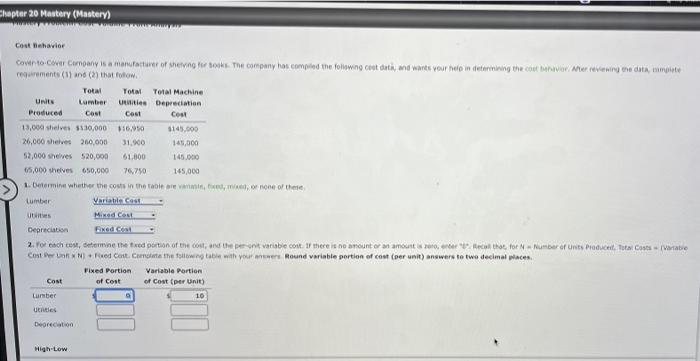

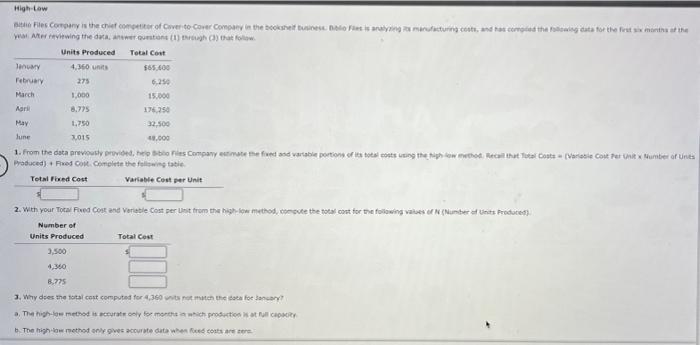

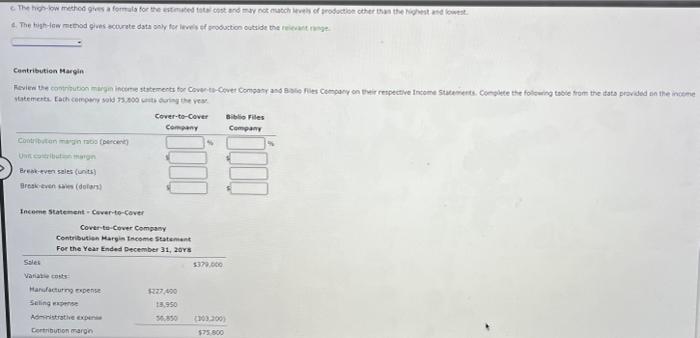

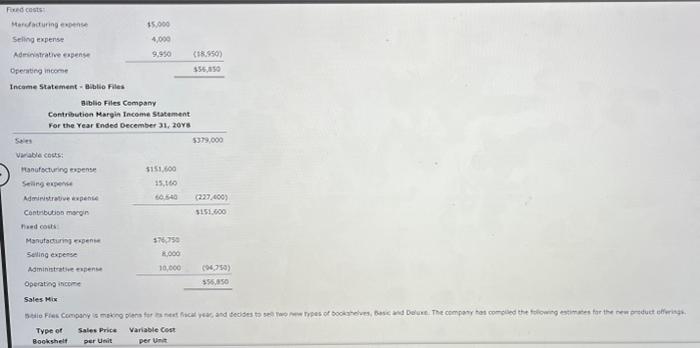

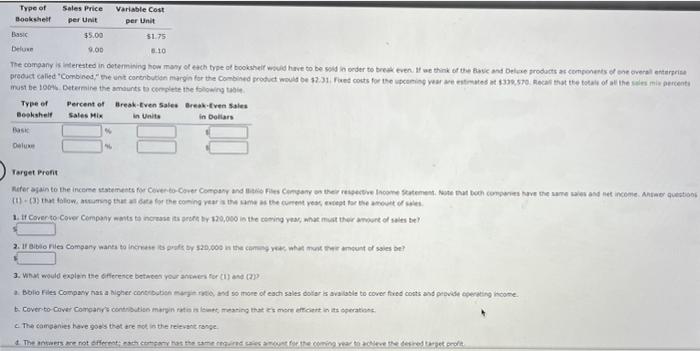

Chapter 20 Mastery (Mastery) Cost Behavior Cowento.com Company is a manufacturer of serving for so. The company has compiled the following conduta, ma wants your help in determining the cout bewoher revewing me dota, mute regements (1) and (2) that follow Total Total Total Machine Unita Lumbar uits Depreciation Produced Cost Cost Cest 13.000 shelves $530,000 $16.950 145.000 26,000 shelves 260,000 31.900 145,000 52,000 shelves 520,000 61.000 145.000 65,000 shelves 650,000 76.750 145,000 1. Determine whether the costs in the table are one of the Lumber Variable cost Mixed Cou Depreciation Exed cost 2. To each com, determine the red portion of the cost and the penatible cont. 11 there is no amount or an amount ocultos. for Number of ints Producent. Tota Costa varatie Coster N Red Cast, Center the follow table with your Round variable portion of cost (per unit) answers to two decimal places Fixed Portion Variable Portion Cost of Cost of Cost (per unit) Lurster 10 unties Deprecation High-Low High-Low Files Company is the chief como of Certo Cover Company in the book to Figuring out and scored the data for the remains at the Wa Mterviewing the data are unstone 1) tratform Units Produced Total Cost TOMY 4,360 units $65.600 February 275 6,25 March 1.000 15.000 8.775 176.25 May 32,500 June 2015 48.000 1. From the data previously provided here to les company estimate the front and variable portion of its total costs in the show method. Recit that to Coats (Variable Cost Per und Munities of Units Produced) + Rred Com. Complete the following tabi Total Fixed cost Variable Cort per Unit 1.750 2. with your Total Fed Cort and Variable Cost per Uisit from the high-low method, cromote the total cost for the following valves en unter Units Produced) Number of Units Produced 3,500 Total Cost 4,360 8.775 3. Why does the total cost computed for 4.360 tot match the data for January a. The method is curately for me which productos CRY The highethod only gives our data whose costs are mere The hew methodges a formula for the strated toward may or matches of production other than the rest and lowest 1. The high low memodies acurate data only for of production outside the recomtrange Contribution Margin Review the contribution man inte statements for Cover-to-Cover Company and files company on their respective Income Statements Complete the following toote