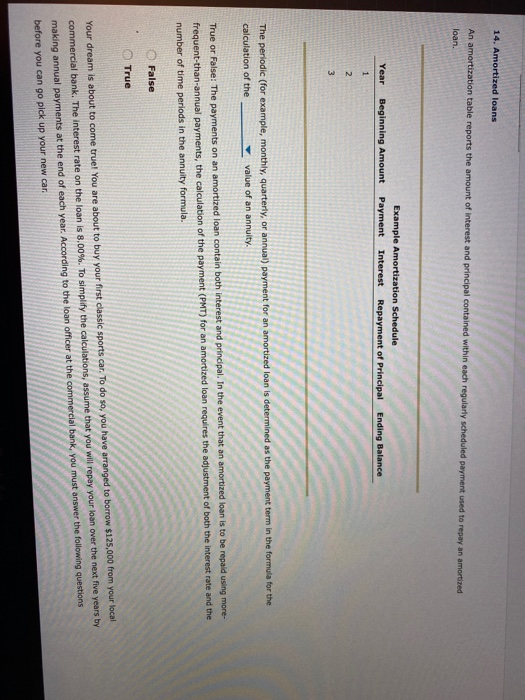

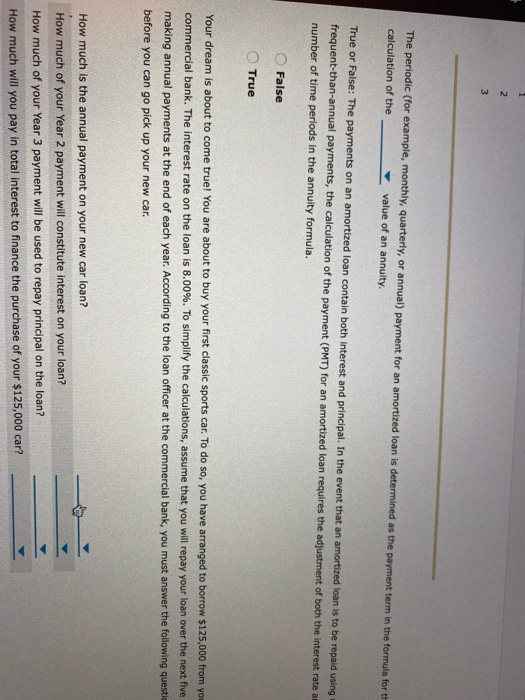

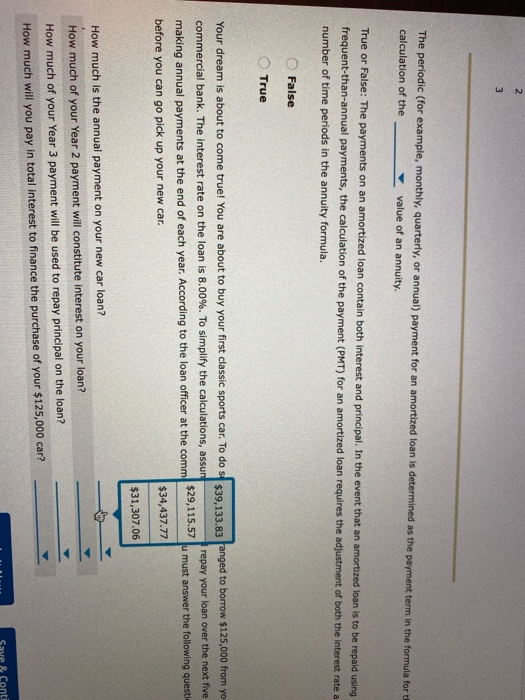

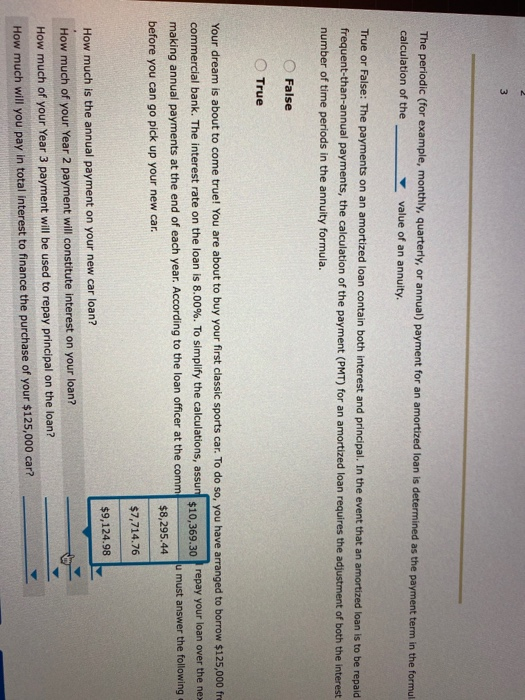

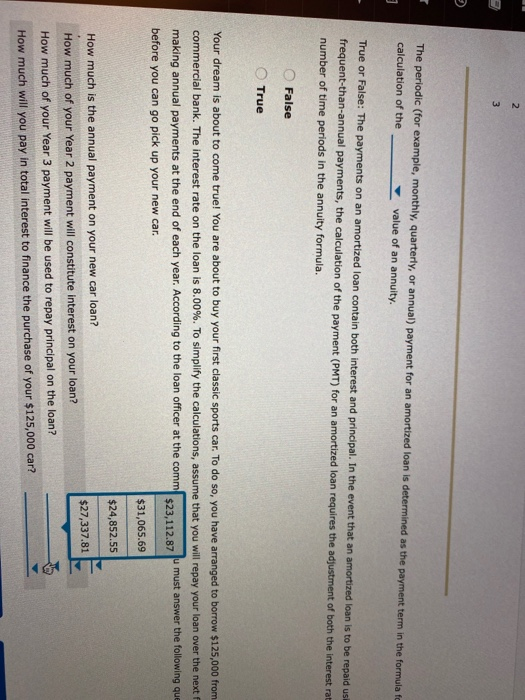

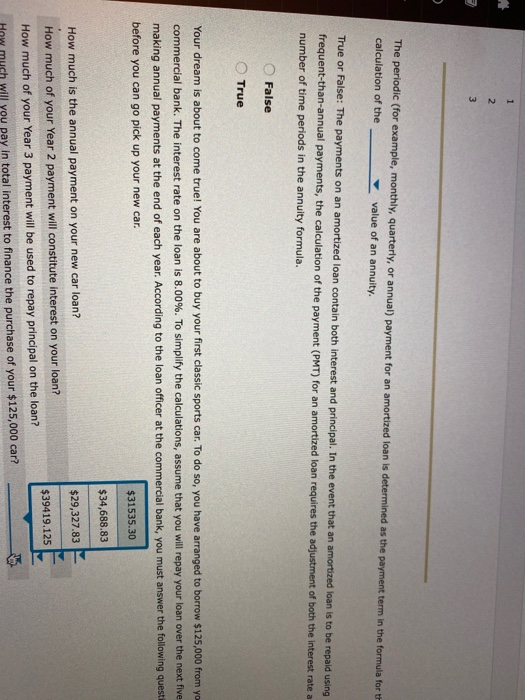

Chapter 4 Assignment 13. More on the time value of money The time value of money concept can be applied in various situations and is a fundamental concept underlying other financial concepts. Consider the following example of the application of this concept. Paolo is a divorce attorney who practices law in Houston. He wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $650 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $7,000 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it's a great deal. Suppose that the appropriate annual interest rate is 5.9%. What is the minimum number of years that Paolo must remain a member of the ADLA so that the lifetime membership is cheaper (on a present value basis) than paying $650 in annual membership dues? (Note: Round your answer up to the nearest year.) 13 years 16 years 19 years 21 years In 1626, Dutchman Peter Minuit purchased Manhattan Island from a local Native American tribe. Historians estimate that the price he paid for the island was about $24 worth of goods, including beads, trinkets, cloth, kettles, and axe heads. Many people find it laughable that Manhattan Island would be sold for $24, but you need to consider the future value (FV) of that price in more current times. If the $24 purchase price could have been Invested at a 4.50% annual interest rate, what is its value as of 2017 (391 years later)? $608,274,670.63 $715,617,259.56 $822,959,848.49 Paolo is a divorce attorney who practices law in Houston. He wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $650 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $7,000 and never have to pay annual membership dues Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it's a great deal. Suppose that the appropriate annual interest rate is 5.9%. What is the minimum number of years that Paolo must remain a member of the ADLA so that the lifetime membership is cheaper (on a present value basis) than paying $650 in annual membership dues? (Note: Round your answer up to the nearest year.) 13 years 16 years 19 years 21 years In 1626, Dutchman Peter Minuit purchased Manhattan Island from a local Native American tribe. Historians estimate that the price he paid for the island was about $24 worth of goods, including beads, trinkets, cloth, kettles, and axe heads. Many people find it laughable that Manhattan Island would be sold for $24, but you need to consider the future value (FV) of that price in more current times. If the $24 purchase price could have been invested at a 4.50% annual interest rate, what is its value as of 2017 (391 years later)? $608,274,670.63 $715,617,259.56 $822,959,848.49 $944,614,782.62 14. Amortized loans An amortization table reports the amount of interest