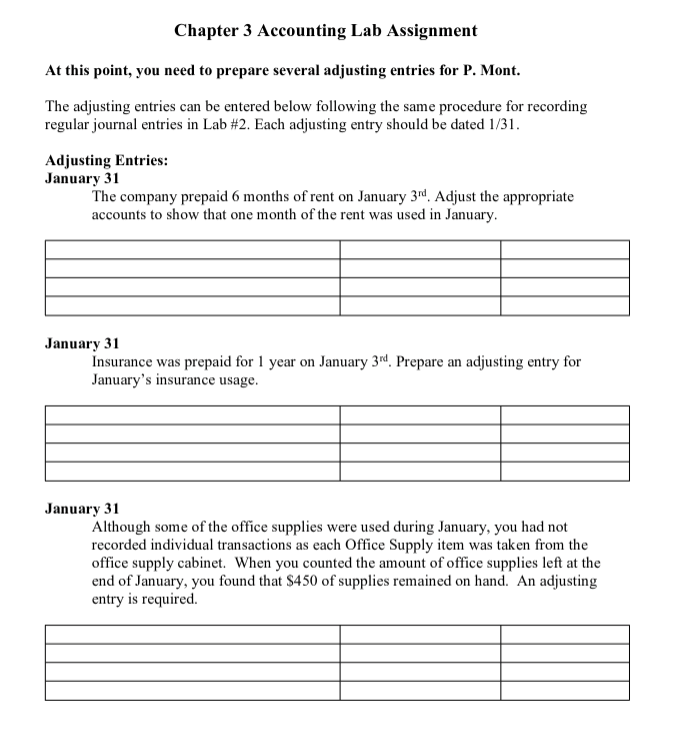

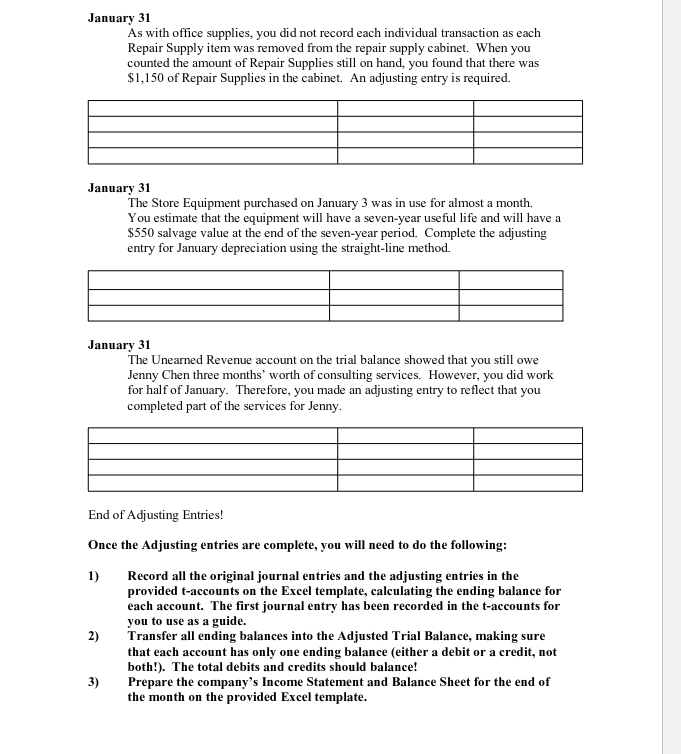

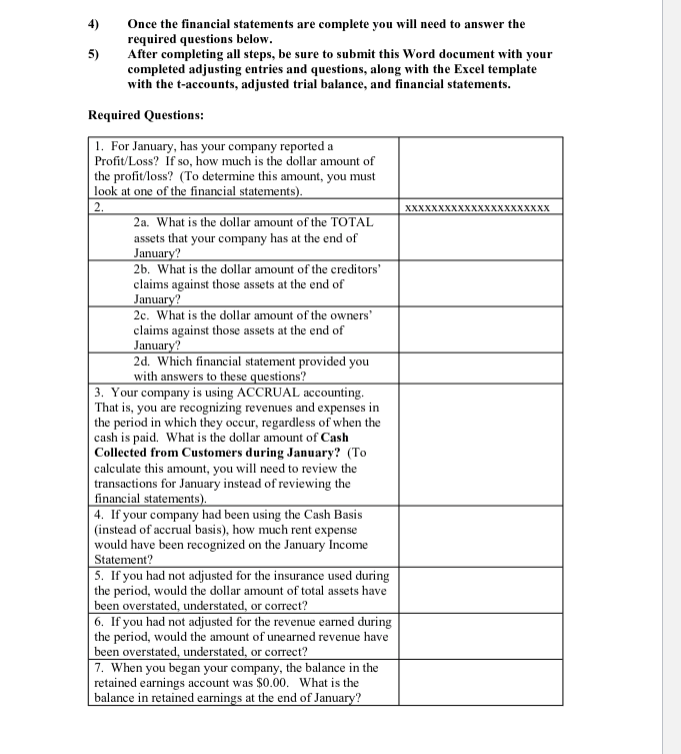

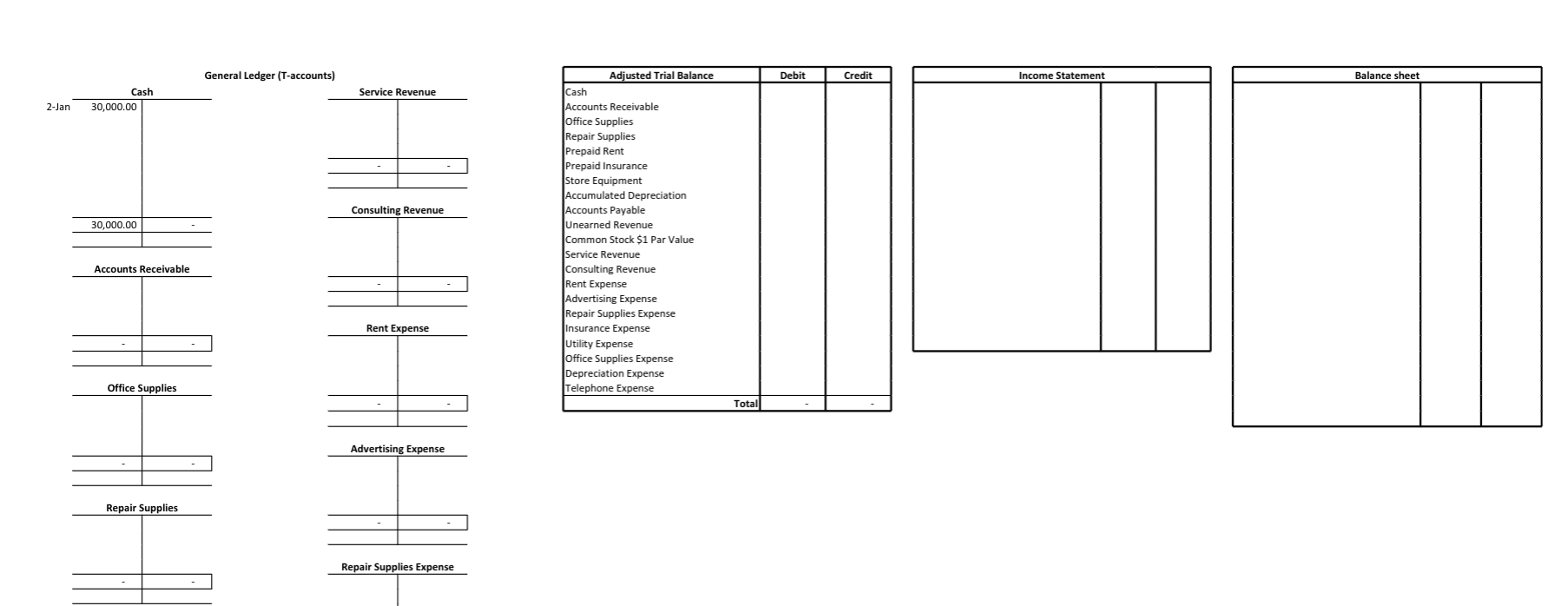

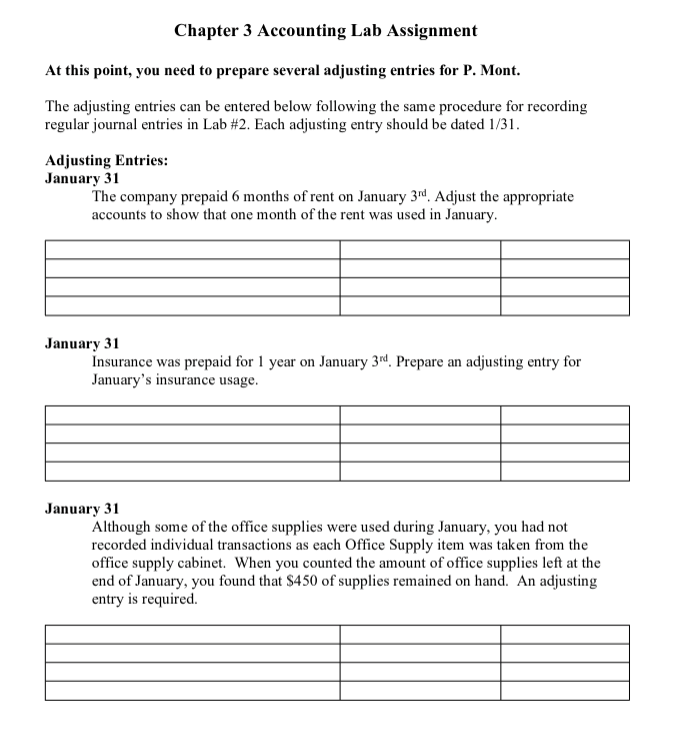

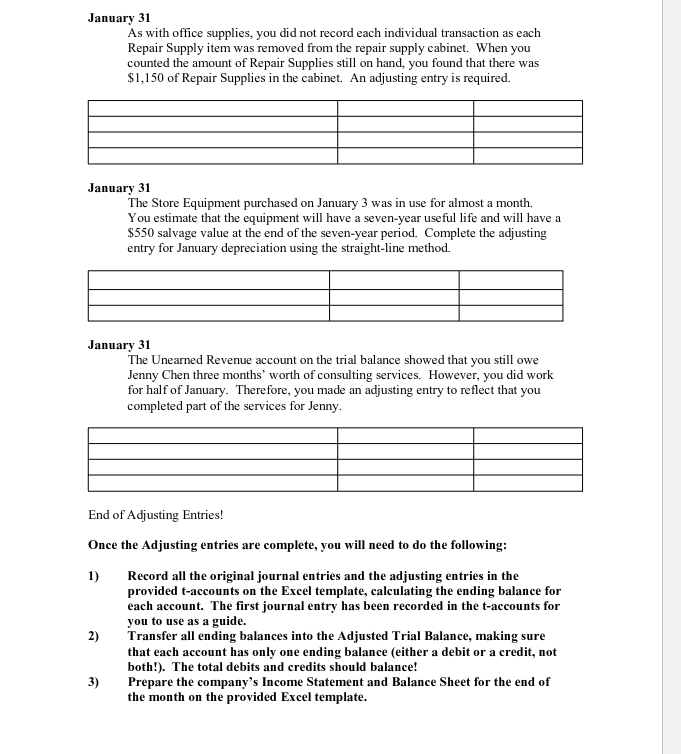

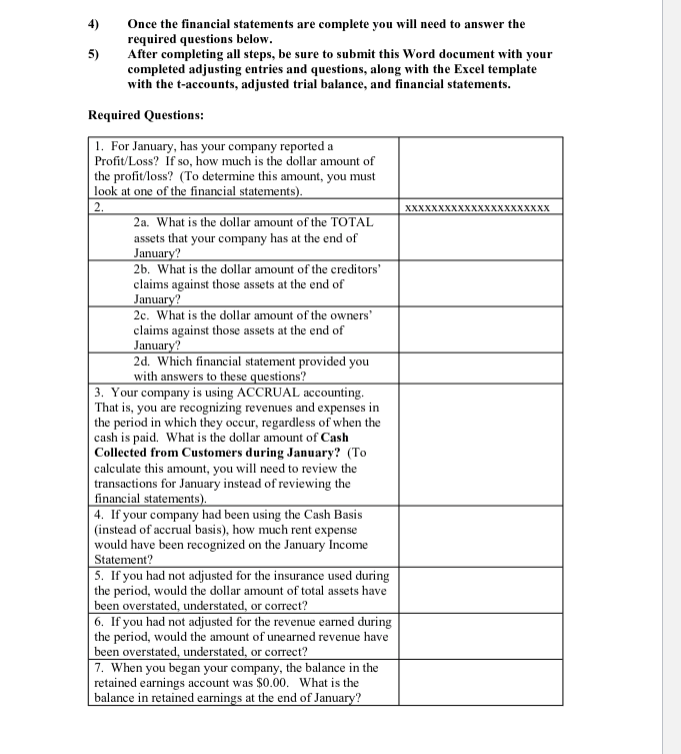

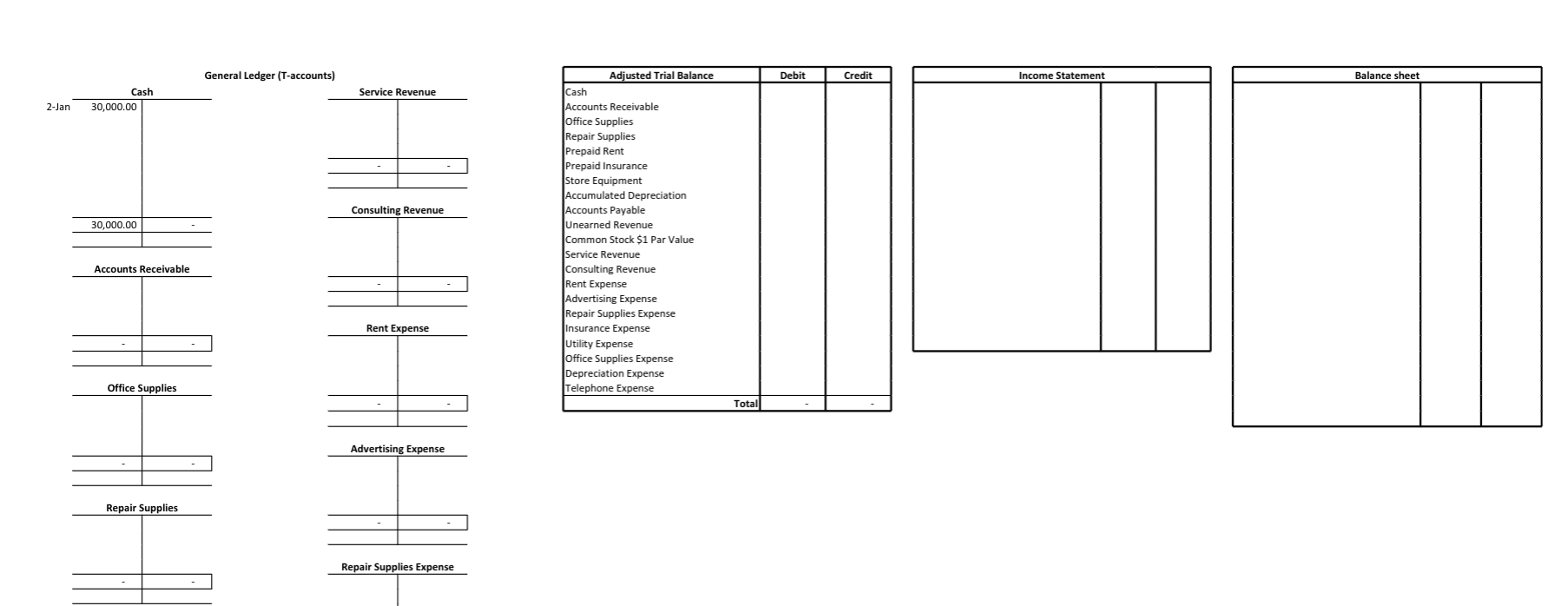

Chapter 3 Accounting Lab Assignment At this point, you need to prepare several adjusting entries for P. Mont. The adjusting entries can be entered below following the same procedure for recording regular journal entries in Lab \#2. Each adjusting entry should be dated 1/31. Adjusting Entries: January 31 The company prepaid 6 months of rent on January 3rd. Adjust the appropriate accounts to show that one month of the rent was used in January. January 31 Insurance was prepaid for 1 year on January 3rd. Prepare an adjusting entry for January's insurance usage. January 31 Although some of the office supplies were used during January, you had not recorded individual transactions as each Office Supply item was taken from the office supply cabinet. When you counted the amount of office supplies left at the end of January, you found that $450 of supplies remained on hand. An adjusting entry is required. January 31 