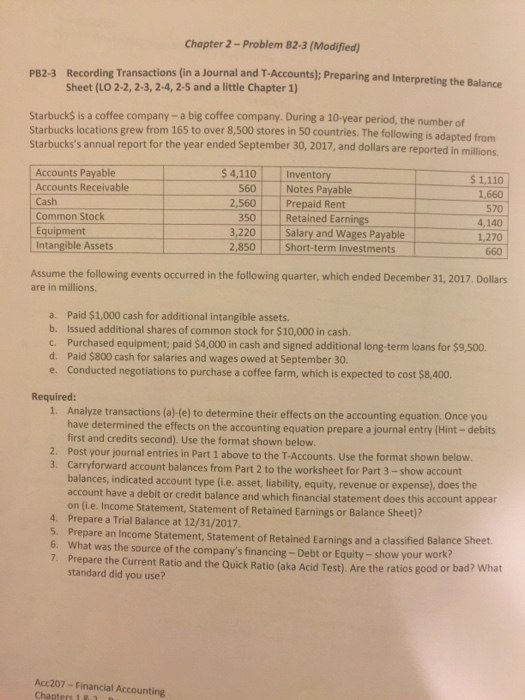

Chapter 2 -Problem 82-3 (Modified) PB2-3 Recording Transactions (in a Journal and T-Accounts); Preparing and Interpreting the Balance Sheet (LO 2-2, 2-3, 2-4, 2-5 and a little Chapter 1) Starbuck$ is a coffee company-a big coffee company. During a 10-year period, the number of Starbucks locations grew from 165 to over 8,500 stores in 50 countries. The following is adapted from Starbucks's annual report for the year ended September 30, 2017, and dollars are re ported in millions. Accounts Payable Accounts Receivable Cash Common Stock $ 4,110 0 Inventory $ 1.110 1,660 570 4,140 1,270 660 560 Notes Payable 2,560 Prepaid Rent 350 Retained Earnings 3,220 Salary and Wages Payable 2,850 Short-term Investments uipment Intangible Assets Assume the following events occurred in the following quarter, which ended December 31, 2017. Dollars are in millions a. Paid $1,000 cash for additional intangible assets. b. Issued additional shares of common stock for $10,000 in cash. c. Purchased equipment; paid $4,000 in cash and signed additional long-term loans for $9,500. d. Paid $800 cash for salaries and wages owed at September 30 e. Conducted negotiations to purchase a coffee farm, which is expected to cost $8,400. Required: 1. Analyze transactions (a-(e) to determine their effects on the accounting equation. Once you have determined the effects on the accounting equation prepare a journal entry (Hint-debits first and credits second). Use the format shown below Post your journal entries in Part 1 above to the T-Accounts. Use the format shown below. Carryforward account balances from Part 2 to the worksheet for Part 3 - show account 2. 3. es, indicated account type (i.e. asset, liability, equity, revenue or expense), does the account have a debit or credit balance and which financial statement does this account appear on (i.e. Income Statement, Statement of Retained Earnings or Balance Sheet)? Prepare a Trial Balance at 12/31/2017 4. 5. Prepare an Income Statement, Statement of Retained Earnings and a classified Balance Sheet. 7. your work? Prepare the Current Ratio and the Quick Ratio (aka Acid Test). Are the ratios good or standard did you use? bad? What Acc207-Financial Accounting