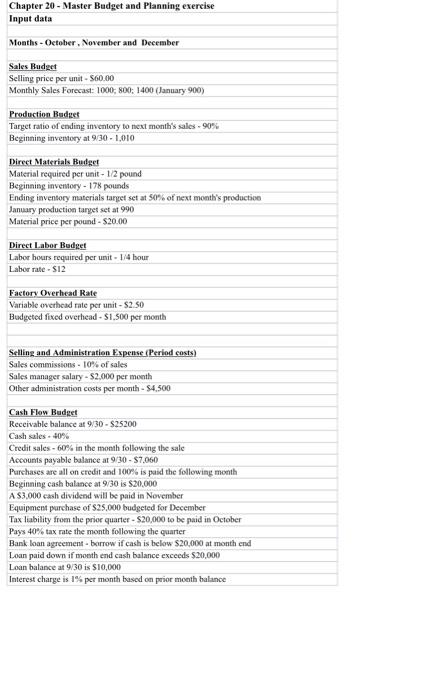

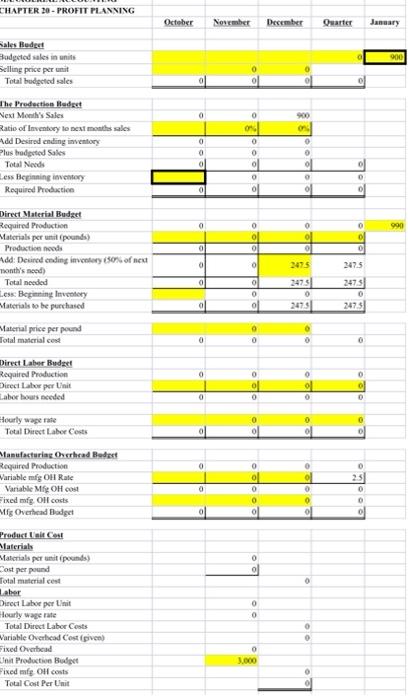

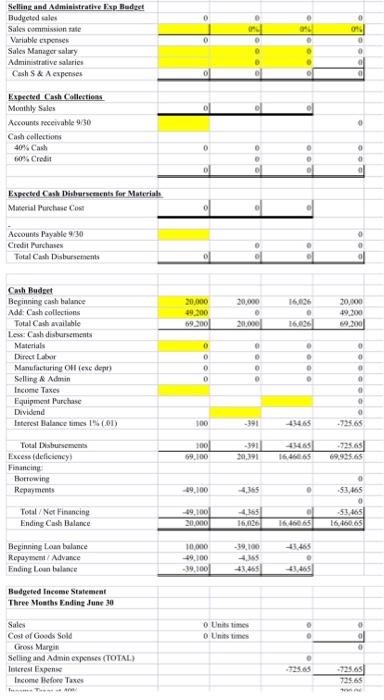

Chapter 20 - Master Budget and Planning exercise Input data Months - October, November and December Sales Budget Selling price per unit - 560.00 Monthly Sales Forecast: 1000, 800: 1400 (January 900) Production Budget Target ratio of ending inventory to next month's sales - 90% Beginning inventory at 9/30 - 1,010 Direct Materials Budget Material required per unit-1/2 pound Beginning inventory - 178 pounds Ending inventory materials target set at 50% of next month's production January production target set at 990 Material price per pound - $20.00 Direct Labor Budget Labor hours required per unit - 1/4 hour Labor rate. S12 Factory Overhead Rate Variable overhead rate per unit - $2.50 Budgeted fixed overhead - S1.500 per month Selling and Administration Expense (Period costs) Sales commissions - 10% of sales Sales manager salary - $2,000 per month Other administration costs per month $4.500 Cash Flow Budget Receivable balance at 9:30 - $25200 Cash sales. 40% Credit sales - 60% in the month following the sale Accounts payable balance at 9/30 - 57,060 Purchases are all on credit and 100% is paid the following month Beginning cash balance at 9/30 is $20.000 A $3,000 cash dividend will be paid in November Equipment purchase of $25.000 budgeted for December Tax liability from the prior quarter-S20,000 to be paid in October Pays 40% tax rate the month following the quarter Bank loan agreement - bairrow if cash is below 20,000 at month end Loan paid down if month end cash balance exceeds $20,000 Loun balance at 9/30 is $10,000 Interest charge is 1% per month based on prior month balance CHAPTER 20 -PROFIT PLANNING October Norimber December Quarter January 900 Sales Budget Hodgeted sales in units Selling price per unit Total budgeted sales 0 900 0 on 0 0 The Production Badget Next Meas Sales Ratio of Inventory to next months sales Add Desired ending inventory Plus bodgeted Sales Total Needs Less Beginning wory Required Production 0 a 0 O a 0 D 0 0 9940 O O 3475 347.5 Direct Material Budget Required Production Materials per unit (pounds) Production needs Add: Deared ending inventory 50% of next month's need Total needed Lesse Beginning Inventory Materials to be purchased Material price per pound Total material cel 0 0 0 ol 2475 0 2475 0 2475 0 0 0 0 0 0 Direct Laber Budget Required Production Direct Labor per Unit Laber bouts needed o ol 0 0 0 O 0 0 Hourly wage rate Total Direct Labor Costs Manufacturing narhrad Bedest Required Production Variable mfg OH Rate Variable Mfg OH cost Fixed mfg Oll costs Mig Overhead Badget 0 0 0 235 ol 0 0 0 0 O Product sit Cos! Materials Materials per unit (pounds) Cost per pound Total material est aber Direct Laboe per Unit Hourly wage rate Total Direct Labor Costs Variable Overhead Cost (piven) Fixed Overhead Unit Production Budget Fixed mg OH costs Total Cost Per Unit 0 0 0 3.000 O Selling and Administratie Exp Badget Budgeted sales Sales missionate Variable expenses Sales Manager salary Administrative salaries Cash & expenses 0 0 0 O Expected Cash Collections Monthly Sales Accounts receivable 9/30 Cash collections 40% Cash 60%. Credit 0 0 ol Expected Cash Diberents for Material Material Purchase Cost Accounts Payable 9:30 Credit Purchase Total Cash Disbursement 0 20.000 15025) 20.000 29.200 9300 20,000 9.200 9.300 20.000 16.06 Cash Budget Beginning cash balance Add: Cash collections Total Cash available Less: Cash disbursements Materials Direct Labor Manufacturing On (exc depr) Selling Admin Income Taxes Equipment Purchase Dividend Interest Balance times 1% (01) 0 0 0 0 . D 0 0 0 0 0 0 o 100 -391 434.65 -725.65 100 69.100 -391 30.11 16.46665 69.925.65 Total Labursement Excess deficiency Financing Horrowing Repayments 19.100 4,165 0 53,165 0 -51.465 16.16665 Total / Net Financing Ending Cash Balance -19,100 20.000 4365 16,026 16.46065 43.465 Beginning Loun balance Repuyen/Advance Ending Loun balance 10,000 49.100 -39.1001 -4.5 43,465) Budgeted Income Statement Three Months Ending June 30 o Units times o Units times les Sales Cost of Goods Sold Gross Margin Selling and Admin expenses (TOTAL) Interest Expense Income Before Taxes -725.65 725.65