As with office supplies, you did not record each individual transaction as each Repair Supply item was removed from the repair supply cabinet. When you counted the amount of Repair Supplies still on hand, you found that there was $1,150 of Repair Supplies in the cabinet. An adjusting entry is required. January 31 The Store Equipment purchased on January 3 was in use for almost a month. You estimate that the equipment will have a seven-year useful life and will have a $550 salvage value at the end of the seven-year period. Complete the adjusting entry for January depreciation using the straight-line method. January 31 The Unearned Revenue account on the trial balance showed that you still owe Jenny Chen three months' worth of consulting services. However, you did work for half of January. Therefore, you made an adjusting entry to reflect that you completed part of the services for Jenny. End of Adjusting Entries! Once the Adjusting entries are complete, you will need to do the following: 1) Record all the original journal entries and the adjusting entries in the provided t-accounts on the Excel template, calculating the ending balance for each account. The first journal entry has been recorded in the t-accounts for you to use as a guide. 2) Transfer all ending balances into the Adjusted Trial Balance, making sure that each account has only one ending balance (either a debit or a credit, not both!). The total debits and credits should balance! 3) Prepare the company's Income Statement and Balance Sheet for the end of the month on the provided Excel template. 4) Once the financial statements are complete you will need to answer the required questions below. 5) After completing all steps, be sure to submit this Word document with your completed adjusting entries and questions, along with the Excel template with the t-accounts, adjusted trial balance, and financial statements. \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ Income Statement } \\ \hline & & \\ \hline \end{tabular} Advertising Expense Repair Supplies Chapter 3 Accounting Lab Assignment At this point, you need to prepare several adjusting entries for P. Mont. The adjusting entries can be entered below following the same procedure for recording regular journal entries in Lab \#2. Each adjusting entry should be dated 1/31. Adjusting Entries: January 31 The company prepaid 6 months of rent on January 3rd. Adjust the appropriate accounts to show that one month of the rent was used in January. January 31 