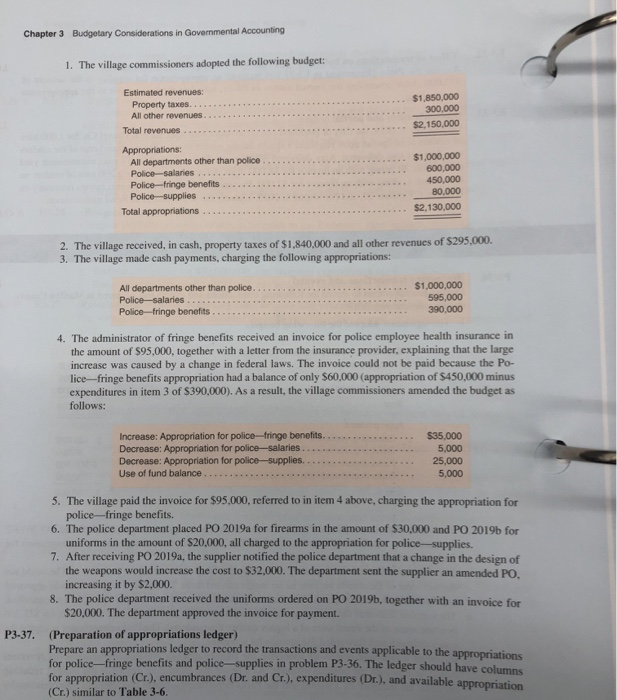

Chapter 3 Budgetary Considerations in Governmental Accounting 1. The village commissioners adopted the following budget: Estimated revenues: Property taxes... All other revenues. Total revenues $1,850.000 300,000 $2,150,000 Appropriations: All departments other than police Police salaries Police-fringe benefits Police-supplies Total appropriations $1,000,000 600,000 450,000 80.000 $2,130.000 2. The village received, in cash, property taxes of $1,840,000 and all other revenues of $295,000. 3. The village made cash payments, charging the following appropriations: All departments other than police. $1,000,000 Police-salaries 595,000 Police-fringe benefits 390,000 4. The administrator of fringe benefits received an invoice for police employee health insurance in the amount of $95,000, together with a letter from the insurance provider, explaining that the large increase was caused by a change in federal laws. The invoice could not be paid because the Po- lice--fringe benefits appropriation had a balance of only $60,000 (appropriation of $450,000 minus expenditures in item 3 of $390,000). As a result, the village commissioners amended the budget as follows: Increase: Appropriation for police-fringe benefits.. Decrease: Appropriation for police-salaries Decrease: Appropriation for police-supplies. Use of fund balance... $35.000 5,000 25,000 5,000 5. The village paid the invoice for $95,000, referred to in item 4 above, charging the appropriation for police-fringe benefits. 6. The police department placed PO 2019a for firearms in the amount of $30,000 and PO 2019 for uniforms in the amount of $20,000, all charged to the appropriation for police-supplies. 7. After receiving PO 2019a, the supplier notified the police department that a change in the design of the weapons would increase the cost to $32,000. The department sent the supplier an amended PO, increasing it by $2,000 8. The police department received the uniforms ordered on PO 2019b, together with an invoice for $20,000. The department approved the invoice for payment. P3-37. (Preparation of appropriations ledger) Prepare an appropriations ledger to record the transactions and events applicable to the appropriations for police--fringe benefits and police-supplies in problem P3-36. The ledger should have columns for appropriation (Cr.), encumbrances (Dr. and Cr.), expenditures (Dr.), and available appropriation (Cr.) similar to Table 3-6. Chapter 3 Budgetary Considerations in Governmental Accounting 1. The village commissioners adopted the following budget: Estimated revenues: Property taxes... All other revenues. Total revenues $1,850.000 300,000 $2,150,000 Appropriations: All departments other than police Police salaries Police-fringe benefits Police-supplies Total appropriations $1,000,000 600,000 450,000 80.000 $2,130.000 2. The village received, in cash, property taxes of $1,840,000 and all other revenues of $295,000. 3. The village made cash payments, charging the following appropriations: All departments other than police. $1,000,000 Police-salaries 595,000 Police-fringe benefits 390,000 4. The administrator of fringe benefits received an invoice for police employee health insurance in the amount of $95,000, together with a letter from the insurance provider, explaining that the large increase was caused by a change in federal laws. The invoice could not be paid because the Po- lice--fringe benefits appropriation had a balance of only $60,000 (appropriation of $450,000 minus expenditures in item 3 of $390,000). As a result, the village commissioners amended the budget as follows: Increase: Appropriation for police-fringe benefits.. Decrease: Appropriation for police-salaries Decrease: Appropriation for police-supplies. Use of fund balance... $35.000 5,000 25,000 5,000 5. The village paid the invoice for $95,000, referred to in item 4 above, charging the appropriation for police-fringe benefits. 6. The police department placed PO 2019a for firearms in the amount of $30,000 and PO 2019 for uniforms in the amount of $20,000, all charged to the appropriation for police-supplies. 7. After receiving PO 2019a, the supplier notified the police department that a change in the design of the weapons would increase the cost to $32,000. The department sent the supplier an amended PO, increasing it by $2,000 8. The police department received the uniforms ordered on PO 2019b, together with an invoice for $20,000. The department approved the invoice for payment. P3-37. (Preparation of appropriations ledger) Prepare an appropriations ledger to record the transactions and events applicable to the appropriations for police--fringe benefits and police-supplies in problem P3-36. The ledger should have columns for appropriation (Cr.), encumbrances (Dr. and Cr.), expenditures (Dr.), and available appropriation (Cr.) similar to Table 3-6