and principal contained within each regularly scheduled payment used to repay an amortized loan Example Amortization Schedule Payment Interest Repayment of Principal Year Beginning Amount Ending Balance 1 2 3 The periodic (for example, monthly, quarterly, or annual) payment for an amortized loan is determined as the payment term in the formula for the calculation of the value of an annuity. True or False: The payments on an amortized loan contain both interest and principal. In the event that an amortized loan is to be repaid using more- frequent-than-annual payments, the calculation of the payment (PMT) for an amortized loan requires the adjustment of both the interest rate and the number of time periods in the annuity formula False True Your dream is about to come true! You are about to buy your first classic sports car. To do so, you have arranged to borrow $125,000 from your local commercial bank. The interest rate on the loan is 8.00%. To simplify the calculations, assume that you will repay your loan over the next five years by making annual payments at the end of each year. According to the loan officer at the commercial bank, you must answer the following questions before you can go pick up your new car An amortization table reports the amount of interest and principal contained within each regularly scheduled payment used to repay an amortized loan. Year Beginning Amount Example Amortization Schedule Payment Interest Repayment of Principal Ending Balance 2 3 The periodic (for example, monthly, quarterly, or annual) payment for an amortized loan is determined as the payment term in the formula for the calculation of the value of an annuity. future True or False: The on an amortized loan contain both interest and principal. In the event that an amortized loan is to be repaid using more- frequent-than-ann present nts, the calculation of the payment (PMT) for an amortized loan requires the adjustment of both the interest rate and the number of time perous i crte annuity formula. False True Your dream is about to come true! You are about to buy your first classic sports car. To do so, you have arranged to borrow $125,000 from your local commercial bank. The interest rate on the loan is 8.00%. To simplify the calculations, assume that you will repay your loan over the next five years by making annual payments at the end of each year. According to the loan officer at the commercial bank, you must answer the following questions before you can go pick up your new car 2 3 The periodic (for example, monthly, quarterly, or annual) payment for an amortized loan is determined as the payment term in the formula fort calculation of the value of an annuity. True or False: The payments on an amortized loan contain both interest and principal. In the event that an amortized loan is to be repaid using frequent-than-annual payments, the calculation of the payment (PMT) for an amortized loan requires the adjustment of both the interest rate an