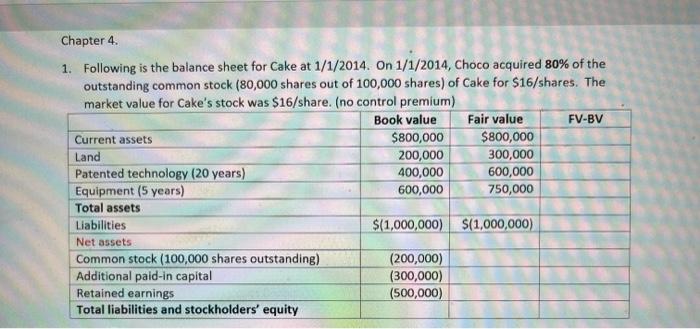

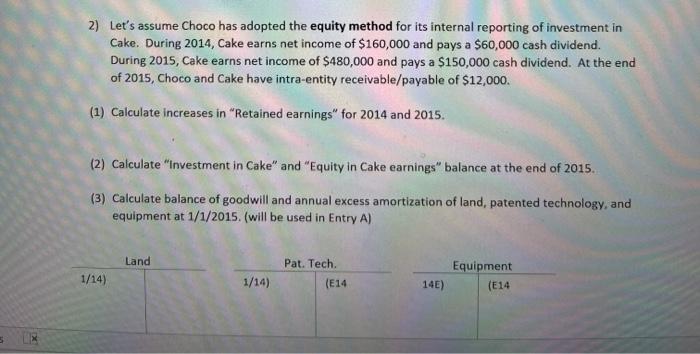

Chapter 4 1. Following is the balance sheet for Cake at 1/1/2014. On 1/1/2014, Choco acquired 80% of the outstanding common stock (80,000 shares out of 100,000 shares) of Cake for $16/shares. The market value for Cake's stock was $16/share. (no control premium) Book value Fair value FV-BV Current assets $800,000 $800,000 Land 200,000 300,000 Patented technology (20 years) 400,000 600,000 Equipment (5 years) 600,000 750,000 Total assets Liabilities $(1,000,000) S(1,000,000) Net assets Common stock (100,000 shares outstanding) (200,000) Additional paid-in capital (300,000) Retained earnings (500,000) Total liabilities and stockholders' equity 2) Let's assume Choco has adopted the equity method for its internal reporting of investment in Cake. During 2014, Cake earns net income of $160,000 and pays a $60,000 cash dividend. During 2015, Cake earns net income of $480,000 and pays a $150,000 cash dividend. At the end of 2015, Choco and Cake have intra-entity receivable/payable of $12,000. (1) Calculate increases in "Retained earnings" for 2014 and 2015. (2) Calculate "Investment in Cake" and "Equity in Cake earnings" balance at the end of 2015. (3) Calculate balance of goodwill and annual excess amortization of land, patented technology, and equipment at 1/1/2015. (will be used in Entry A) Land Pat. Tech 1/14) Equipment (E14 1/14) (E14 14E) 5 Chapter 4 1. Following is the balance sheet for Cake at 1/1/2014. On 1/1/2014, Choco acquired 80% of the outstanding common stock (80,000 shares out of 100,000 shares) of Cake for $16/shares. The market value for Cake's stock was $16/share. (no control premium) Book value Fair value FV-BV Current assets $800,000 $800,000 Land 200,000 300,000 Patented technology (20 years) 400,000 600,000 Equipment (5 years) 600,000 750,000 Total assets Liabilities $(1,000,000) S(1,000,000) Net assets Common stock (100,000 shares outstanding) (200,000) Additional paid-in capital (300,000) Retained earnings (500,000) Total liabilities and stockholders' equity 2) Let's assume Choco has adopted the equity method for its internal reporting of investment in Cake. During 2014, Cake earns net income of $160,000 and pays a $60,000 cash dividend. During 2015, Cake earns net income of $480,000 and pays a $150,000 cash dividend. At the end of 2015, Choco and Cake have intra-entity receivable/payable of $12,000. (1) Calculate increases in "Retained earnings" for 2014 and 2015. (2) Calculate "Investment in Cake" and "Equity in Cake earnings" balance at the end of 2015. (3) Calculate balance of goodwill and annual excess amortization of land, patented technology, and equipment at 1/1/2015. (will be used in Entry A) Land Pat. Tech 1/14) Equipment (E14 1/14) (E14 14E) 5