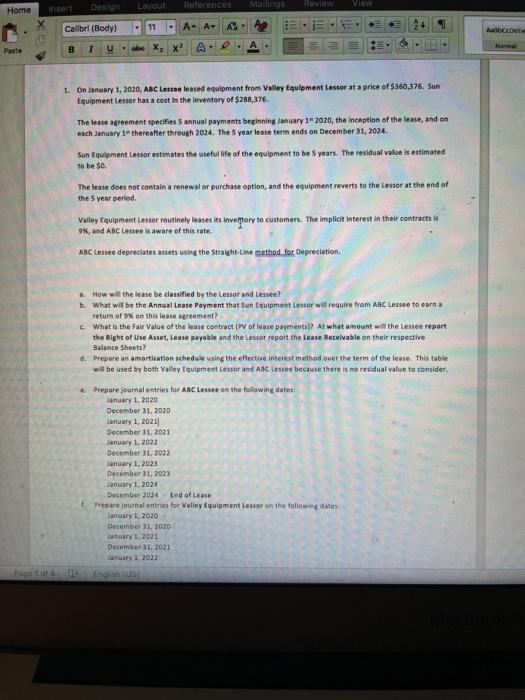

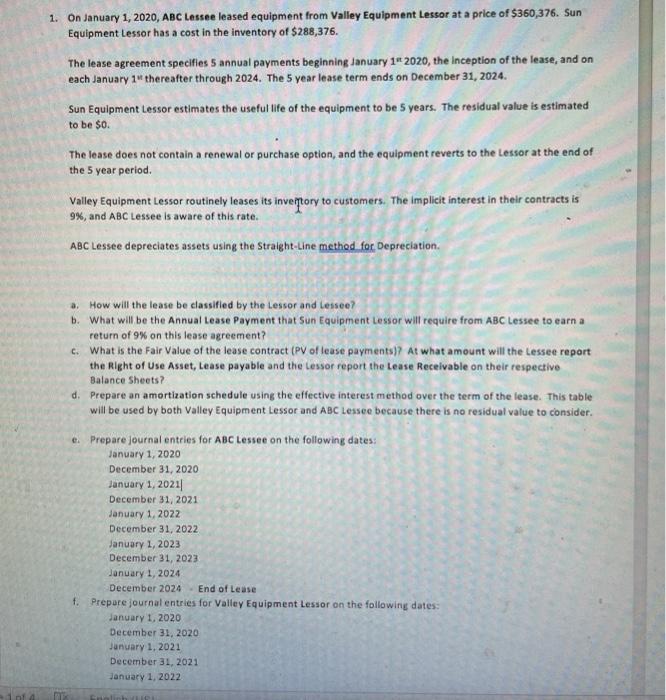

Chapter 21 Group Work 1. On January 1, 2020, ABC Lessee leased equipment from Valley Equipment Lessor at a price of $360,376. Sun Equipment Lessor has a cost in the inventory of $288,376. The lease agreement specifies 5 annual payments beginning January 1 2020, the inception of the lease, and on each January 14 thereafter through 2024. The 5 year lease term ends on December 31, 2024. Sun Equipment Lessor estimates the useful life of the equipment to be 5 years. The residual value is estimated to be $0. The lease does not contain a renewal or purchase option, and the equipment reverts to the Lessor at the end of the 5 year period Valley Equipment Lessor routinely leases its inventory to customers. The implicit interest in their contracts is 9%, and ABC Lessee is aware of this rate. ABC Lessee depreciates assets using the Straight-line method for Depreciation. Home Insert Design ROVIEW Layout References View Cailbrl (Body) 11 -A- A Aartbeat Past B 1 e x x 1. On January 1, 2020, ABC Lessee based equipment from Valley Equipment Lantor at a price of $360,376. Sun Equipment Lessor has a cost in the inventory of $288,376, The lease agreement specifies 5 annual payments beginning ianuary 1 2070, the inception of the lease, and on each January 14 thereafter through 2024. The year lease term ends on December 31, 2024. Sun Equipment Lasser estimates the useful life of the equipment to be years. The residual value is estimated to be $0. The lease does not contain a renewal or purchase option, and the equipment reverts to the lessor at the end of the year period Valley quipment Lestor routinely teases its inventory to customers. The implicit interest in their contracts and ARC Lestee is aware of this rate. ABC Lessee depreciates assets using the Straight-Line method for Depreciation How will the lease be classified by the Lessor and lessee? b. What will be the Annual Lease Payment that Sun Equipment Lessor will require from ABC Lessee to earn a return of "x on this lease agreement? c. What is the Fair Value of the lease contract PV of lease payments? At what amount will the Lessee report the right of Use Asset, Lease payable and the Lestor report the Lease Receivable on their respective Balance Sheets? d. Prepare an amortization schedule using the effective interest method over the term of the lease. This table will be used by both Valley Equipment Lessor and ABC Lessee because there is no residual value to consider. Prepare journal entries for ABC Lestee on the following dates: January 1, 2020 December 31, 2020 January 1, 2021 December 31, 2021 January 1, 2022 December 31, 2022 January 1, 2023 December 31, 2021 January 1, 2024 December 2014 End of Lease Pepere journal entries for Valley Equipment lewer on the following dates January 1, 2020 December 31, 2010 January 1, 2021 December 1, 2021 1. On January 1, 2020, ABC Losse leased equipment from Valley Equipment Lessor at a price of $360,376. Sun Equipment Lessor has a cost in the inventory of $288,376. The lease agreement specifies 5 annual payments beginning January 14 2020, the Inception of the lease, and on each January 1' thereafter through 2024. The 5 year lease term ends on December 31, 2024. Sun Equipment Lessor estimates the useful life of the equipment to be 5 years. The residual value is estimated to be $0. The lease does not contain a renewal or purchase option, and the equipment reverts to the Lessor at the end of the 5 year period Valley Equipment Lessor routinely leases its invertory to customers. The implicit interest in their contracts is 9%, and ABC Lessee is aware of this rate. ABC Lessee depreciates assets using the Straight-Line method for Depreciation. a. How will the lease be classified by the Lessor and lessee? b. What will be the Annual Lease Payment that Sun Equipment Lessor will require from ABC Lessee to earn a return of 9% on this lease agreement? c. What is the Fair value of the lease contract (PV of lease payments? At what amount will the Lessee report the right of Use Asset, Lease payable and the lessor report the Lease Receivable on their respective Balance Sheets? d. Prepare an amortization schedule using the effective interest method over the term of the lease. This table will be used by both Valley Equipment Lessor and ABC Lessee because there is no residual value to consider e Prepare journal entries for ABC Lessee on the following dates: January 1, 2020 December 31, 2020 January 1, 20211 December 31, 2021 January 1, 2022 December 31, 2022 January 1, 2023 December 31, 2023 January 1, 2024 December 2024 End of Lease f. Prepare journal entries for Valley Equipment Lessor on the following dates: January 1, 2020 December 31, 2020 January 1, 2021 December 31, 2021 January 1, 2022