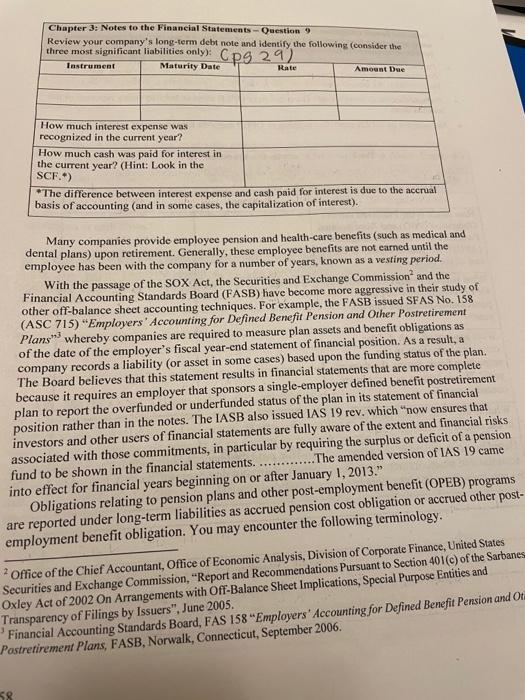

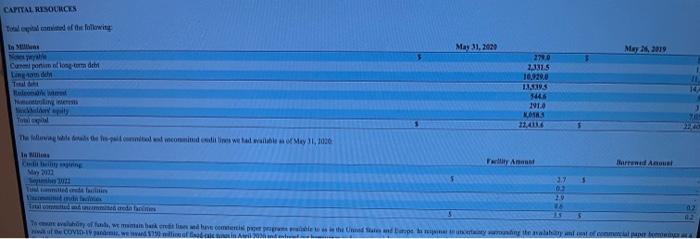

Chapter 3: Notes to the Financial Statements - Question 9 Review your company's long-term debt note and identify the following (consider the three most significant liabilities only): Cpg 29) Instrument Maturity Date Rate Amount Due How much interest expense was recognized in the current year? How much cash was paid for interest in the current year? (Hint: Look in the SCF.) * The difference between interest expense and cash paid for interest is due to the accrual basis of accounting (and in some cases, the capitalization of interest). Many companies provide employee pension and health-care benefits (such as medical and dental plans) upon retirement Generally, these employee benefits are not earned until the employee has been with the company for a number of years, known as a vesting period. With the passage of the SOX Act, the Securities and Exchange Commission and the Financial Accounting Standards Board (FASB) have become more aggressive in their study of other off-balance sheet accounting techniques. For example, the FASB issued SFAS No. 158 (ASC 715) "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans whereby companies are required to measure plan assets and benefit obligations as of the date of the employer's fiscal year-end statement of financial position. As a result, a company records a liability (or asset in some cases) based upon the funding status of the plan The Board believes that this statement results in financial statements that are more complete because it requires an employer that sponsors a single-employer defined benefit postretirement plan to report the overfunded or underfunded status of the plan in its statement of financial position rather than in the notes. The IASB also issued IAS 19 rev. which "now ensures that investors and other users of financial statements are fully aware of the extent and financial risks associated with those commitments, in particular by requiring the surplus or deficit of a pension fund to be shown in the financial statements. The amended version of IAS 19 came into effect for financial years beginning on or after January 1, 2013." Obligations relating to pension plans and other post-employment benefit (OPEB) programs are reported under long-term liabilities as accrued pension cost obligation or accrued other post- employment benefit obligation. You may encounter the following terminology 2 Office of the Chief Accountant, Office of Economic Analysis, Division of Corporate Finance, United States Securities and Exchange Commission, "Report and Recommendations Pursuant to Section 401(c) of the Sarbanes Oxley Act of 2002 On Arrangements with Off-Balance Sheet Implications, Special Purpose Entities and Transparency of Filings by Issuers", June 2005. Financial Accounting Standards Board, FAS 158 "Employers' Accounting for Defined Benefit Pension and Ot Postretirement Plans, FASB, Norwalk, Connecticut, September 2006 58 CAPITAL RESOURCES May 31, 2020 Ma 2019 Componen long-term ditt Lingen 2710 2413.5 10.9200 1.2193 3446 1910 NOTA3 11,2 14 tem Top The Waile etable condities who wa May 31, 1000 Try Anant Harremed Azul \ how 3.7 10 16 Tofu, mammario come to the Undertalem COVIDA Chapter 3: Notes to the Financial Statements - Question 9 Review your company's long-term debt note and identify the following (consider the three most significant liabilities only): Cpg 29) Instrument Maturity Date Rate Amount Due How much interest expense was recognized in the current year? How much cash was paid for interest in the current year? (Hint: Look in the SCF.) * The difference between interest expense and cash paid for interest is due to the accrual basis of accounting (and in some cases, the capitalization of interest). Many companies provide employee pension and health-care benefits (such as medical and dental plans) upon retirement Generally, these employee benefits are not earned until the employee has been with the company for a number of years, known as a vesting period. With the passage of the SOX Act, the Securities and Exchange Commission and the Financial Accounting Standards Board (FASB) have become more aggressive in their study of other off-balance sheet accounting techniques. For example, the FASB issued SFAS No. 158 (ASC 715) "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans whereby companies are required to measure plan assets and benefit obligations as of the date of the employer's fiscal year-end statement of financial position. As a result, a company records a liability (or asset in some cases) based upon the funding status of the plan The Board believes that this statement results in financial statements that are more complete because it requires an employer that sponsors a single-employer defined benefit postretirement plan to report the overfunded or underfunded status of the plan in its statement of financial position rather than in the notes. The IASB also issued IAS 19 rev. which "now ensures that investors and other users of financial statements are fully aware of the extent and financial risks associated with those commitments, in particular by requiring the surplus or deficit of a pension fund to be shown in the financial statements. The amended version of IAS 19 came into effect for financial years beginning on or after January 1, 2013." Obligations relating to pension plans and other post-employment benefit (OPEB) programs are reported under long-term liabilities as accrued pension cost obligation or accrued other post- employment benefit obligation. You may encounter the following terminology 2 Office of the Chief Accountant, Office of Economic Analysis, Division of Corporate Finance, United States Securities and Exchange Commission, "Report and Recommendations Pursuant to Section 401(c) of the Sarbanes Oxley Act of 2002 On Arrangements with Off-Balance Sheet Implications, Special Purpose Entities and Transparency of Filings by Issuers", June 2005. Financial Accounting Standards Board, FAS 158 "Employers' Accounting for Defined Benefit Pension and Ot Postretirement Plans, FASB, Norwalk, Connecticut, September 2006 58 CAPITAL RESOURCES May 31, 2020 Ma 2019 Componen long-term ditt Lingen 2710 2413.5 10.9200 1.2193 3446 1910 NOTA3 11,2 14 tem Top The Waile etable condities who wa May 31, 1000 Try Anant Harremed Azul \ how 3.7 10 16 Tofu, mammario come to the Undertalem COVIDA