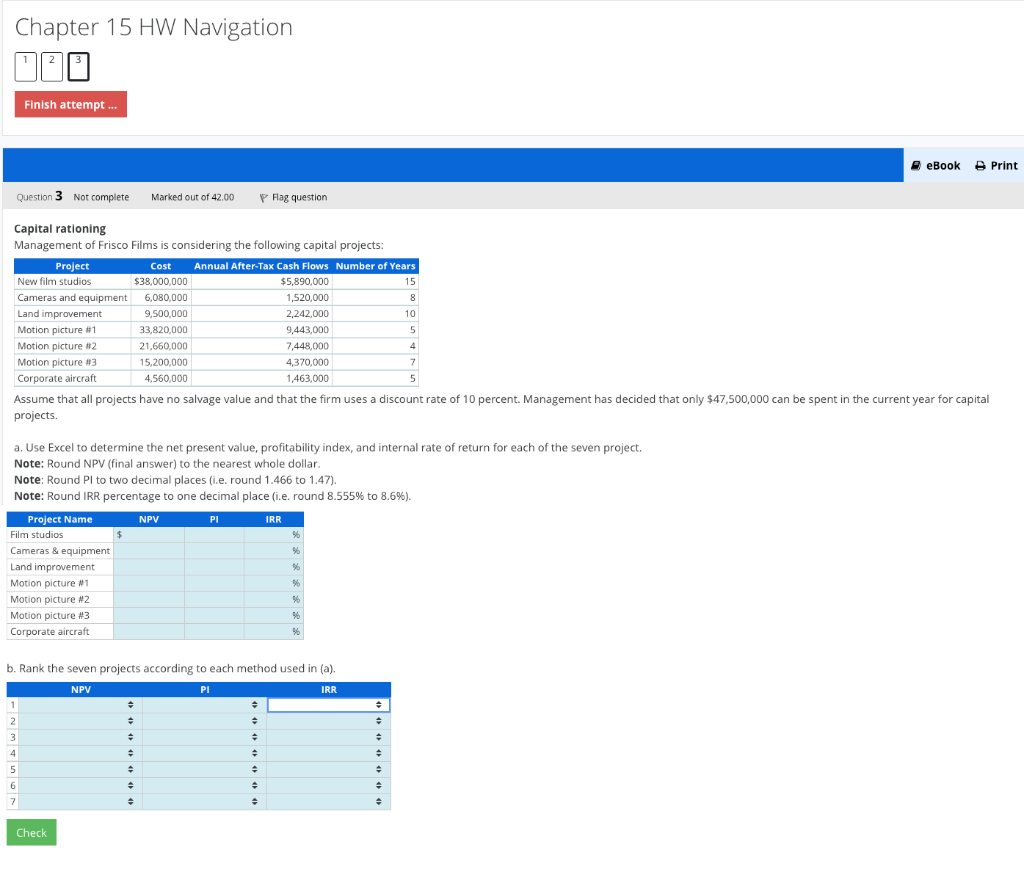

Chapter 15 HW Navigation Finish attempt... Question 3 Not complete Marked out of 42.00 Flag question Capital rationing Cost Cameras and equipment $38,000,000 6,080,000

Chapter 15 HW Navigation Finish attempt... Question 3 Not complete Marked out of 42.00 Flag question Capital rationing Cost Cameras and equipment $38,000,000 6,080,000 Management of Frisco Films is considering the following capital projects: Project New film studios Annual After-Tax Cash Flows Number of Years $5,890,000 15 1,520,000 8 Land improvement 9,500,000 2,242,000 10 Motion picture #1 33,820,000 9,443,000 5 Motion picture #2 21,660,000 7,448,000 4 15,200,000 4,370,000 4,560,000 1,463,000 7 5 eBook Print Motion picture #3 Corporate aircraft Assume that all projects have no salvage value and that the firm uses a discount rate of 10 percent. Management has decided that only $47,500,000 can be spent in the current year for capital projects. a. Use Excel to determine the net present value, profitability index, and internal rate of return for each of the seven project. Note: Round NPV (final answer) to the nearest whole dollar. Note: Round Pl to two decimal places (i.e. round 1.466 to 1.47). Note: Round IRR percentage to one decimal place (i.e. round 8.555% to 8.6%). Project Name NPV Film studios $ Cameras & equipment Land improvement Motion picture #1 Motion picture #2 Motion picture #3 PI IRR % % % % % % % Corporate aircraft b. Rank the seven projects according to each method used in (a). NPV PI IRR 1 = = 2 = 3 = 4 = = 5 = = = 6 = = = 7 = = Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started