Question

Chapter 3 - Handouts Each adjusting entry has either a debit to a account, or a credit to a ADDITIONAL ADJUSTING ENTRIES ONLY - PRACTICE

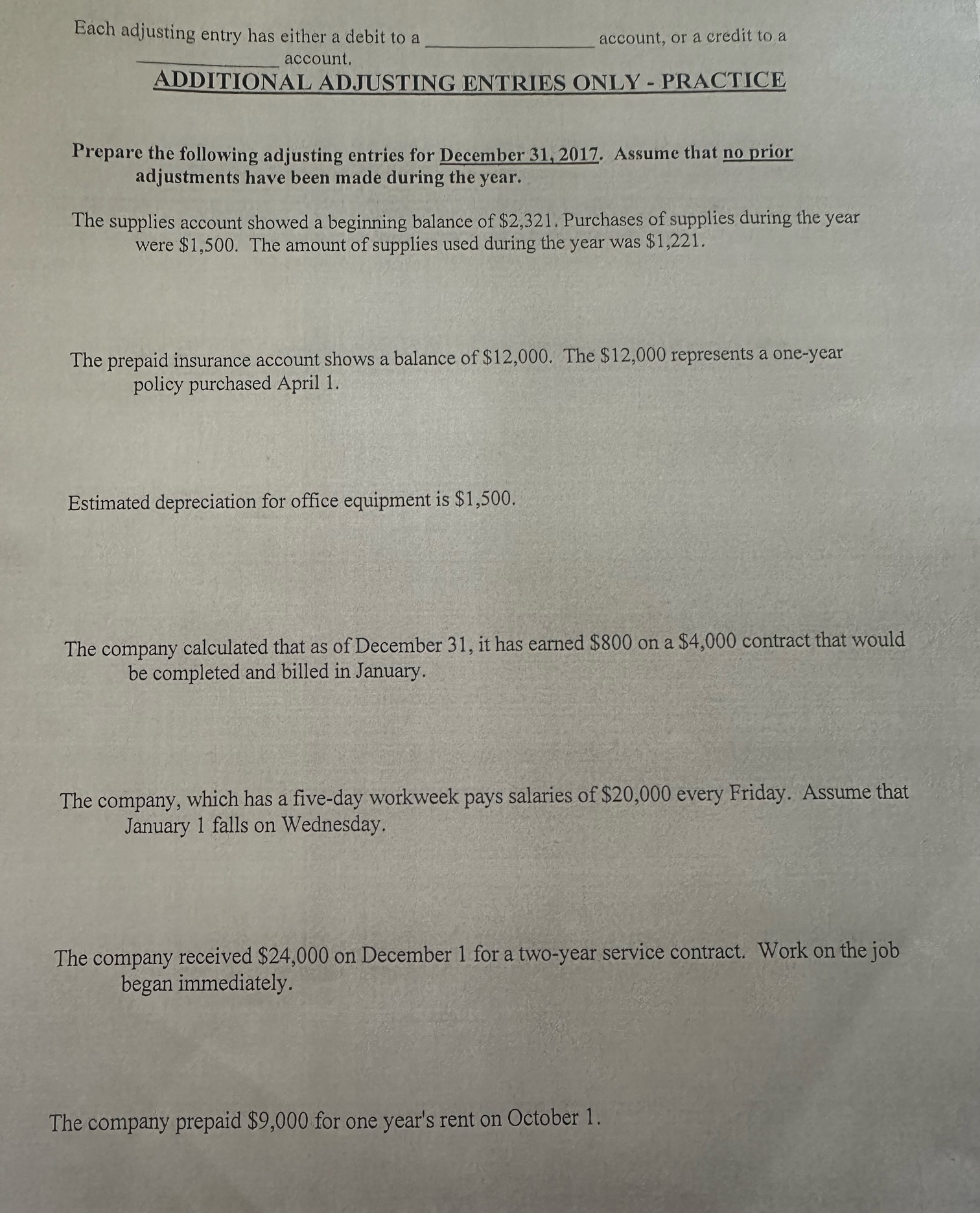

Chapter 3 - Handouts Each adjusting entry has either a debit to a account, or a credit to a ADDITIONAL ADJUSTING ENTRIES ONLY - PRACTICE Prepare the following adjusting entries for December 31,2017. Assume that no prior adjustments have been made during the year. The supplies account showed a beginning balance of $2,321. Purchases of supplies during the year were $1,500. The amount of supplies used during the year was $1,221. The prepaid insurance account shows a balance of $12,000. The $12,000 represents a one-year policy purchased April 1. Estimated depreciation for office equipment is $1,500. The company calculated that as of December 31 , it has earned $800 on a $4,000 contract that would be completed and billed in

Chapter 3 - Handouts Each adjusting entry has either a debit to a account, or a credit to a ADDITIONAL ADJUSTING ENTRIES ONLY - PRACTICE Prepare the following adjusting entries for December 31,2017. Assume that no prior adjustments have been made during the year. The supplies account showed a beginning balance of $2,321. Purchases of supplies during the year were $1,500. The amount of supplies used during the year was $1,221. The prepaid insurance account shows a balance of $12,000. The $12,000 represents a one-year policy purchased April 1. Estimated depreciation for office equipment is $1,500. The company calculated that as of December 31 , it has earned $800 on a $4,000 contract that would be completed and billed in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started