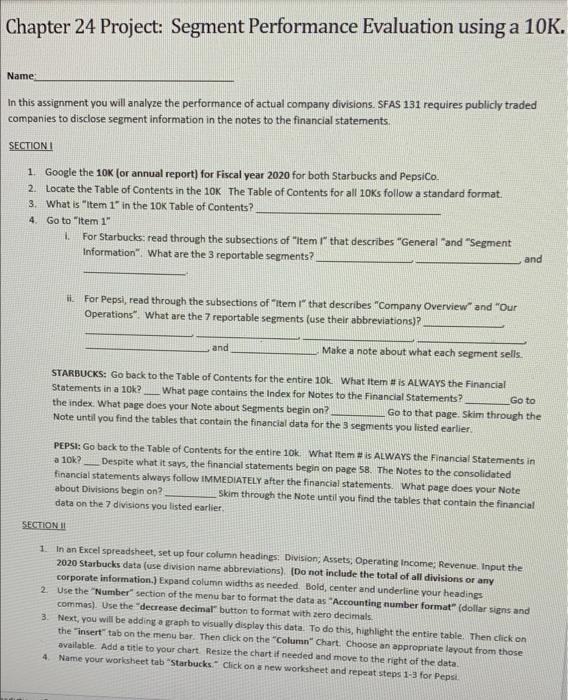

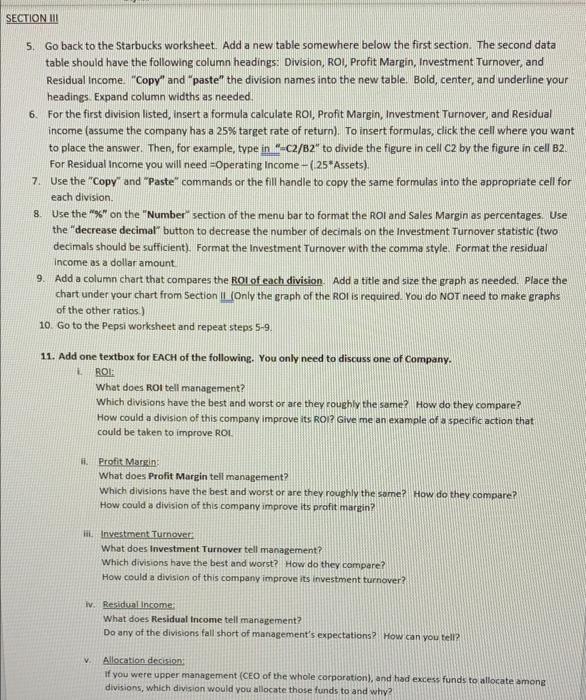

Chapter 24 Project: Segment Performance Evaluation using a 10K. Name In this assignment you will analyze the performance of actual company divisions. SFAS 131 requires publicly traded companies to disclose segment information in the notes to the financial statements. SECTIONI 1 Google the 10K (or annual report) for Fiscal year 2020 for both Starbucks and PepsiCo. 2. Locate the Table of Contents in the 10K The Table of Contents for all 10Ks follow a standard format. 3. What is "item 1' in the 10K Table of Contents? 4 Go to Item 1 1. For Starbucks: read through the subsections of item that describes "General and "Segment Information". What are the 3 reportable segments? and i For Pepsi, read through the subsections of "ItemI" that describes "Company Overview" and "Our Operations". What are the 7 reportable segments (use their abbreviations) and Make a note about what each segment sells. STARBUCKS: Go back to the Table of Contents for the entire 10k. What Item is ALWAYS the Financial Statements in a 10k? What page contains the Index for Notes to the Financial Statements? Go to the index. What page does your Note about Segments begin on? Go to that page. Skim through the Note until you find the tables that contain the financial data for the 3 segments you listed earlier PEPSI: Go back to the Table of Contents for the entire 10k What Item is ALWAYS the Financial Statements in a 10k? Despite what it says, the financial statements begin on page 58. The Notes to the consolidated financial statements always follow IMMEDIATELY after the financial statements. What page does your Note about Divisions begin on? Skim through the Note until you find the tables that contain the financial data on the 7 divisions you listed earlier SECTION II 1. In an Excel spreadsheet, set up four column headings. Division, Assets, Operating Income: Revenue Input the 2020 Starbucks data (use division name abbreviations) (Do not include the total of all divisions or any corporate information.) Expand column widths as needed Bold, center and underline your headings 2. Use the "Number section of the menu bar to format the data as Accounting number format" (dollar signs and commas). Use the decrease decimal" button to format with zero decimals. 3. Next, you will be adding a graph to visually display this data. To do this, highlight the entire table. Then click on the "insert" tab on the menu bar. Then click on the "Column" Chart. Choose an appropriate layout from those available. Add a title to your chart Resize the chart if needed and move to the right of the data 4. Name your worksheet tab "Starbucks. Click on a new worksheet and repeat steps 1-3 for Pepsi SECTION III 5. Go back to the Starbucks worksheet. Add a new table somewhere below the first section. The second data table should have the following column headings: Division, ROI, Profit Margin, Investment Turnover, and Residual Income. "Copy" and "paste" the division names into the new table. Bold, center, and underline your headings Expand column widths as needed. 6. For the first division listed, insert a formula calculate ROI, Profit Margin, Investment Turnover and Residual income (assume the company has a 25% target rate of return). To insert formulas, click the cell where you want to place the answer. Then, for example, type in 1-C2/62" to divide the figure in cell C2 by the figure in cell B2. For Residual income you will need Operating Income - (25 Assets), 7. Use the "Copy" and "Paste" commands or the fill handle to copy the same formulas into the appropriate cell for each division 8. Use the "%" on the "Number" section of the menu bar to format the Roland Sales Margin as percentages. Use the "decrease decimal" button to decrease the number of decimals on the Investment Turnover statistic two decimals should be sufficient). Format the Investment Turnover with the comma style. Format the residual Income as a dollar amount 9. Add a column chart that compares the ROI of each division. Add a title and size the graph as needed. Place the chart under your chart from Section || (Only the graph of the Rol is required. You do NOT need to make graphs of the other ratios.) 10. Go to the Pepsi worksheet and repeat steps 5-9 11. Add one textbox for EACH of the following. You only need to discuss one of Company ROI: What does ROI tell management? Which divisions have the best and worst or are they roughly the same? How do they compare? How could a division of this company improve its ROI? Give me an example of a specific action that could be taken to improve ROL Profit Marin What does Profit Margin tell management? Which divisions have the best and worst or are they roughly the same? How do they compare? How could a division of this company improve its profit margin? HL Investment Turnovec What does Investment Turnover tell management? Which divisions have the best and worst? How do they compare? How could a division of this company improve its investment turnover? iv. Residual income What does Residual income tell management? Do any of the divisions fall short of management's expectations? How can you tell? v Allocation decision if you were upper management (CEO of the whole corporation), and had excess funds to allocate among divisions, which division would you allocate those funds to and why