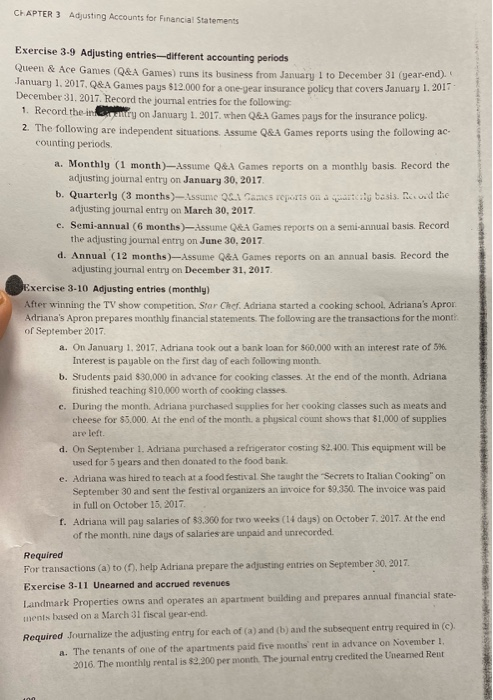

CHAPTER 3 Adjusting Accounts for Financial Statements Exercise 3.9 Adjusting entries-different accounting periods Queen & Ace Ganies (Q&A Games) runs its business from January I to December 31 (year-end). January 1, 2017, Q&A Games pays $12.000 for a one-year insurance policy that covers January 1, 2017 December 31, 2017. Record the journal entries for the following 1. Record the incisery on January 1, 2017. when Q&A Games pays for the insurance policy. 2. The following are independent situations. Assume Q&A Games reports using the following ac. counting periods a. Monthly (1 month)-Assume Q&A Games reports on a monthly basis. Record the adjusting journal entry on January 30, 2017 b. Quarterly (3 months)-Assume 001 Cancs son utily basis. Did the adjusting journal entry on March 30, 2017 c. Semi-annual (6 months)- assume Q&A Games reports on a semi-annual basis. Record the adjusting journal entry on June 30, 2017 d. Annual (12 months)-Assume Q&A Games reports on an annual basis. Record the adjusting journal entry on December 31, 2017 Exercise 3-10 Adjusting entries (monthly) After winning the TV show competition. Star Chef. Adriana started a cooking school, Adriana's Apron Adriana's Apron prepares monthly financial statements. The following are the transactions for the monti of September 2017 a. On January 1, 2017, Adriana took out a bank loan for $60.000 with an interest rate of 5% Interest is payable on the first day of each following month b. Students paid $30,000 in advance for cooking classes. At the end of the month. Adriana finished teaching $10.000 worth of cooking classes c. During the month. Adriana purchased supplies for her cooking classes such as meats and cheese for $5.000. At the end of the month. a physical count shows that $1,000 of supplies are left. d. On September 1. Adriana purchased a refrigerator costing $2.100. This equipment will be used for 5 years and then donated to the food bank. e. Adriana was hired to teach at a food festival She taught the "Secrets to Italian Cooking" on September 30 and sent the festival organizers an invoice for $9,350. The invoice was paid in full on October 15, 2017 f. Adriana will pay salaries of $3.300 for two weeks (14 days) on October 7, 2017. At the end of the month nine days of salaries are unpaid and unrecorded Required For transactions (a) to (f), help Adriana prepare the adjusting entries on September 30, 2017 Exercise 3-11 Unearned and accrued revenues Landmark Properties owns and operates an apartment building and prepares annual financial state- ments bused on a March 31 fiscal year-end. Required Journalize the adjusting entry for each of (a) and (b) and the subsequent entry required in (c) a. The tenants of one of the apartments paid five months rent in advance on November 1, 2016. The monthly rental is $2.200 per month. The journal entry credited the Uneamed Rent