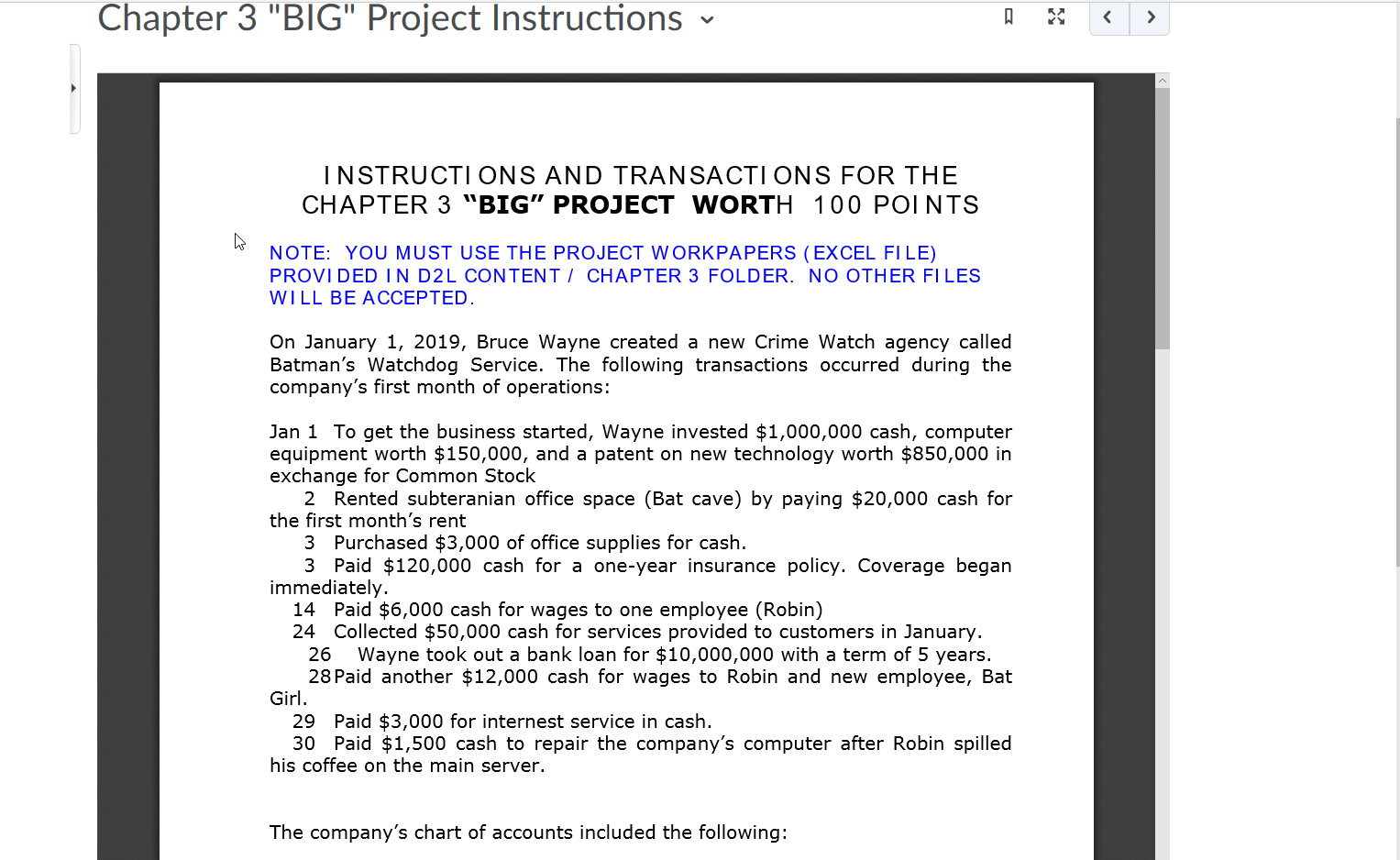

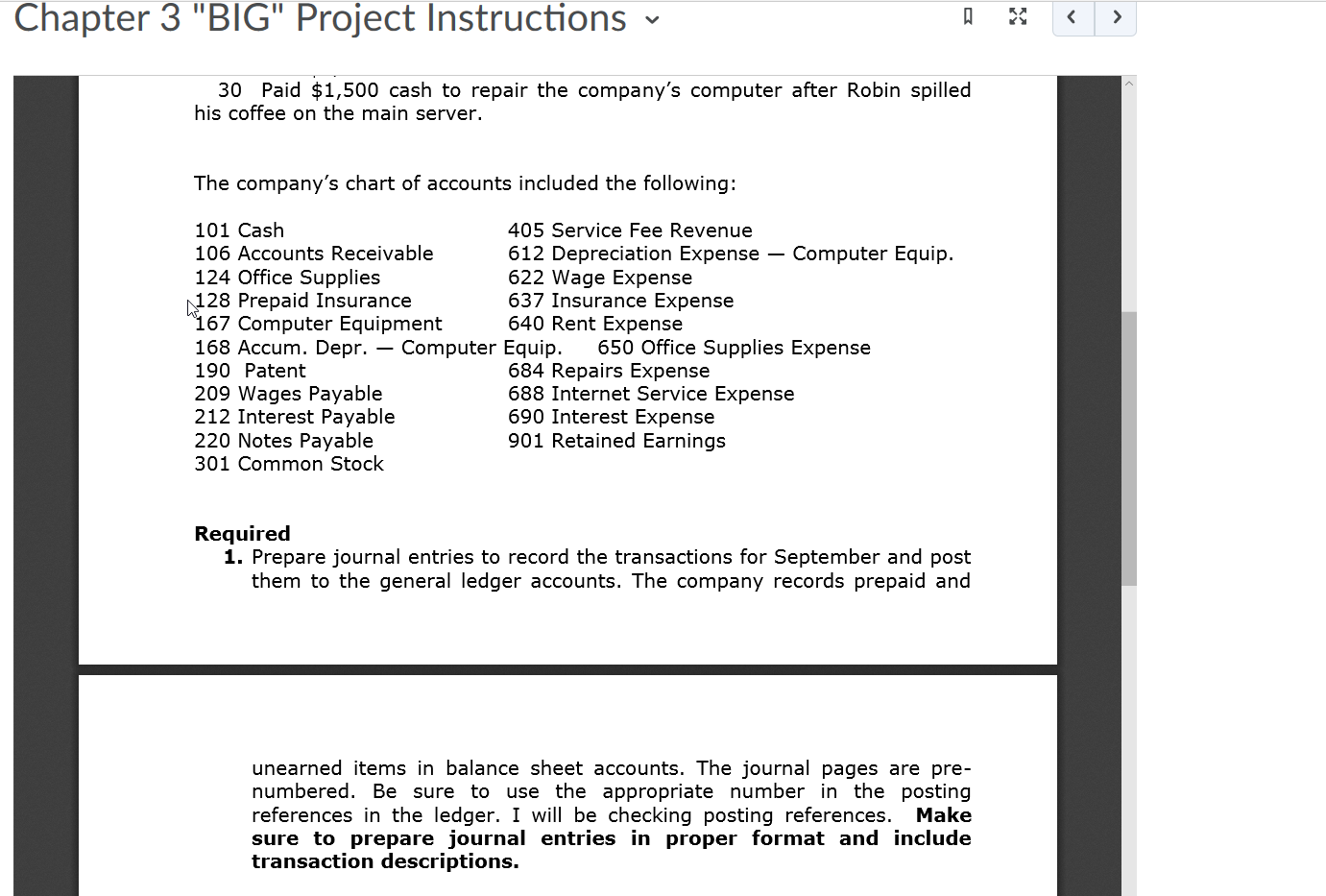

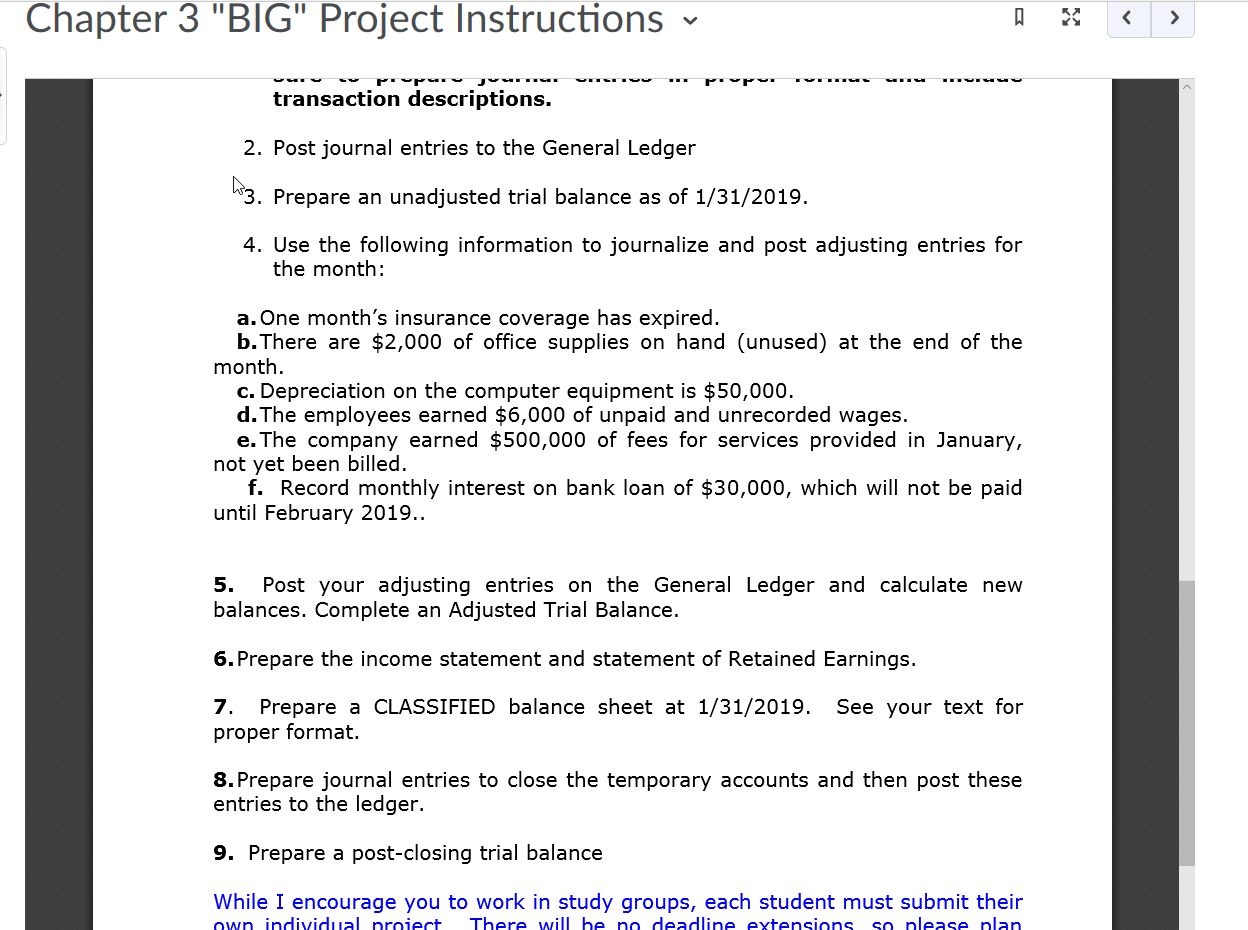

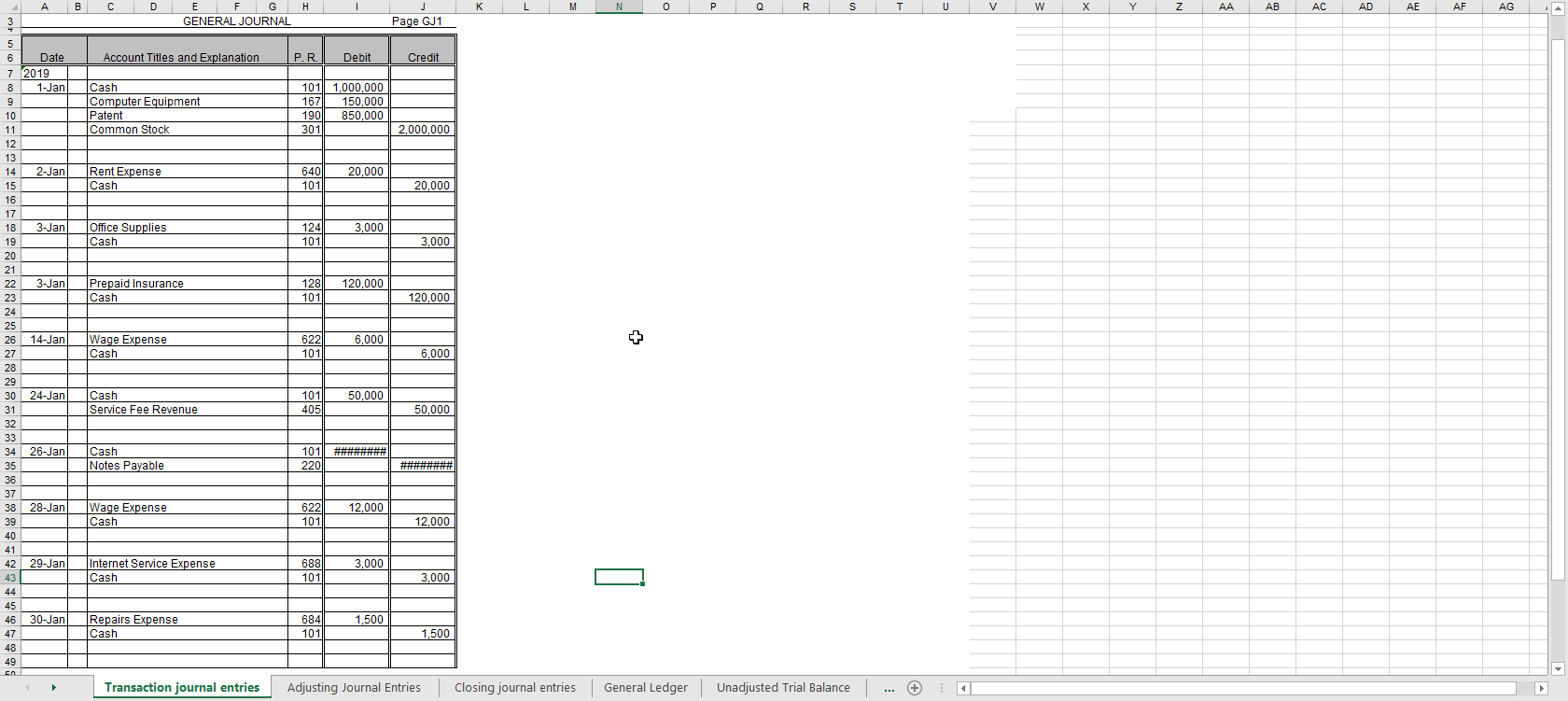

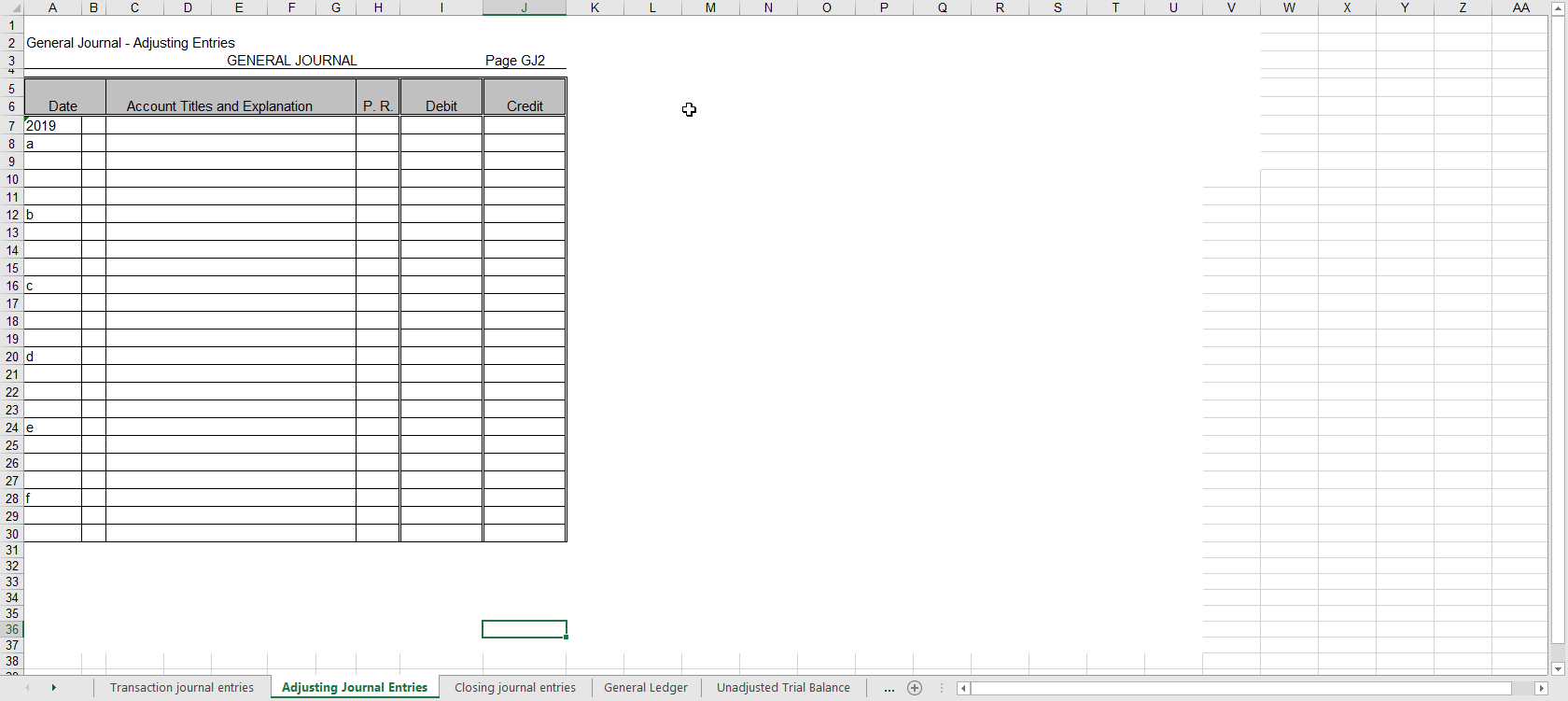

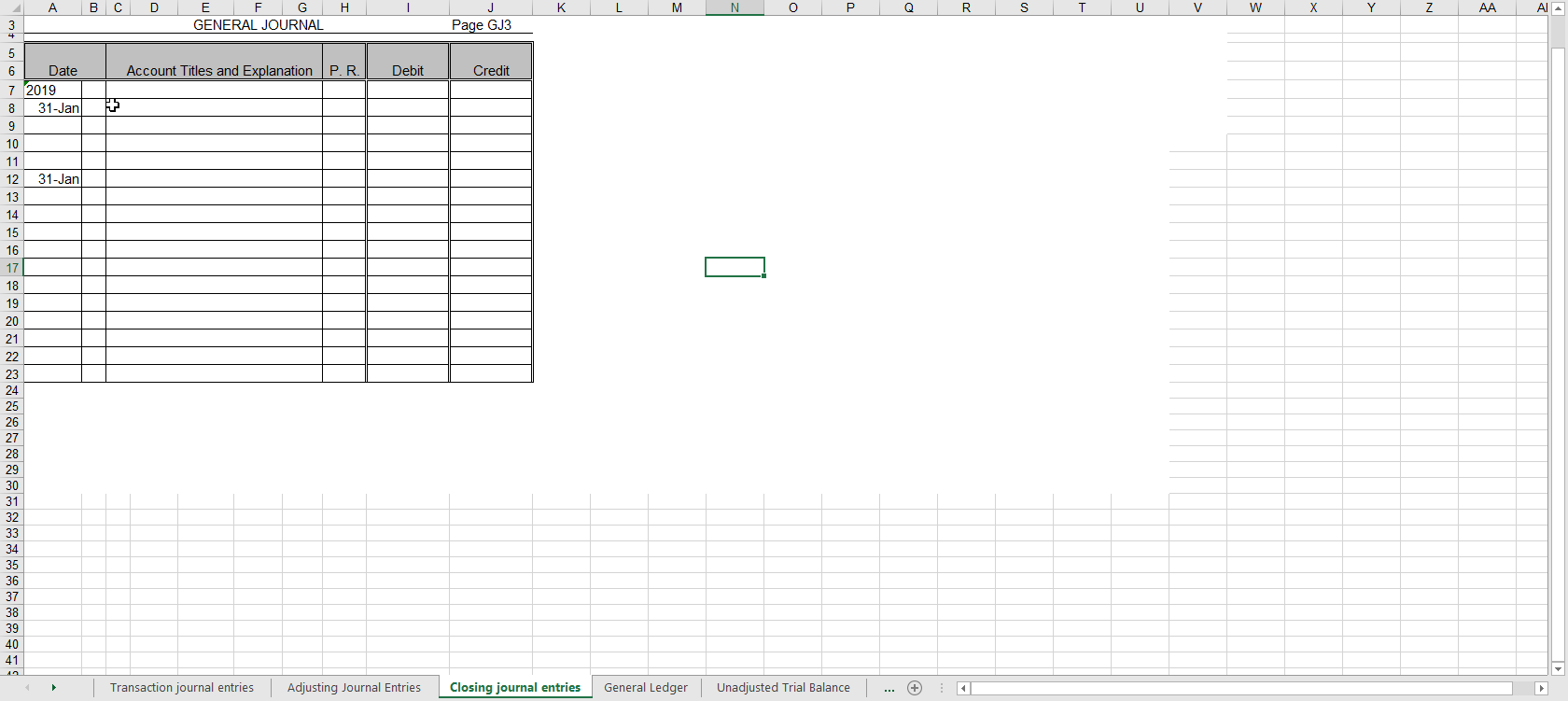

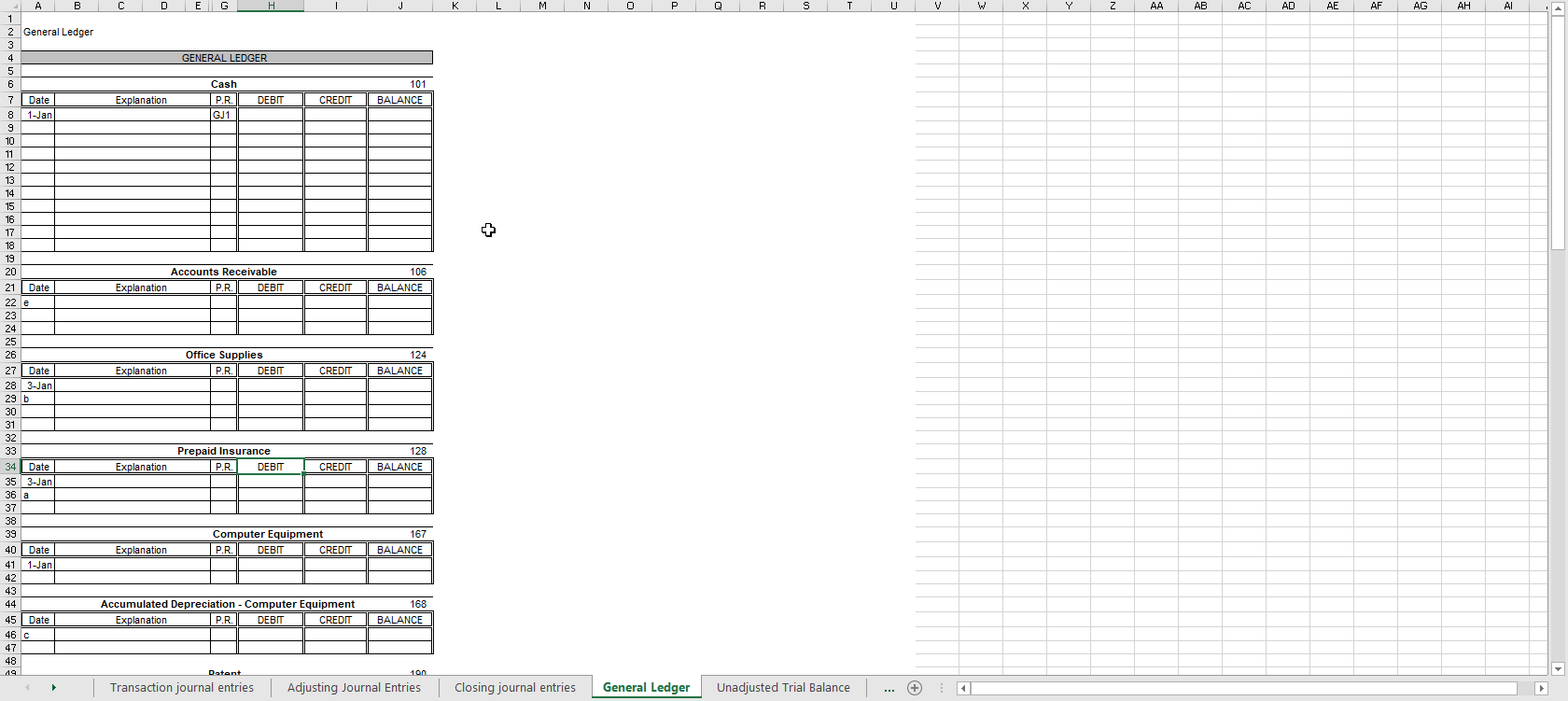

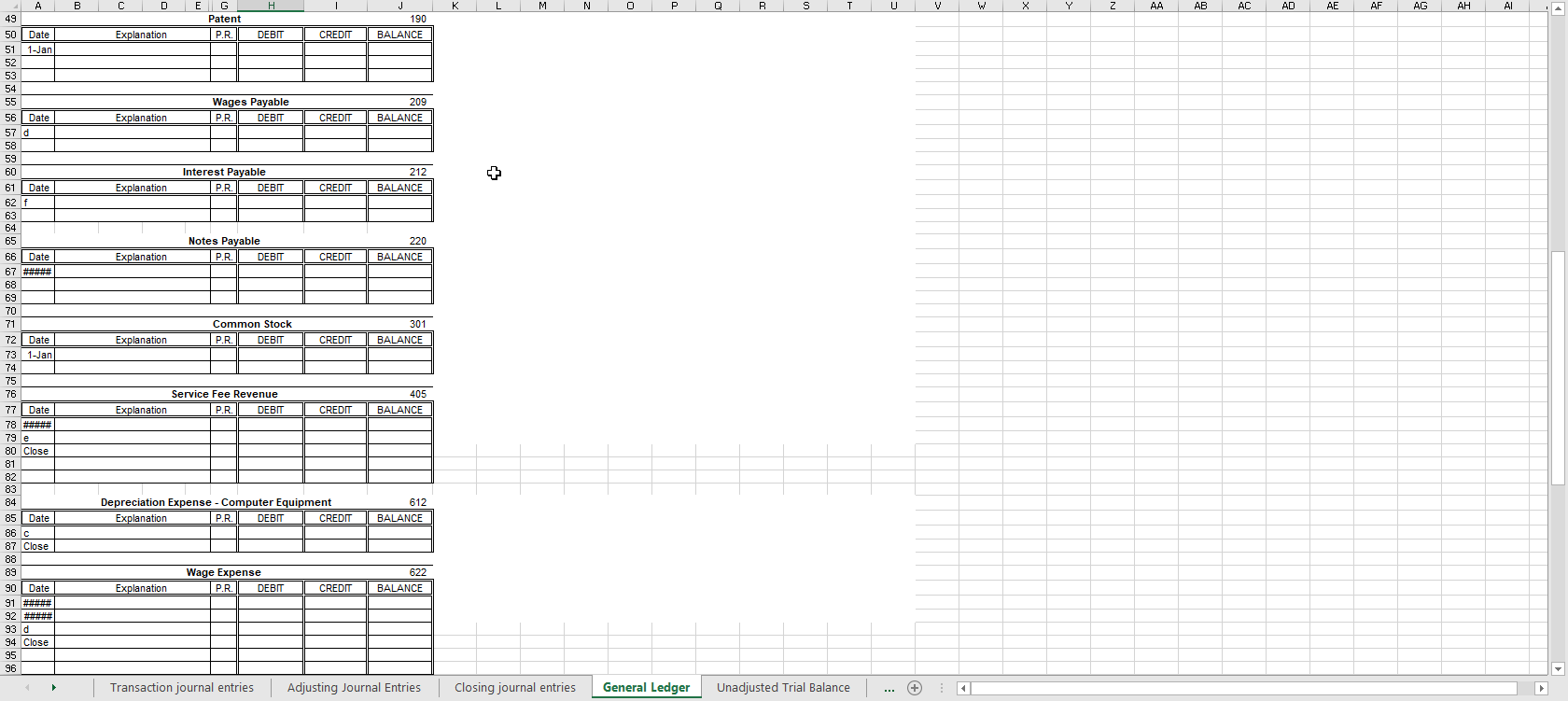

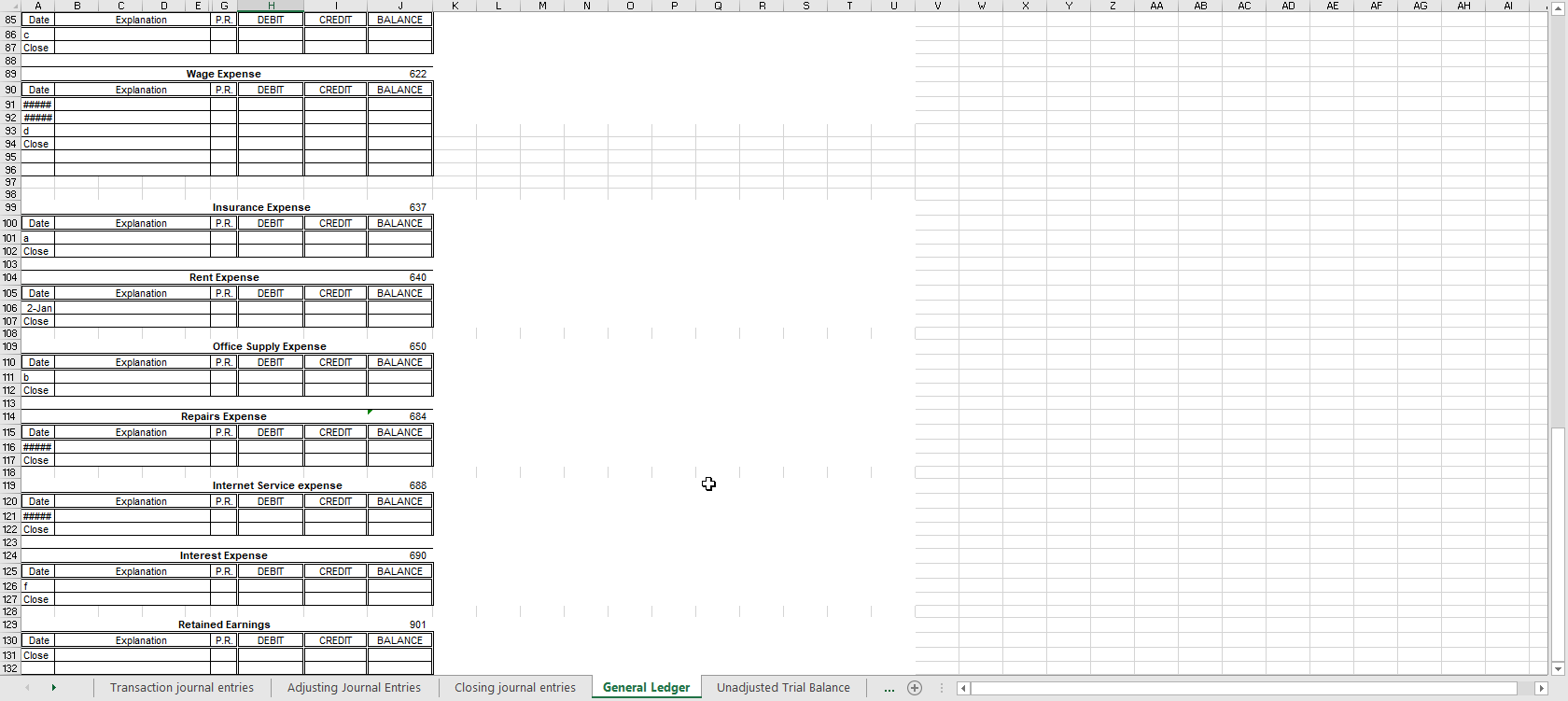

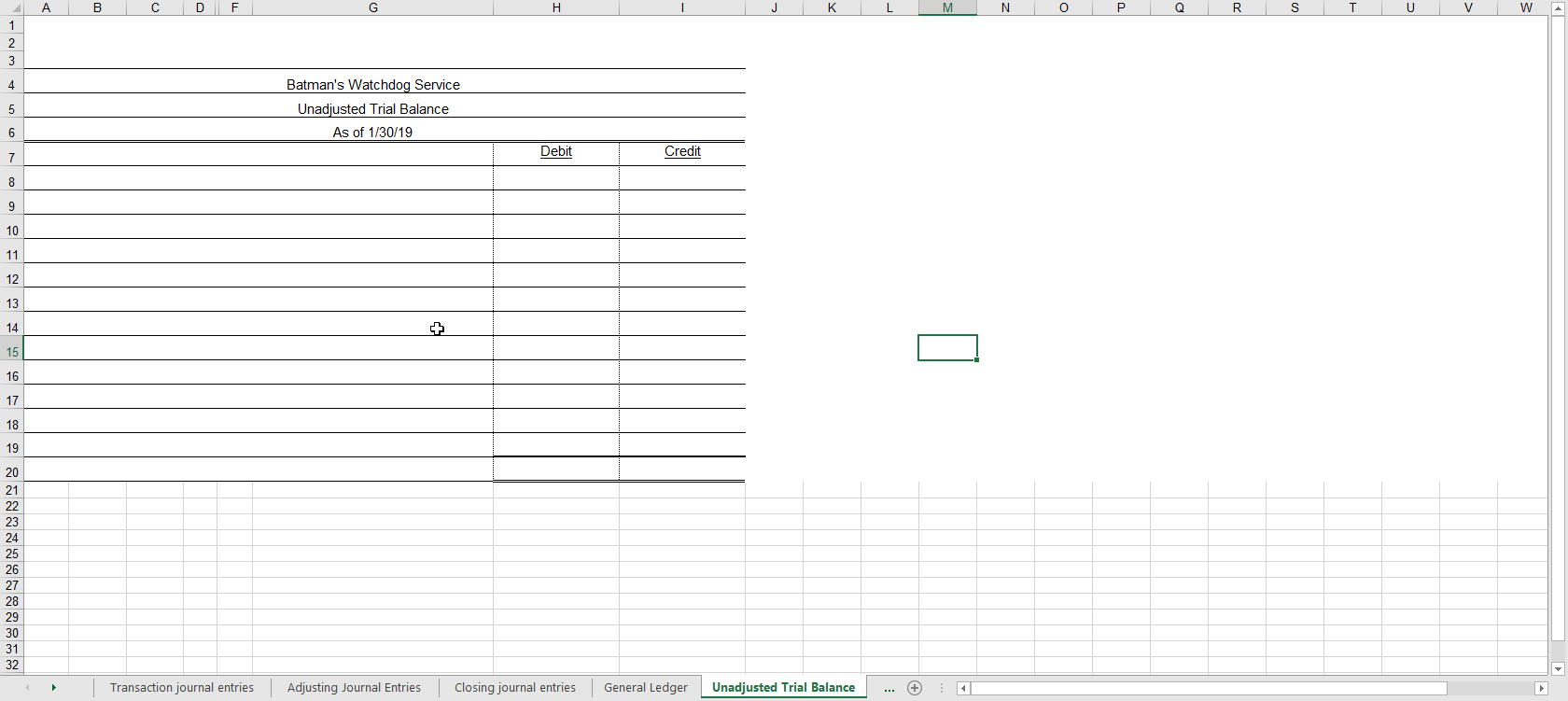

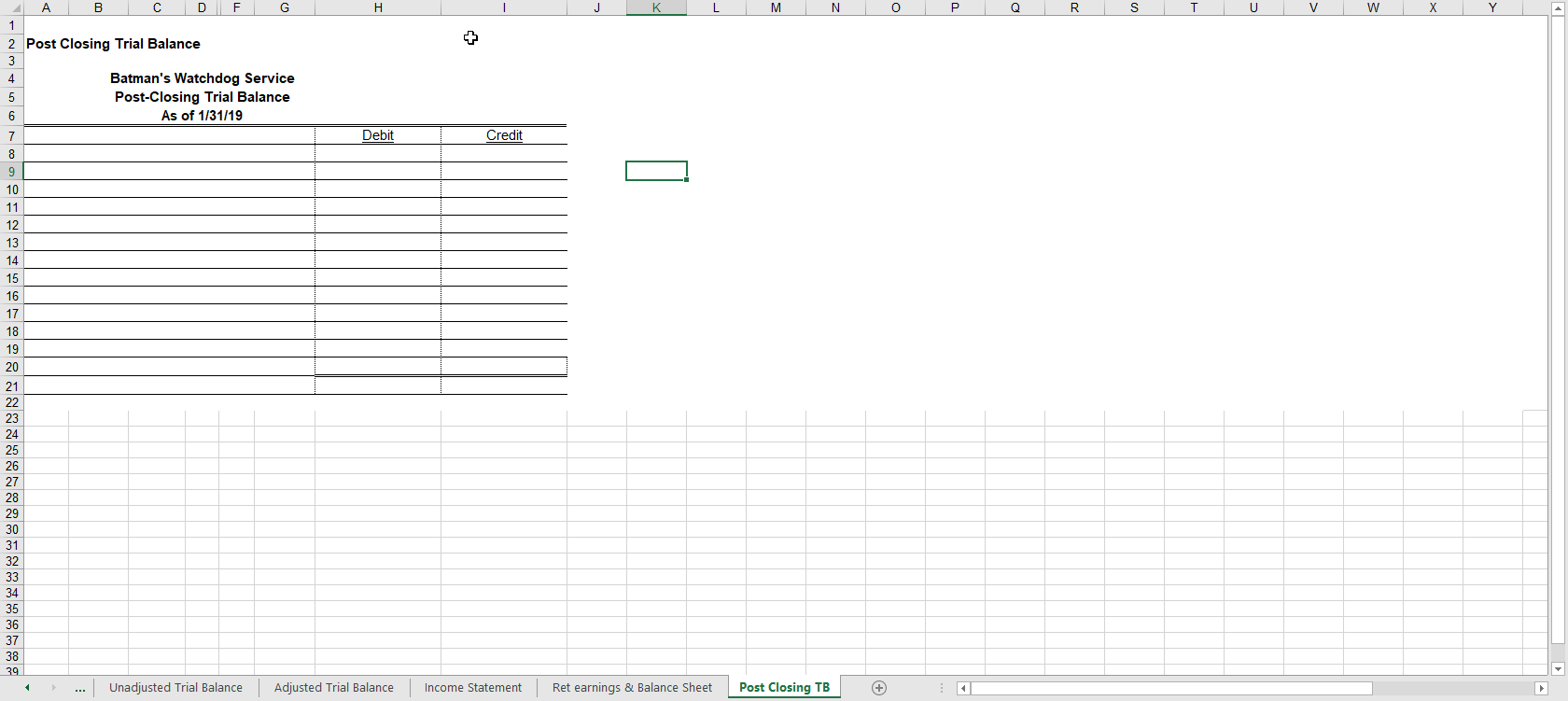

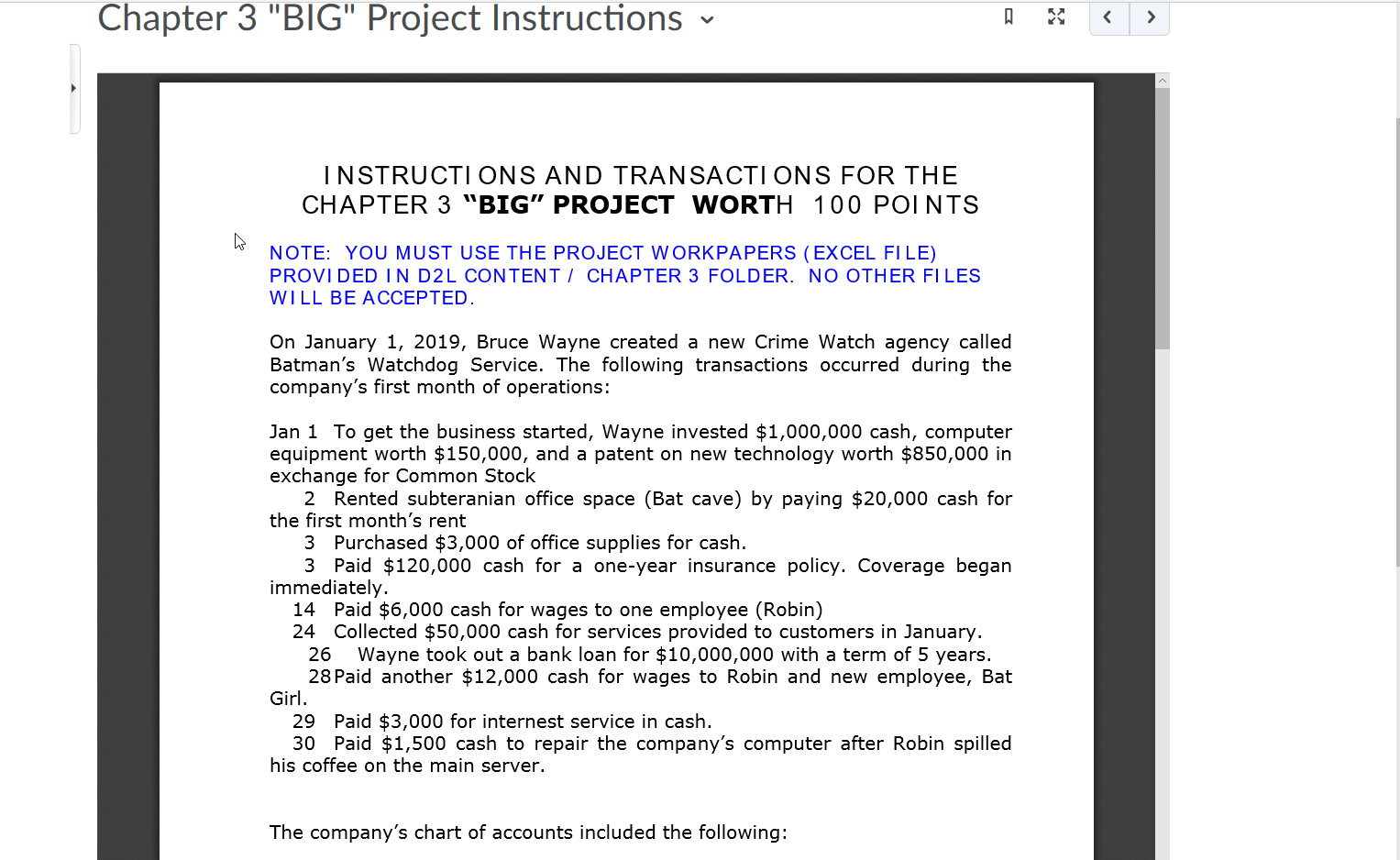

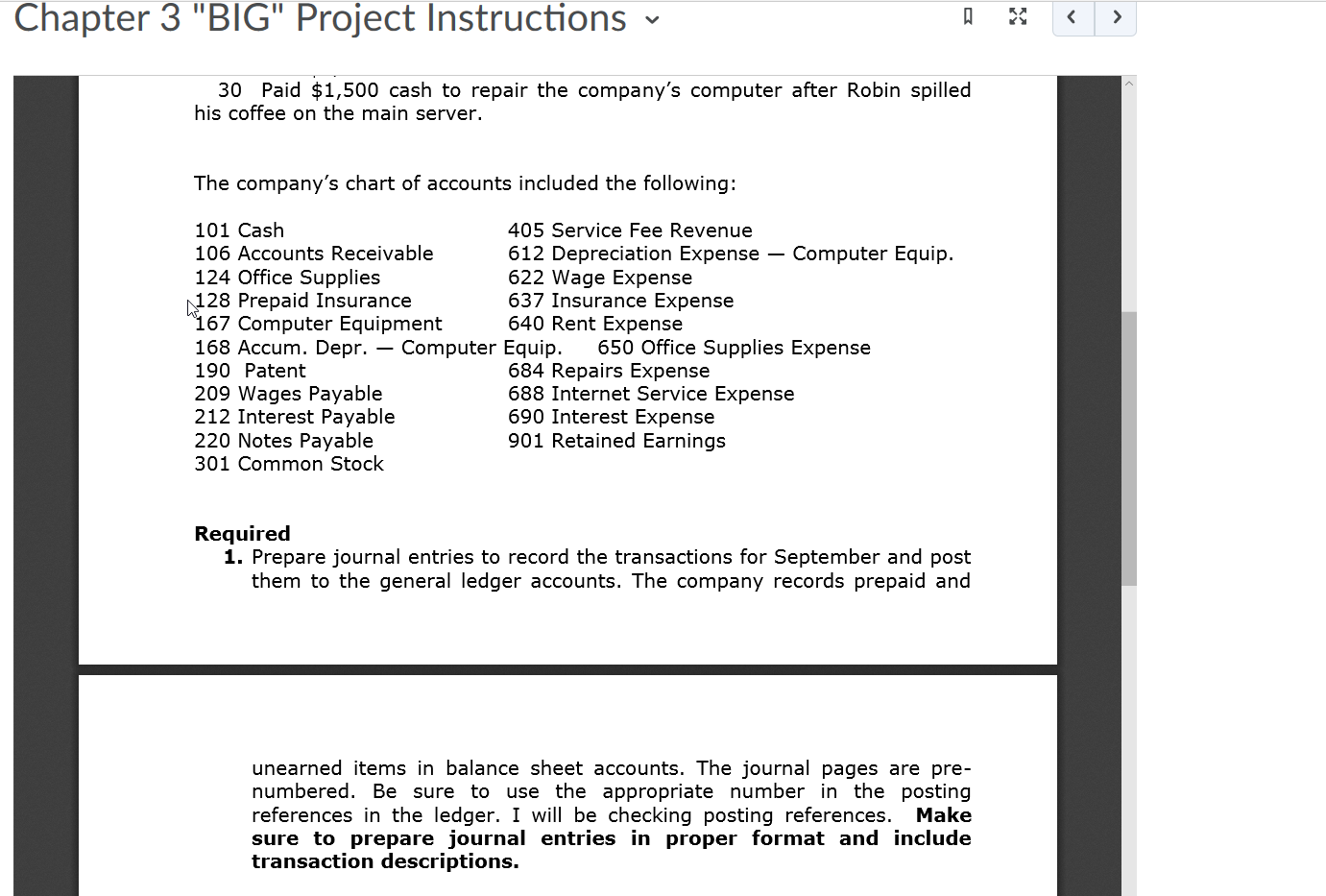

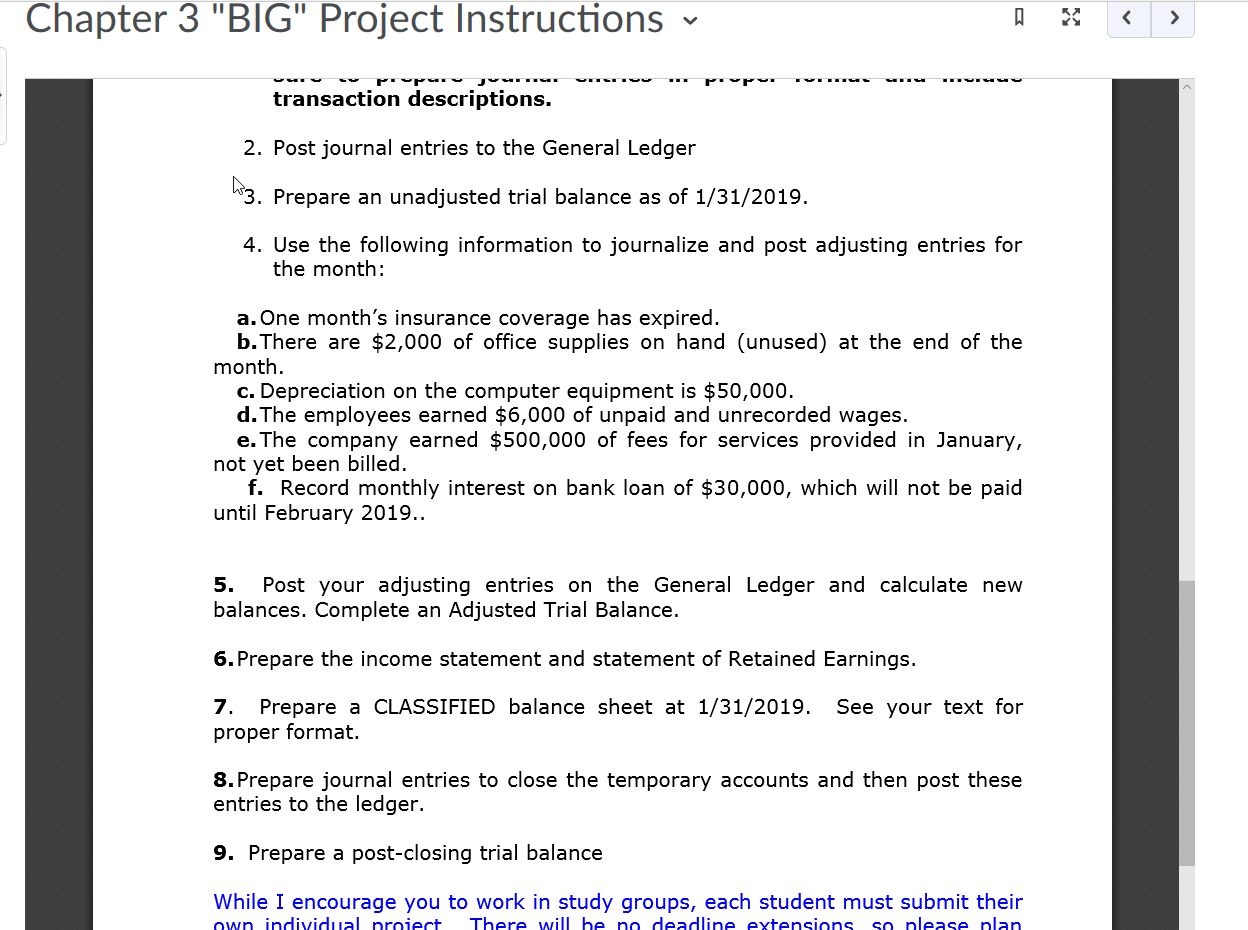

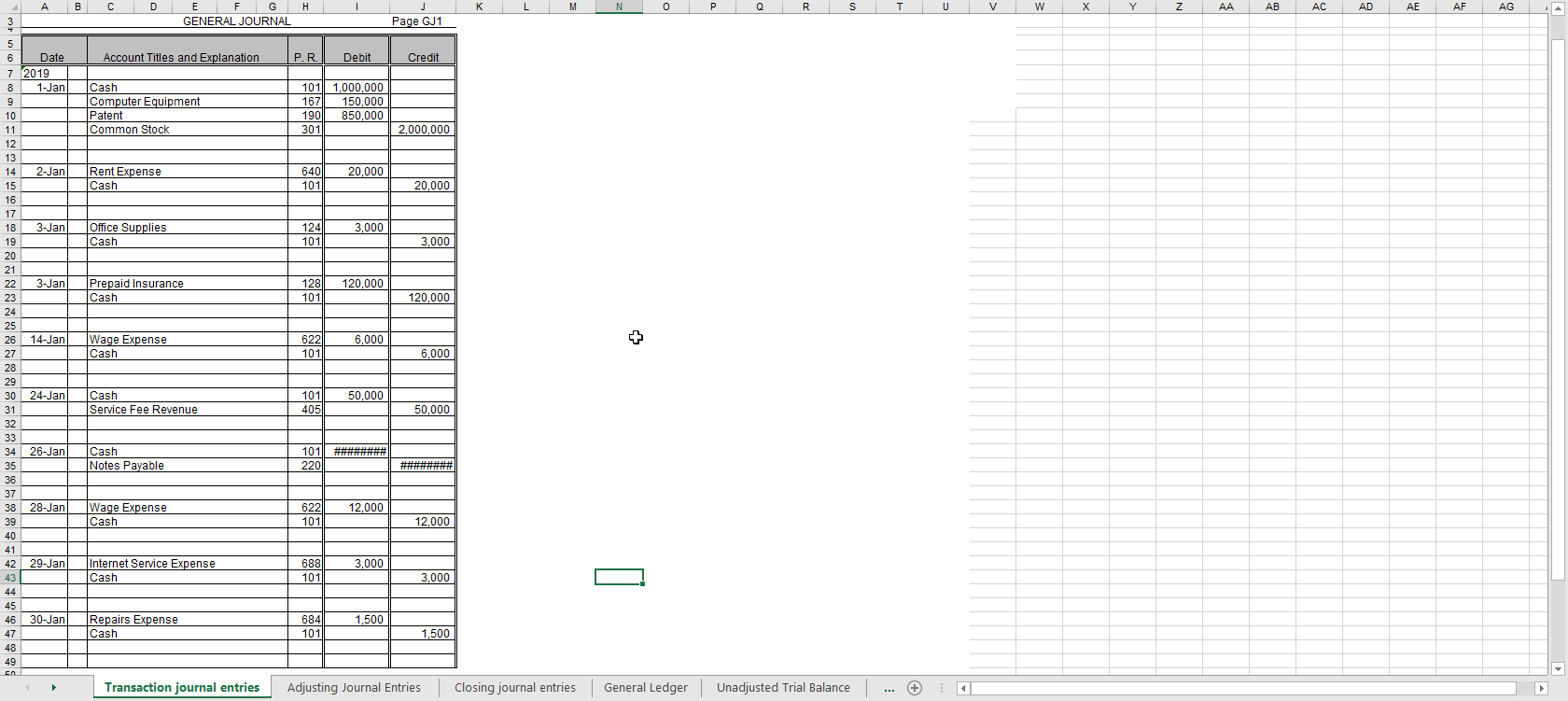

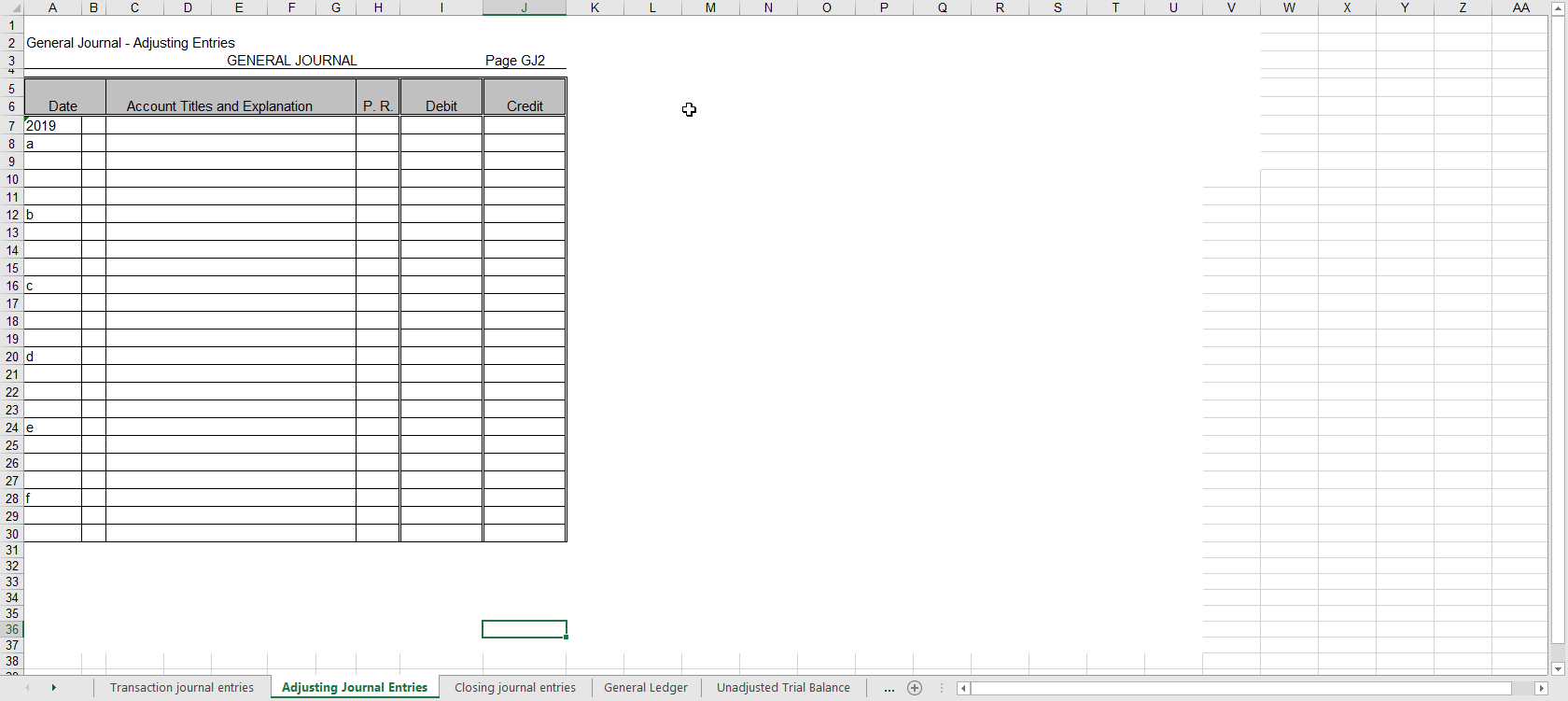

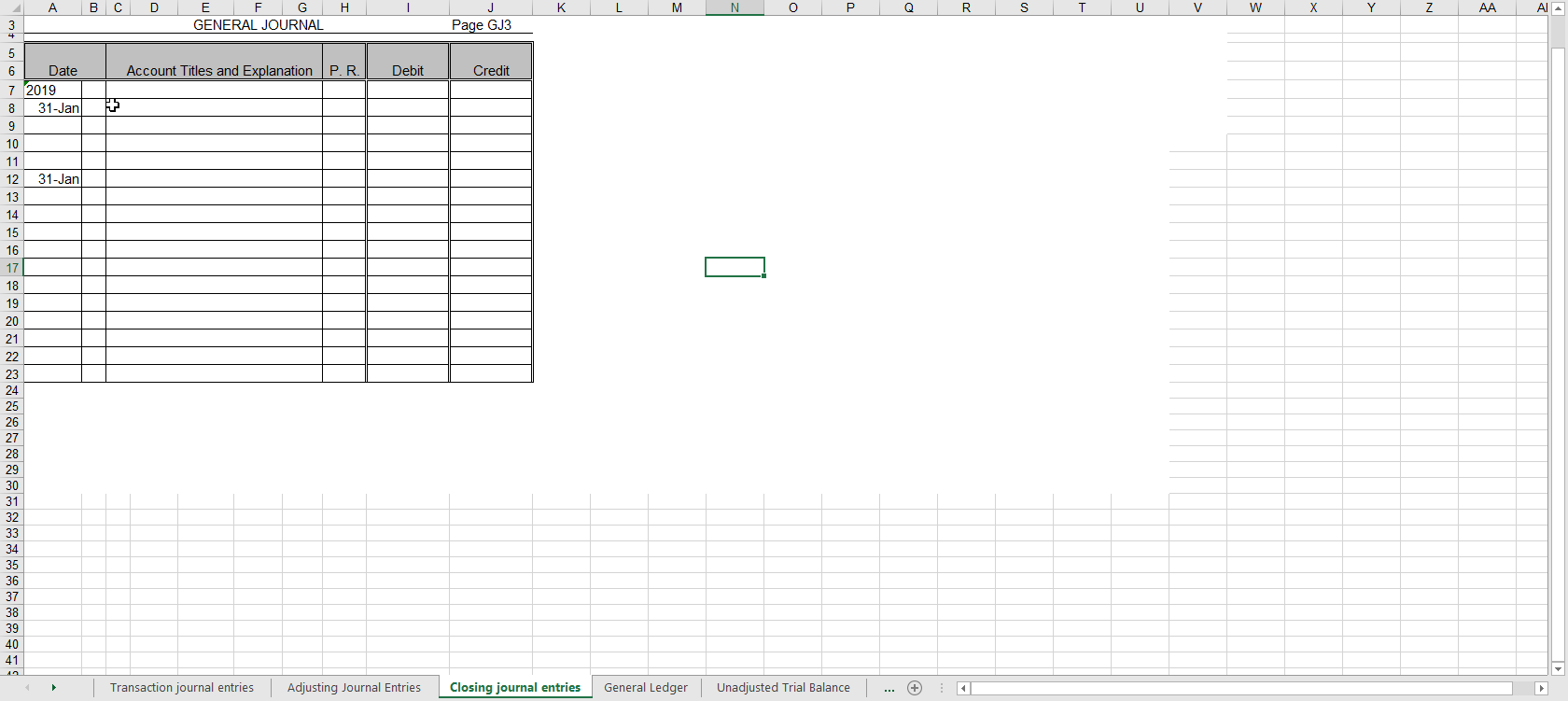

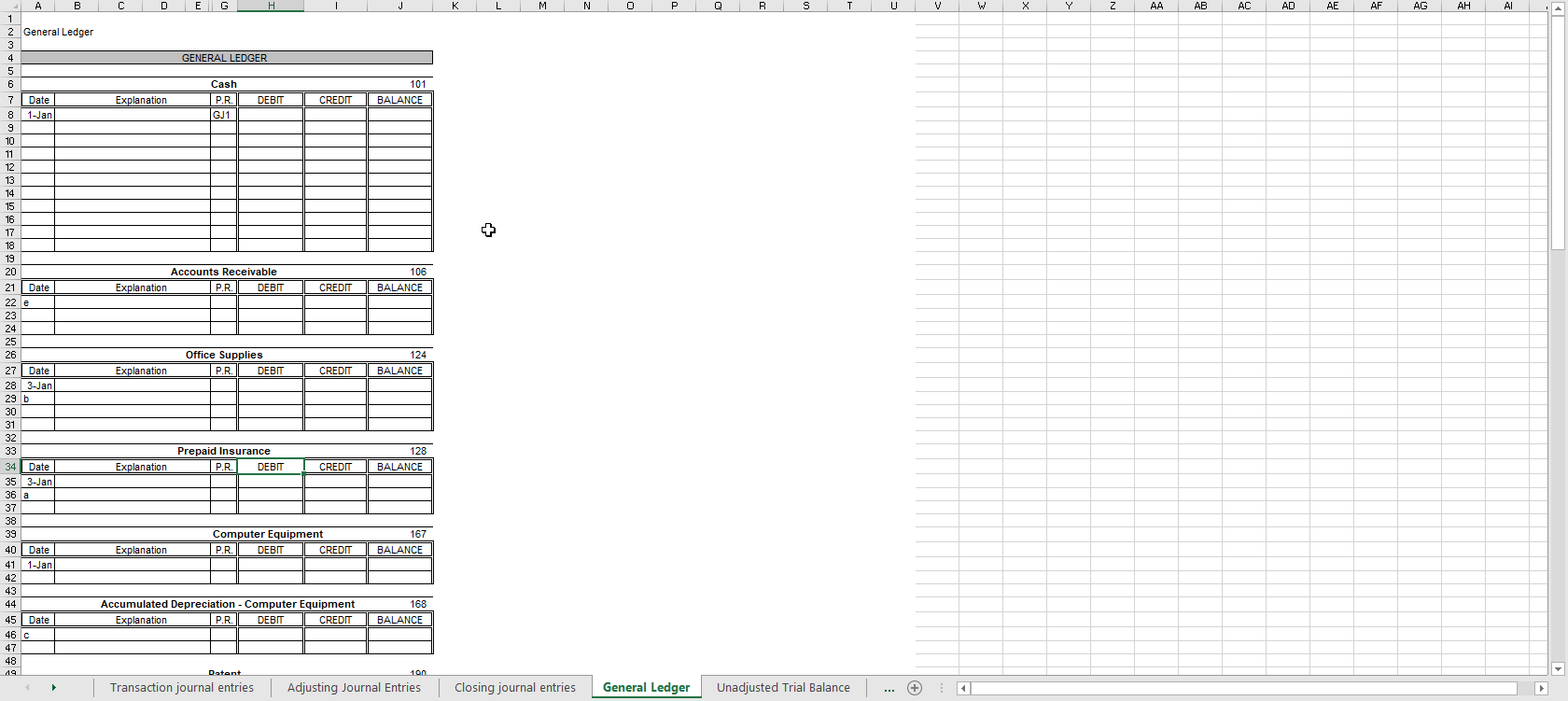

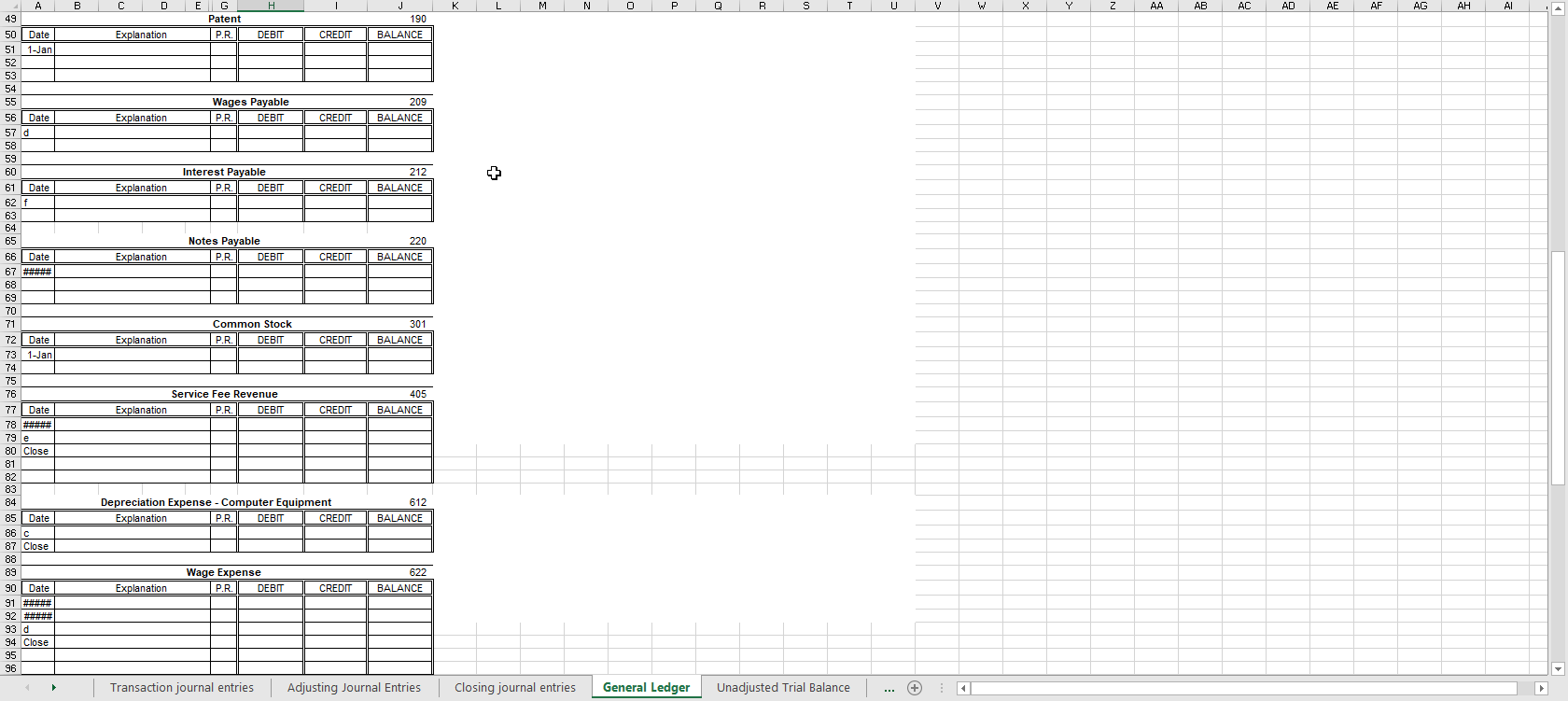

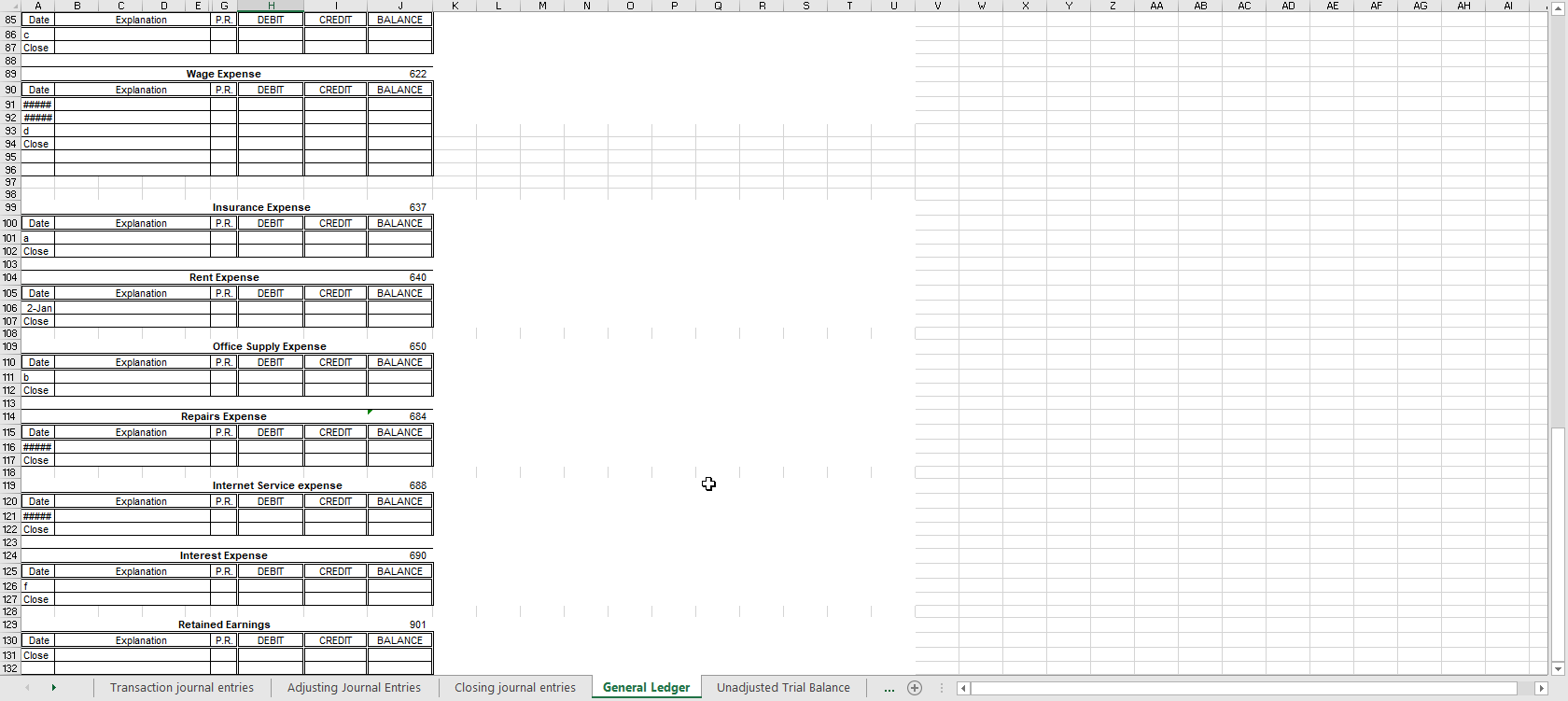

Chapter 3 "BIG" Project Instructions INSTRUCTI ONS AND TRANSACTI ONS FOR THE CHAPTER 3 "BIG" PROJECT WORTH 100 POINTS NOTE: YOU MUST USE THE PROJECT WORKPAPERS (EXCEL FILE) PROVI DED IN D2L CONTENT / CHAPTER 3 FOLDER. NO OTHER FILES WILL BE ACCEPTED. On January 1, 2019, Bruce Wayne created a new Crime Watch agency