Answered step by step

Verified Expert Solution

Question

1 Approved Answer

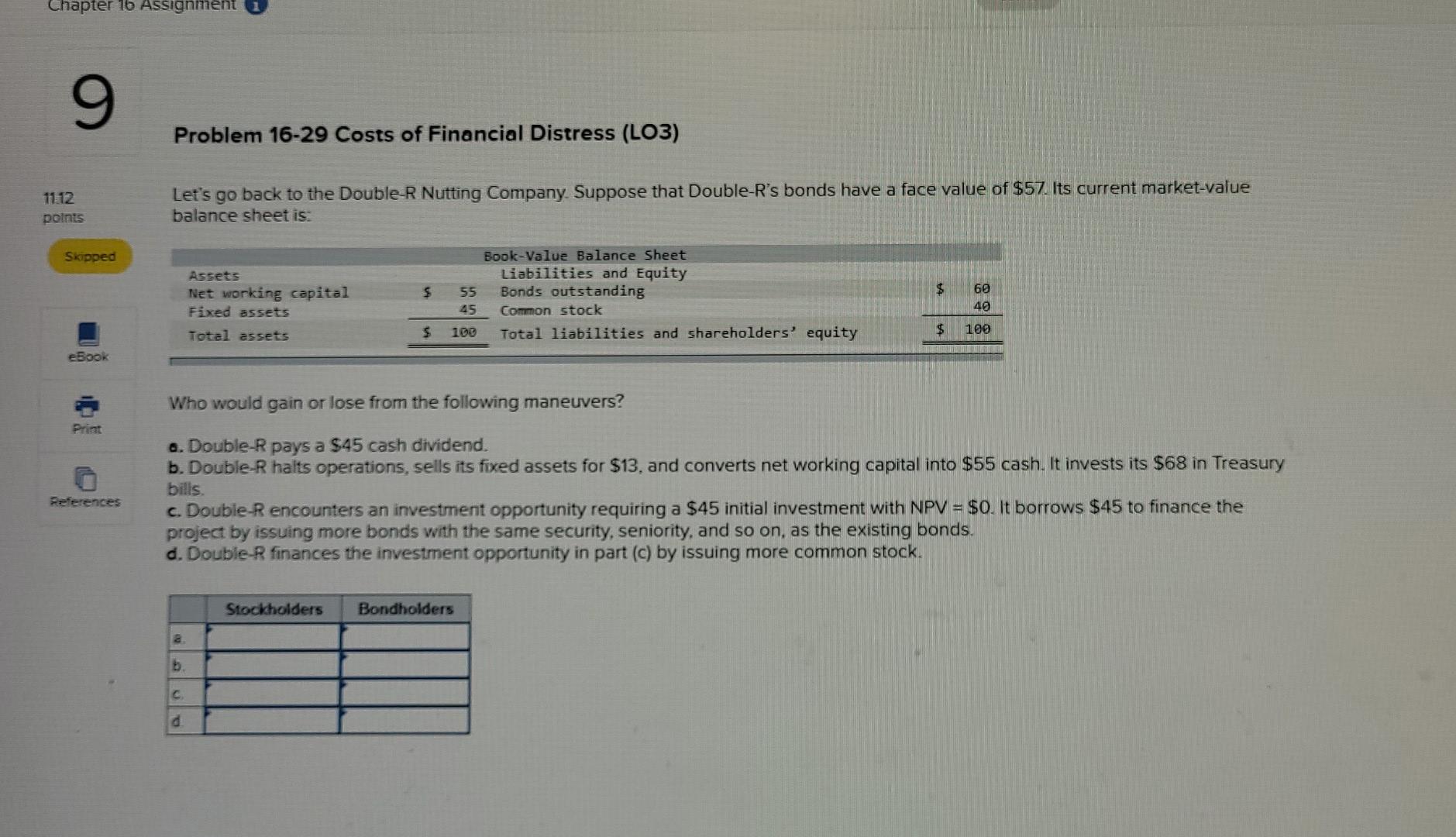

Chapter 16 Assignment 9 Problem 16-29 Costs of Financial Distress (LO3) 11.12 points Let's go back to the Double-R Nutting Company. Suppose that Double-R's bonds

Chapter 16 Assignment 9 Problem 16-29 Costs of Financial Distress (LO3) 11.12 points Let's go back to the Double-R Nutting Company. Suppose that Double-R's bonds have a face value of $57. Its current market value balance sheet is Skipped $ $ 60 Assets Net working capital Fixed assets Total assets Book-Value Balance Sheet Liabilities and Equity 55 Bonds outstanding 45 Common stock 100 Total liabilities and shareholders' equity 40 5 $ 100 eBook Who would gain or lose from the following maneuvers? a. Double-R pays a $45 cash dividend. b. Double-R halts operations, sells its fixed assets for $13, and converts net working capital into $55 cash. It invests its $68 in Treasury bills c. Double-Rencounters an investment opportunity requiring a $45 initial investment with NPV = $0. It borrows $45 to finance the project by issuing more bonds with the same security, seniority, and so on, as the existing bonds. d. Double-R finances the investment opportunity in part (c) by issuing more common stock. References Stockholders Bondholders 2 C d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started