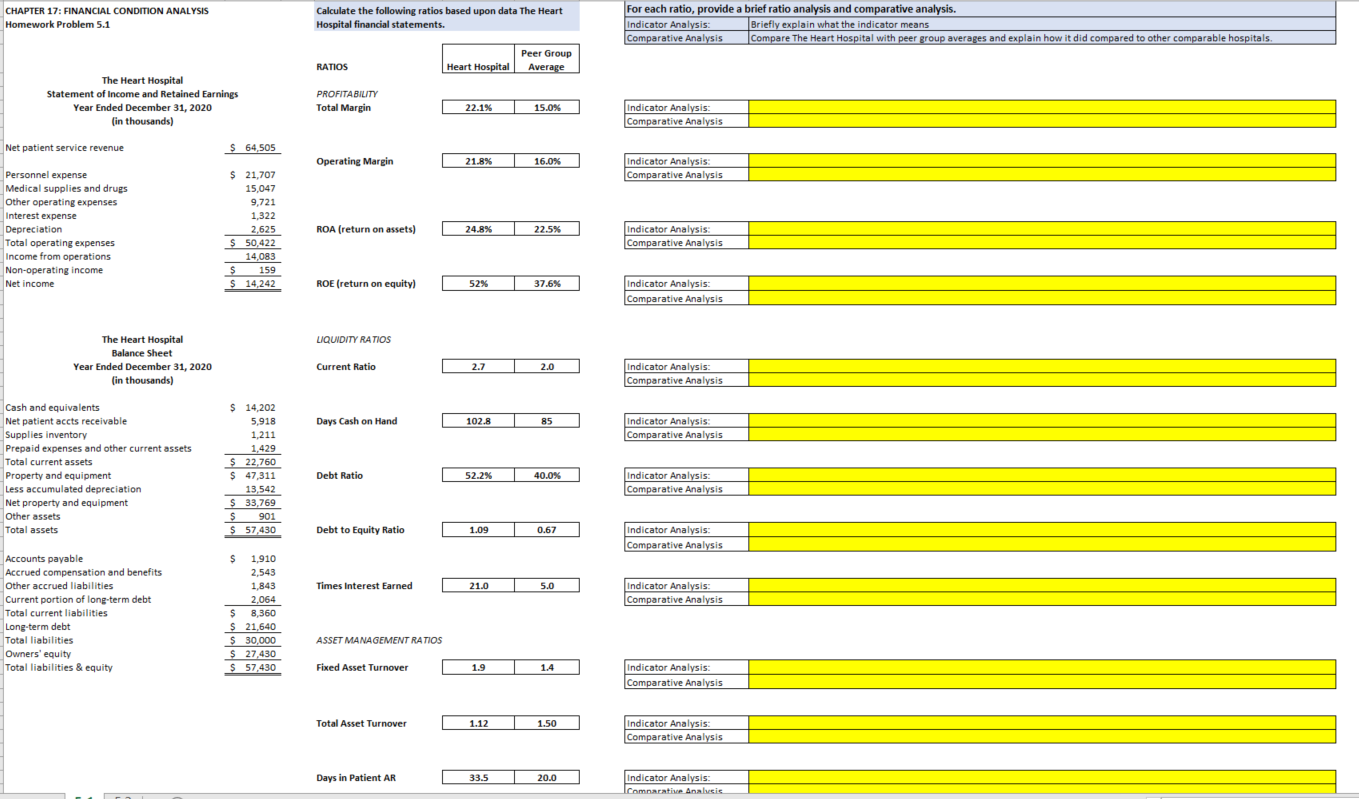

CHAPTER 17: FINANCIAL CONDITION ANALYSIS Homework Problem 5.1 Calculate the following ratios based upon data The Heart Hospital financial statements. For each ratio, provide a brief ratio analysis and comparative analysis. Indicator Analysis: Briefly explain what the indicator means Comparative Analysis Compare The Heart Hospital with peer group averages and explain how it did compared to other comparable hospitals. RATIOS Peer Group Average Heart Hospital The Heart Hospital Statement of Income and Retained Earnings Year Ended December 31, 2020 (in thousands) PROFITABILITY Total Margin 22.1% 15.0% Indicator Analysis: Comparative Analysis Net patient service revenue $ 64,505 Operating Margin 21.8% 16.0% Indicator Analysis: Comparative Analysis Personnel expense Medical supplies and drugs Other operating expenses Interest expense Depreciation Total operating expenses Income from operations Non-operating income Net income $ 21,707 15,047 9,721 1,322 2,625 $ 50,422 14,083 $ 159 $ 14,242 ROA (return on assets) 24.8% 22.5% Indicator Analysis: Comparative Analysis ROE (return on equity) 52% 37.6% Indicator Analysis: Comparative Analysis LIQUIDITY RATIOS The Heart Hospital Balance Sheet Year Ended December 31, 2020 , (in thousands) Current Ratio 2.7 2.0 Indicator Analysis: Comparative Analysis Days Cash on Hand 102.8 85 Indicator Analysis: Comparative Analysis Cash and equivalents Net patient accts receivable Supplies inventory Prepaid expenses and other current assets Total current assets Property and equipment Less accumulated depreciation Net property and equipment Other assets Total assets $ 14.202 5,918 1,211 1,429 $ 22,760 $ 47,311 13,542 $ 33,769 $ 901 $ 57,430 Debt Ratio 52.2% 40.0% Indicator Analysis: : Comparative Analysis Debt to Equity Ratio 1.09 0.67 Indicator Analysis: : Comparative Analysis Times Interest Earned 21.0 5.0 Indicator Analysis: Comparative Analysis Accounts payable Accrued compensation and benefits Other accrued liabilities Current portion of long-term debt Total current liabilities Long-term debt Total liabilities Owners' equity Total liabilities & equity $ $ 1,910 2,543 1,843 2,064 s $ 8,360 $ 21,640 $ 30.000 $ 27,430 $ 57,430 ASSET MANAGEMENT RATIOS Fixed Asset Turnover 1.9 1.4 Indicator Analysis: Comparative Analysis Total Asset Turnover 1.12 1.50 Indicator Analysis: Comparative Analysis Days in Patient AR 33.5 20.0 Indicator Analysis: Comparative Analysis