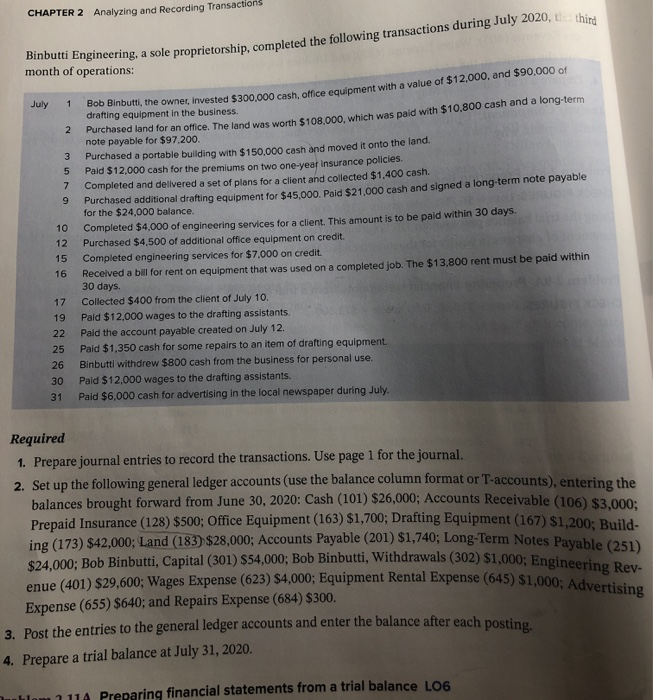

CHAPTER 2 Analyzing and Recording Transactions thin Binbutti Engineering, a sole proprietorship, completed the follo ring, a sole proprietorship, completed the following transactions during July 2020, 10 month of operations: July 1 Bob Binbutti, the owner invested $300.000 cash, office equipment with a var vested $300.000 cash, office equipment with a value of $12,000and $90,000 of drafting equipment in the business. ald with $10.800 cash and a long-term 2 Purchased land for an office. The land was worth $108,000, which was paid with $10.800 note payable for $97.200. 3 Purchased a portable building with $150,000 cash and moved it onto the land. 5 Paid $12,000 cash for the premiums on two one-year Insurance policies. 7 Completed and delivered a set of plans for a client and collected $1.400 cash Purchased additional drafting equipment for $45.000 Paid $21.000 cash and signed a long-term note payable for the $24,000 balance. Completed $4,000 of engineering services for a client. This amount is to be paid within 30 days, 12 Purchased $4.500 of additional office equipment on credit. 15 Completed engineering services for $7,000 on credit. 16 Received a bal for rent on equipment that was used on a completed job. The $13.800 rent must be paid within 30 days. 17 Collected $400 from the client of July 10. Pald $12,000 wages to the drafting assistants. 22 Paid the account payable created on July 12. 25 Paid $1.350 cash for some repairs to an item of drafting equipment. 26 Binbutti withdrew $800 cash from the business for personal use. 30 Paid $12,000 wages to the drafting assistants. 31 Paid $6,000 cash for advertising in the local newspaper during July. Required 1. Prepare journal entries to record the transactions. Use page 1 for the journal, 2. Set up the following general ledger accounts (use the balance column format or T-accounts), er balances brought forward from June 30, 2020: Cash (101) $26,000; Accounts Receivable (106) Prepaid Insurance (128) $500; Office Equipment (163) $1,700; Drafting Equipment (167) $1,200: Build- ing (173) $42,000; Land (183) $28,000; Accounts Payable (201) $1,740; Long-Term Notes Paya $24.000: Bob Binbutti, Capital (301) $54,000; Bob Binbutti, Withdrawals (302) $1,000: Engi enue (401) $29,600; Wages Expense (623) $4,000; Equipment Rental Expense (645) $1,000 Expense (655) $640; and Repairs Expense (684) $300. 3. Post the entries to the general ledger accounts and enter the balance after each posti 4. Prepare a trial balance at July 31, 2020. ole (201) $1,740; Long-Term Notes Payable (251) Withdrawals (302) $1,000; Engineering Rev- Expense (645) $1,000; Advertising uhlom 711A Preparing financial statements from a trial balance 106