Question

Chapter 3 HW: 1 Pitman Company is a small editorial services company owned and operated by Jan Pitman. On October 31, 2019, the end of

Chapter 3 HW: 1

Pitman Company is a small editorial services company owned and operated by Jan Pitman. On October 31, 2019, the end of the current year, Pitman Company's accounting clerk prepared the following unadjusted trial balance:

| Pitman Company | ||||

| Unadjusted Trial Balance | ||||

| October 31, 2019 | ||||

| Debit Balances | Credit Balances | |||

| Cash | 4,700 | |||

| Accounts Receivable | 42,670 | |||

| Prepaid Insurance | 7,960 | |||

| Supplies | 2,170 | |||

| Land | 125,490 | |||

| Building | 306,370 | |||

| Accumulated DepreciationBuilding | 153,330 | |||

| Equipment | 150,800 | |||

| Accumulated DepreciationEquipment | 109,210 | |||

| Accounts Payable | 13,380 | |||

| Unearned Rent | 7,590 | |||

| Jan Pitman, Capital | 325,900 | |||

| Jan Pitman, Drawing | 16,630 | |||

| Fees Earned | 361,630 | |||

| Salaries and Wages Expense | 215,530 | |||

| Utilities Expense | 47,370 | |||

| Advertising Expense | 25,310 | |||

| Repairs Expense | 19,170 | |||

| Miscellaneous Expense | 6,870 | |||

| 971,040 | 971,040 | |||

The data needed to determine year-end adjustments are as follows:

- Unexpired insurance at October 31, $5,330.

- Supplies on hand at October 31, $650.

- Depreciation of building for the year, $3,530.

- Depreciation of equipment for the year, $3,060.

- Unearned rent at October 31, $1,970.

- Accrued salaries and wages at October 31, $3,450.

- Fees earned but unbilled on October 31, $20,250.

Required:

