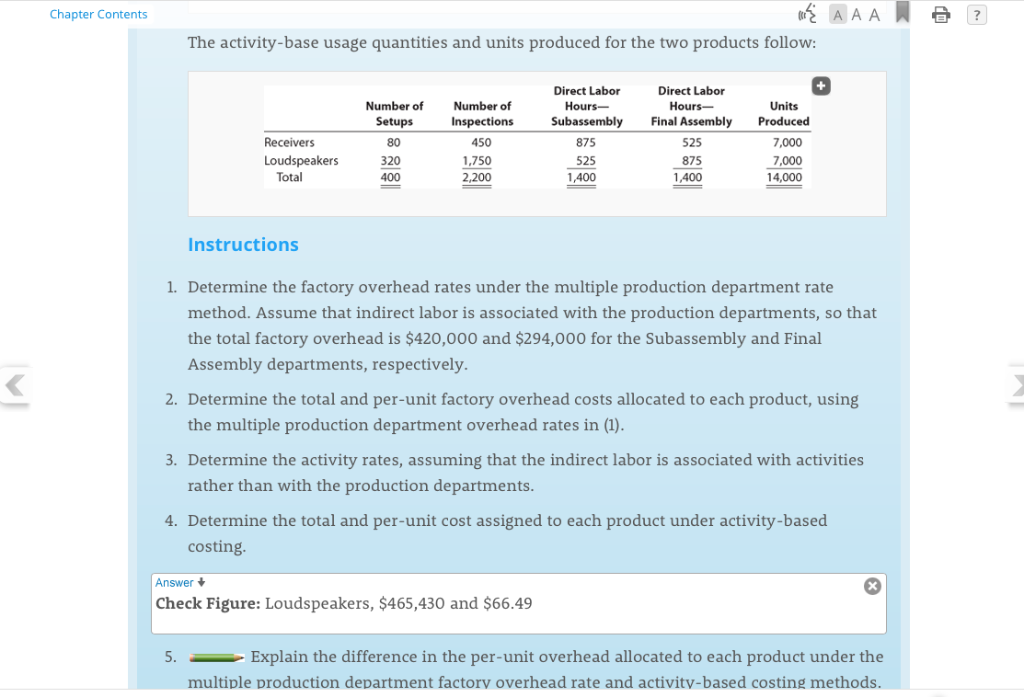

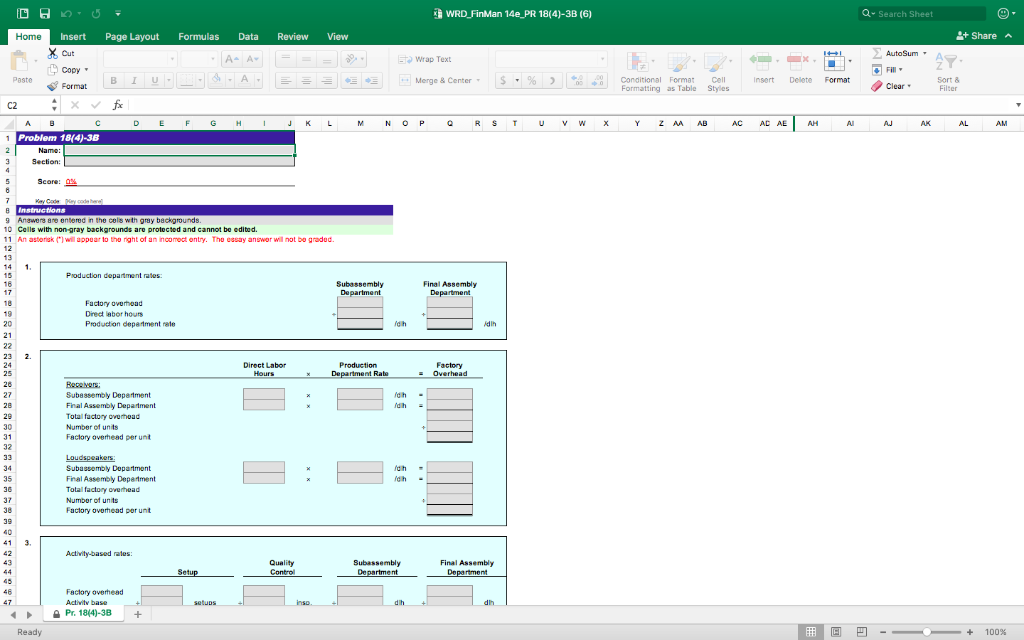

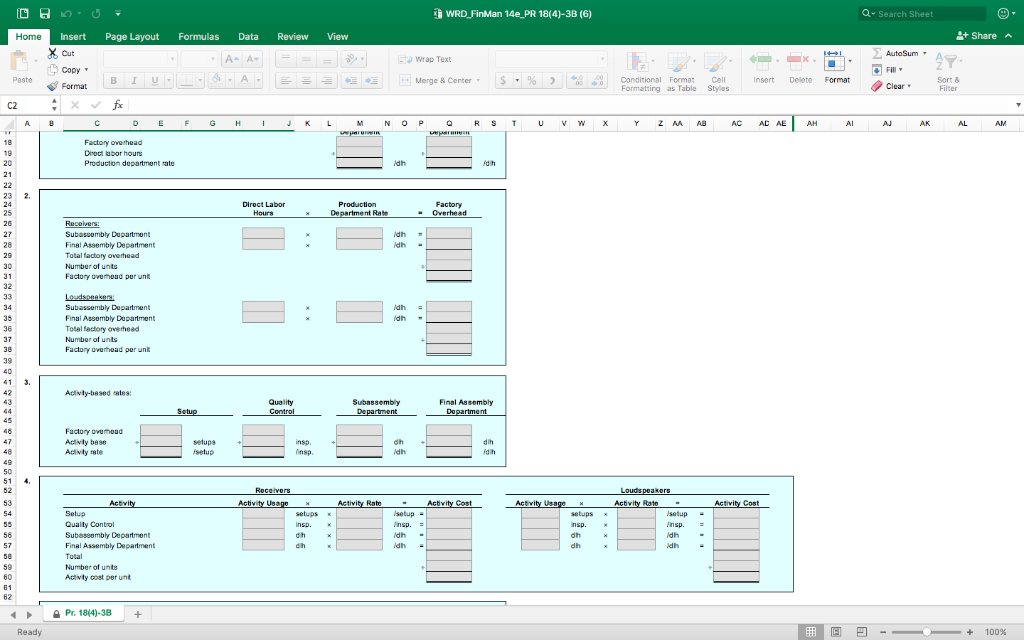

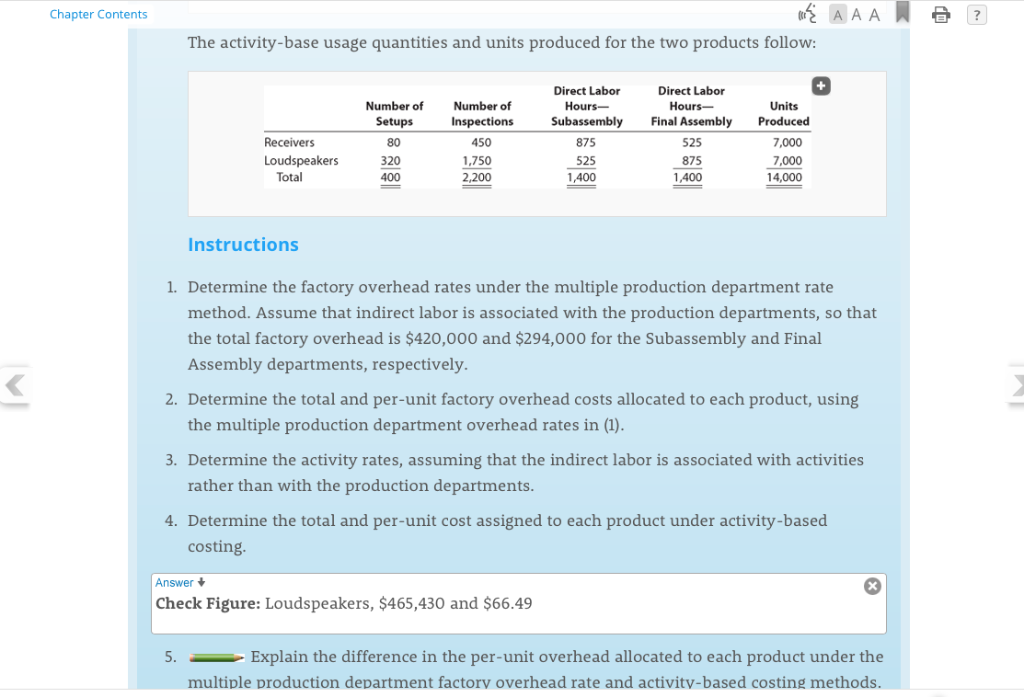

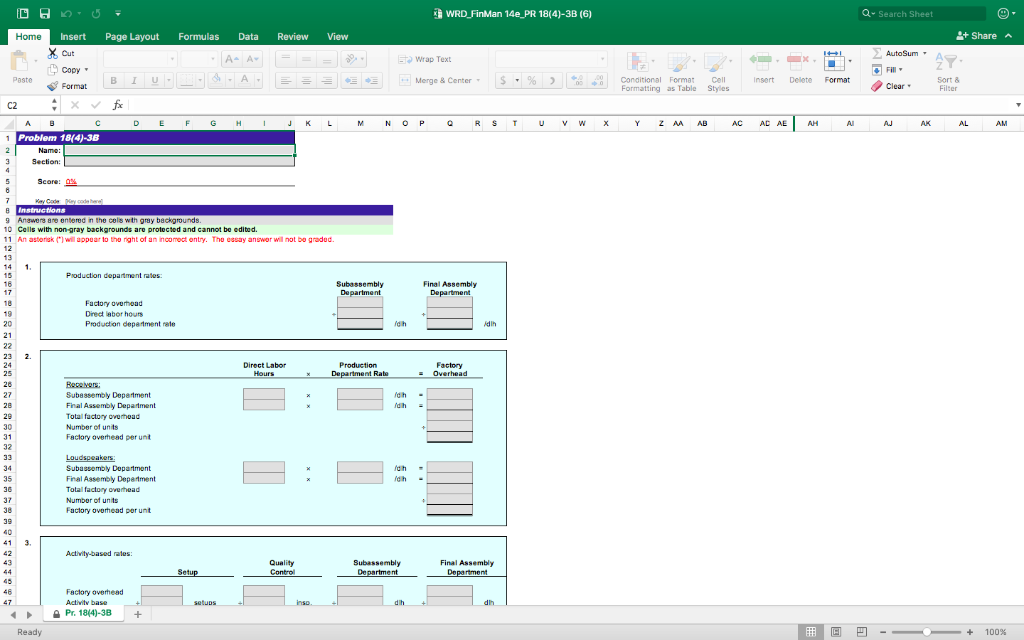

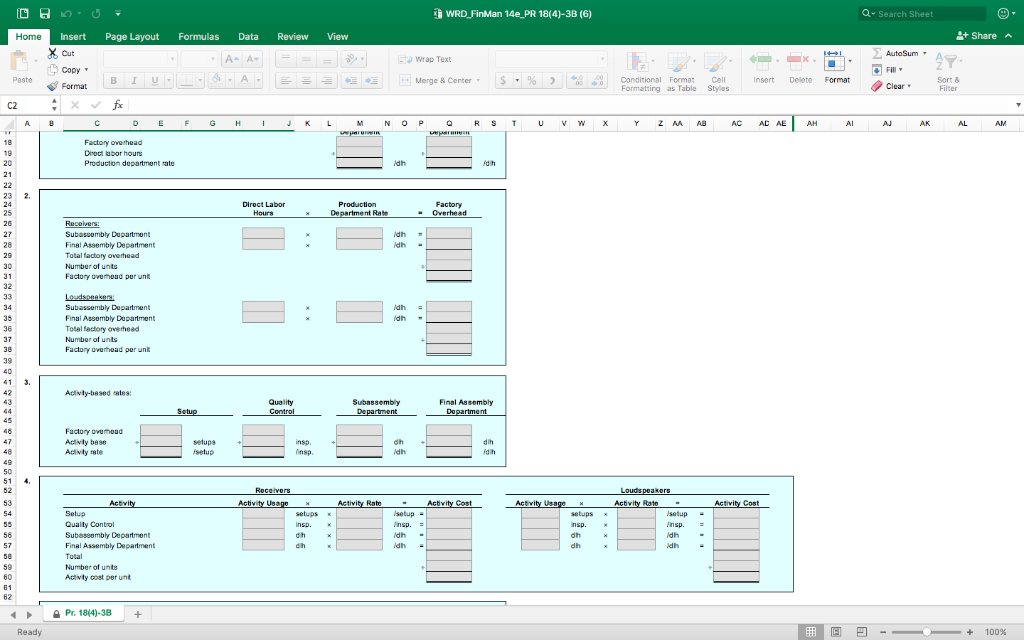

Chapter 18: Activity-Based Costing Chapter Contents poche AAA ? PR 18-3B Activity-based department rate product costing and product cost distortions Obj. 3, 4 Big Sound Inc. manufactures two products: receivers and loudspeakers. The factory overhead incurred is as follows: EXCEL TEMPLATE Indirect labor Subassembly Department Final Assembly Department Total $400,400 198,800 114,800 $714,000 The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Activity Setup Quality control Total Budgeted Activity Cost $138,600 261,800 $400,400 Activity Base Number of setups Number of inspections The activity-base usage quantities and units produced for the two products follow: Number of Setups Number of Inspections 450 1,750 Direct Labor Hours- Subassembly 875 525 Direct Labor Hours- Final Assembly 525 875 Units Produced 