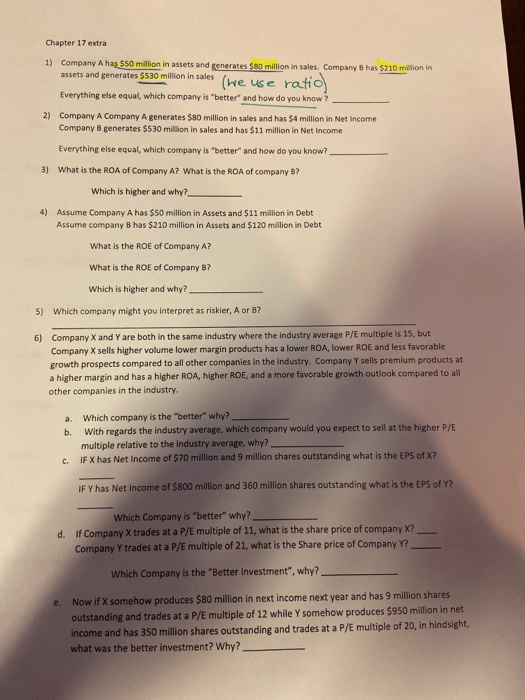

Chapter 17 extra 1) Company A has $50 million in assets and generates $80 million in sales. Company B has $210 million in assets and generates $530 million in sales we use ratio Everything else equal, which company is "better and how do you know? 2) Company A Company A generates $80 million in sales and has 54 million in Net Income Company B generates $530 million in sales and has $11 million in Net Income Everything else equal, which company is "better" and how do you know? 3) What is the ROA of Company A? What is the ROA of company B? Which is higher and why? 4) Assume Company A has $50 million in Assets and $11 million in Debt Assume company B has $210 million in Assets and $120 million in Debt What is the ROE of Company A? What is the ROE of Company B? Which is higher and why? 5) Which company might you interpret as riskier, A or B? 6) Company X and Y are both in the same industry where the industry average P/E multiple is 15, but Company X sells higher volume lower margin products has a lower ROA, lower ROE and less favorable growth prospects compared to all other companies in the industry. Company Y sells premium products at a higher margin and has a higher ROA, higher ROE, and a more favorable growth outlook compared to all other companies in the industry. a. Which company is the "better" why? b. With regards the industry average, which company would you expect to sell at the higher P/E multiple relative to the industry average, why? C. IF X has Net Income of $70 million and 9 million shares outstanding what is the EPS of ? IF Y has Net Income of $800 million and 360 million shares outstanding what is the EPS of Y? Which Company is "better" why? d. If Company Xtrades at a P/E multiple of 11, what is the share price of company X? Company Y trades at a P/E multiple of 21, what is the Share price of Company Y? Which Company is the "Better Investment", why? e. Now if X somehow produces $80 million in next income next year and has 9 million shares outstanding and trades at a P/E multiple of 12 while Y somehow produces $950 million in net income and has 350 million shares outstanding and trades at a P/E multiple of 20, in hindsight, what was the better investment? Why