Answered step by step

Verified Expert Solution

Question

1 Approved Answer

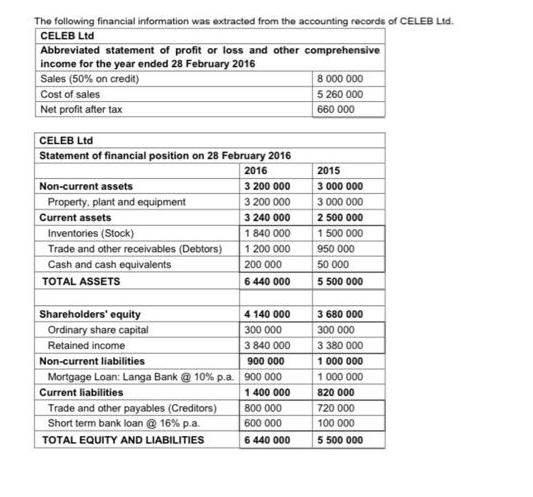

The following financial information was extracted from the accounting records of CELEB Ltd. CELEB Ltd Abbreviated statement of profit or loss and other comprehensive

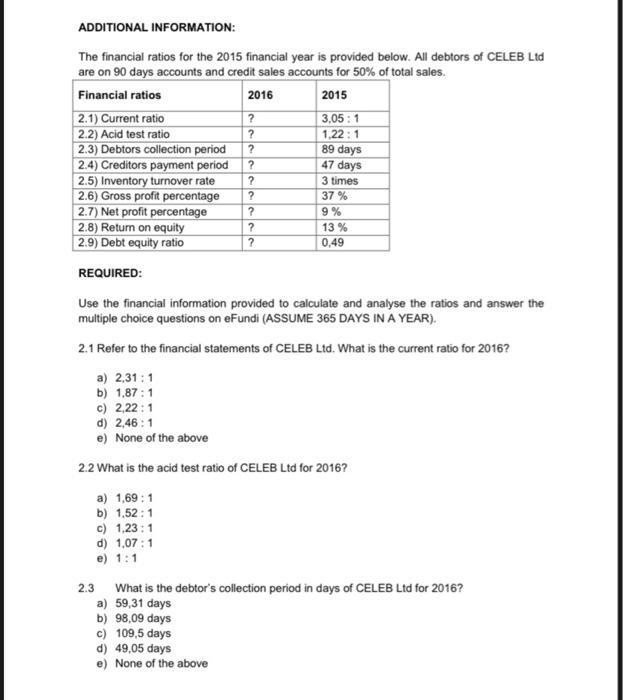

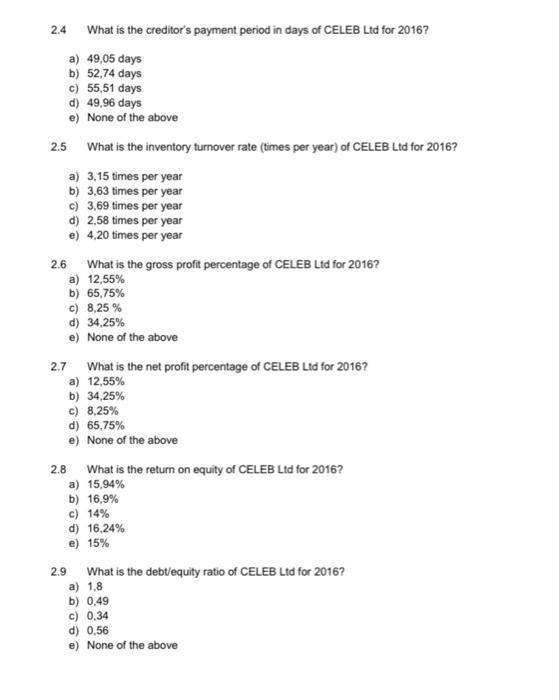

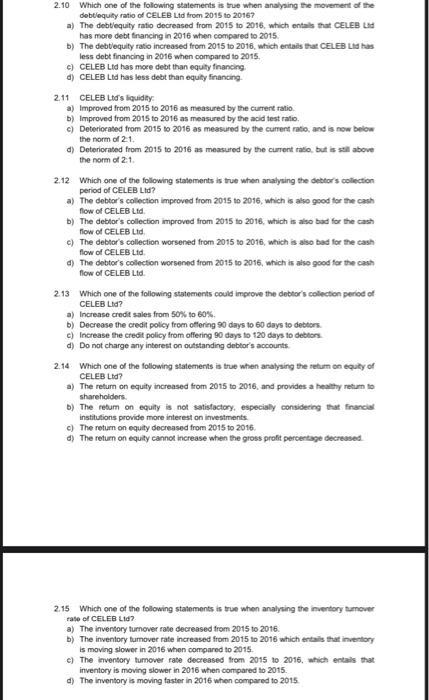

The following financial information was extracted from the accounting records of CELEB Ltd. CELEB Ltd Abbreviated statement of profit or loss and other comprehensive income for the year ended 28 February 2016 Sales (50% on credit) Cost of sales Net profit after tax CELEB Ltd Statement of financial position on 28 February 2016 Non-current assets Property, plant and equipment Current assets Inventories (Stock) Trade and other receivables (Debtors) Cash and cash equivalents TOTAL ASSETS 2016 3 200 000 3 200 000 3 240 000 1 840 000 1 200 000 200 000 6 440 000 Shareholders' equity Ordinary share capital Retained income 4 140 000 300 000 3 840 000 Non-current liabilities 900 000 Mortgage Loan: Langa Bank @ 10% p.a. 900 000 Current liabilities 1 400 000 Trade and other payables (Creditors) Short term bank loan @ 16% p.a. TOTAL EQUITY AND LIABILITIES 800 000 600 000 6 440 000 8 000 000 5 260 000 660 000 2015 3 000 000 3 000 000 2 500 000 1 500 000 950 000 50 000 5 500 000 3 680 000 300 000 3 380 000 1 000 000 1 000 000 820 000 720 000 100 000 5 500 000 ADDITIONAL INFORMATION: The financial ratios for the 2015 financial year is provided below. All debtors of CELEB Ltd are on 90 days accounts and credit sales accounts for 50% of total sales. Financial ratios 2016 2015 2.1) Current ratio ? 2.2) Acid test ratio ? 2.3) Debtors collection period ? 2.4) Creditors payment period ? ? ? 2.5) Inventory turnover rate 2.6) Gross profit percentage 2.7) Net profit percentage 2.8) Return on equity 2.9) Debt equity ratio ? ? 2.3 ? 3,05:1 1,22:1 89 days 47 days 3 times 37% 9% 13% 0,49 REQUIRED: Use the financial information provided to calculate and analyse the ratios and answer the multiple choice questions on eFundi (ASSUME 365 DAYS IN A YEAR). 2.1 Refer to the financial statements of CELEB Ltd. What is the current ratio for 2016? a) 2,31:1 b) 1,87:1 c) 2,22:1 d) 2,46:1 e) None of the above 2.2 What is the acid test ratio of CELEB Ltd for 2016? a) 1,69:1 b) 1,52:1 c) 1,23:1 d) 1,07:1 e) 1:1 What is the debtor's collection period in days of CELEB Ltd for 2016? a) 59,31 days b) 98,09 days c) 109,5 days d) 49,05 days e) None of the above 2.4 2.5 What is the creditor's payment period in days of CELEB Ltd for 2016? a) 49,05 days b) 52,74 days c) 55,51 days d) 49,96 days e) None of the above What is the inventory turnover rate (times per year) of CELEB Ltd for 2016? a) 3,15 times per year b) 3,63 times per year c) 3,69 times per year d) 2,58 times per year e) 4,20 times per year 2.6 What is the gross profit percentage of CELEB Ltd for 2016? a) 12,55% b) 65,75% c) 8,25 % d) 34,25% e) None of the above 2.7 What is the net profit percentage of CELEB Ltd for 2016? a) 12,55% b) 34,25% c) 8,25% d) 65,75% e) None of the above 2.8 What is the return