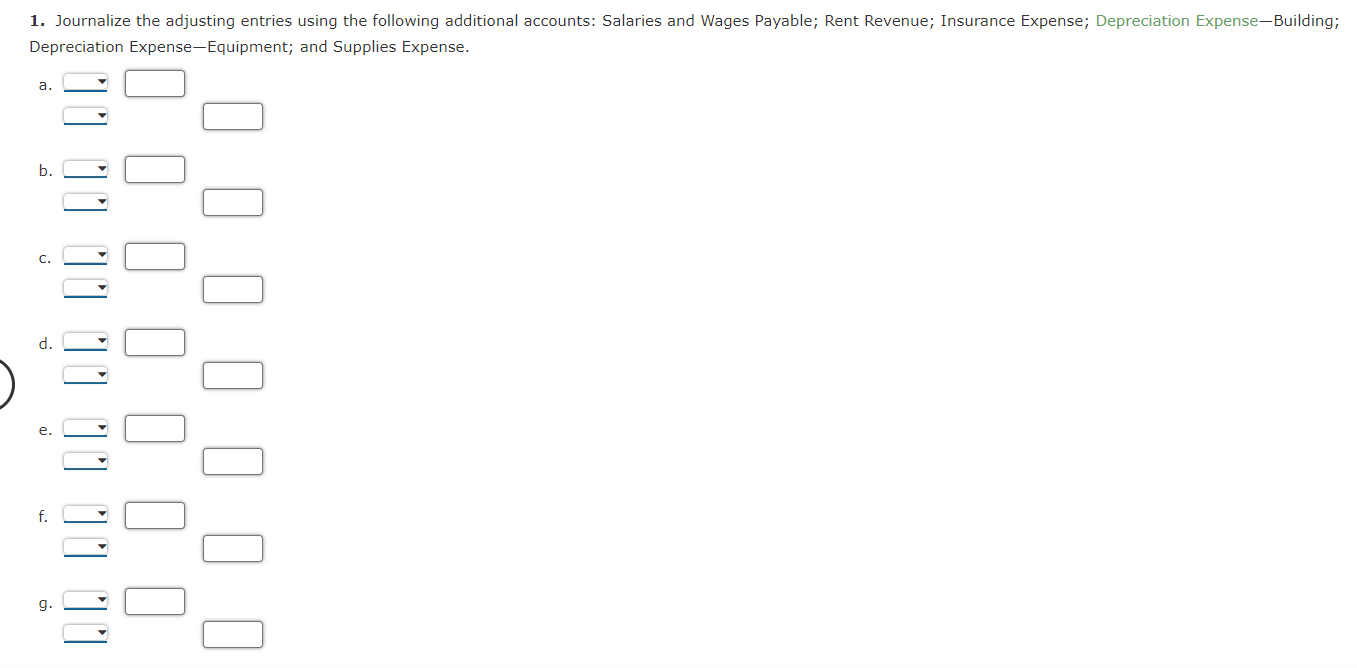

1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense.

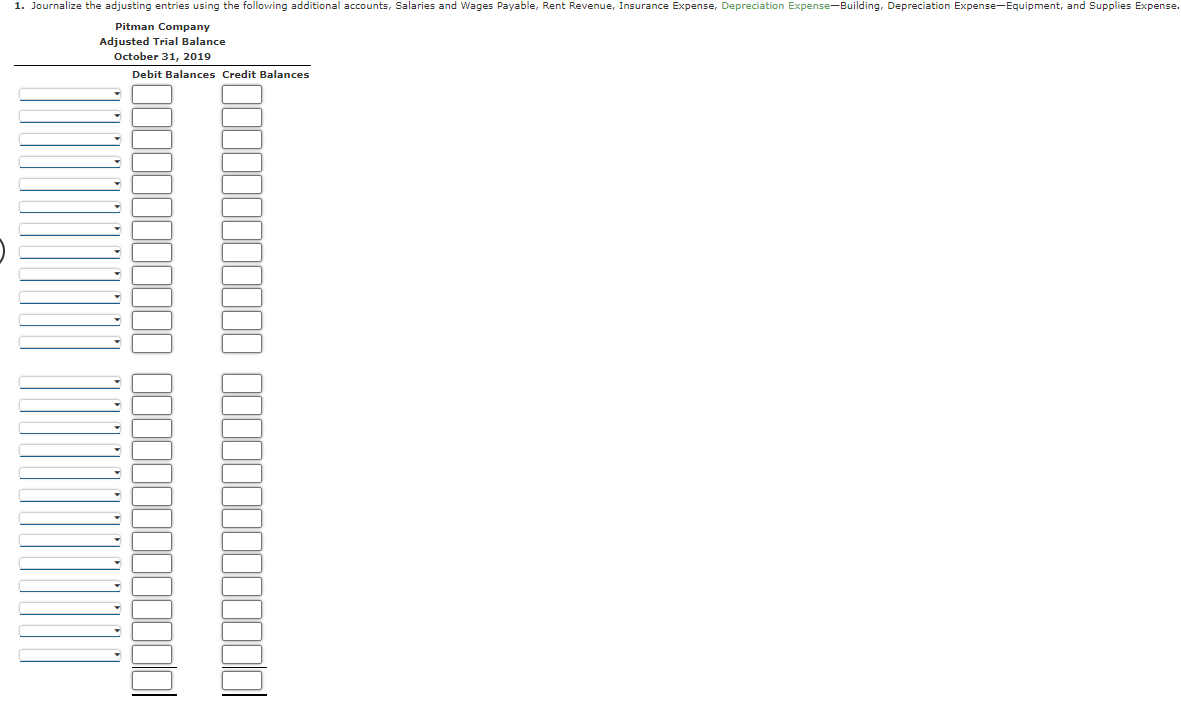

1. Journalize the adjusting entries using the following additional accounts, Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense.

1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense. a. b. ' || 1 | | | | | | | | | 0 0 0 0 0 0 0 | | | | | | | e. 9. 1. Journalize the adjusting entries using the following additional accounts, Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation Expense-Building, Depreciation Expense-Equipment, and Supplies Expense. Pitman Company Adjusted Trial Balance October 31, 2019 Debit Balances Credit Balances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started