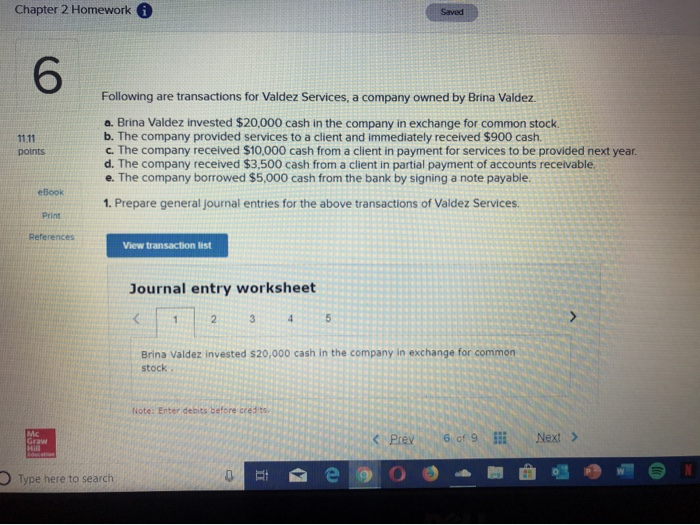

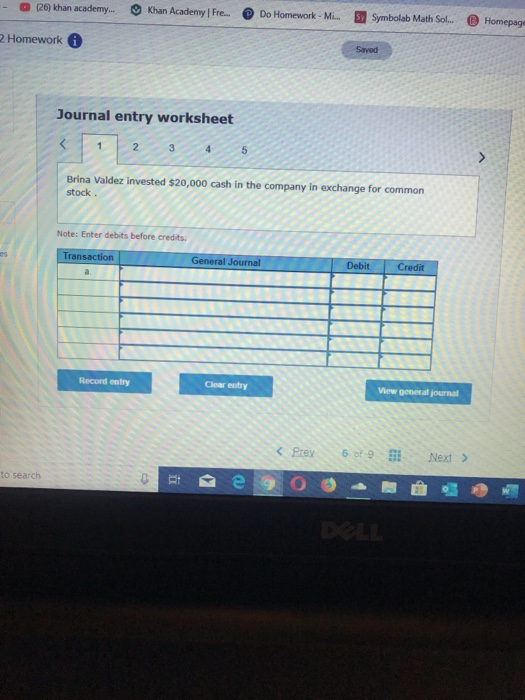

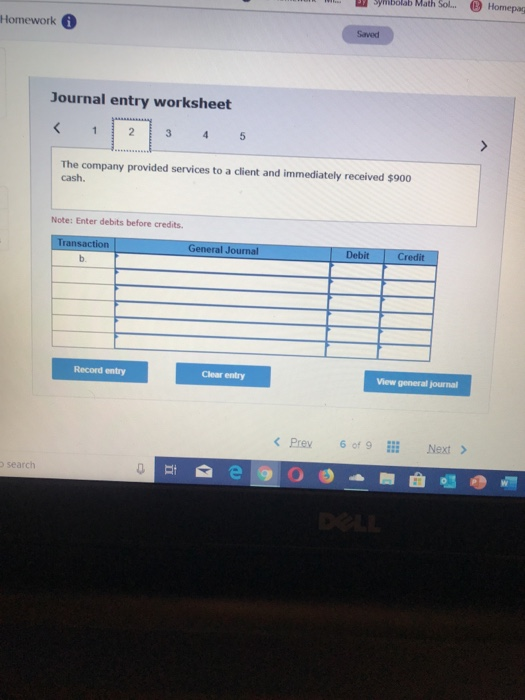

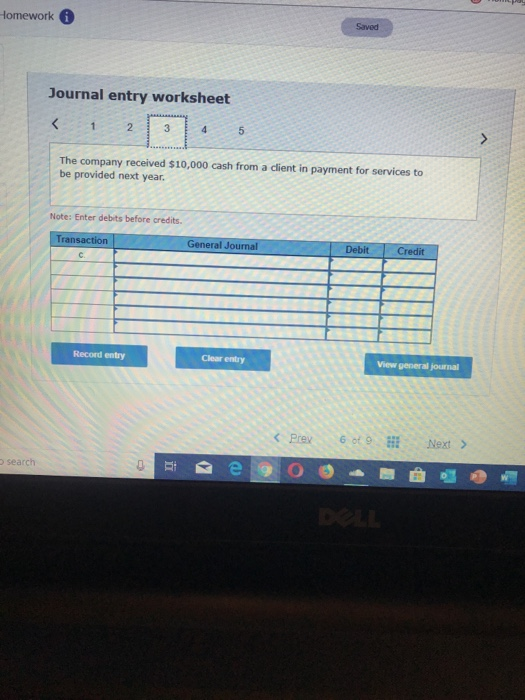

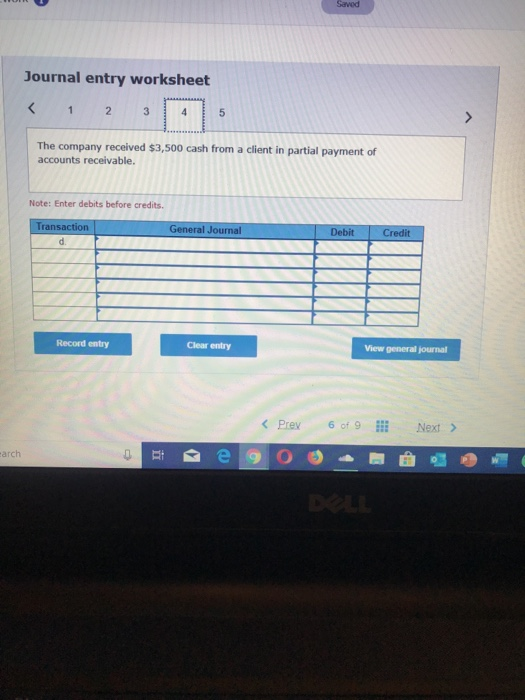

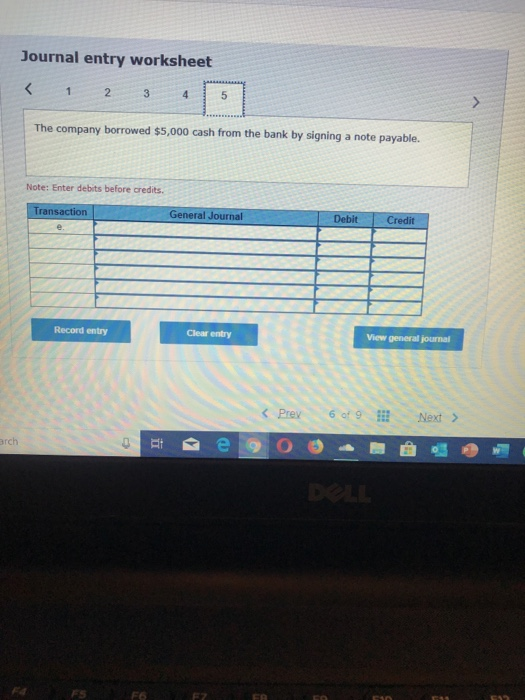

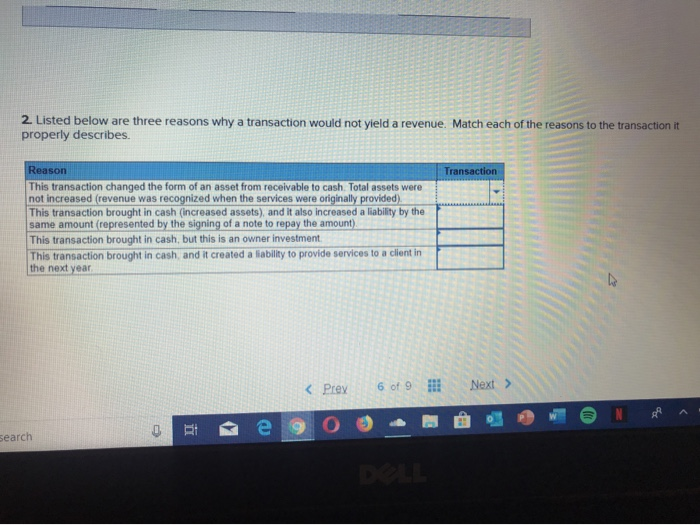

Chapter 2 Homework Saved Following are transactions for Valdez Services, a company owned by Brina Valdez. 1111 points a. Brina Valdez invested $20,000 cash in the company in exchange for common stock b. The company provided services to a client and immediately received $900 cash. c. The company received $10,000 cash from a client in payment for services to be provided next year. d. The company received $3,500 cash from a client in partial payment of accounts receivable. e. The company borrowed $5,000 cash from the bank by signing a note payable. eBook 1. Prepare general journal entries for the above transactions of Valdez Services Print References View transaction list Journal entry worksheet Brina Valdez invested $20,000 cash in the company in exchange for common stock Note: Enter debits before credits Type here to search e 90 @o we 26) than academy Khan Academy Fre Do Homework - Mi 5 Symbolab Math Solus Homepag Homework Saved Journal entry worksheet Brina Valdez invested $20,000 cash in the company in exchange for common Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal to search e903 - mework Saved Journal entry worksheet 3 4 5 The company provided services to a client and immediately received $900 cash. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal Search mework i Journal entry worksheet 2 3 4 5 The company received $10,000 cash from a client in payment for services to be provided next year. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal > Search Saved Journal entry worksheet arch Journal entry worksheet 2. Listed below are three reasons why a transaction would not yield a revenue. Match each of the reasons to the transaction it properly describes. Transaction Reason This transaction changed the form of an asset from receivable to cash. Total assets were not increased revenue was recognized when the services were originally provided) This transaction brought in cash (increased assets), and it also increased a liability by the same amount represented by the signing of a note to repay the amount) This transaction brought in cash, but this is an owner investment This transaction brought in cash, and it created a liability to provide services to a client in the next year