Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 2: Applying Excel Data Markup on job cost 75% Department Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable

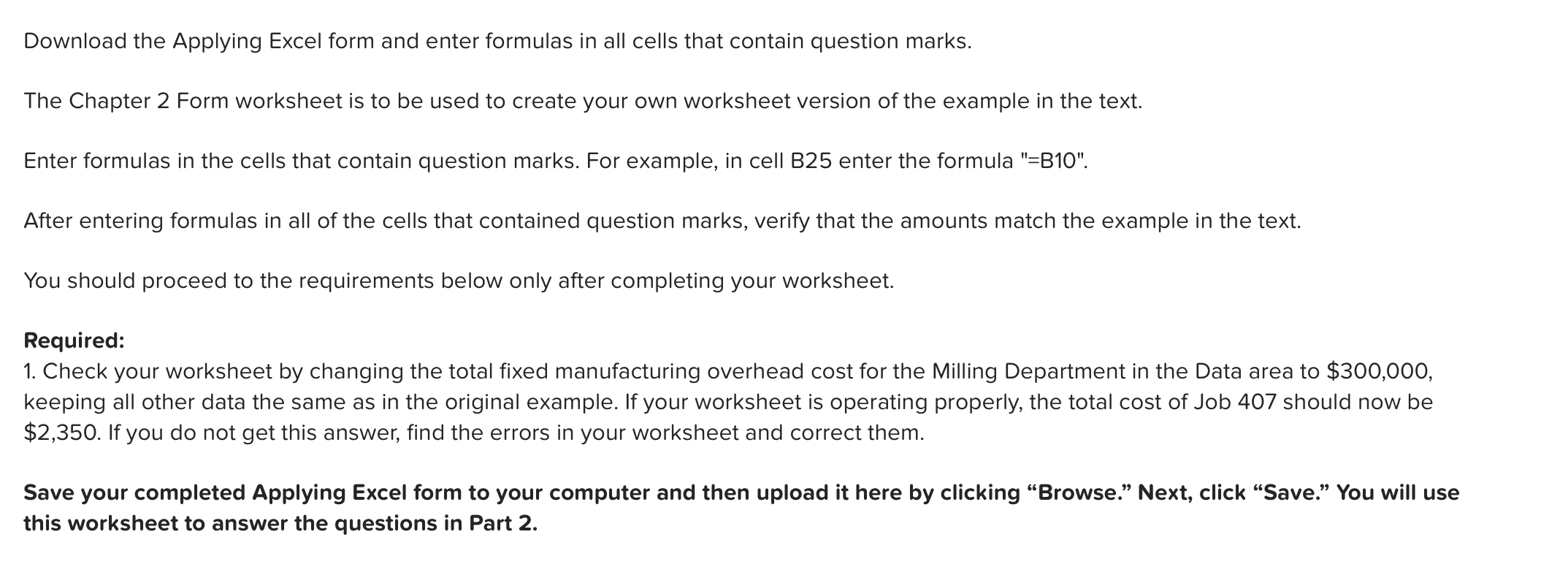

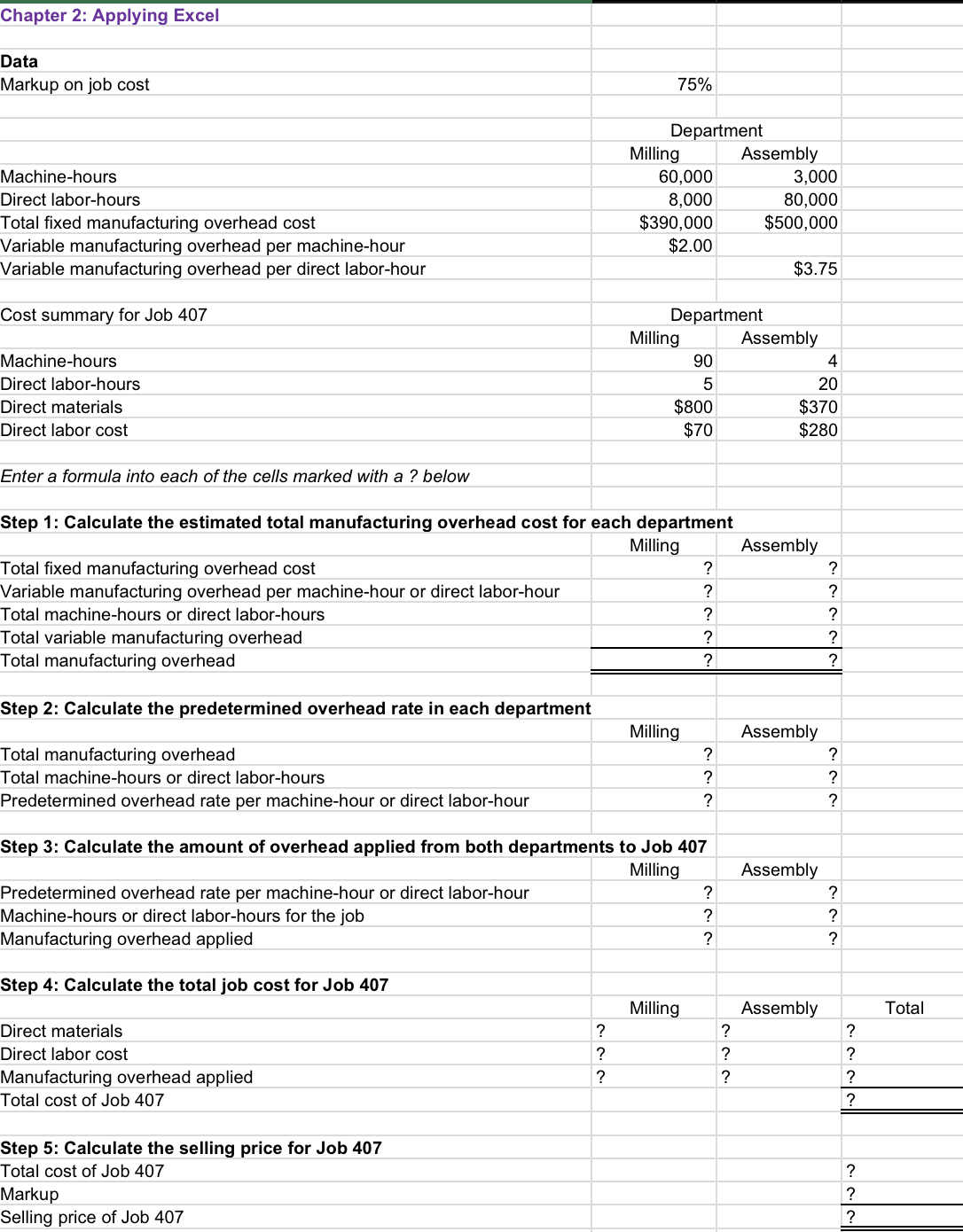

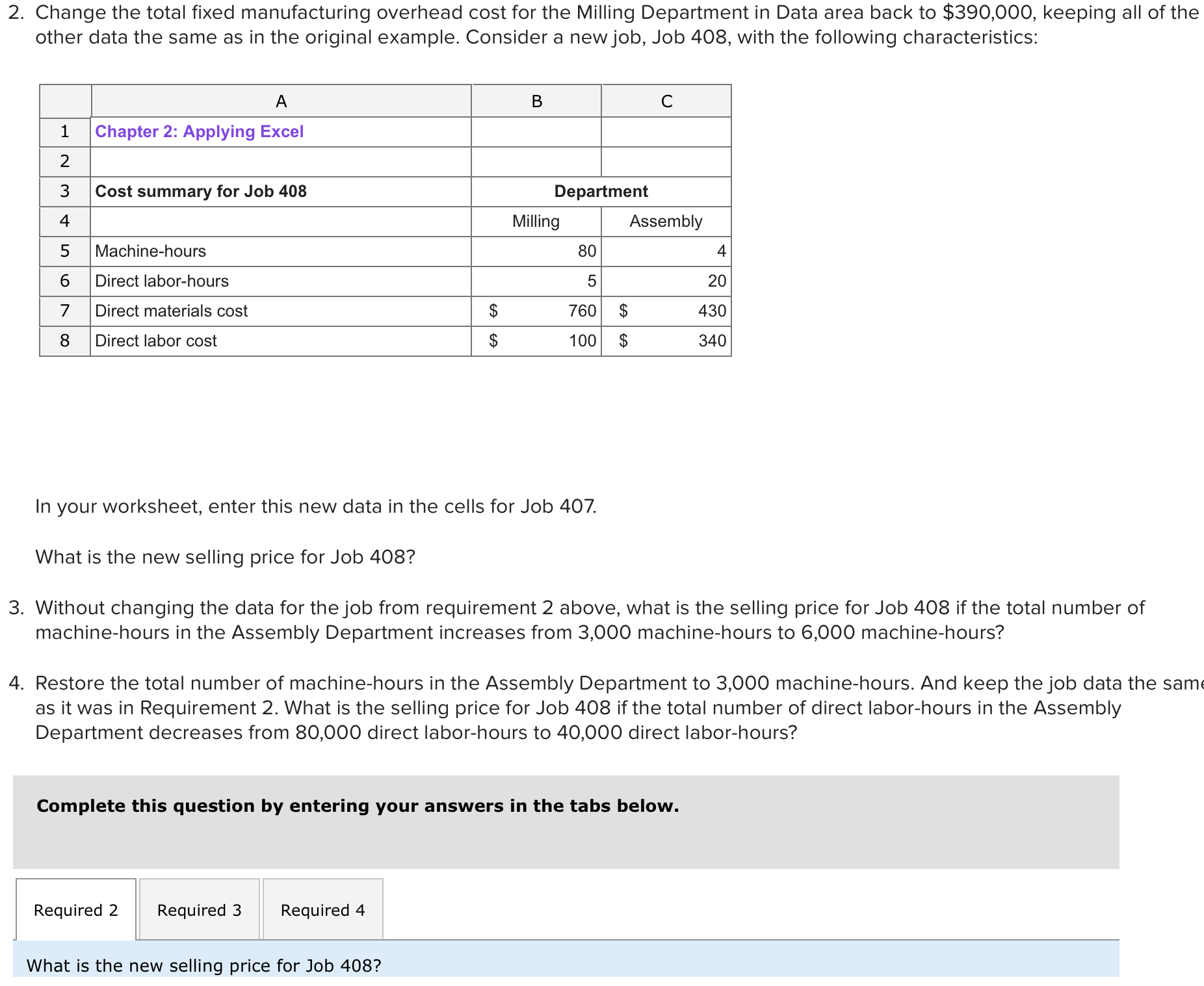

Chapter 2: Applying Excel Data Markup on job cost 75% Department Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Cost summary for Job 407 Machine-hours Direct labor-hours Direct materials Direct labor cost Enter a formula into each of the cells marked with a ? below Step 1: Calculate the estimated total manufacturing overhead cost for each department \begin{tabular}{l|l|l|} & Milling & Assembly \\ \hline Total fixed manufacturing overhead cost & ? & ? \\ \hline Variable manufacturing overhead per machine-hour or direct labor-hour & ? & ? \\ \hline Total machine-hours or direct labor-hours & ? & ? \\ \hline Total variable manufacturing overhead & ? & ? \\ \hline Total manufacturing overhead & ? & ? \\ \hline \hline \end{tabular} Step 2: Calculate the predetermined overhead rate in each department Total manufacturing overhead Total machine-hours or direct labor-hours Predetermined overhead rate per machine-hour or direct labor-hour Milling 60,000 8,000 $390,000 $2.00 Department Milling Assembly $3.75 Assembly 80,000 $500,000 90 4 $800 $370 $70 $280 Step 3: Calculate the amount of overhead applied from both departments to Job 407 Predetermined overhead rate per machine-hour or direct labor-hour Machine-hours or direct labor-hours for the job Manufacturing overhead applied Step 4: Calculate the total job cost for Job 407 Direct materials Direct labor cost Manufacturing overhead applied Total cost of