7,000 7,000 Receivers Loudspeakers 320 Chapter Contents AAA ? The activity-base usage quantities and units produced for the two products follow: Number of Inspections Direct Labor Hours- Subassembly Direct Labor Hours- Final Assembly Number of Setups 80 320 400 450 Receivers Loudspeakers Total 875 Units Produced 7,000 7,000 14,000 1.750 525 2.200 1,400 Instructions 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is $420,000 and $294,000 for the Subassembly and Final Assembly departments, respectively. 2. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). 3. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. 4. Determine the total and per-unit cost assigned to each product under activity-based costing. Answer + Check Figure: Loudspeakers, $465,430 and $66.49 5. Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods. WRD_FinMan 14e_PR 18(4)-3B (6) Q- Search Sheet DOW = Home Insert Page Layout X Cut + Share AutoSum Formulas Data A A - A " Review = = 3 View = 2 3 & - Copy Wrap Text Merge & Center 3 3 $ % Conditional Format Cell Insert Delete Format cleare Sort & Filter fc Paste Format C2 x A B C 1 Problem 18(4)-3B Name: Section: D E F G H I J K L M N O P Q R S T U V W X Y Z M AB AC AD AE AH AI AJ AK AL AM Score: 0 Yay Codecoder B Instructions 9 Answers are entered in the calls with gray backgrounds. 10 Calls with non-gray backgrounds are protected and cannot be edited. 11 An astonisk ") will appear to thonght of an incomoct ontry. The essay answer will not be gradud Production department rates: Subassembly Department Final Assembly Department Factory overhoud Direct inbor hours Production department rate Direct Labor Production Department Rate Overhead Idth - Boco Subassembly Department Final Assembly Department Total factory overhoud Number of units Factory Overhead perunt Ich - Loudspeakers: Subasomoy Department Final Assembly Department Total factory overhead Number of units Factory overhead por unt Activity-based rates: Subassembly Department 47 Factory overhead Activity base Pr. 1844)-3B + Ready #0 -- - + 100% WRD_FinMan 14e_PR 18(4)-3B (6) Q- Search Sheet DOW = Home Insert Page Layout X Cut Formulas + Share Review = = Data A AY - A View = AutoSum " Copy Eta Wrap Text Merge & Center - Paste - B - $ - Format Conditional Format Formatting as Table Coll Styles i nsert Delete Format Clear Sort & Filter C2 x fc N O P R S T U V W X Y Z M AB AC AD AE AH AI AJ AK AL AM Factory overhead Dioctubor hours Production department rate Factory Direct Labor Hours Production Department Rate Overhead Idh - Receivers: Subassembly Department Final Assembly Department Total factory overhead Number of units Factory overad per unit Idh = Loudspeaker Subassembly Department Final Assembly Department Total factory overhead Number of units Factory overhead per unit Activity-based sales: Quality Subassembly Department Final Assembly Department Factory overhead Activity base Activity rate Receivers Activity Usage Loudspeakers Activity Rate Activity Activity Rate - Activity Cost Activity Usage Activity Cost Setup INSP idh - Qualty Control Subassembly Department Final Assembly Department Total Number of units Activity cost perunt 58 Pr. 1844)-3B Ready # C - + 100%