Insurance was prepaid for 1 year on January 3rd. Prepare an adjusting entry for January's insurance usage. January 31 Although some of the office supplies were used during January, you had not recorded individual transactions as each Office Supply item was taken from the office supply cabinet. When you counted the amount of office supplies left at the end of January, you found that $450 of supplies remained on hand. An adjusting entry is required. January 31 As with office supplies, you did not record each individual transaction as each Repair Supply item was removed from the repair supply cabinet. When you counted the amount of Repair Supplies still on hand, you found that there was $1,150 of Repair Supplies in the cabinet. An adjusting entry is required. January 31 The Store Equipment purchased on January 3 was in use for almost a month. You estimate that the equipment will have a seven-year useful life and will have a $550 salvage value at the end of the seven-year period. Complete the adjusting entry for January depreciation using the straight-line method. January 31 The Unearned Revenue account on the trial balance showed that you still owe Jenny Chen three months' worth of consulting services. However, you did work for half of January. Therefore, you made an adjusting entry to reflect that you completed part of the services for Jenny. End of Adjusting Entries! Once the Adjusting entries are complete, you will need to do the following: 1) Record all the original journal entries and the adjusting entries in the provided t-accounts on the Excel template, calculating the ending balance for each account. The first journal entry has been recorded in the t-accounts for you to use as a guide. 2) Transfer all ending balances into the Adjusted Trial Balance, making sure that each account has only one ending balance (either a debit or a credit, not both!). The total debits and credits should balance! 3) Prepare the company's Income Statement and Balance Sheet for the end of the month on the provided Excel template. 4) Once the financial statements are complete you will need to answer the required questions below. 5) After completing all steps, be sure to submit this Word document with your completed adjusting entries and questions, along with the Excel template with the t-accounts, adjusted trial balance, and financial statements. \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ Income Statement } \\ \hline & & \\ \hline \end{tabular} Advertising Expense Repair Supplies