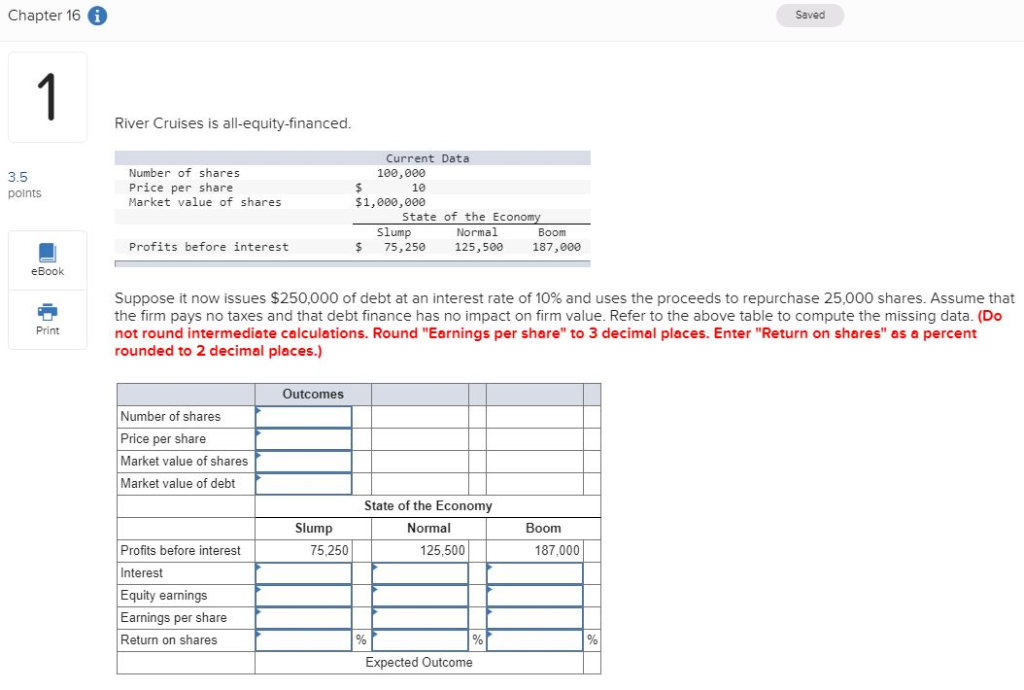

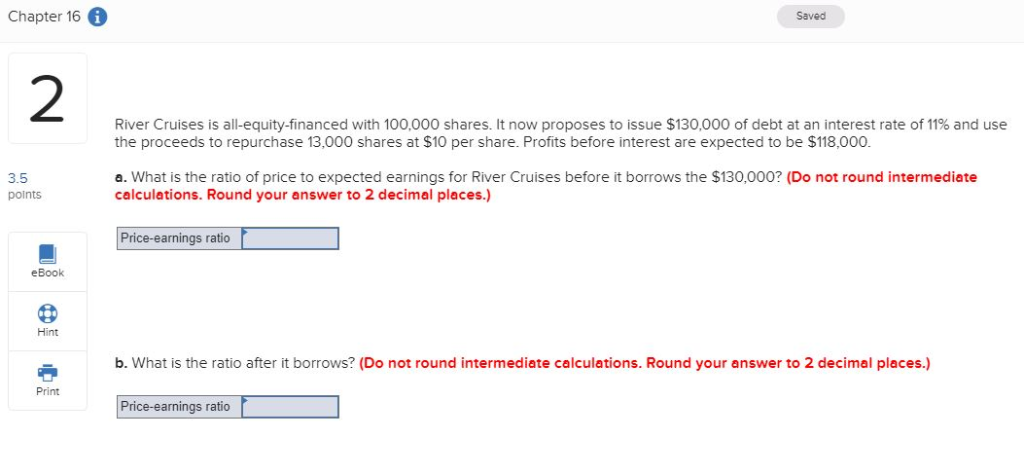

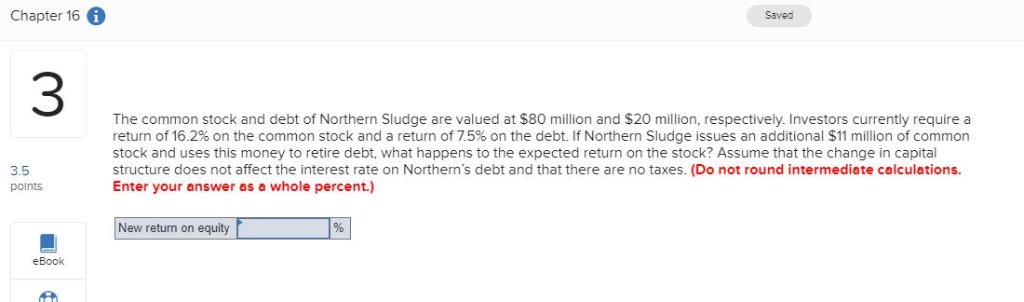

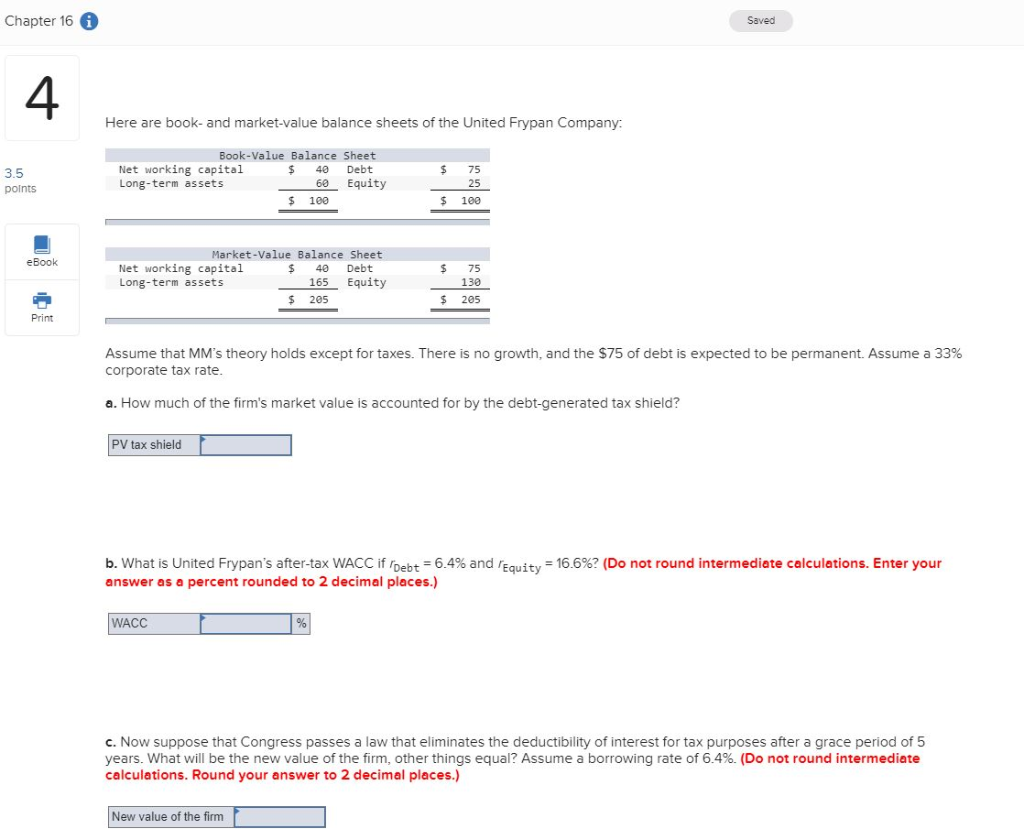

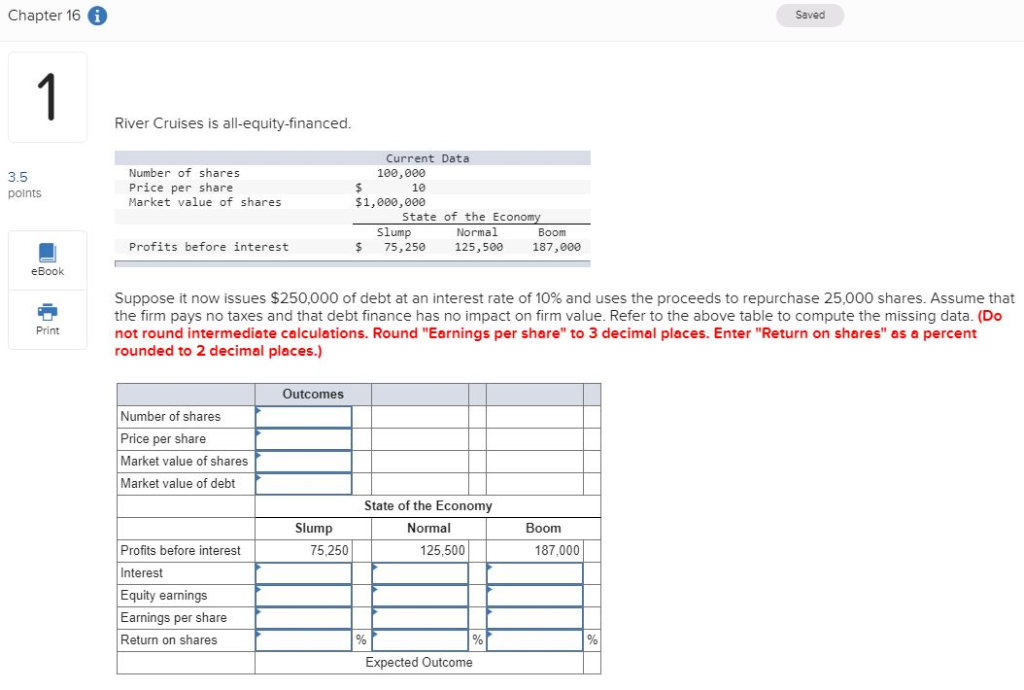

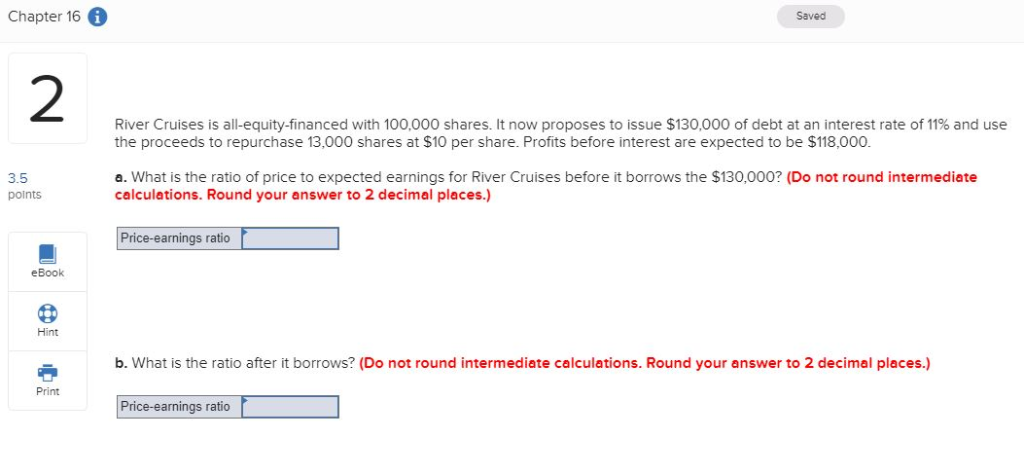

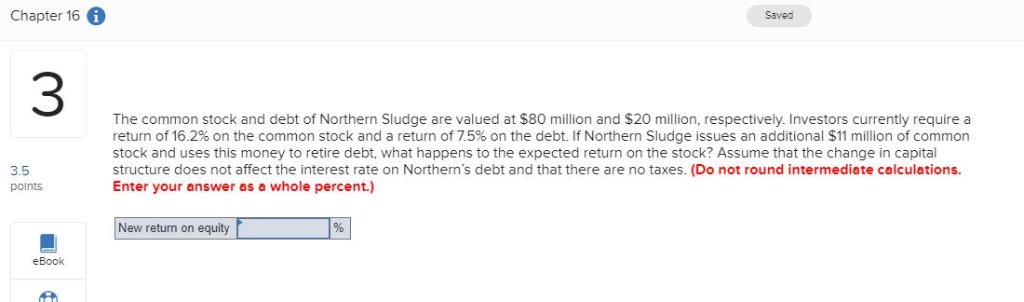

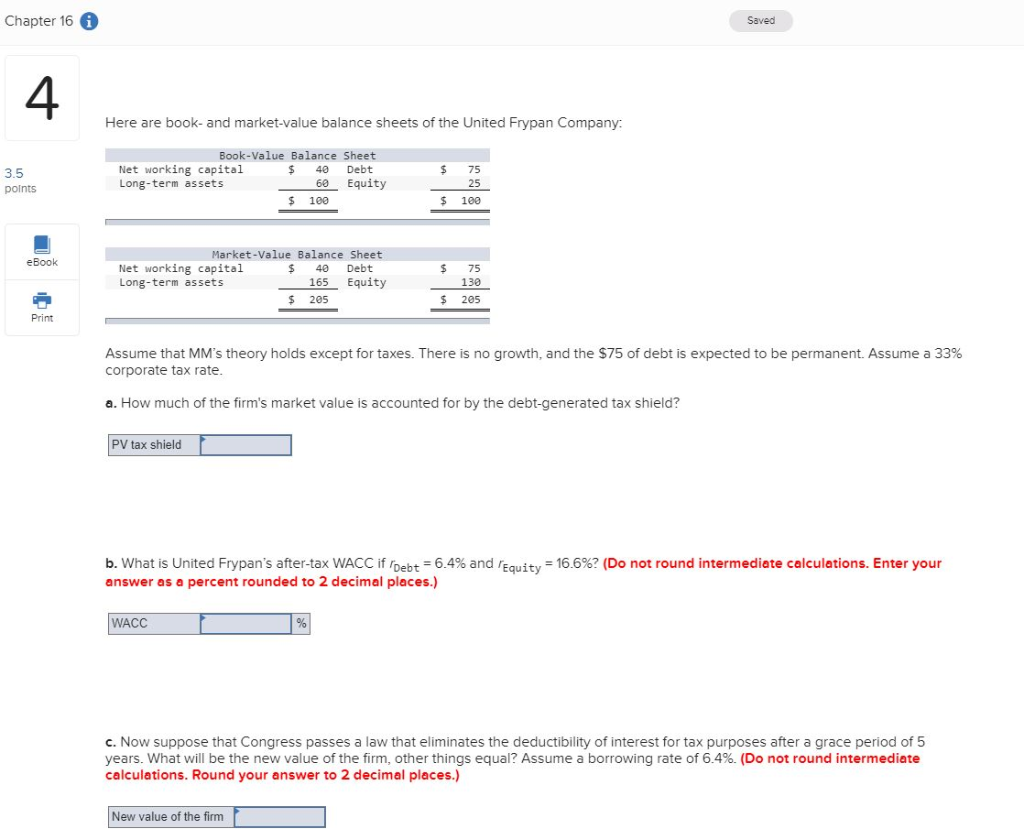

Chapter 16 0 Saved River Cruises is all-equity-financed. 3.5 points Number of shares Price per share Market value of shares Current Data 100,000 $ 10 $1,000,000 State of the Economy Slump Normal Boom $ 75,250 125,500 187,000 Profits before interest eBook Print Suppose it now issues $250,000 of debt at an interest rate of 10% and uses the proceeds to repurchase 25,000 shares. Assume that the firm pays no taxes and that debt finance has no impact on firm value. Refer to the above table to compute the missing data. (Do not