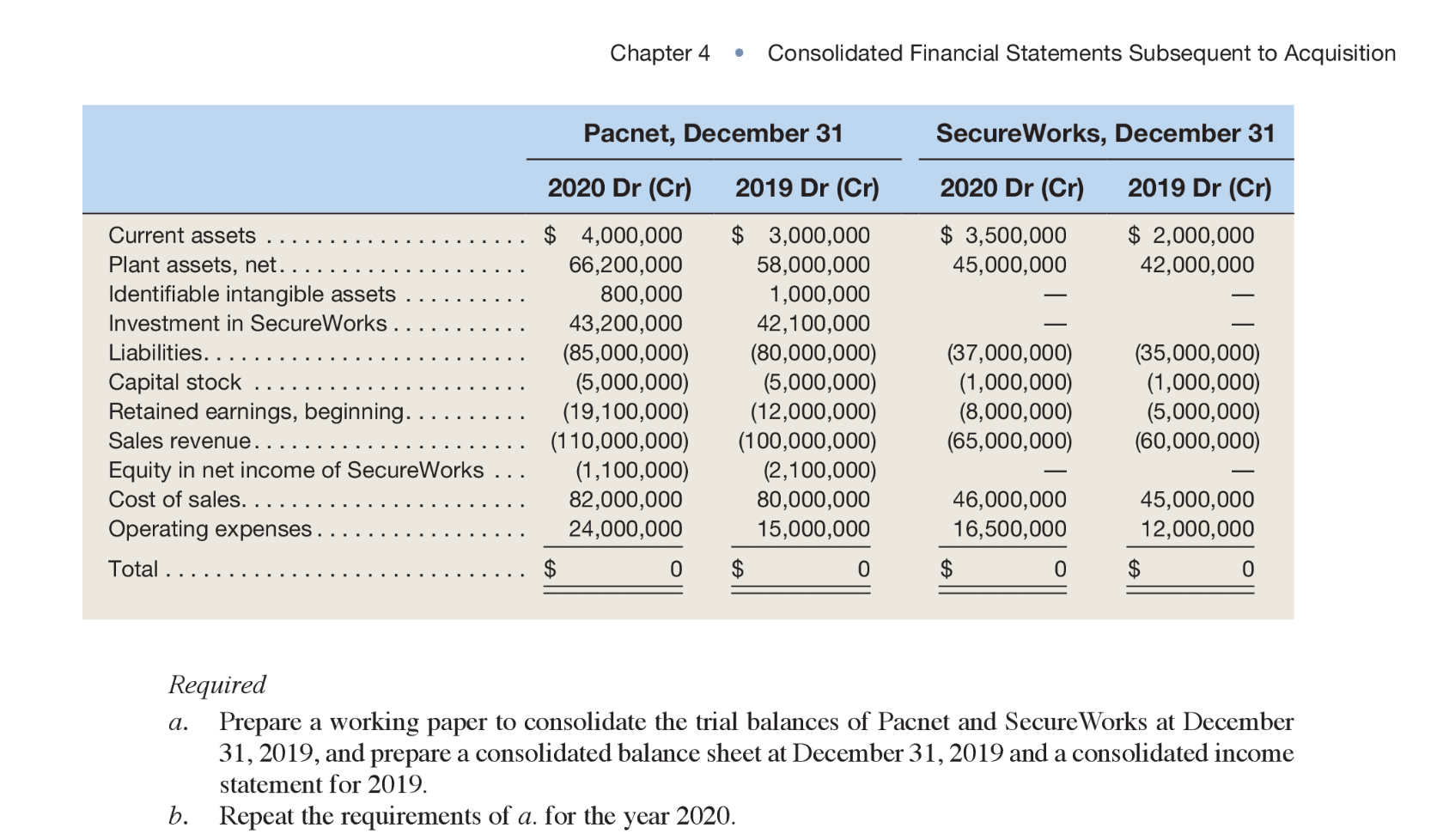

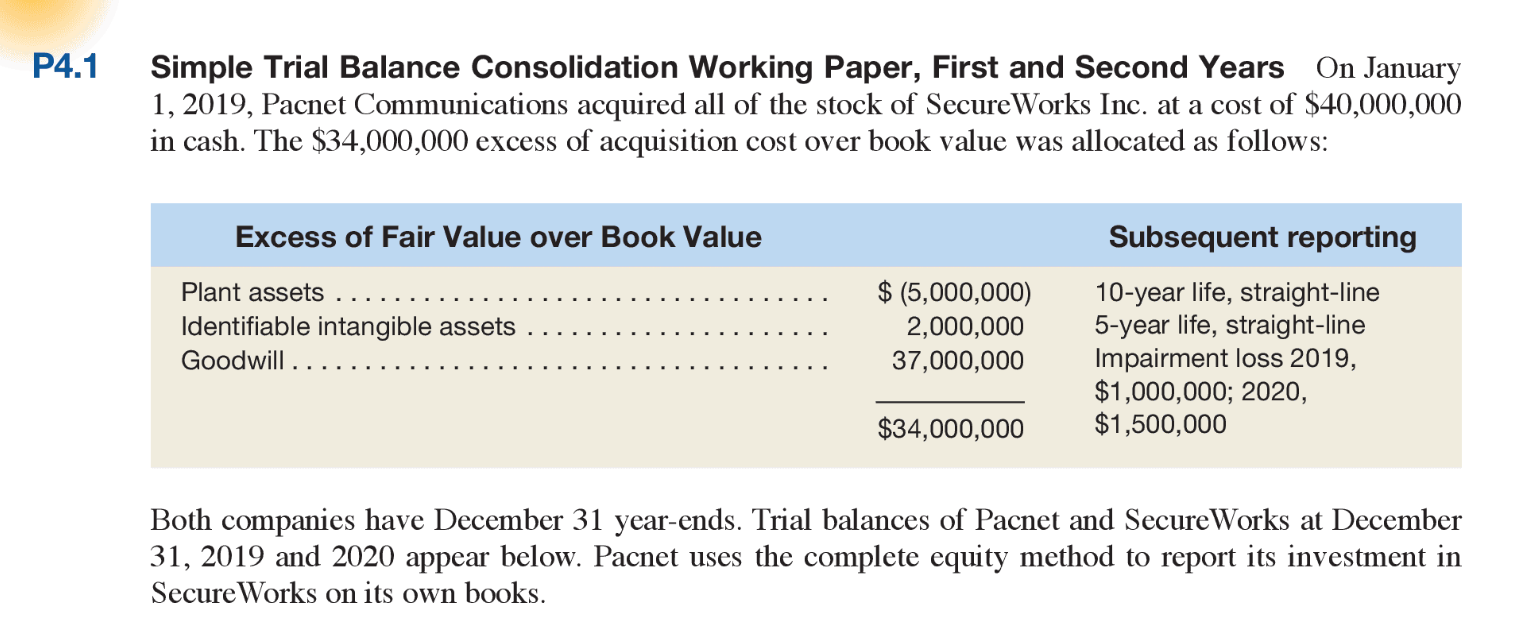

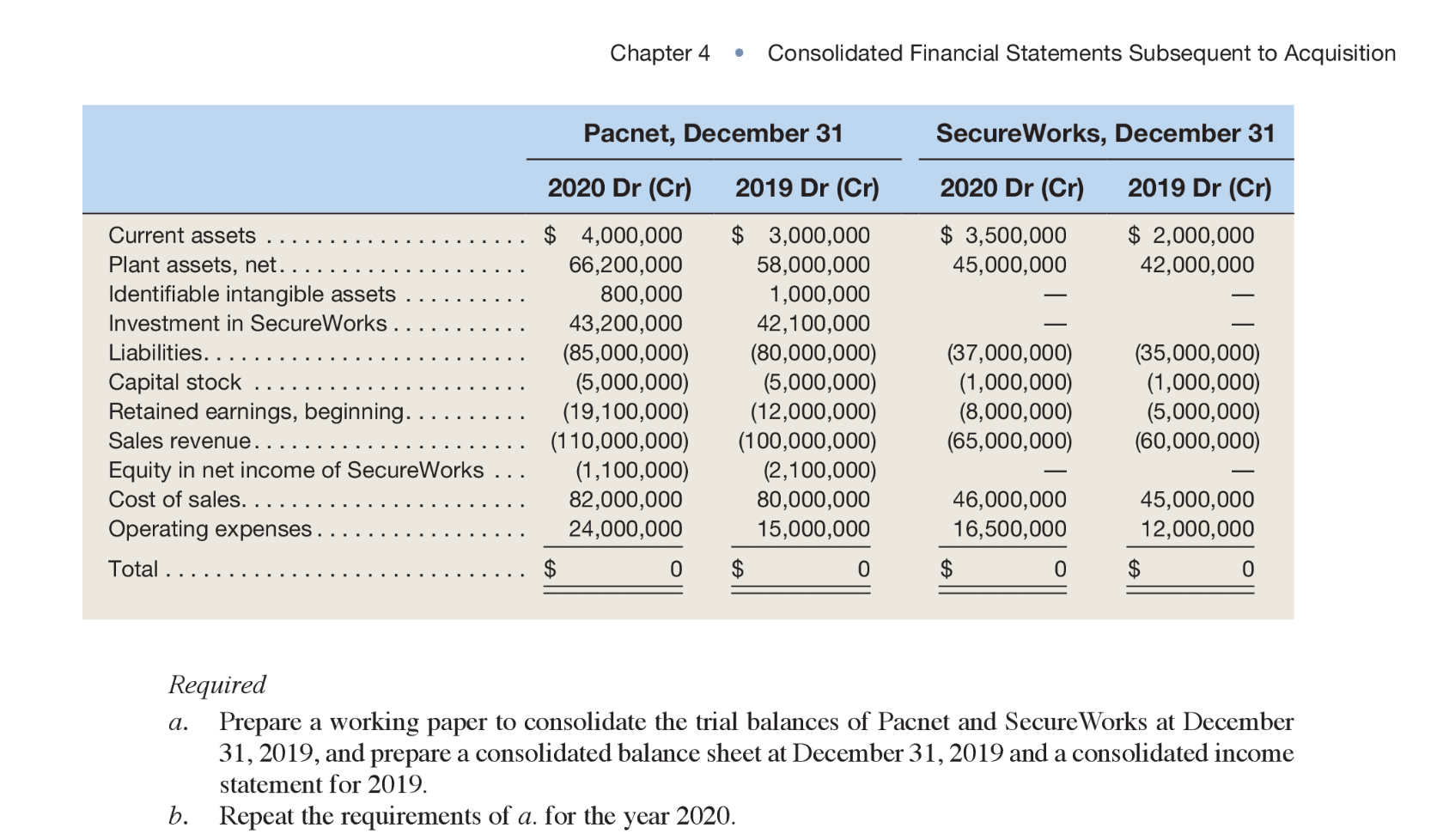

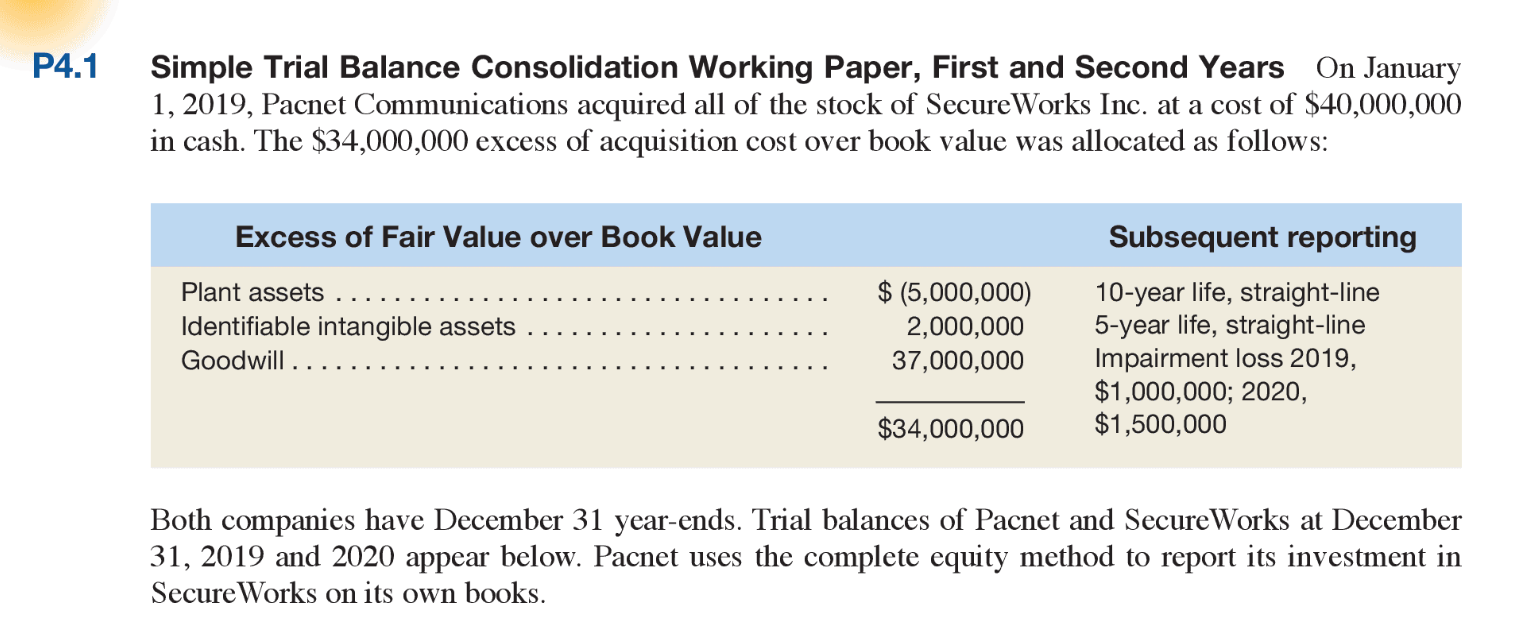

Chapter 4 Consolidated Financial Statements Subsequent to Acquisition Pacnet, December 31 SecureWorks, December 31 2020 Dr (Cr) 2019 Dr (Cr) 2020 Dr (Cr) 2019 Dr (Cr) $ 3,500,000 45,000,000 $ 2,000,000 42,000,000 Current assets ..................... $ 4,000,000 Plant assets, net.................... 66,200,000 Identifiable intangible assets ... ..... 800,000 Investment in SecureWorks .... 43,200,000 Liabilities.. (85,000,000) Capital stock .......... ...... (5,000,000) Retained earnings, beginning.......... . (19.100.000) Sales revenue... .......... (110,000,000 Equity in net income of SecureWorks ... (1,100,000) Cost of sales. ......... 82,000,000 Operating expenses......... ....... 24,000,000 Total .......... $ 3,000,000 58,000,000 1,000,000 42,100,000 (80,000,000) (5,000,000) (12.000.000) (100,000,000) (2,100,000) 80,000,000 15,000,000 (37,000,000) (1,000,000) (8,000,000) (65,000,000) (35,000,000) (1,000,000) (5,000,000) (60,000,000) 