from the itata pressed in the income statements, accompany od 7.000 they Cover-to-Cover Biblio Files Company Company Coton percent) Break even sales unit) Brevesa (dotas) Income Statement-Cover-to-Cover Cover Cover Company Contribution Margie Income Statement For the Year Ended December 31, 2015 Sale $370.000 Varicosts Hantung expense 27.490 Selling we 13.950 Anthe 50.850 103.300 Contribution margin $75 500 Fie costs Mardaduring expens $5,000 Selling expense 4.000 Administrative expenses 9.950 (18.950 Operating income $56,050 Income Statement-Biblio Files Biblio Files Company Contribution Margin Income Statement For the Year Ended December 31, 2018 5379.000 wable cous: Manufacturing en 3151.00 Selinger 15.160 Administrative pente (227.400) Contribution margin 5151300 Puedo Manuten 376755 Selling expense 2.000 Administrative expense 10.000 94.750) Operating income 555.850 Sales Mix Fles Company's molens focal and decides to types of books, and the company has come the following times for the new product offerings Type of Sales Price Variable Cost Bookshell Per Unit Per Une Type of Sales Price Variable Cost Bookshell per Unit per Unit Basic $5.00 $1.75 Deluwe 9.00 6.10 The company interested in determining how many of each type of bookshe would have to be sold in order to break even to the love and Dele products components of an overal enterprise product called "Combo" the unit contribution margin for the combined product would be 1231 Fred costs for the upcoming year $78,570 Rathat the total of the semi percent must be 100% termine the amounts to complete the flowing Type of Percent of Break Even Sales Bresk-Even Sales Bookshell Sales Mix in Unite in Dollars Baske Dale Target Pront Rufer again to the income statements for over tower Company and Company on the tive Income Statement on to compare the same was an et income. A 100 that following that for the coming the same as the centre out of 1. tt Cover to Cover Company wants to create by 120,000 is the coming yes, what must the mount of sales te 2. U bio es company was to increase to probe by $20,000 in the corner what the amount of see? 3. What would explain the ofference between your homes for (1) and 2. Bolio Files Company at a nigher contration are and so more of each sales coter is available to cover fred coats and provide operating income 5. Cover to cover comicana contribution margin ratio se let meaning that es more efficient and operatione c. The companies have goes that are not is the relevant range 4. The me me not offer com as the same for the coming year the desire target profit