Answered step by step

Verified Expert Solution

Question

1 Approved Answer

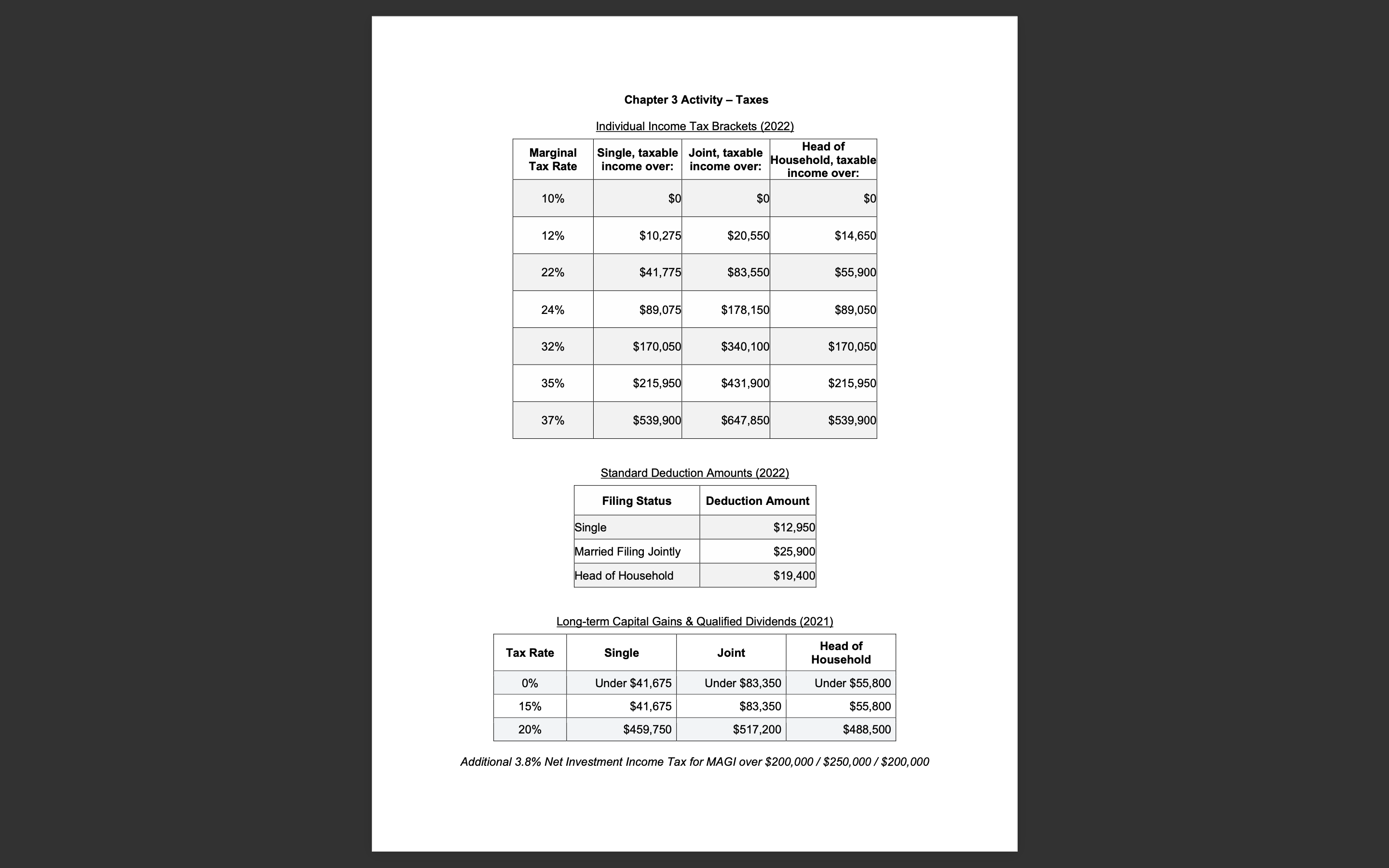

Chapter 3 Activity - Taxes Individual Income Tax Brackets (2022) Long-term Capital Gains & Qualified Dividends (2021) Additional 3.8% Net Investment Income Tax for MAGI

