Chapter 16 Q4

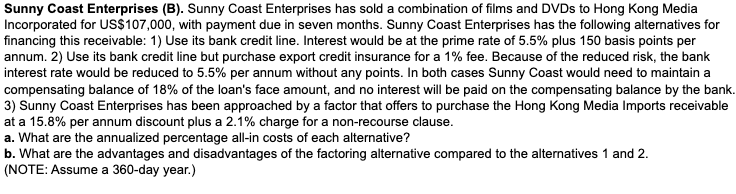

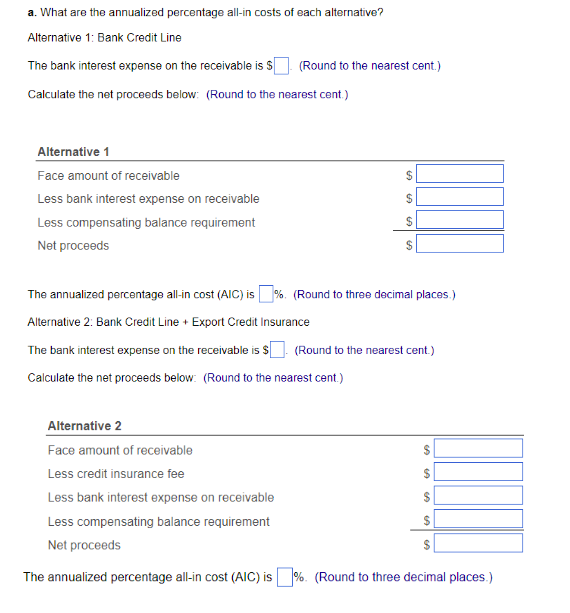

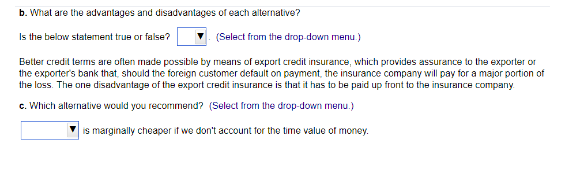

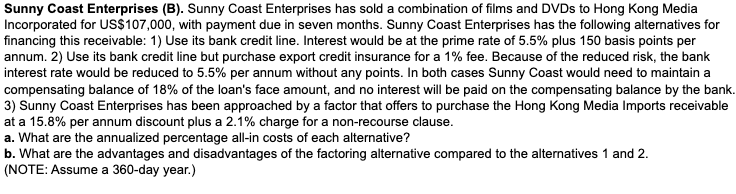

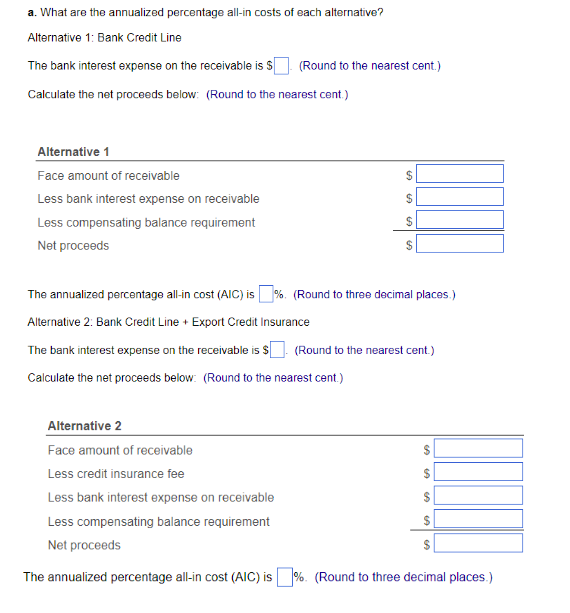

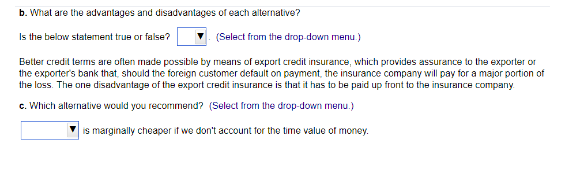

Sunny Coast Enterprises (B). Sunny Coast Enterprises has sold a combination of films and DVDs to Hong Kong Media Incorporated for US$107,000, with payment due in seven months. Sunny Coast Enterprises has the following alternatives for financing this receivable: 1) Use its bank credit line. Interest would be at the prime rate of 5.5% plus 150 basis points per annum. 2) Use its bank credit line but purchase export credit insurance for a 1% fee. Because of the reduced risk, the bank interest rate would be reduced to 5.5% per annum without any points. In both cases Sunny Coast would need to maintain a compensating balance of 18% of the loan's face amount, and no interest will be paid on the compensating balance by the bank. 3) Sunny Coast Enterprises has been approached by a factor that offers to purchase the Hong Kong Media Imports receivable at a 15.8% per annum discount plus a 2.1% charge for a non-recourse clause. a. What are the annualized percentage all-in costs of each alternative? b. What are the advantages and disadvantages of the factoring alternative compared to the alternatives 1 and 2. (NOTE: Assume a 360-day year.) a. What are the annualized percentage all-in costs of each alternative? Alternative 1: Bank Credit Line The bank interest expense on the receivable is $ Calculate the net proceeds below: (Round to the nearest cent.) Alternative 1 Face amount of receivable Less bank interest expense on receivable Less compensating balance requirement Net proceeds (Round to the nearest cent.) SA 60 $ 69 $ 60 The annualized percentage all-in cost (AIC) is %. (Round to three decimal places.) Alternative 2: Bank Credit Line + Export Credit Insurance The bank interest expense on the receivable is $ Calculate the net proceeds below: (Round to the nearest cent.) (Round to the nearest cent.) Alternative 2 Face amount of receivable Less credit insurance fee Less bank interest expense on receivable Less compensating balance requirement Net proceeds The annualized percentage all-in cost (AIC) is%. (Round to three decimal places.) SA $ $ CA SA b. What are the advantages and disadvantages of each alternative? Is the below statement true or false? (Select from the drop-down menu.) Better credit terms are often made possible by means of export credit insurance, which provides assurance to the exporter or the exporter's bank that, should the foreign customer default on payment, the insurance company will pay for a major portion of the loss. The one disadvantage of the export credit insurance is that it has to be paid up front to the insurance company. c. Which alternative would you recommend? (Select from the drop-down menu.) is marginally cheaper if we don't account for the time value of money