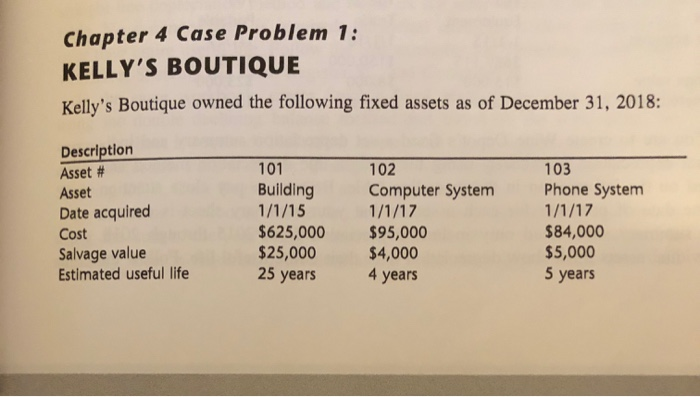

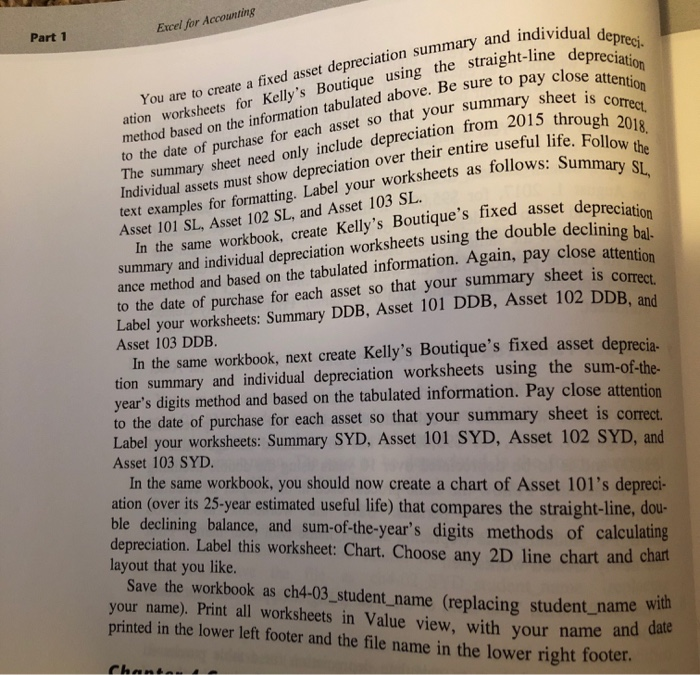

Chapter 4 Case Problem 1: KELLY'S BOUTIQUE Kelly's Boutique owned the following fixed assets as of December 31, 2018: Descriptiorn Asset # Asset Date acquired Cost Salvage value Estimated useful life 101 Building Computer System Phone System 102 103 $625,000 $25,000 25 years $95,000 $4,000 4 years $84,000 $5,000 5 years Part 1 Excel for Account You are to create a fixed asset depreciation summary and indivi above. Be sure to pay close attention ation worksheets for Kelly's Boutique using the straight-line d sheet is correct 5 t o the date of purchase for each asset so that your summ The method based on the information tabulated above. Be sure to e summary sheet need only include depreciation from 20 preciation over their entire useful life. Follo ividual assets must show de text examples fo Asset 101 SL, Asset 102 SL, and Asset 103 SL r formatting. Label your worksheets as follows: Summ SL, he same workbook, create Kelly's Boutique's fixed asset depreciation In t summary and individual depreciation worksheets using the double declining ance method and based on the tabulated information. Again, pay close at to the date of purchase for each asset so that your summary sheet is correct Label your worksheets: Summary DDB, Asset 101 DDB, Asset 102 DDB Asset 103 DDB. and the same workbook, next create Kelly's Boutique's fixed asset deprecia- tion summary and individual depreciation worksheets using the sum-of-the- year's digits method and based on the tabulated information. Pay close attention to the date of purchase for each asset so that your summary sheet is co rrect Label your worksheets: Summary SYD, Asset 101 SYD, Asset 102 SYD, and Asset 103 SYD. In the same workbook, you should now create a chart of Asset 101's depreci- ation (over its 25-year estimated useful life) that compares the straight-line, dou ble declining balance, and sum-of-the-year's digits methods of calculating depreciation. Label this worksheet: Chart. Choose any 2D line chart and chart Save the workbook as ch4-03_student name (replacing student name with layout that you like your name). Print all worksheets in Value view, with your name and d printed in the lower left footer and the file name in the lower right foote