Job 407 Step 5: Calculate the selling price for Job 407 Total cost of Job 407 Markup Selling price of Job 407 Milling Assembly ? ? ? \begin{tabular}{l|l} \hline? & ? \\ \hline? & ? \\ \hline? & ? \end{tabular} Chapter 2: Applying Excel Data Markup on job cost 75% Department Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Cost summary for Job 407 Machine-hours Direct labor-hours Direct materials Direct labor cost Enter a formula into each of the cells marked with a ? below Step 1: Calculate the estimated total manufacturing overhead cost for each department \begin{tabular}{l|l|l|} & Milling & Assembly \\ \hline Total fixed manufacturing overhead cost & ? & ? \\ \hline Variable manufacturing overhead per machine-hour or direct labor-hour & ? & ? \\ \hline Total machine-hours or direct labor-hours & ? & ? \\ \hline Total variable manufacturing overhead & ? & ? \\ \hline Total manufacturing overhead & ? & ? \\ \hline \hline \end{tabular} Step 2: Calculate the predetermined overhead rate in each department Total manufacturing overhead Total machine-hours or direct labor-hours Predetermined overhead rate per machine-hour or direct labor-hour Milling 60,000 8,000 $390,000 $2.00 Department Milling Assembly $3.75 Assembly 80,000 $500,000 90 4 $800 $370 $70 $280 Step 3: Calculate the amount of overhead applied from both departments to Job 407 Predetermined overhead rate per machine-hour or direct labor-hour Machine-hours or direct labor-hours for the job Manufacturing overhead applied Step 4: Calculate the total job cost for Job 407 Direct materials Direct labor cost Manufacturing overhead applied Total cost of Job 407 Step 5: Calculate the selling price for Job 407 Total cost of Job 407 Markup Selling price of Job 407 Milling Assembly ? ? ? \begin{tabular}{l|l} \hline? & ? \\ \hline? & ? \\ \hline? & ? \end{tabular}

