Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Chapter 3) Tony V's sells pizzas. During 2020, the sales for the restaurant was $1,088,400 while the cost of goods sold was $787,000. The accounts

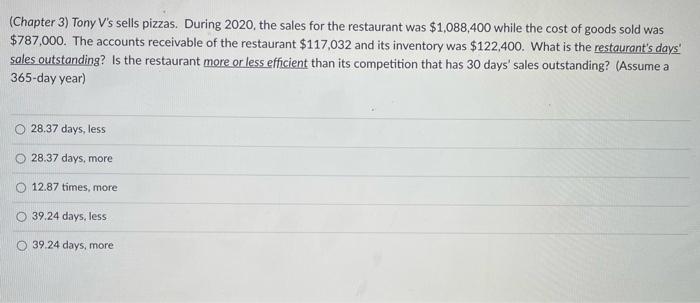

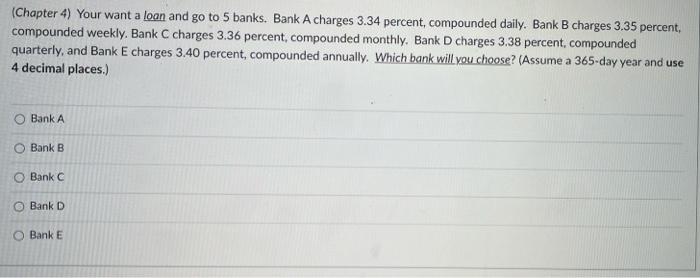

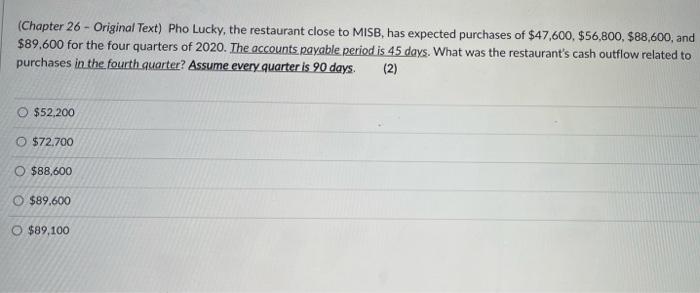

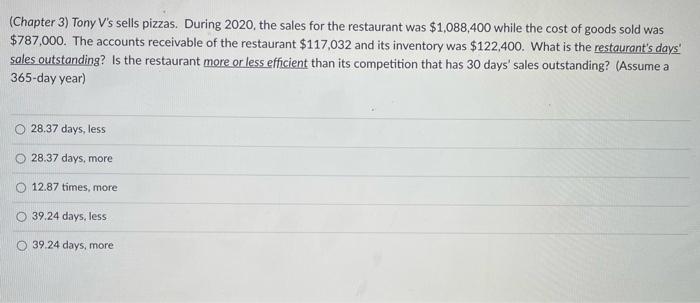

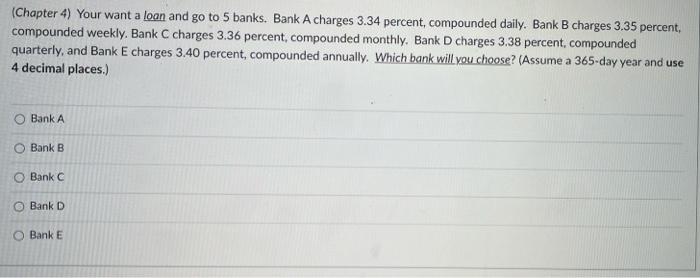

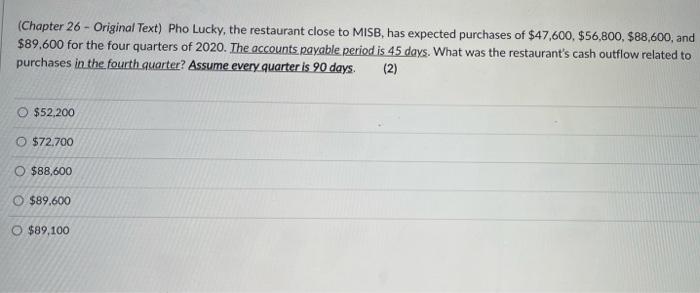

(Chapter 3) Tony V's sells pizzas. During 2020, the sales for the restaurant was $1,088,400 while the cost of goods sold was $787,000. The accounts receivable of the restaurant $117,032 and its inventory was $122,400. What is the restaurant's days! sales outstanding? Is the restaurant more or less efficient than its competition that has 30 days' sales outstanding? (Assume a 365-day year) 28.37 days, less 28.37 days, more 12.87 times, more 39.24 days, less 39.24 days, more (Chapter 4) Your want a loan and go to 5 banks. Bank A charges 3.34 percent, compounded daily. Bank B charges 3.35 percent, compounded weekly. Bank C charges 3.36 percent, compounded monthly. Bank D charges 3.38 percent, compounded quarterly, and Bank E charges 3.40 percent, compounded annually. Which bank will you choose? (Assume a 365-day year and use 4 decimal places.) Bank A O Bank B O Bank C Bank D O Bank E (Chapter 26 - Original Text) Pho Lucky, the restaurant close to MISB, has expected purchases of $47,600, $56,800, $88,600, and $89,600 for the four quarters of 2020. The accounts payable period is 45 days. What was the restaurant's cash outflow related to purchases in the fourth quarter? Assume every quarter is 90 days. (2) $52,200 $72.700 O $88,600 $89.600 $89,100

(Chapter 3) Tony V's sells pizzas. During 2020, the sales for the restaurant was $1,088,400 while the cost of goods sold was $787,000. The accounts receivable of the restaurant $117,032 and its inventory was $122,400. What is the restaurant's days! sales outstanding? Is the restaurant more or less efficient than its competition that has 30 days' sales outstanding? (Assume a 365-day year) 28.37 days, less 28.37 days, more 12.87 times, more 39.24 days, less 39.24 days, more (Chapter 4) Your want a loan and go to 5 banks. Bank A charges 3.34 percent, compounded daily. Bank B charges 3.35 percent, compounded weekly. Bank C charges 3.36 percent, compounded monthly. Bank D charges 3.38 percent, compounded quarterly, and Bank E charges 3.40 percent, compounded annually. Which bank will you choose? (Assume a 365-day year and use 4 decimal places.) Bank A O Bank B O Bank C Bank D O Bank E (Chapter 26 - Original Text) Pho Lucky, the restaurant close to MISB, has expected purchases of $47,600, $56,800, $88,600, and $89,600 for the four quarters of 2020. The accounts payable period is 45 days. What was the restaurant's cash outflow related to purchases in the fourth quarter? Assume every quarter is 90 days. (2) $52,200 $72.700 O $88,600 $89.600 $89,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started