Answered step by step

Verified Expert Solution

Question

1 Approved Answer

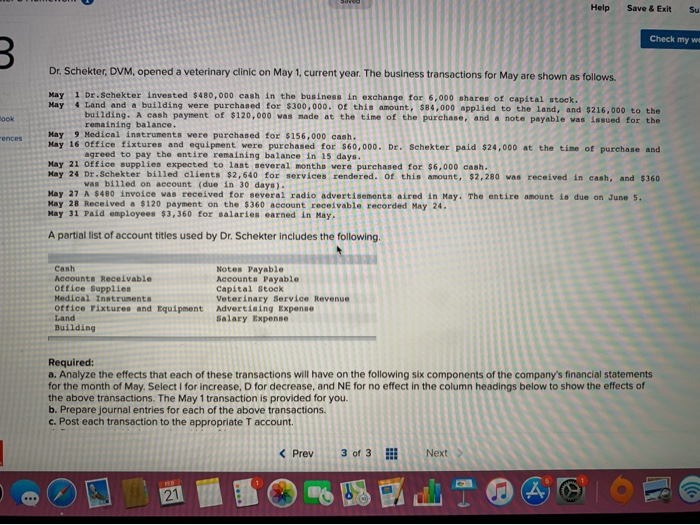

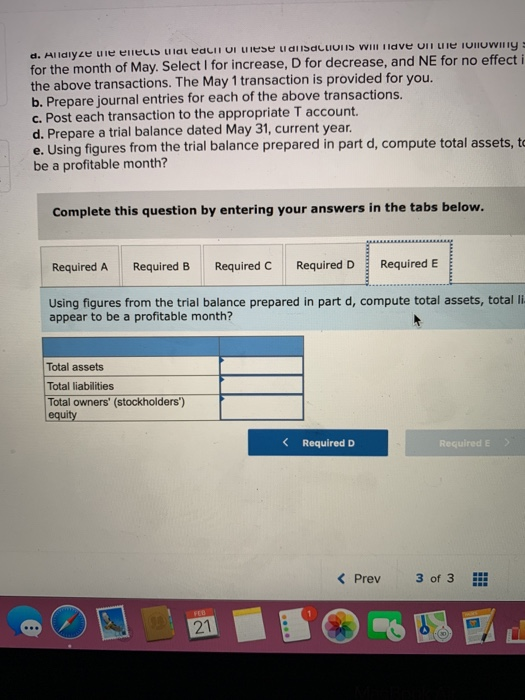

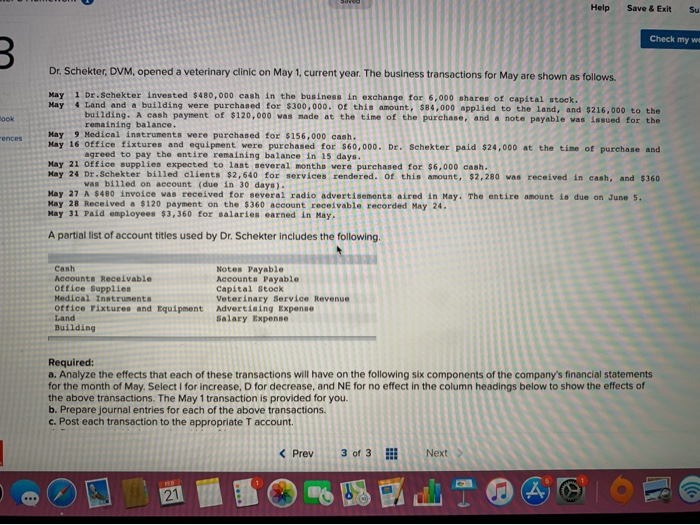

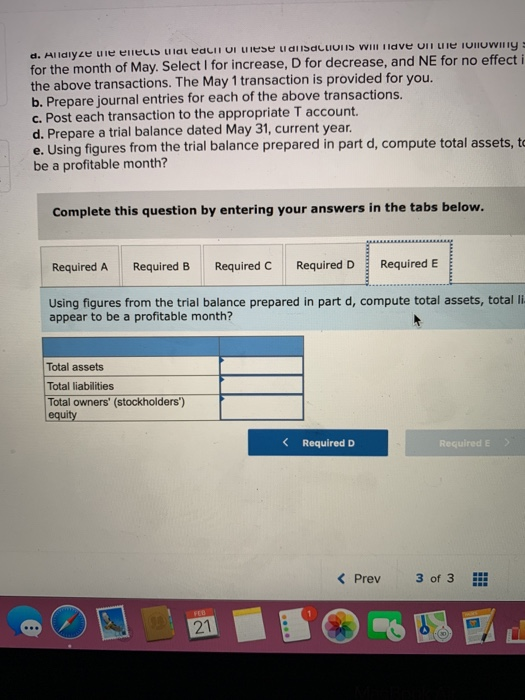

chapter 3 hw requirded E Help Save & Exit Su Check my w Dr. Schekter, DVM, opened a veterinary clinic on May 1, current year.

chapter 3 hw requirded E

Help Save & Exit Su Check my w Dr. Schekter, DVM, opened a veterinary clinic on May 1, current year. The business transactions for May are shown as follows. May 1 Dr.Sehekter Invested $480,000 cash in the business in exchange for 6,000 shares of capital stock. May 4 Land and a building were purchased for $300,000. Of this amount, 584,000 applied to the land, and $216,000 to the building. A cash payment of $120,000 was made at the time of the purchase, and a note payable was issued for the remaining balance. May 9 Medical Instruments were purchased for $156,000 cash. May 16 office fixtures and equipment were purchased for $60,000. Dr. Sehekter paid $24,000 at the time of purchase and agreed to pay the entire remaining balance in 15 days. May 21 office supplies expected to last several months were purchased for $6,000 cash. May 24 Dr.Schekter billed clients $2,640 for services rendered of this amount, $2,280 was received in cash, and $360 was billed on account (due in 30 days). May 27 A $480 Invoice was received for several radio advertisements aired in May. The entire amount is due on June 5. May 28 Received a $120 payment on the $360 account receivable recorded May 24. May 31 Paid employees $3,360 for salaries earned in May. A partial list of account titles used by Dr. Schekter includes the fol 3 Cash Accounts Receivable office Supplies Medical Instruments office Fixtures and Equipment Land Building Notes Payable Accounts Payable Capital Stock Veterinary Service Revenue Advertising Expense Salary Expense Required: a. Analyze the effects that each of these transactions will have on the following six components of the company's financial statements for the month of May. Select I for increase, D for decrease, and NE for no effect in the column headings below to show the effects of the above transactions. The May 1 transaction is provided for you. b. Prepare journal entries for each of the above transactions c. Post each transaction to the appropriate T account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started