number of time periods in the annuity formula. False True Your dream is about to come true! You are about to buy your first classic sports car. To do so, you have arranged to borrow $125,000 from you commercial bank. The interest rate on the loan is 8.00%. To simplify the calculations, assume that you will repay your loan over the next five making annual payments at the end of each year. According to the loan officer at the commercial bank, you must answer the following questi before you can go pick up your new car. How much is the annual payment on your new car loan? How much of your Year 2 payment will constitute interest on your loan? How much of your Year 3 payment will be used to repay principal on the loan? How much will you pay in total interest to finance the purchase of your $125,000 car? 2 3 The periodic (for example, monthly, quarterly, or annual) payment for an amortized loan is determined as the payment term in the formula fort calculation of the value of an annuity. True or False: The payments on an amortized loan contain both interest and principal. In the event that an amortized loan is to be repaid using frequent-than-annual payments, the calculation of the payment (PMT) for an amortized loan requires the adjustment of both the interest rate a number of time periods in the annuity formula. O False True Your dream is about to come true! You are about to buy your first classic sports car. To do s $39,133.83 fanged to borrow $125,000 from yo commercial bank. The interest rate on the loan is 8.00%. To simplify the calculations, assur repay your loan over the next five making annual payments at the end of each year. According to the loan officer at the comm $29,115.57 u must answer the following questi before you can go pick up your new car. $34,437.77 $31,307.06 How much is the annual payment on your new car loan? How much of your Year 2 payment will constitute interest on your loan? How much of your Year 3 payment will be used to repay principal on the loan? How much will you pay in total interest to finance the purchase of your $125,000 car? & Conti 3 The periodic (for example, monthly, quarterly, or annual) payment for an amortized loan is determined as the payment term in the formul calculation of the value of an annuity. True or False: The payments on an amortized loan contain both interest and principal. In the event that an amortized loan is to be repaid frequent-than-annual payments, the calculation of the payment (PMT) for an amortized loan requires the adjustment of both the interest number of time periods in the annuity formula. False True Your dream is about to come true! You are about to buy your first classic sports car. To do so, you have arranged to borrow $125,000 fra commercial bank. The interest rate on the loan is 8.00%. To simplify the calculations, assun $10,369.30 repay your loan over the ne making annual payments at the end of each year. According to the loan officer at the comm u must answer the