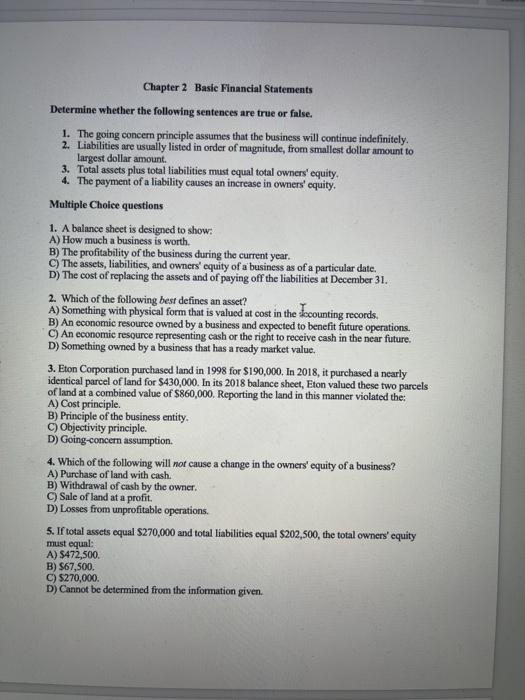

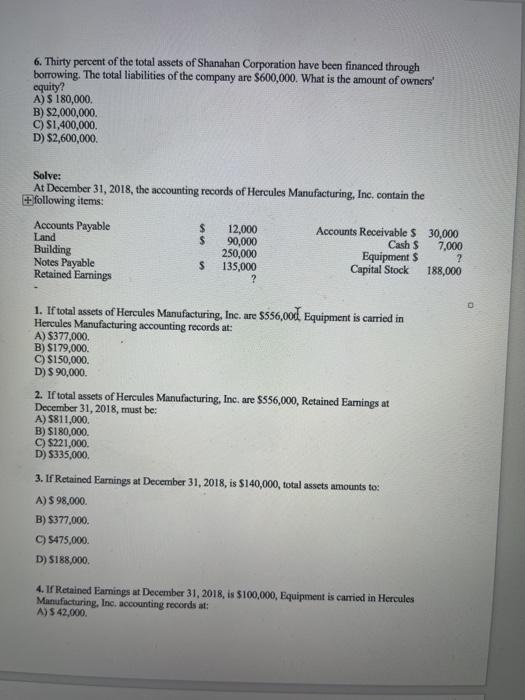

Chapter 2 Basic Financial Statements Determine whether the following sentences are true or false. 1. The going concern principle assumes that the business will continue indefinitely. 2. Liabilities are usually listed in order of magnitude, from smallest dollar amount to largest dollar amount. 3. Total assets plus total liabilities must equal total owners' equity. 4. The payment of a liability causes an increase in owners' equity, Multiple Choice questions 1. A balance sheet is designed to show: A) How much a business is worth B) The profitability of the business during the current year. C) The assets, liabilities, and owners' equity of a business as of a particular date. D) The cost of replacing the assets and of paying off the liabilities at December 31. 2. Which of the following best defines an asset? A) Something with physical form that is valued at cost in the tocounting records. B) An economic resource owned by a business and expected to benefit future operations. An economic resource representing cash or the right to receive cash in the near future. D) Something owned by a business that has a ready market value. 3. Eton Corporation purchased land in 1998 for $190,000. In 2018, it purchased a nearly identical parcel of land for $430,000. In its 2018 balance sheet, Eton valued these two parcels of land at a combined value of $860,000, Reporting the land in this manner violated the A) Cost principle. B) Principle of the business entity. C) Objectivity principle. D) Going-concern assumption. 4. Which of the following will not cause a change in the owners' equity of a business? A) Purchase of land with cash. B) Withdrawal of cash by the owner. C) Sale of land at a profit D) Losses from unprofitable operations. 5. If total assets equal $270,000 and total liabilities equal $202,500, the total owners' equity must equal: A) $472,500. B) $67,500. C) $270,000. D) Cannot be determined from the information given 6. Thirty percent of the total assets of Shanahan Corporation have been financed through borrowing. The total liabilities of the company are $600,000. What is the amount of owners' equity? A) $ 180,000 B) $2,000,000 C) $1,400,000 D) $2,600,000 Solve: At December 31, 2018, the accounting records of Hercules Manufacturing, Inc. contain the +-following items: Accounts Payable $ 12,000 Accounts Receivable $ 30,000 Land $ 90,000 Cash $ 7,000 Building 250,000 Notes Payable Equipments ? $ 135,000 Retained Earnings Capital Stock 188,000 ? 1. If total assets of Hercules Manufacturing, Inc. are $556,00d Equipment is carried in Hercules Manufacturing accounting records at: A) $377,000 B) S179,000 C) $150,000 D) $ 90,000 2. If total assets of Hercules Manufacturing, Inc. are $556,000, Retained Earings at December 31, 2018, must be: A) 5811,000 B) $180,000 C) $221,000. D) $335,000 3. If Retained Earnings at December 31, 2018, is $140,000, total assets amounts to: A) S 98.000 B) $377,000. C) $475,000 D) S188,000 4. Retained Earnings at December 31, 2018, is $100,000, Equipment is carried in Hercules Manufacturing, Inc. accounting records at: A) S 42,000