called Batman's Watchdog Service. The following transactions occurred during the company's first month of operations: Jan 1 To get the business started, Wayne invested $1,000,000 cash, computer equipment worth $150,000, and a patent on new technology worth $850,000 in exchange for Common Stock 2 Rented subteranian office space (Bat cave) by paying $20,000 cash for the first month's rent 3 Purchased $3,000 of office supplies for cash. 3 Paid $120,000 cash for a one-year insurance policy. Coverage began immediately. 14 Paid $6,000 cash for wages to one employee (Robin) 24 Collected $50,000 cash for services provided to customers in January. Wayne took out a bank loan for $10,000,000 with a term of 5 years. 26 28 Paid another $12,000 cash for wages to Robin and new employee, Bat Girl. 29 Paid $3,000 for internest service in cash. 30 Paid $1,500 cash to repair the company's computer after Robin spilled his coffee on the main server. The company's chart of accounts included the following: Chapter 3 "BIG" Project Instructions 30 Paid $1,500 cash to repair the company's computer after Robin spilled his coffee on the main server. The company's chart of accounts included the following: 101 Cash 106 Accounts Receivable 405 Service Fee Revenue 612 Depreciation Expense 622 Wage Expense 637 Insurance Expense 640 Rent Expense Computer Equip. 124 Office Supplies 128 Prepaid Insurance 167 Computer Equipment 168 Accum. Depr. 190 Patent 650 Office Supplies Expense Computer Equip. 684 Repairs Expense 688 Internet Service Expense 690 Interest Expense 901 Retained Earnings 209 Wages Payable 212 Interest Payable 220 Notes Payable 301 Common Stock Required 1. Prepare journal entries to record the transactions for September and post them to the general ledger accounts. The company records prepaid and unearned items in balance sheet accounts. The journal pages are pre- numbered. Be sure to use the appropriate number in the posting references in the ledger. I will be checking posting references. sure to prepare journal entries in proper format and include transaction descriptions. Make Chapter 3 "BIG" Project Instructions transaction descriptions. 2. Post journal entries to the General Ledger 3. Prepare an unadjusted trial balance as of 1/31/2019. 