Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( CHAPTER 2 1 ) There is a project in HappyLand that an American - based company would like to invest in . The project

CHAPTER

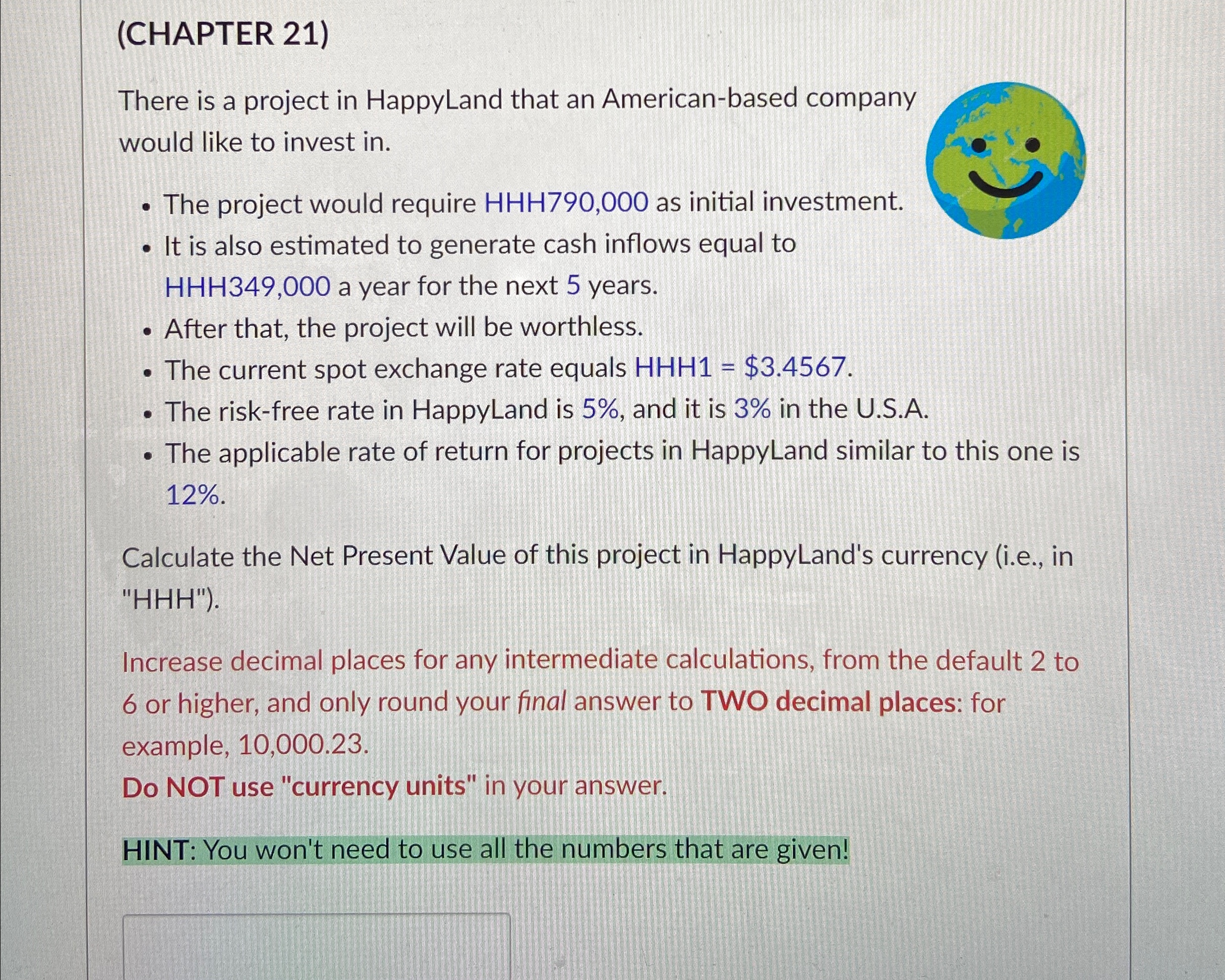

There is a project in HappyLand that an Americanbased company would like to invest in

The project would require as initial investment.

It is also estimated to generate cash inflows equal to HHH a year for the next years.

After that, the project will be worthless.

The current spot exchange rate equals $

The riskfree rate in HappyLand is and it is in the USA

The applicable rate of return for projects in HappyLand similar to this one is

Calculate the Net Present Value of this project in HappyLand's currency ie in

Increase decimal places for any intermediate calculations, from the default to or higher, and only round your final answer to TWO decimal places: for example,

Do NOT use "currency units" in your answer.

HINT: You won't need to use all the numbers that are given!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started