round intermediate calculations. Round "Earnings per share" to 3 decimal places. Enter "Return on shares" as a percent rounded to 2 decimal places.) Outcomes Number of shares Price per share Market value of shares Market value of debt Slump 75,250 State of the Economy Normal 125,500 Boom 187,000 Profits before interest Interest Equity earnings Earnings per share Return on shares Expected Outcome Chapter 16 Saved River Cruises is all-equity-financed with 100,000 shares. It now proposes to issue $130,000 of debt at an interest rate of 11% and use the proceeds to repurchase 13,000 shares at $10 per share. Profits before interest are expected to be $118,000. 3.5 a. What is the ratio of price to expected earnings for River Cruises before it borrows the $130,000? (Do not round intermediate calculations. Round your answer to 2 decimal places.) points Price-earnings ratio eBook Hint b. What is the ratio after it borrows? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Print Price-earnings ratio Chapter 16 Saved The common stock and debt of Northern Sludge are valued at $80 million and $20 million, respectively. Investors currently require a return of 16.2% on the common stock and a return of 7.5% on the debt. If Northern Sludge issues an additional $11 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? Assume that the change in capital structure does not affect the interest rate on Northern's debt and that there are no taxes. (Do not round intermediate calculations. Enter your answer as a whole percent.) 3.5 points New return on equity % eBook Chapter 16 Saved A Here are book- and market value balance sheets of the United Frypan Company: $ 75 3.5 points Book-Value Balance Sheet Net working capital $ 40 Debt Long-term assets 60 Equity $ 100 25 109 eBook $ Market -Value Balance Sheet Net working capital $ 40 Debt Long-term assets 165 Equity $ 205 75 130 205 $ Print Assume that MM's theory holds except for taxes. There is no growth, and the $75 of debt is expected to be permanent. Assume a 33% corporate tax rate. a. How much of the firm's market value is accounted for by the debt-generated tax shield? PV tax shield b. What is United Frypan's after-tax WACC if lebt = 6.4% and Equity = 16.6%? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) WACC % c. Now suppose that Congress passes a law that eliminates the deductibility of interest for tax purposes after a grace period of 5 years. What will be the new value of the firm, other things equal? Assume a borrowing rate of 6.4%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) New value of the firm