4. Use the following information to journalize and post adjusting entries for the month: a. One month's insurance coverage has expired. b. There are $2,000 of office supplies on hand (unused) at the end of the month. c. Depreciation on the computer equipment is $50,000. d. The employees earned $6,000 of unpaid and unrecorded wages. e. The company earned $500,000 of fees for services provided in January, not yet been billed. f. Record monthly interest on bank loan of $30,000, which will not be paid until February 2019.. Post your adjusting entries on the General Ledger and calculate new balances. Complete an Adjusted Trial Balance. 5. 6. Prepare the income statement and statement of Retained Earnings. 7. Prepare a CLASSIFIED balance sheet at 1/31/2019. proper format. See your text for 8. Prepare journal entries to close the temporary accounts and then post these entries to the ledger. 9. Prepare a post-closing trial balance While I encourage you to work in study groups, each student must submit their There wilL be no deadline extensions so please plan own individual proiect AA AB AC AD AE AF AG GENERAL JOURNAL Page GJ1 3 P. R. Account Titles and Explanation Date Debit Credit 7 2019 101 1,000,000 167 150,000 Cash Computer Equipment Patent 1-Jan 190 850,000 10 Common Stock 301 2,000,000 11 12 13 Rent Expense Cash 2-Jan 640 20,000 14 101 20,000 15 16 17 Office Supplies 3-Jan 124 3,000 18 Cash 101 3,000 19 20 21 Prepaid Insurance 120,000 3-Jan 128 22 120,000 Cash 101 23 24 25 Wage Expense 14-Jan 622 6,000 26 Cash 101 6,000 27 28 29 30 24-Jan Cash 101 50,000 405 Service Fee Revenue 50,000 31 32 33 101 ######## 26-Jan Cash Notes Payable 34 220 ######## 35 36 37 38 28-Jan Wage Expense 622 12,000 Cash 101 12,000 39 40 41 Internet Service Expense 29-Jan 688 3,000 42 Cash 101 3,000 43 44 45 Repairs Expense 46 30-Jan 47 684 1,500 Cash 101 1,500 48 49 Adjusting Journal Entries Transaction journal entries Closing journal entries General Ledger Unadjusted Trial Balance D K R AA 2 General Journal - Adjusting Entries GENERAL JOURNAL Page GJ2 P. R. Account Titles and Explanation Debit Credit Date 7 2019 8 a 10 11 12 b 13 14 15 16 c 17 18 19 20 d 21 22 23 24 e 25 26 27 28 f 29 30 31 32 33 34 35 36 37 38 Unadjusted Trial Balance Adjusting Journal Entries Transaction journal entries Closing journal entries General Ledger +) N Al A G J K