Question

Chapter 18 question 9: Bombay Company's book and market value balance sheets are as follows: (NWC = net working capital; LTA = long term assets;

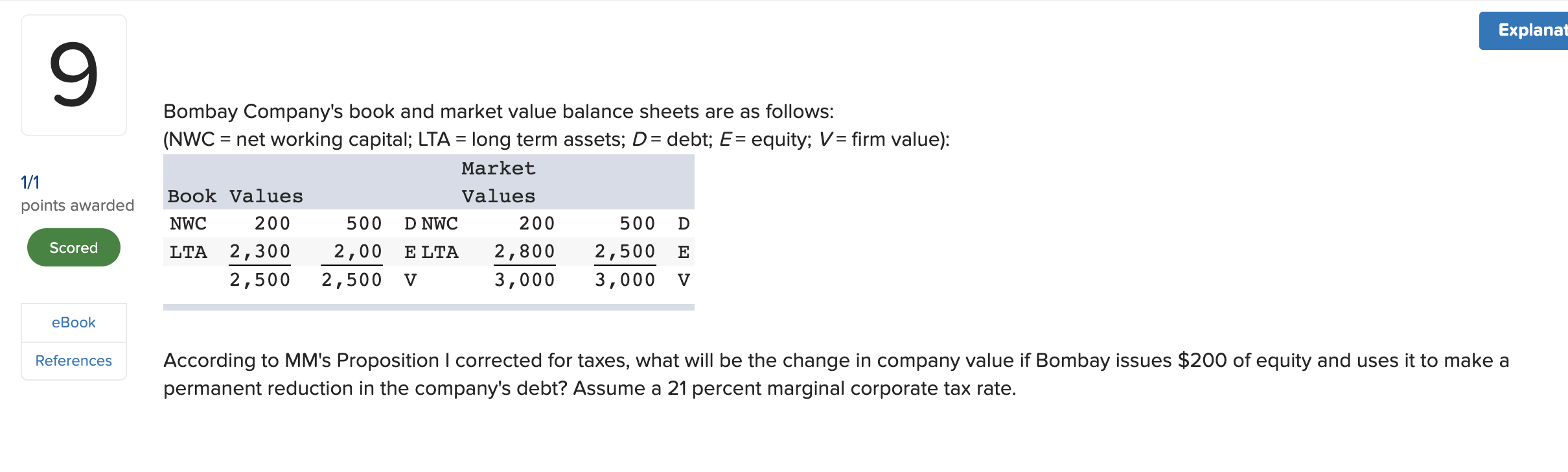

Chapter 18 question 9:  Bombay Company's book and market value balance sheets are as follows: (NWC = net working capital; LTA = long term assets; D = debt; E = equity; V = firm value): Book Values Market Values NWC 200 500 D NWC 200 500 D LTA 2,300 2,00 E LTA 2,800 2,500 E 2,500 2,500 V 3,000 3,000 V According to MM's Proposition I corrected for taxes, what will be the change in company value if Bombay issues $200 of equity and uses it to make a permanent reduction in the company's debt? Assume a 21 percent marginal corporate tax rate.

Bombay Company's book and market value balance sheets are as follows: (NWC = net working capital; LTA = long term assets; D = debt; E = equity; V = firm value): Book Values Market Values NWC 200 500 D NWC 200 500 D LTA 2,300 2,00 E LTA 2,800 2,500 E 2,500 2,500 V 3,000 3,000 V According to MM's Proposition I corrected for taxes, what will be the change in company value if Bombay issues $200 of equity and uses it to make a permanent reduction in the company's debt? Assume a 21 percent marginal corporate tax rate.

*********PLEASE LIST ALL THE STEPS AS DETAILED AS POSSIBLE, WILL RATE IF THE ANSWER IS CORRECT, THANK YOU*********

Explanat 9 Bombay Company's book and market value balance sheets are as follows: (NWC = net working capital; LTA = long term assets; D = debt; E= equity; V = firm value): Market 1/1 Book Values Values points awarded NWC 200 500 D NWC D 500 2,500 E Scored LTA 2,300 200 2,800 3,000 2,00 ELTA 2,500 2,500 V 3,000 V eBook References According to MM's Proposition I corrected for taxes, what will be the change in company value if Bombay issues $200 of equity and uses it to make a permanent reduction in the company's debt? Assume a 21 percent marginal corporate tax rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started