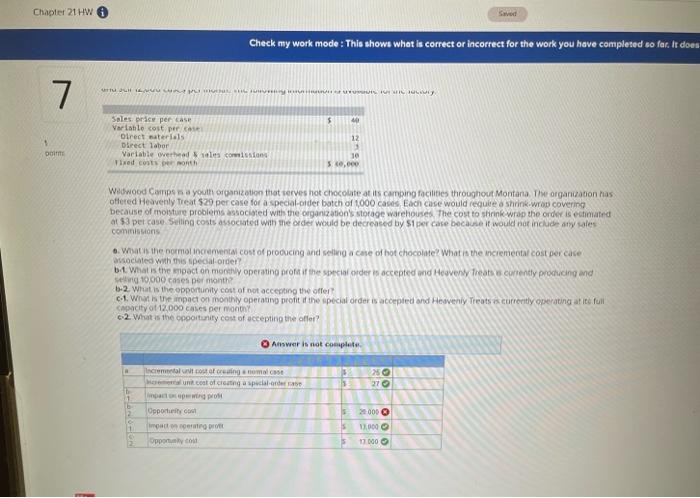

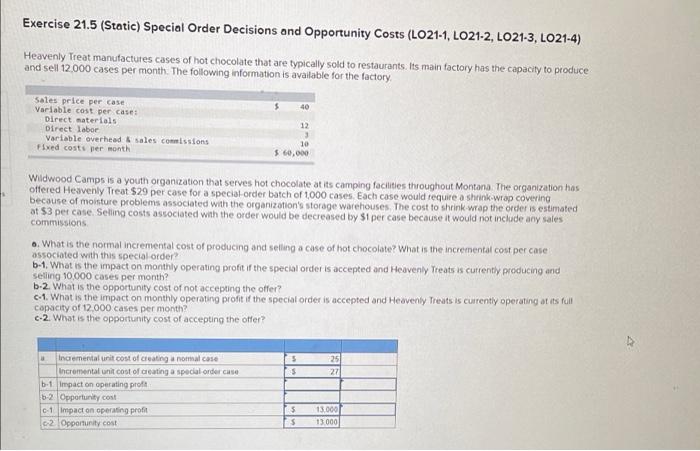

Chapter 21 HW Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does 7 UAVH $ Sales price per case Variable cost per Direct materials Direct labor Variable overhead eles command Vied content 12 1 30 50.000 Wedwood Compen a youth organization that serves hot chocolate at its Camping facilities throughout Montana. The organization has offered Heavenly Treat $20 per case for a special order batch of 1000 cases Each case would require a shrink Wrou covering because of moisture problems associated with the organization's storage warehouses. The cost to shrink wrap the order is estimated 3 percase Selling costs asociated with the order would be decreased by Sper case because it would not include any sales commissions 6. What the normal incremental cost of producing and selling a case of hot chocolate? What is the incremental cost percase associated with this special order b. What the mood on monthly operating proff the special order is accepted and Heaven Treats content producing and seg 10,000 cases per month 1-2. What is the opportunity cost of not accepting the offer c.1. What is the inpact on monthly operating profit of the special order is accepted and Heavenly Treats is currently operating at iti full Capacity of 12,000 cases per month 6.2. What is the oportunity cost of accepting the offer? Answer is not complete 250 27 1 Incremenomaa un cost of creating a speciale na pro Opportunity Impacto Oppory co 200000 12.000 17 000 Exercise 21.5 (Static) Special Order Decisions and Opportunity Costs (LO21-1, LO21-2, LO21-3, LO21-4) Heavenly Treat manufactures cases of hot chocolate that are typically sold to restaurants. Its main factory has the capacity to produce and sell 12.000 cases per month The following information is available for the factory 5 40 Sales price per case Variable cost per cases Direct materials Direct labor Variable overhead sales commissions Fixed costs per month 12 3 10 $ 60,000 Wildwood Camps is a youth organization that serves hot chocolate at its camping facilities throughout Montana. The organization has offered Heavenly Treat $29 per case for a special order batch of 1000 cases. Each case would require a shrink wrap covering because of moisture problems associated with the organization's storage warehouses. The cost to shrink wrap the order is estimated at $3 per case. Selling costs associated with the order would be decreased by si per case because it would not include any sales commissions o. What is the normal incremental cost of producing and selling a case of hot chocolate? What is the incremental cost per case associated with this special order b.1. What is the impact on monthly operating profit if the special order is accepted and Heavenly Treats is currently producing and selling 10,000 cases per month? b-2. What is the opportunity cost of not accepting the offer? 0-1. What is the impact on monthly operating profit if the special order is accepted and Heavenly Treats is currently operating at its full capacity of 12,000 cases per month c-2. What is the opportunity cost of accepting the offer? 5 $ 25 27 Incremental unit cost of creating a normal case Incremental unit cost of creating a special order case b-1 Impact on operating profil 6-2 Opportunity.com c1 Impact on operating profit 0.2 Opportunity cost $ 5 13.000 13000