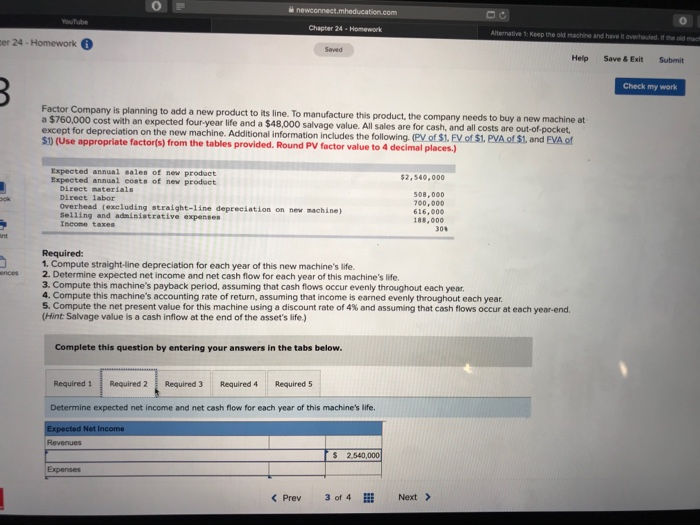

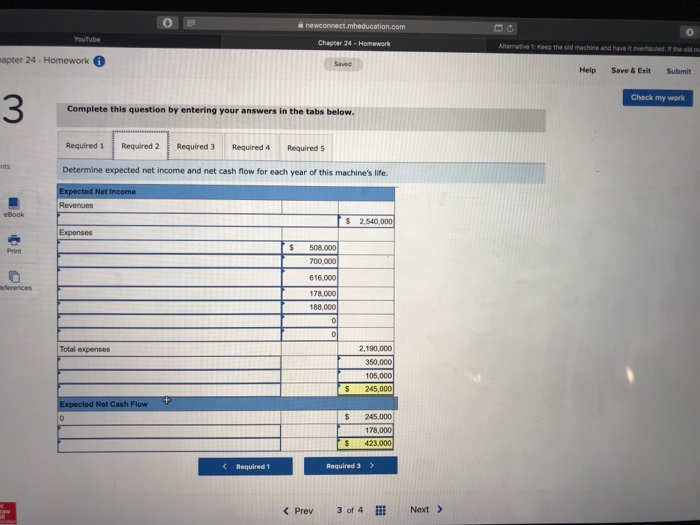

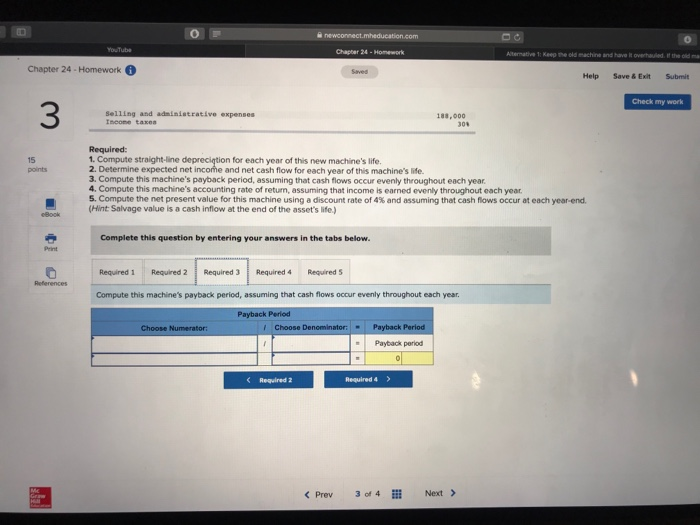

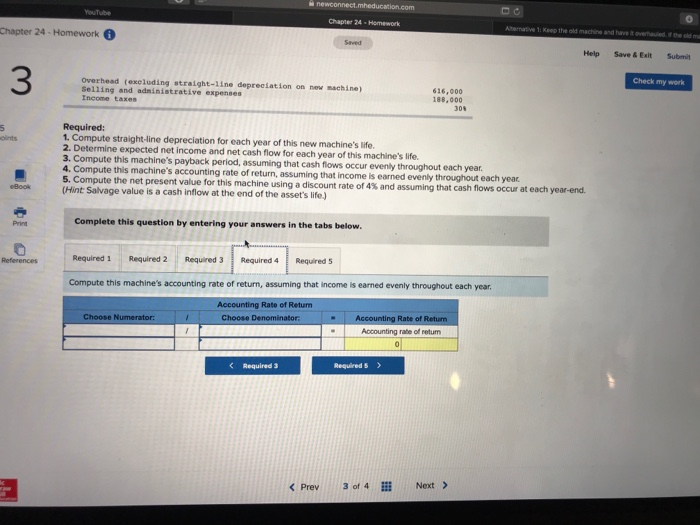

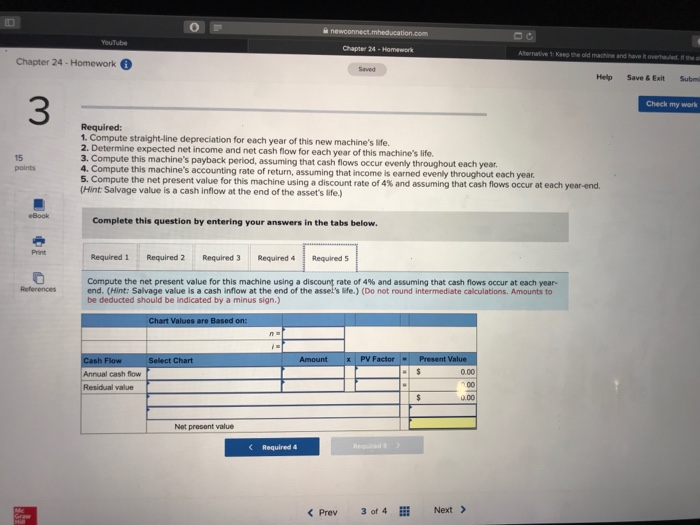

Chapter 24 -Homework Alternative 1: Keep the old machihe and have it overuled. er 24-Homework Help Save &Exit Submit Check my work Factor Company a $760,000 cost with an exp is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at pected four-year life and a $48,000 salvage value. All sales are for cash, and all costs are out-of-pocket, ation on the new machine. Additional information includes the following. (PY of S1. FV of S1, PVA of S1, and FVA of $) (Use appropriate factor(s) from the tables provided. Round PV factor value to 4 decimal places.) Expected annual sales of new product Expected annual costs of new prodact 2,540,000 Direct materials Direct labor Overhead (excluding straight-line depreeiation on new machine) Selling and administrative expenses Incone taxes 508,000 700,000 616,000 188,000 Required: 1.Compute straight-line depreciation for each year of this new machine's life ences 2. Determine expected net income and net cash flow for each year of this machine's life. 3. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year 4. Compute this machine's accounting rate of return, assuming that income is earned evenly throughout cach year. 5, compute the net present value for this machine using a discount rate of 4% and assuming that cash flows occur at each year-end. (Hint: Salvage value is a cash inflow at the end of the asset's life.) Complete this question by entering your answers in the tabs below Required 1 Required 2Required 3Required 4 Required 5 Determine expected net income and net cash flow for each year of this machine's life Revenues $ 2.540 Expenses Next> Prev 3f 4 Next> Abernative 1: Keep the old machine and Chapter 24-Homework Help Save&Exit Submit Check my work Overhead (excluding straight-1ine depreciation on new machine) Selling and administrative expenses ncome taxes 616,000 188,000 308 Required 1. Compute straight-line depreciation for each year of this new machine's life 2. Determine expected net income and net cash flow for each year of this machine's life. 3. