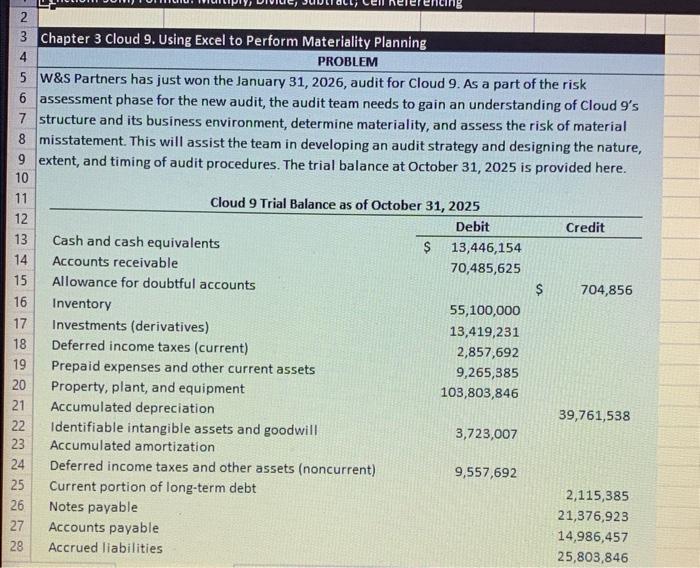

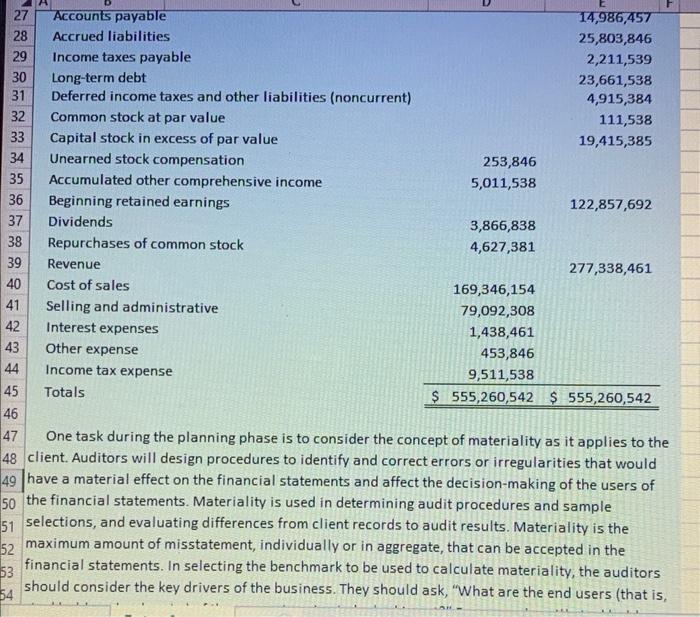

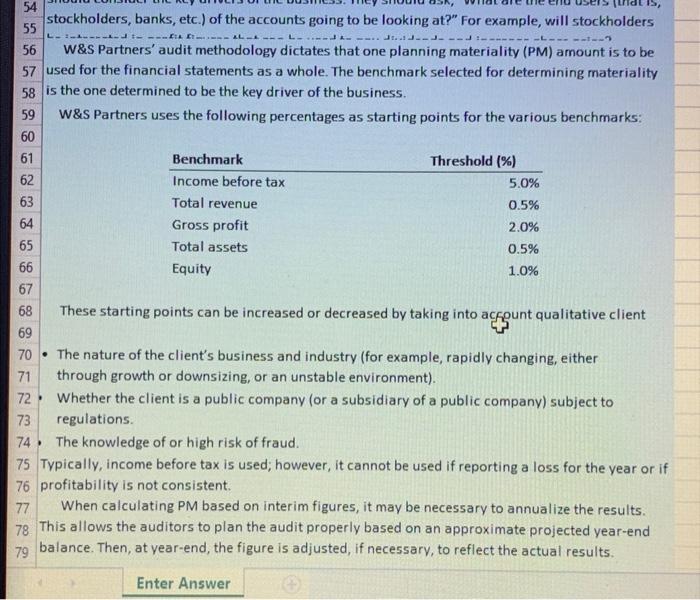

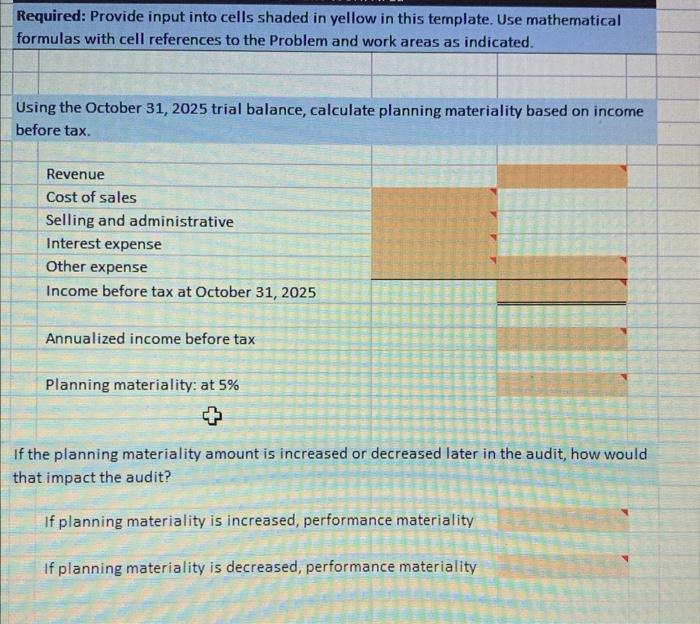

Chapter 3 Cloud 9. Using Excel to Perform Materiality Planning 4 PROBLEM W\&S Partners has just won the January 31, 2026, audit for Cloud 9. As a part of the risk assessment phase for the new audit, the audit team needs to gain an understanding of Cloud 9 's structure and its business environment, determine materiality, and assess the risk of material misstatement. This will assist the team in developing an audit strategy and designing the nature, extent, and timing of audit procedures. The trial balance at October 31,2025 is provided here. Cloud 9 Trial Balance as of October 31, 2025 Cash and cash equivalents Accounts receivable Allowance for doubtful accounts \begin{tabular}{ccc} & Debit & Credit \\ \hline$ & 13,446,154 & \end{tabular} Inventory Investments (derivatives) Deferred income taxes (current) Prepaid expenses and other current assets Property, plant, and equipment Accumulated depreciation Identifiable intangible assets and goodwill 70,485,625 Accumulated amortization Deferred income taxes and other assets (noncurrent) Current portion of long-term debt Notes payable Accounts payable Accrued liabilities 9,557,692 39,761,538 3,723,007 704,856 One task during the planning phase is to consider the concept of materiality as it applies to the client. Auditors will design procedures to identify and correct errors or irregularities that would have a material effect on the financial statements and affect the decision-making of the users of the financial statements. Materiality is used in determining audit procedures and sample selections, and evaluating differences from client records to audit results. Materiality is the maximum amount of misstatement, individually or in aggregate, that can be accepted in the financial statements. In selecting the benchmark to be used to calculate materiality, the auditors should consider the key drivers of the business. They should ask, "What are the end users (that is, stockholders, banks, etc.) of the accounts going to be looking at?" For example, will stockholders W\&S Partners' audit methodology dictates that one planning materiality (PM) amount is to be used for the financial statements as a whole. The benchmark selected for determining materiality is the one determined to be the key driver of the business. W\&S Partners uses the following percentages as starting points for the various benchmarks: These starting points can be increased or decreased by taking into acfount qualitative client - The nature of the client's business and industry (for example, rapidly changing, either through growth or downsizing, or an unstable environment). - Whether the client is a public company (or a subsidiary of a public company) subject to regulations. The knowledge of or high risk of fraud. Typically, income before tax is used; however, it cannot be used if reporting a loss for the year or if profitability is not consistent. When calculating PM based on interim figures, it may be necessary to annualize the results. This allows the auditors to plan the audit properly based on an approximate projected year-end balance. Then, at year-end, the figure is adjusted, if necessary, to reflect the actual results. If planning materiality is increased, performance materiality If planning materiality is decreased, performance materiality