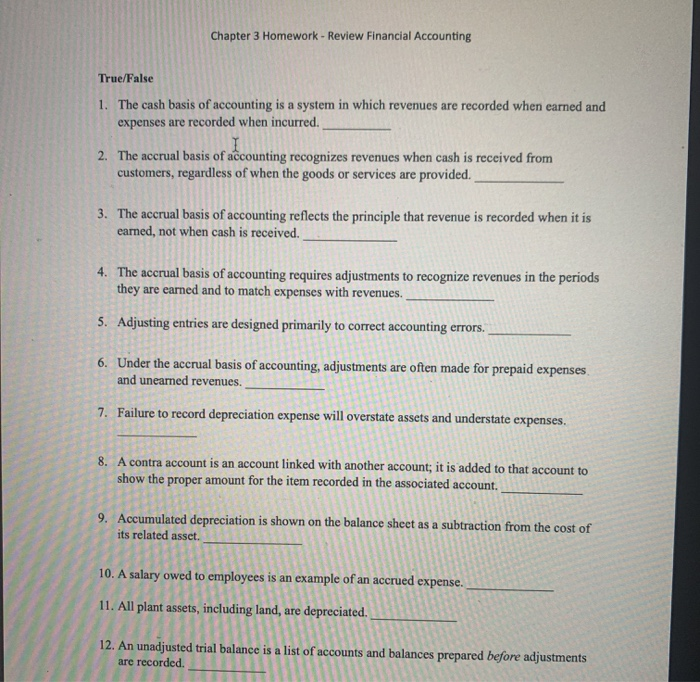

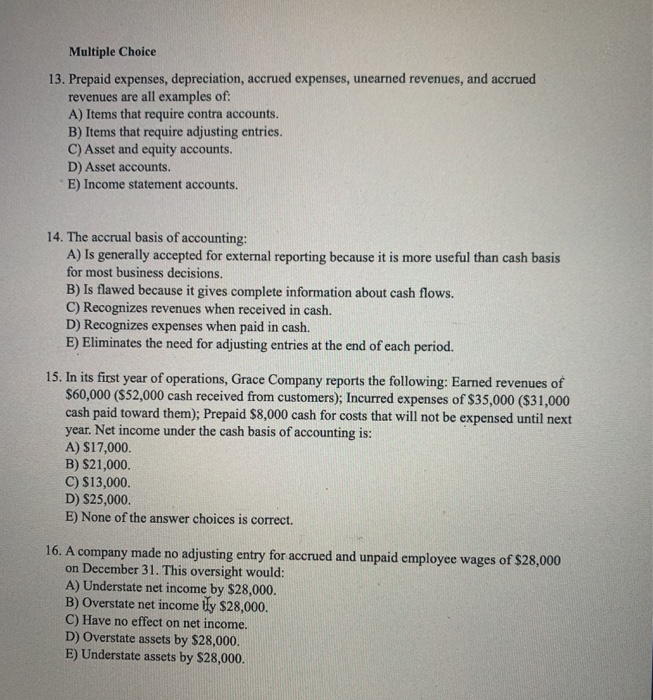

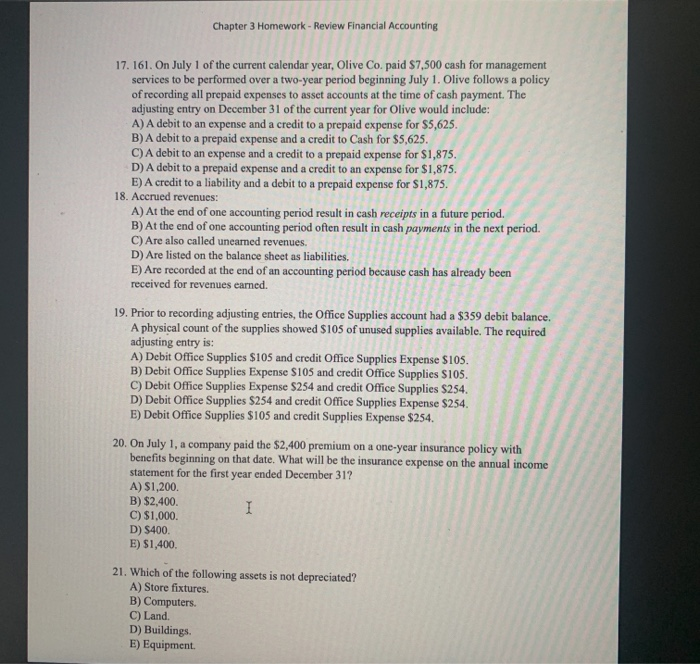

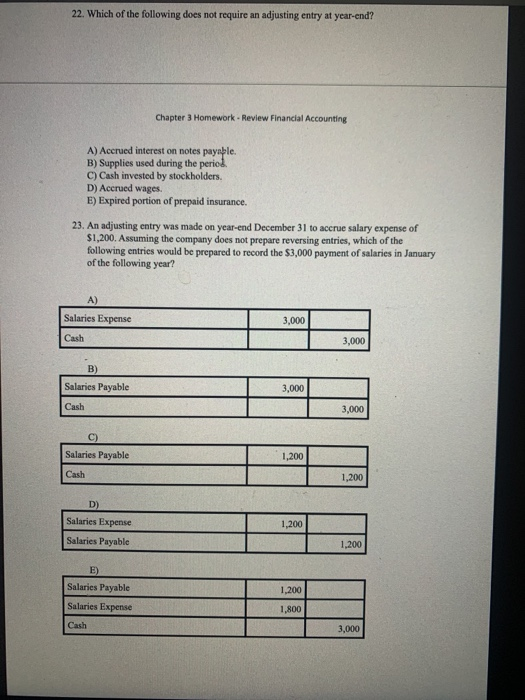

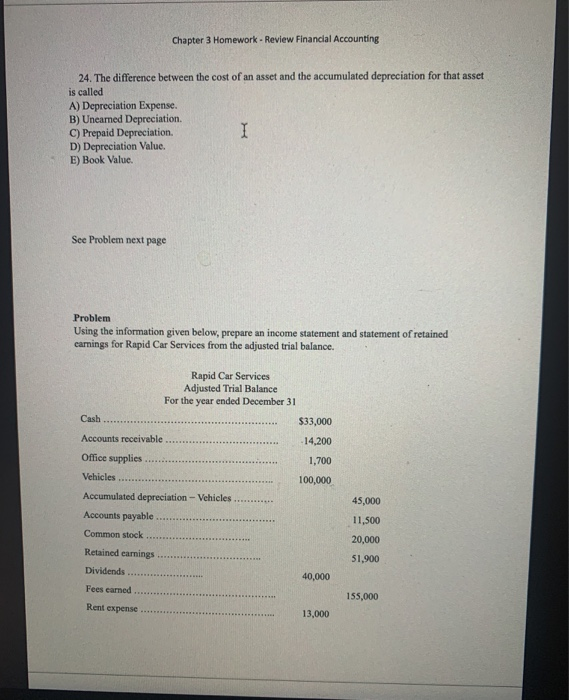

Chapter 3 Homework - Review Financial Accounting True/False 1. The cash basis of accounting is a system in which revenues are recorded when earned and expenses are recorded when incurred. 1 2. The accrual basis of accounting recognizes revenues when cash is received from customers, regardless of when the goods or services are provided. 3. The accrual basis of accounting reflects the principle that revenue is recorded when it is earned, not when cash is received. 4. The accrual basis of accounting requires adjustments to recognize revenues in the periods they are earned and to match expenses with revenues. 5. Adjusting entries are designed primarily to correct accounting errors. 6. Under the accrual basis of accounting, adjustments are often made for prepaid expenses and unearned revenues. 7. Failure to record depreciation expense will overstate assets and understate expenses. 8. A contra account is an account linked with another account; it is added to that account to show the proper amount for the item recorded in the associated account. 9. Accumulated depreciation is shown on the balance sheet as a subtraction from the cost of its related asset. 10. A salary owed to employees is an example of an accrued expense. 11. All plant assets, including land, are depreciated. 12. An unadjusted trial balance is a list of accounts and balances prepared before adjustments are recorded. Multiple Choice 13. Prepaid expenses, depreciation, accrued expenses, unearned revenues, and accrued revenues are all examples of: A) Items that require contra accounts. B) Items that require adjusting entries. C) Asset and equity accounts. D) Asset accounts. E) Income statement accounts. 14. The accrual basis of accounting: A) Is generally accepted for external reporting because it is more useful than cash basis for most business decisions. B) Is flawed because it gives complete information about cash flows. C) Recognizes revenues when received in cash. D) Recognizes expenses when paid in cash. E) Eliminates the need for adjusting entries at the end of each period. 