on equity of CELEB Ltd for 2016? a) 15,94% b) 16,9% c) 14% d) 16,24% e) 15% 2.9 What is the debt/equity ratio of CELEB Ltd for 2016? a) 1,8 b) 0,49 c) 0,34 d) 0,56 e) None of the above 2.10 Which one of the following statements is true when analysing the movement of the debtlequity ratio of CELEB Ltd from 2015 to 20167 a) The debtlequity ratio decreased from 2015 to 2016, which entails that CELEB Ltd has more debt financing in 2016 when compared to 2015. b) The debt equity ratio increased from 2015 to 2016, which entails that CELEB Ltd has less debt financing in 2016 when compared to 2015. c) CELEB Ltd has more debt than equity financing d) CELEB Ltd has less debt than equity financing. 2.11 CELEB Ltd's liquidity: a) Improved from 2015 to 2016 as measured by the current ratio b) Improved from 2015 to 2016 as measured by the acid test ratio. c) Deteriorated from 2015 to 2016 as measured by the current ratio, and is now below the norm of 2:1. d) Deteriorated from 2015 to 2016 as measured by the current ratio, but is still above the norm of 2:1. 2.12 Which one of the following statements is true when analysing the debtor's collection period of CELEB Ltd? a) The debtor's collection improved from 2015 to 2016, which is also good for the cash flow of CELEB Ltd. b) The debtor's collection improved from 2015 to 2016, which is also bad for the cash flow of CELEB Ltd. c) The debtor's collection worsened from 2015 to 2016, which is also bad for the cash flow of CELEB Ltd. d) The debtor's collection worsened from 2015 to 2016, which is also flow of CELEB Ltd. good for the cash 2.13 Which one of the following statements could improve the debtor's collection period of CELEB Ltd? a) Increase credit sales from 50% to 60%. b) Decrease the credit policy from offering 90 days to 60 days to debtors c) Increase the credit policy from offering 90 days to 120 days to debtors d) Do not charge any interest on outstanding debtor's accounts. 2.14 Which one of the following statements is true when analysing the retum on equity of CELEB Ltd? a) The return on equity increased from 2015 to 2016, and provides a healthy return to shareholders. b) The return on equity is not satisfactory, especially considering that financial institutions provide more interest on investments c) The return on equity decreased from 2015 to 2016. d) The return on equity cannot increase when the gross profit percentage decreased 2.15 Which one of the following statements is true when analysing the inventory turnover rate of CELEB Lid? a) The inventory turnover rate decreased from 2015 to 2016. b) The inventory tumover rate increased from 2015 to 2016 which entails that inventory is moving slower in 2016 when compared to 2015. c) The inventory turnover rate decreased from 2015 to 2016, which entails that inventory is moving slower in 2016 when compared to 2015. d) The inventory is moving faster in 2016 when compared to 2015.

Step by Step Solution

★★★★★

3.55 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Question 21 a is correct option 2311 Current ratio current assetscurrent liabilities 32400001400000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started