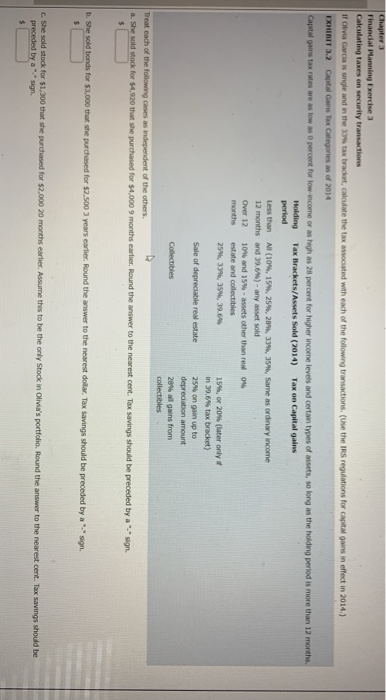

Chapter 3 Financial Planning Exercise 4 Effect of tax credit vs, tax exemption By defining after-tax income, demonstrate the differences resulting from a $2,000 tax credit versus a $2,000 tax deduction for a single taxpayer in the 25% tax bracket with $38,000 of pre-tax income Round your answers to two decimal places. (Use Exhibit 3.3.) Deductions Credit $ Chapter 3 Financial Planning Exercise 3 Calculating taxes on security transactions If Olivia Garcia is single and in the tax bracket calculate the tax associated with each of the following transactions. Use the IRS regulations for capital gains in effect in 2014.) EXHIBIT 3.2 Capital Gains Tax Categories as of 2014 Capital gains tax rates we as low aso percent for low-income or as high as 28 percent for higher income levels and certain types of assets, so long as the holding period is more than 12 months Holding Tax Brackets/Assets sold (2014) Tax on Capital gains period Less than All (10%, 15%, 25%, 284, 334, 354, Same as ordinary income 12 months and 39.6%) - any asset sold Over 12 10% and 15%-assets other than real 04 months estate and collectibles 259, 334, 35, 39.6% 15%, or 20% (later only in 39.6% tax bracket) Sale of depreciable real estate 254 on gain up to depreciation amount Collectibles 28% all gains from collectibles Treat each of the following cases as independent of the others. a. She sold stock for $4.920 that she purchased for $4,000 9 months earlier. Round the answer to the nearest cent Tax savings should be preceded by a sign. $ b. She sold bonds for $3,000 that she purchased for $2,500 3 years earlier. Round the answer to the nearest dollar. Tax savings should be preceded by a "sign. c. She sold stock for $1,300 that she purchased for $2,000 20 months earlier. Assume this to be the only Stock in Olivia's portfolio. Round the answer to the nearest cent. Tax savings should be preceded by a "." sign. $ Chapter 3 Financial Planning Exercise 4 Effect of tax credit vs, tax exemption By defining after-tax income, demonstrate the differences resulting from a $2,000 tax credit versus a $2,000 tax deduction for a single taxpayer in the 25% tax bracket with $38,000 of pre-tax income Round your answers to two decimal places. (Use Exhibit 3.3.) Deductions Credit $ Chapter 3 Financial Planning Exercise 3 Calculating taxes on security transactions If Olivia Garcia is single and in the tax bracket calculate the tax associated with each of the following transactions. Use the IRS regulations for capital gains in effect in 2014.) EXHIBIT 3.2 Capital Gains Tax Categories as of 2014 Capital gains tax rates we as low aso percent for low-income or as high as 28 percent for higher income levels and certain types of assets, so long as the holding period is more than 12 months Holding Tax Brackets/Assets sold (2014) Tax on Capital gains period Less than All (10%, 15%, 25%, 284, 334, 354, Same as ordinary income 12 months and 39.6%) - any asset sold Over 12 10% and 15%-assets other than real 04 months estate and collectibles 259, 334, 35, 39.6% 15%, or 20% (later only in 39.6% tax bracket) Sale of depreciable real estate 254 on gain up to depreciation amount Collectibles 28% all gains from collectibles Treat each of the following cases as independent of the others. a. She sold stock for $4.920 that she purchased for $4,000 9 months earlier. Round the answer to the nearest cent Tax savings should be preceded by a sign. $ b. She sold bonds for $3,000 that she purchased for $2,500 3 years earlier. Round the answer to the nearest dollar. Tax savings should be preceded by a "sign. c. She sold stock for $1,300 that she purchased for $2,000 20 months earlier. Assume this to be the only Stock in Olivia's portfolio. Round the answer to the nearest cent. Tax savings should be preceded by a "." sign. $