15. In its first year of operations, Grace Company reports the following: Earned revenues of $60,000 (552,000 cash received from customers); Incurred expenses of $35,000 ($31,000 cash paid toward them); Prepaid $8,000 cash for costs that will not be expensed until next year. Net income under the cash basis of accounting is: A) $17,000 B) $21,000. C) $13,000. D) $25,000. E) None of the answer choices is correct. 16. A company made no adjusting entry for accrued and unpaid employee wages of $28,000 on December 31. This oversight would: A) Understate net income by $28,000. B) Overstate net income Iy $28,000. C) Have no effect on net income. D) Overstate assets by $28,000. E) Understate assets by $28,000. Chapter 3 Homework - Review Financial Accounting 17. 161. On July 1 of the current calendar year, Olive Co. paid $7,500 cash for management services to be performed over a two-year period beginning July 1. Olive follows a policy of recording all prepaid expenses to asset accounts at the time of cash payment. The adjusting entry on December 31 of the current year for Olive would include: A) A debit to an expense and a credit to a prepaid expense for $5,625. B) A debit to a prepaid expense and a credit to Cash for $5,625. C) A debit to an expense and a credit to a prepaid expense for $1,875. D) A debit to a prepaid expense and a credit to an expense for $1,875. E) A credit to a liability and a debit to a prepaid expense for $1,875. 18. Accrued revenues: A) At the end of one accounting period result in cash receipts in a future period. B) At the end of one accounting period often result in cash payments in the next period. C) Are also called unearned revenues. D) Are listed on the balance sheet as liabilities. E) Are recorded at the end of an accounting period because cash has already been received for revenues earned. 19. Prior to recording adjusting entries, the Office Supplies account had a $359 debit balance. A physical count of the supplies showed $105 of unused supplies available. The required adjusting entry is: A) Debit Office Supplies $105 and credit Office Supplies Expense $105. B) Debit Office Supplies Expense $105 and credit Office Supplies $105. C) Debit Office Supplies Expense S254 and credit Office Supplies $254. D) Debit Office Supplies $254 and credit Office Supplies Expense $254. E) Debit Office Supplies $105 and credit Supplies Expense $254. 