R AA GENERAL JOURNAL Page GJ3 5 Account Titles and Explanation P. R. Date Debit Credit 6 7 2019 31-Jan 10 11 31-Jan 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 General Ledger Adjusting Journal Entries Closing journal entries Transaction journal entries Unadjusted Trial Balance AA AB R. AC AD AE AF AG AH Al 2 General Ledger 4 GENERAL LEDGER 6. Cash 101 DEBIT Date Explanation P.R. CREDIT BALANCE 1-Jan GJ1 10 11 12 13 14 15 16 17 18 19 20 Accounts Receivable 106 DEBIT CREDIT 21 Date Explanation P.R. BALANCE 22 e 23 24 25 Office Supplies 26 124 27 Date Explanation P.R. DEBIT CREDIT BALANCE 28 3-Jan 29 b 30 31 32 33 Prepaid Insurance 128 34 Date 35 3-Jan BALANCE Explanation P.R. DEBIT CREDIT 36 a 37 38 39 Computer Equipment 167 40 Date Explanation P.R. DEBIT CREDIT BALANCE 41 1-Jan 42 43 Accumulated Depreciation - Computer Equipment 44 168 45 Date Explanation P.R. DEBIT CREDIT BALANCE 46 c 47 48 19 Datent General Ledger Transaction journal entries Adjusting Journal Entries Closing journal entries Unadjusted Trial Balance +. A A B C DEG AA AB R. AC AD AE AF AG AH Al 49 Patent 190 CREDIT 50 Date Explanation P.R. DEBIT BALANCE 51 1-Jan 