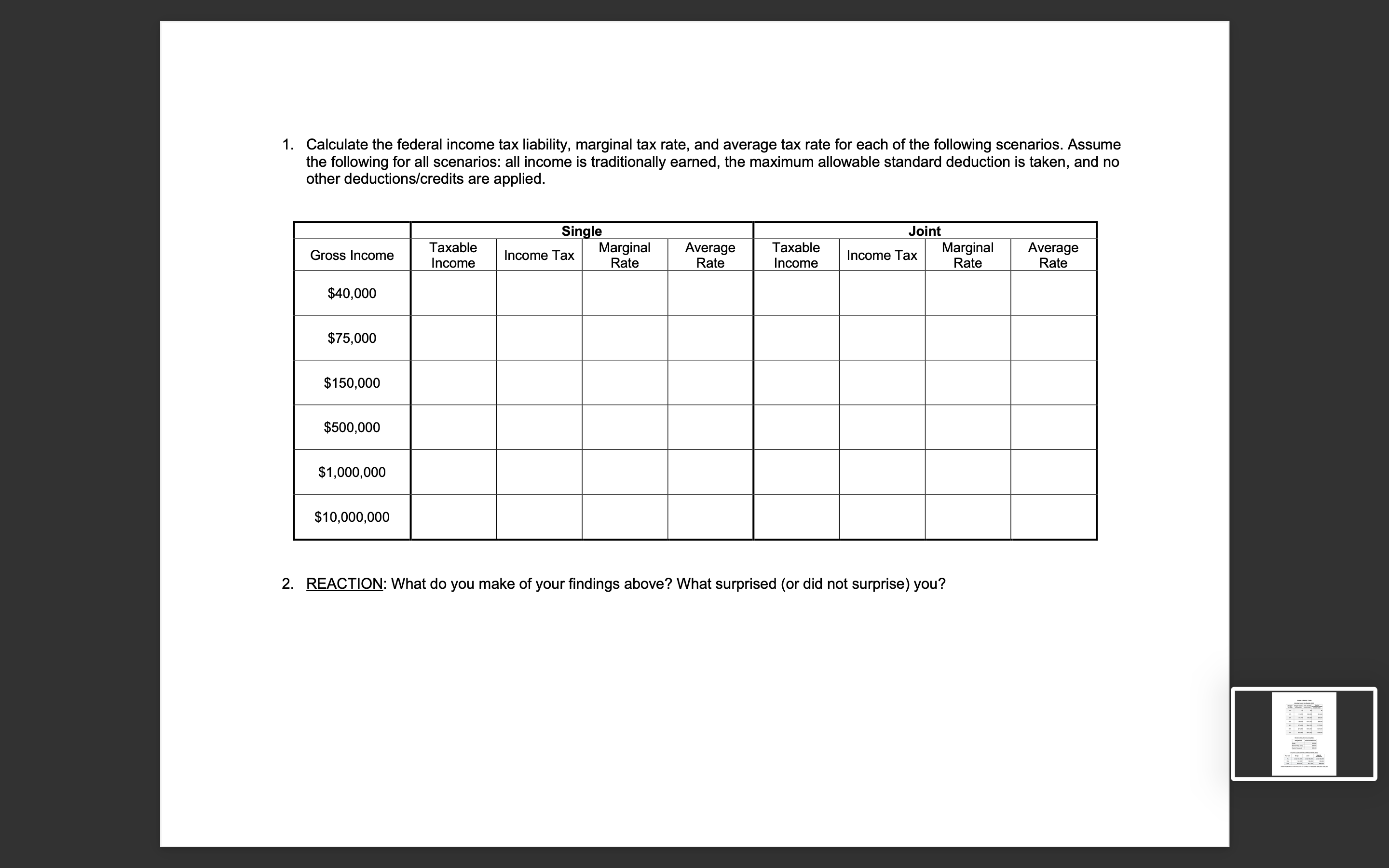

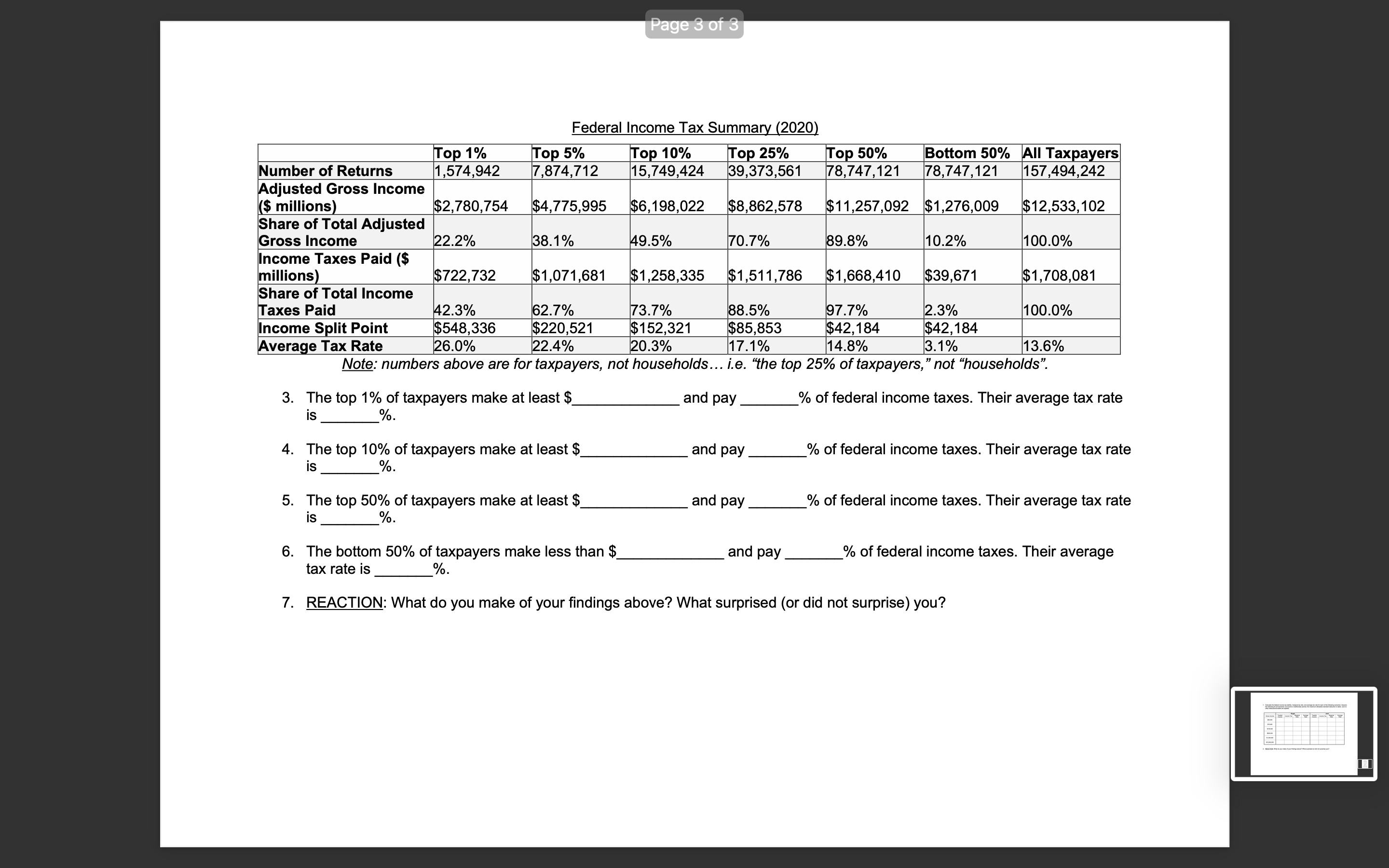

Chapter 3 Activity - Taxes Individual Income Tax Brackets (2022) Long-term Capital Gains \& Qualified Dividends (2021) Additional 3.8\% Net Investment Income Tax for MAGI over $200,000/$250,000/$200,000 1. Calculate the federal income tax liability, marginal tax rate, and average tax rate for each of the following scenarios. Assume the following for all scenarios: all income is traditionally earned, the maximum allowable standard deduction is taken, and no other deductions/credits are applied. 2. REACTION: What do you make of your findings above? What surprised (or did not surprise) you? Federal Income Tax Summary (2020) 3. The top 1% of taxpayers make at least ? is and pay and pay %. % of federal income taxes. Their average tax rate % of federal income taxes. Their average tax rate is and pay % of federal income taxes. Their average tax rate 5. The top 50% of taxpayers make at least $. is '. 6. The bottom 50% of taxpayers make less than $ and pay % of federal income taxes. Their average tax rate is 'o. 7. REACTION: What do you make of your findings above? What surprised (or did not surprise) you? Chapter 3 Activity - Taxes Individual Income Tax Brackets (2022) Long-term Capital Gains \& Qualified Dividends (2021) Additional 3.8\% Net Investment Income Tax for MAGI over $200,000/$250,000/$200,000 1. Calculate the federal income tax liability, marginal tax rate, and average tax rate for each of the following scenarios. Assume the following for all scenarios: all income is traditionally earned, the maximum allowable standard deduction is taken, and no other deductions/credits are applied. 