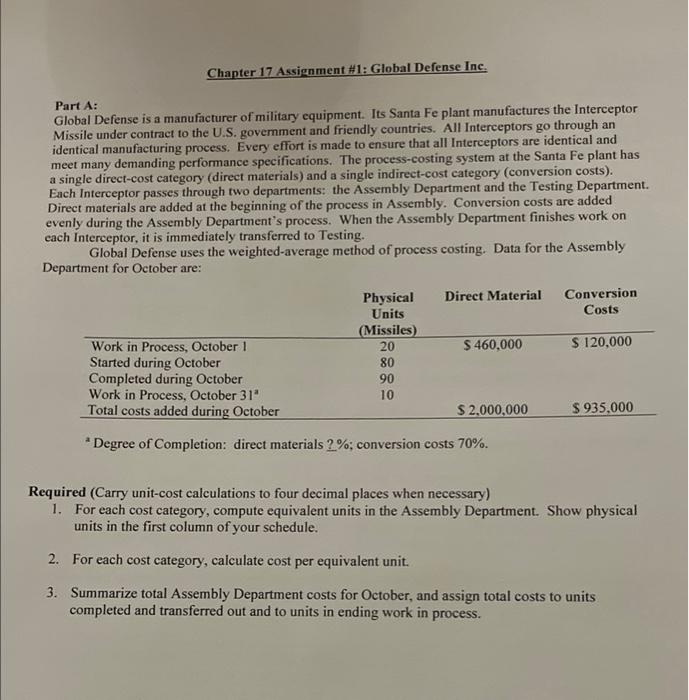

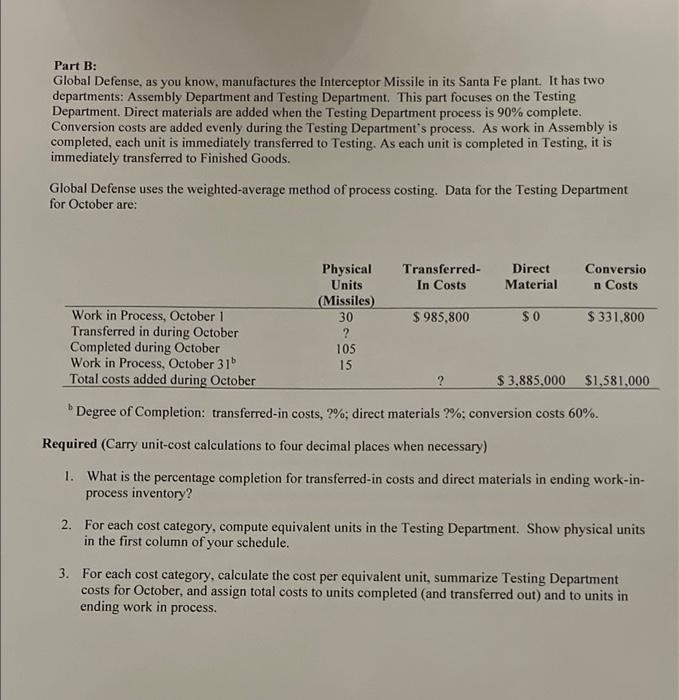

Chapter 17 Assignment #1: Global Defense Inc. Part A: Global Defense is a manufacturer of military equipment. Its Santa Fe plant manufactures the Interceptor Missile under contract to the U.S. government and friendly countries. All Interceptors go through an identical manufacturing process. Every effort is made to ensure that all Interceptors are identical and meet many demanding performance specifications. The process-costing system at the Santa Fe plant has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Each Interceptor passes through two departments: the Assembly Department and the Testing Department. Direct materials are added at the beginning of the process in Assembly. Conversion costs are added evenly during the Assembly Department's process. When the Assembly Department finishes work on cach Interceptor, it is immediately transferred to Testing. Global Defense uses the weighted average method of process costing. Data for the Assembly Department for October are: Direct Material Conversion Costs Physical Units (Missiles) 20 80 90 10 $ 460,000 Work in Process, October 1 Started during October Completed during October Work in Process, October 31" Total costs added during October $ 120,000 $ 2,000,000 $935,000 * Degree of Completion: direct materials 2%, conversion costs 70%. Required (Carry unit-cost calculations to four decimal places when necessary) 1. For each cost category, compute equivalent units in the Assembly Department. Show physical units in the first column of your schedule. 2. For each cost category, calculate cost per equivalent unit. 3. Summarize total Assembly Department costs for October, and assign total costs to units completed and transferred out and to units in ending work in process. Part B: Global Defense, as you know, manufactures the Interceptor Missile in its Santa Fe plant. It has two departments: Assembly Department and Testing Department. This part focuses on the Testing Department. Direct materials are added when the Testing Department process is 90% complete. Conversion costs are added evenly during the Testing Department's process. As work in Assembly is completed, each unit is immediately transferred to Testing. As each unit is completed in Testing, it is immediately transferred to Finished Goods. Global Defense uses the weighted-average method of process costing. Data for the Testing Department for October are: Transferred- In Costs Direct Material Conversio n Costs Physical Units Missiles) 30 ? 105 15 $ 985,800 $0 Work in Process, October 1 Transferred in during October Completed during October Work in Process, October 31 Total costs added during October $ 331,800 ? $ 3,885,000 $1,581,000 b Degree of Completion: transferred-in costs, 2%; direct materials ?%: conversion costs 60%. Required (Carry unit-cost calculations to four decimal places when necessary) 1. What is the percentage completion for transferred-in costs and direct materials in ending work-in- process inventory? 2. For each cost category, compute equivalent units in the Testing Department. Show physical units in the first column of your schedule. 3. For each cost category, calculate the cost per equivalent unit, summarize Testing Department costs for October, and assign total costs to units completed (and transferred out) and to units in ending work in process