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year 4. Compute this machine's accounting rate of return, assuming that 5. Compute the net present value for (Hint Salvage value is a cash inflow at the end of the asset's life.) oints income is earned evenly throughout each year this machine using a discount rate of 4% and assuming that cash flows occur at each year-end. Complete this question by entering your answers in the tabs below Print Required 1 Required 2 Required 3 Required 4 Compute this machine's accounting rate of return, assuming that income is earned evenly throughout each year Required S References Rate of Return Accounting rate of returm Required 5 > Prev YouTube 24 - Homework Alhernative t: Kaeep the old machine and have Rovruled Chapter 24-Homework Saved Help Save&Exit Submi 3 Check my work Required 1. Compute straight-ine depreciation for each year of this new machine's life 2. Determine expected net income and net cash flow for each year of this machine's life. 15 points 3. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year 4. Compute this machine's accounting rate of return, assuming that income is earned evenly throughout each year 5. Compute the net present value f for this machine using a discount rate of 4% and assuming that cash flows occur at each year-end. (Hint Salvage value is a cash inflow at the end of the asset's life.) Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 Required 3 Required 4 Required 5 Compute the net present value for this machine using a discoung rate of 4% and assuming that cash flows ocor at each year. end. (Hint: Salvage value is a cash inflow at the end of the assel's life.) (Do not round intermediate calculations. Amounts to be deducted should be indicated by a minus sign.) References 0.00 Annual cash flow Residual value Net prosent value