46,000,000 16,500,000 45,000,000 12,000,000 Required a. Prepare a working paper to consolidate the trial balances of Pacnet and SecureWorks at December 31, 2019, and prepare a consolidated balance sheet at December 31, 2019 and a consolidated income statement for 2019. b. Repeat the requirements of a. for the year 2020. P4.1 Simple Trial Balance Consolidation Working Paper, First and Second Years On January 1, 2019, Pacnet Communications acquired all of the stock of SecureWorks Inc. at a cost of $40,000,000 in cash. The $34,000,000 excess of acquisition cost over book value was allocated as follows: Excess of Fair Value over Book Value Subsequent reporting Plant assets ........ ......... Identifiable intangible assets ......... Goodwill ...... ....................... $ (5,000,000) 2,000,000 37,000,000 10-year life, straight-line 5-year life, straight-line Impairment loss 2019, $1,000,000; 2020, $1,500,000 $34,000,000 Both companies have December 31 year-ends. Trial balances of Pacnet and SecureWorks at December 31, 2019 and 2020 appear below. Pacnet uses the complete equity method to report its investment in Secure Works on its own books. Chapter 4 Consolidated Financial Statements Subsequent to Acquisition Pacnet, December 31 SecureWorks, December 31 2020 Dr (Cr) 2019 Dr (Cr) 2020 Dr (Cr) 2019 Dr (Cr) $ 3,500,000 45,000,000 $ 2,000,000 42,000,000 Current assets ..................... $ 4,000,000 Plant assets, net.................... 66,200,000 Identifiable intangible assets ... ..... 800,000 Investment in SecureWorks .... 43,200,000 Liabilities.. (85,000,000) Capital stock .......... ...... (5,000,000) Retained earnings, beginning.......... . (19.100.000) Sales revenue... .......... (110,000,000 Equity in net income of SecureWorks ... (1,100,000) Cost of sales. ......... 82,000,000 Operating expenses......... ....... 24,000,000 Total .......... $ 3,000,000 58,000,000 1,000,000 42,100,000 (80,000,000) (5,000,000) (12.000.000) (100,000,000) (2,100,000) 80,000,000 15,000,000 (37,000,000) (1,000,000) (8,000,000) (65,000,000) (35,000,000) (1,000,000) (5,000,000) (60,000,000) 46,000,000 16,500,000 45,000,000 12,000,000 Required a. Prepare a working paper to consolidate the trial balances of Pacnet and SecureWorks at December 31, 2019, and prepare a consolidated balance sheet at December 31, 2019 and a consolidated income statement for 2019. b. Repeat the requirements of a. for the year 2020. P4.1 Simple Trial Balance Consolidation Working Paper, First and Second Years On January 1, 2019, Pacnet Communications acquired all of the stock of SecureWorks Inc. at a cost of $40,000,000 in cash. The $34,000,000 excess of acquisition cost over book value was allocated as follows: Excess of Fair Value over Book Value Subsequent reporting Plant assets ........ ......... Identifiable intangible assets ......... Goodwill ...... ....................... $ (5,000,000) 2,000,000 37,000,000 10-year life, straight-line 5-year life, straight-line Impairment loss 2019, $1,000,000; 2020, $1,500,000 $34,000,000 Both companies have December 31 year-ends. Trial balances of Pacnet and SecureWorks at December 31, 2019 and 2020 appear below. Pacnet uses the complete equity method to report its investment in Secure Works on its own books