Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 2 HW ( i ) Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for

Chapter HW i

Saved

Help

Save & Exit

Submit

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

points

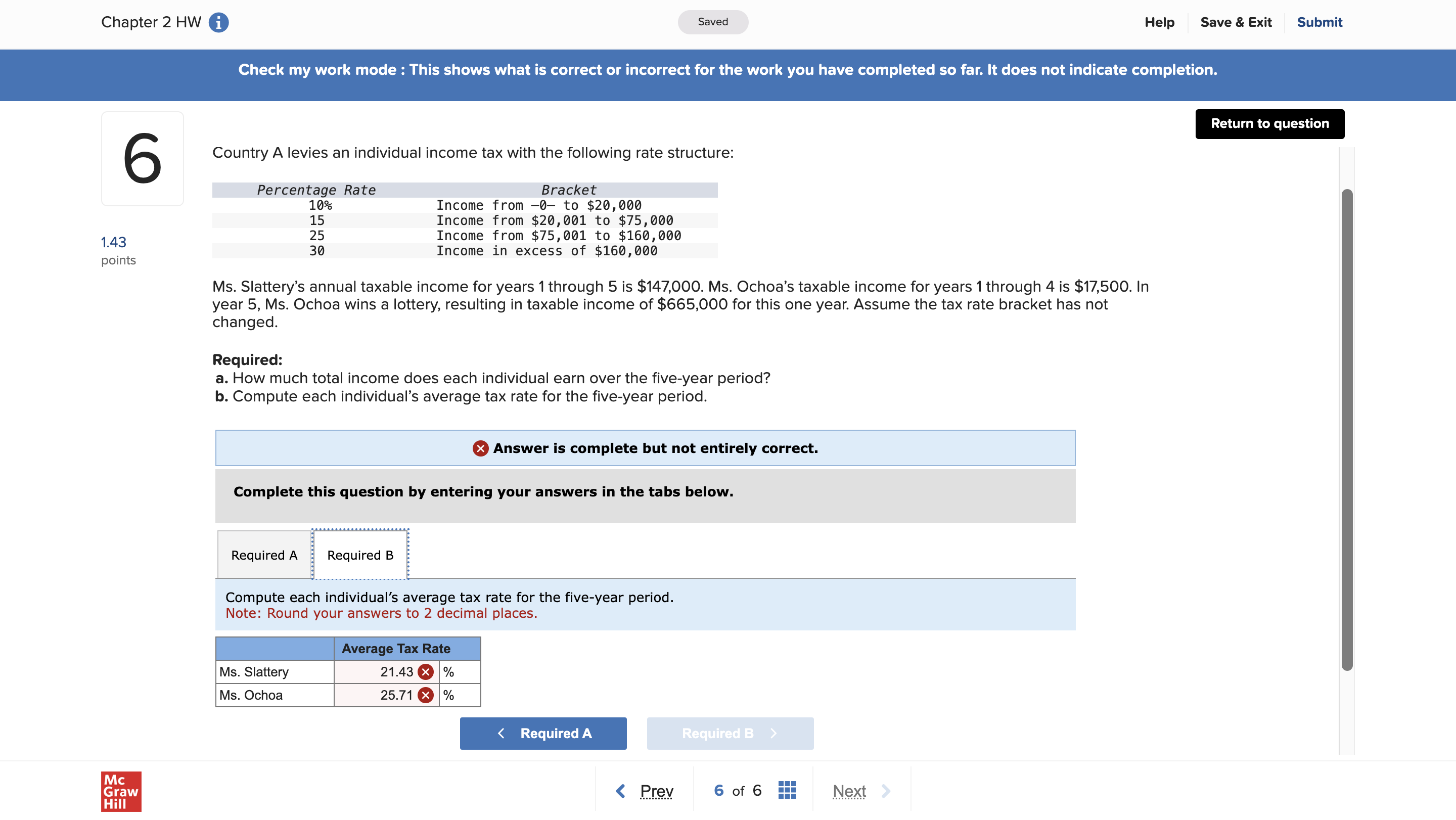

Country A levies an individual income tax with the following rate structure:

Return to question

Ms Slattery's annual taxable income for years through is $ Ms Ochoa's taxable income for years through is $ In year Ms Ochoa wins a lottery, resulting in taxable income of $ for this one year. Assume the tax rate bracket has not changed.

Required:

a How much total income does each individual earn over the fiveyear period?

b Compute each individual's average tax rate for the fiveyear period.

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required

Required B

Compute each individual's average tax rate for the fiveyear period.

Note: Round your answers to decimal places.

tableAverage Tax RateMs Slattery,times Ms Ochoa,times

Required

Required B

Mc

Graw

Prev

of

Next

Use the picture. It has all the info

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started