Answered step by step

Verified Expert Solution

Question

1 Approved Answer

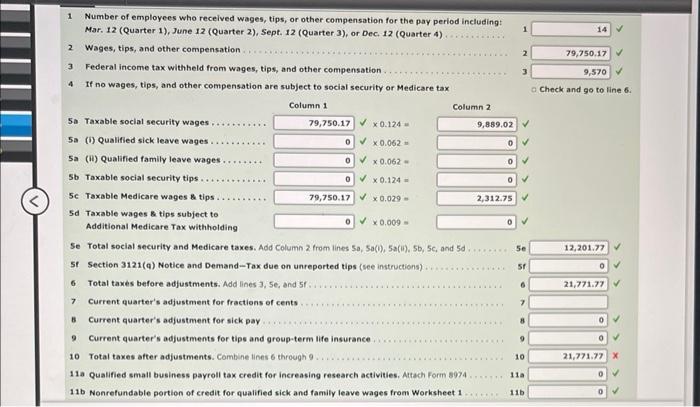

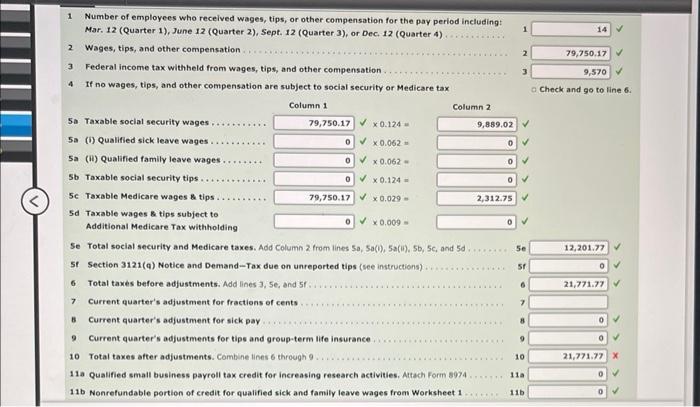

chapter 3 Number of employees who received wages, tips, or other compensation for the pay period includingt Mar. 12 (Quarter 1), June 12 (Quarter 2),

chapter 3

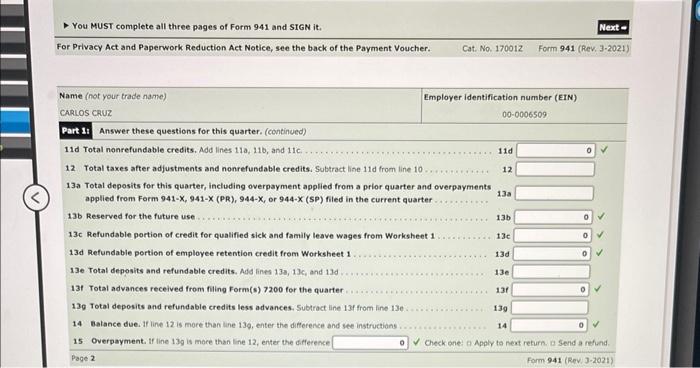

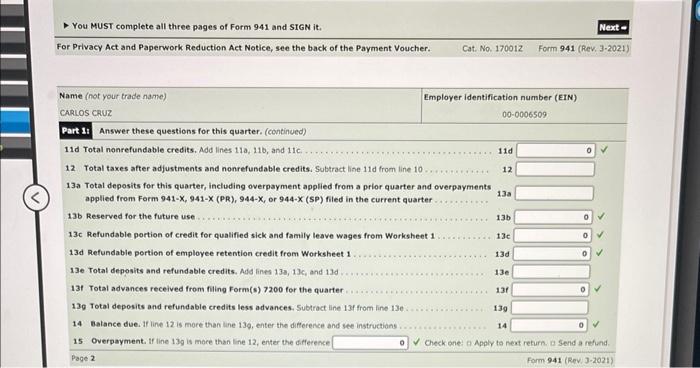

Number of employees who received wages, tips, or other compensation for the pay period includingt Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12( Quarter 4) - You MUST complete all three pages of Form 941 and SIGN it, Name (not your trade name) Part 11 Answer these questions for this quarter. (continued) 11d Total nonrefundable credits, Add lines 11a, 116 , and 11c. 12. Total taxes after adjustments and nonrefundable credits, Subtract line 11 d from line 10.+++w++,12. 13a Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments 13 a applied from Form 941Xp941X(PR),944Xf or 944X(SP) filed in the current quarter . 13b Reserved for the future use 15 Overpayment. If line 13g is more than line 12 , enter the diference 0. Check one: fi Apply to rest return. id Send a refund. Page 2 Form 941 (Rev. J-2021)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started