following before you can go pick up your new car. $8,295.44 $7,714.76 $9,124.98 How much is the annual payment on your new car loan? How much of your Year 2 payment will constitute interest on your loan? How much of your Year 3 payment will be used to repay principal on the loan? How much will you pay in total interest to finance the purchase of your $125,000 car? 2 3 The periodic (for example, monthly, quarterly, or annual) payment for an amortized loan is determined as the payment term in the formula fc calculation of the value of an annuity. True or False: The payments on an amortized loan contain both interest and principal. In the event that an amortized loan is to be repaid us frequent-than-annual payments, the calculation of the payment (PMT) for an amortized loan requires the adjustment of both the interest rat number of time periods in the annuity formula. False True Your dream is about to come true! You are about to buy your first classic sports car. To do so, you have arranged to borrow $125,000 from commercial bank. The interest rate on the loan is 8.00%. To simplify the calculations, assume that you will repay your loan over the next F making annual payments at the end of each year. According to the loan officer at the comm u must answer the following que $23,112.87 before you can go pick up your new car. $31,065.69 $24,852.55 How much is the annual payment on your new car loan? $27,337.81 6 KK How much of your Year 2 payment will constitute interest on your loan? How much of your Year 3 payment will be used to repay principal on the loan? How much will you pay in total interest to finance the purchase of your $125,000 car? 2 3 The periodic (for example, monthly, quarterly, or annual) payment for an amortized loan is determined as the payment term in the formula forth calculation of the value of an annuity. True or False: The payments on an amortized loan contain both interest and principal. In the event that an amortized loan is to be repaid using frequent-than-annual payments, the calculation of the payment (PMT) for an amortized loan requires the adjustment of both the interest rate a number of time periods in the annuity formula. False True Your dream is about to come true! You are about to buy your first classic sports car. To do so, you have arranged to borrow $125,000 from yo commercial bank. The interest rate on the loan is 8.00%. To simplify the calculations, assume that you will repay your loan over the next five making annual payments at the end of each year. According to the loan officer at the commercial bank, you must answer the following questi before you can go pick up your new car. $31535.30 $34,688.83 $29,327.83 $39419.125 How much is the annual payment on your new car loan? How much of your Year 2 payment will constitute interest on your loan? How much of your Year 3 payment will be used to repay principal on the loan? How much will you pay in total interest to finance the purchase of your $125,000 car