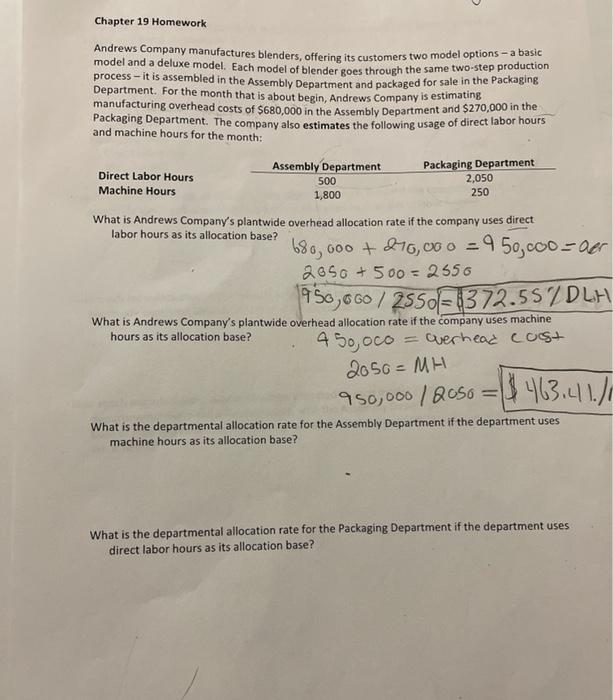

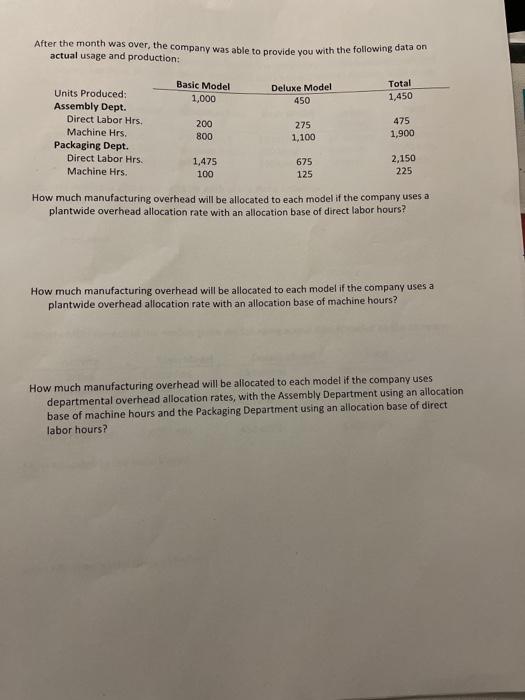

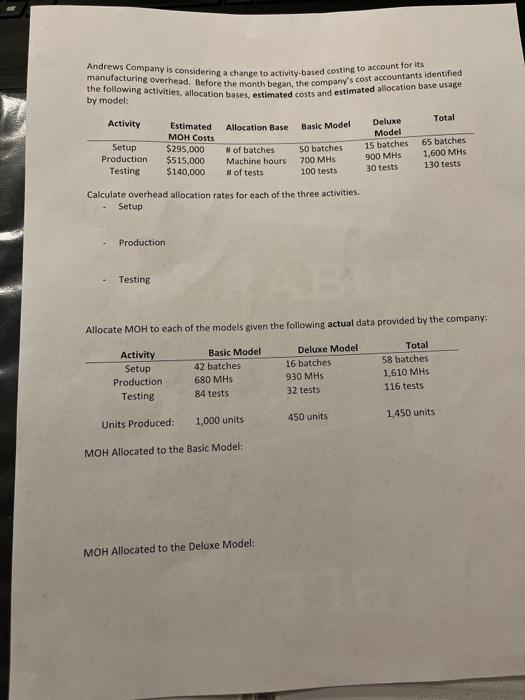

Chapter 19 Homework Andrews Company manufactures blenders, offering its customers two model options - a basic model and a deluxe model. Each model of blender goes through the same two-step production process - it is assembled in the Assembly Department and packaged for sale in the Packaging manufacturing overhead costs of $680,000 in the Assembly Department and $270,000 in the Packaging Department. The company also estimates the following usage of direct labor hours and machine hours for the month: Assembly Department Packaging Department Direct Labor Hours Machine Hours What is Andrews Company's plantwide overhead allocation rate if the company uses direct labor hours as its allocation base? 680,000 + 216,000 = 950,coo=aer 2650 + 500=2550 950,660 / 2550=1372.557 DLH What is Andrews Company's plantwide overhead allocation rate if the company uses machine hours as its allocation base? 4 50, oco = overhead coast 500 1,800 2,050 250 2050 = MH 950,000 12050 = 8463.411.) What is the departmental allocation rate for the Assembly Department if the department uses machine hours as its allocation base? What is the departmental allocation rate for the Packaging Department if the department uses direct labor hours as its allocation base? After the month was over, the company was able to provide you with the following data on actual usage and production: Total Basic Model 1,000 Deluxe Model 450 1,450 Units Produced: Assembly Dept. Direct Labor Hrs Machine Hrs. Packaging Dept. Direct Labor Hrs. Machine Hrs. 200 800 275 1,100 475 1,900 1,475 100 675 125 2,150 225 How much manufacturing overhead will be allocated to each model if the company uses a plantwide overhead allocation rate with an allocation base of direct labor hours? How much manufacturing overhead will be allocated to each model if the company uses a plantwide overhead allocation rate with an allocation base of machine hours? How much manufacturing overhead will be allocated to each model if the company uses departmental overhead allocation rates, with the Assembly Department using an allocation base of machine hours and the Packaging Department using an allocation base of direct labor hours? Andrews Company is considering a change to activity-based costing to account for its manufacturing overhead. Before the month began, the company's cost accountants identified the following activities, allocation bases, estimated costs and estimated allocation base usage by model: Total Activity Allocation Base Basic Model Setup Production Testing Estimated MOH Costs $295,000 $515,000 $140,000 Deluxe Model 15 batches 900 MHS 30 tests of batches Machine hours # of tests 50 batches 700 MHS 100 tests 65 batches 1,600 MHS 130 tests Calculate overhead allocation rates for each of the three activities. Setup Production Testing Allocate MOH to each of the models given the following actual data provided by the company: Activity Setup Production Testing Basic Model 42 batches 680 MHS 84 tests Deluxe Model 16 batches 930 MHS 32 tests Total 58 batches 1,610 MHS 116 tests 450 units 1,450 units Units Produced: 1,000 units MOH Allocated to the Basic Model: MOH Allocated to the Deluxe Model