52 53 54 209 55 Wages Payable CREDIT 56 Date Explanation P.R. DEBIT BALANCE 57 d 58 59 Interest Payable 60 212 Date 62 f DEBIT 61 Explanation P.R. CREDIT BALANCE 63 64 Notes Payable 65 220 66 Date Explanation P.R. DEBIT CREDIT BALANCE 67 ####2# 68 69 70 71 Common Stock 301 Date 72 Explanation P.R. DEBIT CREDIT BALANCE 73 1-Jan 74 75 Service Fee Revenue 76 405 77 | Date BALANCE Explanation P.R. DEBIT CREDIT 79 le 80 Close 81 82 83 84 Depreciation Expense - Computer Equipment 612 85 Date Explanation P.R. DEBIT CREDIT BALANCE 86 c 87 Close 88 89 Wage Expense 622 90 Date Explanation P.R. DEBIT CREDIT BALANCE 91 ##### 92 ####2# 93 d 94 Close 95 96 General Ledger Transaction journal entries Adjusting Journal Entries Closing journal entries Unadjusted Trial Balance +. K R. AA AB AC AD AE AF AG AH Al P.R. CREDIT 85 Date Explanation DEBIT BALANCE 87 Close 88 89 Wage Expense 622 90 | Date Explanation P.R. DEBIT CREDIT BALANCE 91 ##### 92 ## 93 d 94 Close 95 96 97 98 99 Insurance Expense 637 CREDIT 100 Date Explanation P.R. DEBIT BALANCE 101 a 102 Close 103 Rent Expense 104 640 105 Date 106 2-Jan Explanation P.R. DEBIT CREDIT BALANCE 107 Close 108 