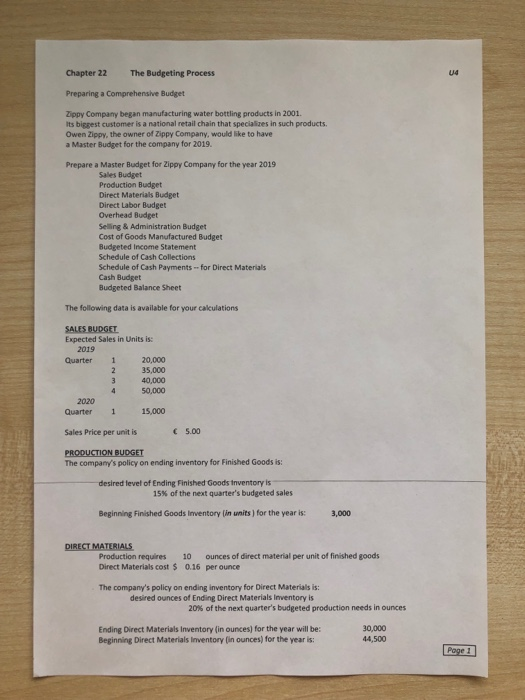

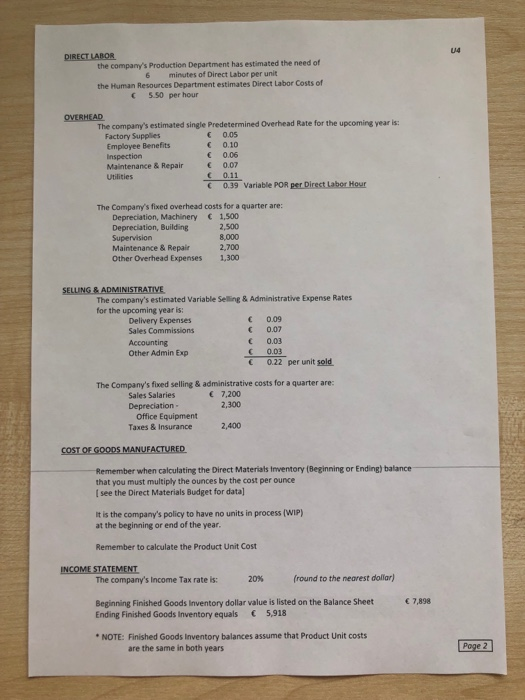

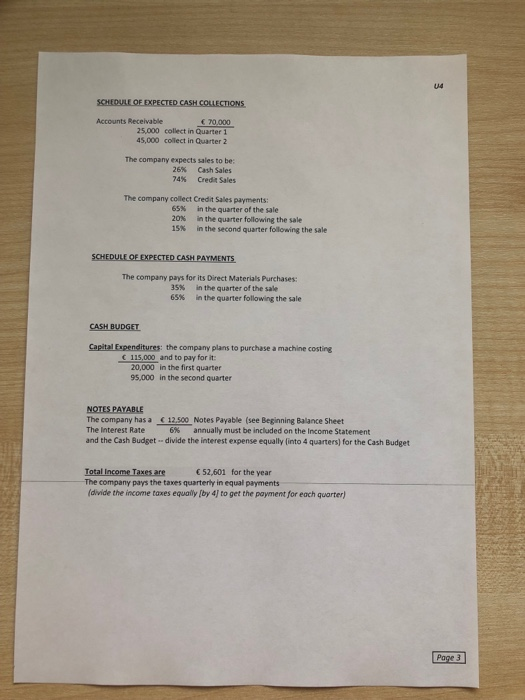

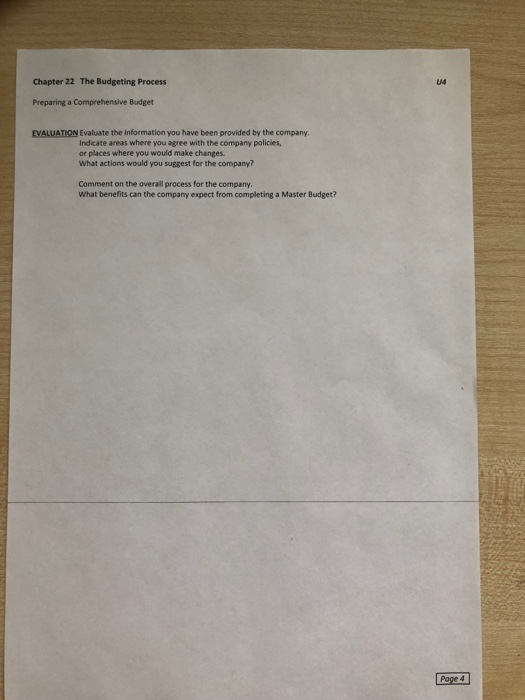

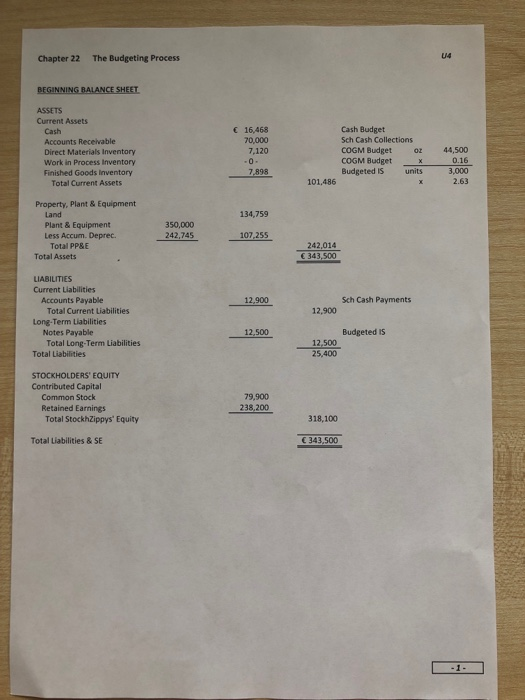

Chapter 22 The Budgeting Process Preparing a Comprehensive Budget Zippy Company began manufacturing water bottling products in 2001. Its biggest customer is a national retail chain that specializes in such products Owen Zippy, the owner of Zippy Company, would like to have a Master Budget for the company for 2019. Prepare a Master Budget for Zippy Company for the year 2019 Sales Budget Production Budget Direct Materials Budget Direct Labor Budget Overhead Budget Selling & Administration Budget Cost of Goods Manufactured Budget Budgeted Income Statement Schedule of Cash Collections Schedule of Cash Payments for Direct Materials Cash Budget Budgeted Balance Sheet The following data is available for your cakculations SALES BUDGET Expected Sales in Units is: 2019 Quarter 1 20,000 35,000 40,000 4 50,000 2020 Quarter 1 15,000 Sales Price per unit is 5.00 PRODUCTION BUDGET The compay's policy on ending inventory for Finished Goods is desired level of Ending Finished Goods tnventory is 15% of the next quarter's budgeted sales Beginning Finished Goods Inventory lin units ) for the year is: 3,000 ounces of direct material per unit of finished goods Production requires Direct Materials cost $ 10 016 per ounce The company's policy on ending inventory for Direct Materials is desired ounces of Ending Direct Materials Inventory is 20% of the next quarter's budgeted production needs in ounces Ending Direct Materials Inventory (in ounces) for the year will be Beginning Direct Materials Inventory (in ounces) for the year is: 30,000 14,500 the company's Production Department has estimated the need of 6 minutes of Direct Labor per unit the Human Resources Department estimates Direct Labor Costs of C 5.50 per hour OVERHEAD The company's estimated single Predetermined Overhead Rate for the upcoming year is: Factory Supplies Employee Benefits Inspection 0.05 0.10 0.06 Maintenance &Repair0.07 Utilities 0.11 0.39 Variable POR perDirettaborHour The Company's fixed overhead costs for a quarter are Depreciation, Machinery 1,500 Depreciation, Building 2,500 Maintenance & Repair Other Overhead Expenses 2,700 1,300 The company's estimated Variable Selling & Administrative Expense Rates for the upcoming year is: 0.09 Delivery Expenses Sales Commissions 0.07 C 0.03 0.03 C 0.22 per unit sold Other Admin Exp The Company's fixed selling & administrative costs for a quarter are: Sales Salaries Depreciation 7,200 Office Equipment Taxes & Insurance2,400 Remember when calculating the Direct Materials Inventory (Beginning or Ending) balance that you must multiply the