Answered step by step

Verified Expert Solution

Question

1 Approved Answer

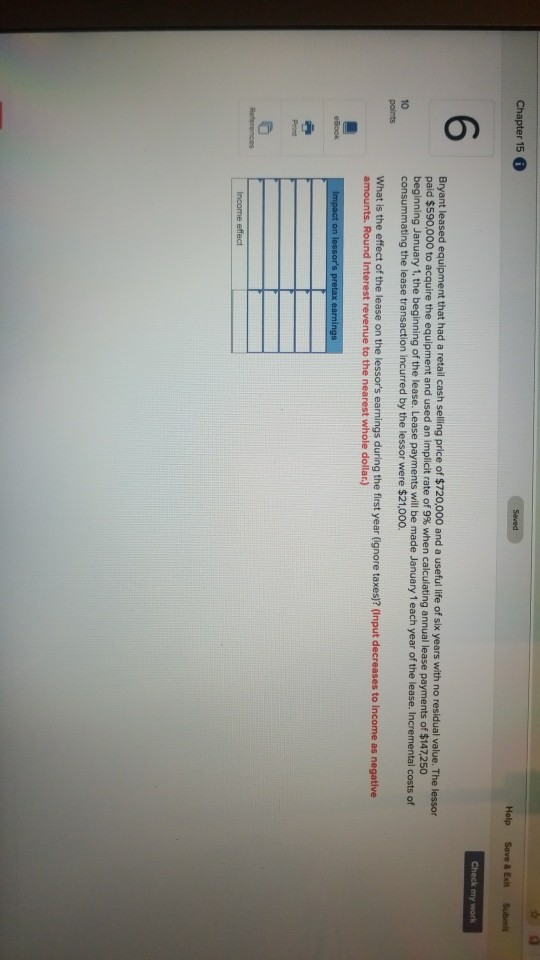

Chapter 15 i Seved Help Save & Exit Submit Check my work Bryant leased equipment that had a retail cash selling price of $720,000 and

Chapter 15 i Seved Help Save & Exit Submit Check my work Bryant leased equipment that had a retail cash selling price of $720,000 and a useful life of six years with no re paid $590,000 to acquire the equipment and used an implicit rate of 9 % when calculating annual lease payments of $147,250 beginning January 1, the beginning of the lease. Lease payments will be made January 1 each year of the lease. Incremental costs of consummating the lease transaction incurred by the lessor were $21,000. dual value. The lessor 10 points What is the effect of the lease on the lessor's earnings during the first year (ignore taxes)? (Input decreases to Income as negative amounts. Round Interest revenue to the nearest whole dollar.) C eBook Impact on lessor's pretax earnings Print References Income effect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started