Chapter 2: Applying Excel Data Markup on job cost 75% Department Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Cost summary for Job 407 Machine-hours Direct labor-hours Direct materials Direct labor cost Enter a formula into each of the cells marked with a ? below Step 1: Calculate the estimated total manufacturing overhead cost for each department \begin{tabular}{l|l|l|} & Milling & Assembly \\ \hline Total fixed manufacturing overhead cost & ? & ? \\ \hline Variable manufacturing overhead per machine-hour or direct labor-hour & ? & ? \\ \hline Total machine-hours or direct labor-hours & ? & ? \\ \hline Total variable manufacturing overhead & ? & ? \\ \hline Total manufacturing overhead & ? & ? \\ \hline \hline \end{tabular} Step 2: Calculate the predetermined overhead rate in each department Total manufacturing overhead Total machine-hours or direct labor-hours Predetermined overhead rate per machine-hour or direct labor-hour Milling 60,000 8,000 $390,000 $2.00 Department Milling Assembly $3.75 Assembly 80,000 $500,000 90 4 $800 $370 $70 $280 Step 3: Calculate the amount of overhead applied from both departments to Job 407 Predetermined overhead rate per machine-hour or direct labor-hour Machine-hours or direct labor-hours for the job Manufacturing overhead applied Step 4: Calculate the total job cost for Job 407 Direct materials Direct labor cost Manufacturing overhead applied Total cost of Job 407 Step 5: Calculate the selling price for Job 407 Total cost of Job 407 Markup Selling price of Job 407 Milling Assembly ? ? ? \begin{tabular}{l|l} \hline? & ? \\ \hline? & ? \\ \hline? & ? \end{tabular} Chapter 2: Applying Excel Data Markup on job cost 75% Department Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Cost summary for Job 407 Machine-hours Direct labor-hours Direct materials Direct labor cost Enter a formula into each of the cells marked with a ? below Step 1: Calculate the estimated total manufacturing overhead cost for each department \begin{tabular}{l|l|l|} & Milling & Assembly \\ \hline Total fixed manufacturing overhead cost & ? & ? \\ \hline Variable manufacturing overhead per machine-hour or direct labor-hour & ? & ? \\ \hline Total machine-hours or direct labor-hours & ? & ? \\ \hline Total variable manufacturing overhead & ? & ? \\ \hline Total manufacturing overhead & ? & ? \\ \hline \hline \end{tabular} Step 2: Calculate the predetermined overhead rate in each department Total manufacturing overhead Total machine-hours or direct labor-hours Predetermined overhead rate per machine-hour or direct labor-hour Milling 60,000 8,000 $390,000 $2.00 Department Milling Assembly $3.75 Assembly 80,000 $500,000 90 4 $800 $370 $70 $280 Step 3: Calculate the amount of overhead applied from both departments to Job 407 Predetermined overhead rate per machine-hour or direct labor-hour Machine-hours or direct labor-hours for the job Manufacturing overhead applied Step 4: Calculate the total job cost for Job 407 Direct materials Direct labor cost Manufacturing overhead applied Total cost of Job 407 Step 5: Calculate the selling price for Job 407 Total cost of Job 407 Markup Selling price of Job 407 Milling Assembly ? ? ? \begin{tabular}{l|l} \hline? & ? \\ \hline? & ? \\ \hline? & ? \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started