ounces by the cost per ounce I see the Direct Materials Budget for datal It is the company's policy to have no units in process (WIP) at the beginning or end of the year Remember to calculate the Product Unit Cost The company's income Tax rate is: 20% (round to the nearest dollar) Beginning Finished Goods Inventory dollar value is listed on the Balance Sheet Ending Finished Goods Inventory equals 5,918 7,898 NOTE: Finished Goods Inventory balances assume that Product Unit costs are the same in both years Poge 2 14 SCHEDULE OF EXPECTED CASH COLLECTIONS Accounts Receivable 70,000 25,000 collect in Quarter 1 45,000 collect in Quarter 2 The company expects sales to be: 26% 74% Cash Sales Credit Sales The company collect Credit Sales payments: 65% 20% 15% in the quarter of the sale in the quarter following the sale in the second quarter following the sale The company pays for its Direct Materials Purchases: % 65% inthe quarter of the sale in the quarter following the sale CASH BUDGET Capital Expenditures: the company plans to purchase a machine costing C 115,000 and to pay for it 20,000 in the first quarter 95,000 in the second quarter NOTES PAYABLE The company has a 12.500 Notes Payable (see Beginning Balance Sheet The Interest Rate annually must be included on the Income Statement and the Cash Budget divide the interest expense equally (into 4 quarters) for the Cash Budget 52,601 for the year The company pays the taxes quarterly in equal payments (divide the income taxes equally Iby 4j to get the payment for each quarter) Page 3 Chapter 22 The Budgeting Process Preparing a Comprehensive Budget EVALUATION Evaluate the information you have been provided by the company Indicate areas where you agree with the company policies or places where you would make changes. What actions would you suggest for the company? Comment on the overall process for the company. What benefits can the company expect from completing a Master Budget? Pope 4 Chapter 22 The Budgeting Process ASSETS Current Assets Cash Accounts Receivable Direct Materials Inventory Work in Process inventory Finished Goods Inventory 16,468 70,000 7,120 Cash Budget Sch Cash Collections COGM Budget oz COGM Budget Budgeted Is units 44,500 0.16 3,000 2.63 Total Current Assets 101.486 Property, Plant& Equipment Land Plant & Equipment Less Accum. Deprec. 134,759 350,000 242,745 107.255 242,014 343,500 Total PP&E Total Assets LIABILITIES Current Liabilities Accounts Payable 12,900 Sch Cash Payments Total Current Liabilities 12,900 Long-Term Liabilities Notes Payable 12,500 Budgeted IS Total Long-Term Liabilities Total Liabilities 12,500 25,400 STOCKHOLDERS' EQUITY Contributed Capital 79,900 Common Stock Retained Earnings Total StockhZippys' Equity 318,100 Total Liabilities & SE 343,500 1