109 Office Supply Expense 650 CREDIT 110 Date Explanation P.R. DEBIT BALANCE 111 b 112 Close 113 Repairs Expense 114 684 Explanation BALANCE 115 Date P.R DEBIT CREDIT 116 ##### 117 Close ******** 118 Internet Service expense 119 688 120| Date Explanation P.R. DEBIT CREDIT BALANCE 121 ##### 122 Close 123 Interest Expense 124 690 CREDIT BALANCE 125 Date Explanation P.R. DEBIT 126 f 127 Close 128 Retained Earnings 129 901 Explanation 130 Date P.R. DEBIT CREDIT BALANCE 131 Close 132 Closing journal entries General Ledger Unadjusted Trial Balance Transaction journal entries Adjusting Journal Entries ... A. K M 1 3 Batman's Watchdog Service 4 Unadjusted Trial Balance As of 1/30/19 Debit Credit 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 General Ledger Adjusting Journal Entries Unadjusted Trial Balance Transaction journal entries Closing journal entries A G K P 1 2 Post Closing Trial Balance 3 Batman's Watchdog Service Post-Closing Trial Balance 4 As of 1/31/19 Debit Credit 8 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Adjusted Trial Balance Unadjusted Trial Balance Income Statement Post Closing TB Ret earnings & Balance Sheet