2. REACTION: What do you make of your findings above? What surprised (or did not surprise) you? Federal Income Tax Summary (2020) 3. The top 1% of taxpayers make at least ? is and pay and pay %. % of federal income taxes. Their average tax rate % of federal income taxes. Their average tax rate is and pay % of federal income taxes. Their average tax rate 5. The top 50% of taxpayers make at least $. is '. 6. The bottom 50% of taxpayers make less than $ and pay % of federal income taxes. Their average tax rate is 'o. 7. REACTION: What do you make of your findings above? What surprised (or did not surprise) you

Chapter 3 Activity - Taxes Individual Income Tax Brackets (2022) Long-term Capital Gains \& Qualified Dividends (2021) Additional 3.8\% Net Investment Income Tax for MAGI over $200,000/$250,000/$200,000 1. Calculate the federal income tax liability, marginal tax rate, and average tax rate for each of the following scenarios. Assume the following for all scenarios: all income is traditionally earned, the maximum allowable standard deduction is taken, and no other deductions/credits are applied. 2. REACTION: What do you make of your findings above? What surprised (or did not surprise) you? Federal Income Tax Summary (2020) 3. The top 1% of taxpayers make at least ? is and pay and pay %. % of federal income taxes. Their average tax rate % of federal income taxes. Their average tax rate is and pay % of federal income taxes. Their average tax rate 5. The top 50% of taxpayers make at least $. is '. 6. The bottom 50% of taxpayers make less than $ and pay % of federal income taxes. Their average tax rate is 'o. 7. REACTION: What do you make of your findings above? What surprised (or did not surprise) you? Chapter 3 Activity - Taxes Individual Income Tax Brackets (2022) Long-term Capital Gains \& Qualified Dividends (2021) Additional 3.8\% Net Investment Income Tax for MAGI over $200,000/$250,000/$200,000 1. Calculate the federal income tax liability, marginal tax rate, and average tax rate for each of the following scenarios. Assume the following for all scenarios: all income is traditionally earned, the maximum allowable standard deduction is taken, and no other deductions/credits are applied. 2. REACTION: What do you make of your findings above? What surprised (or did not surprise) you? Federal Income Tax Summary (2020) 3. The top 1% of taxpayers make at least ? is and pay and pay %. % of federal income taxes. Their average tax rate % of federal income taxes. Their average tax rate is and pay % of federal income taxes. Their average tax rate 5. The top 50% of taxpayers make at least $. is '. 6. The bottom 50% of taxpayers make less than $ and pay % of federal income taxes. Their average tax rate is 'o. 7. REACTION: What do you make of your findings above? What surprised (or did not surprise) you Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started