20. On July 1, a company paid the $2,400 premium on a one-year insurance policy with benefits beginning on that date. What will be the insurance expense on the annual income statement for the first year ended December 31? A) $1,200. B) $2,400. I C) $1,000 D) $400. E) $1,400 21. Which of the following assets is not depreciated? A) Store fixtures. B) Computers C) Land D) Buildings E) Equipment 22. Which of the following does not require an adjusting entry at year-end? Chapter 3 Homework - Review Financial Accounting A) Accrued interest on notes payable. B) Supplies used during the period. C) Cash invested by stockholders. D) Accrued wages. E) Expired portion of prepaid insurance. 23. An adjusting entry was made on year-end December 31 to accrue salary expense of $1,200. Assuming the company does not prepare reversing entries, which of the following entries would be prepared to record the $3,000 payment of salaries in January of the following year? A) Salaries Expense 3,000 Cash 3,000 B) Salaries Payable 3,000 Cash 3,000 C) Salaries Payable 1,200 Cash 1,200 D) Salaries Expense Salaries Payable 1,200 1,200 E) Salaries Payable Salaries Expense 1,200 1,800 Cash 3,000 Chapter 3 Homework - Review Financial Accounting 24. The difference between the cost of an asset and the accumulated depreciation for that asset is called A) Depreciation Expense. B) Unearned Depreciation. C) Prepaid Depreciation. I D) Depreciation Value. E) Book Value See Problem next page Problem Using the information given below, prepare an income statement and statement of retained carnings for Rapid Car Services from the adjusted trial balance. Rapid Car Services Adjusted Trial Balance For the year ended December 31 Cash $33,000 -14,200 Accounts receivable Office supplies Vehicles Accumulated depreciation - Vehicles Accounts payable Common stock 1,700 100,000 45,000 11,500 20,000 51,900 Retained earnings Dividends 40,000 Fees earned 155,000 Rent expense 13,000 Do what you can please im on a trip and havent had time to do this